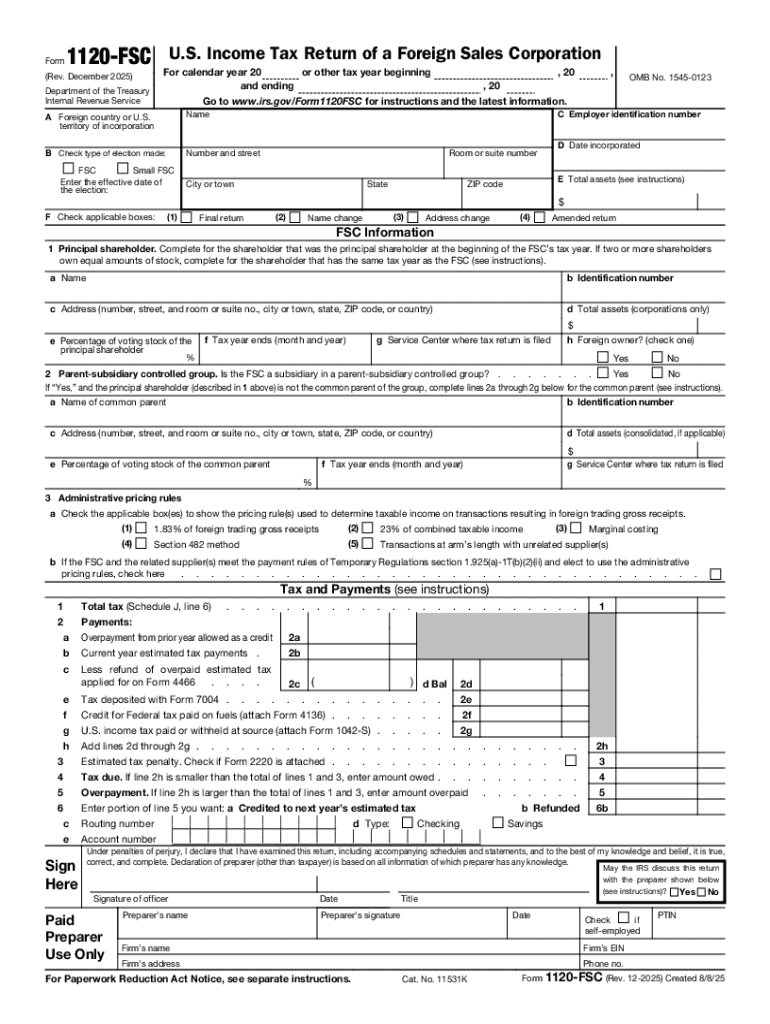

IRS 1120-FSC 2025-2026 free printable template

Get, Create, Make and Sign IRS 1120-FSC

How to edit IRS 1120-FSC online

Uncompromising security for your PDF editing and eSignature needs

IRS 1120-FSC Form Versions

How to fill out IRS 1120-FSC

How to fill out form 1120-fsc rev december

Who needs form 1120-fsc rev december?

Comprehensive Guide to Form 1120-FSC Rev December Form

Understanding Form 1120-FSC

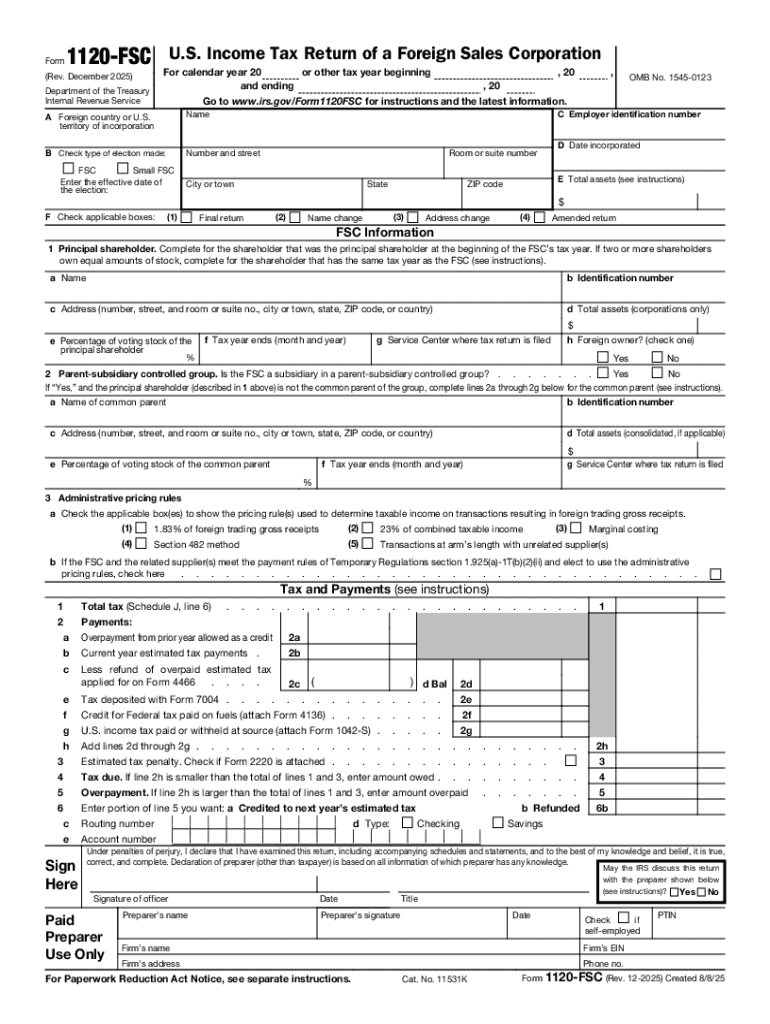

Form 1120-FSC, officially known as the U.S. Income Tax Return for a Foreign Sales Corporation, plays a pivotal role for corporations involved in international trade. Its primary purpose is to allow U.S. companies to report their income and expenses related to the operations of a foreign sales corporation (FSC). By doing so, they can maximize their tax benefits, enabling them to reinvest more of their capital into expanding their overseas operations. This form is integral for compliance with U.S. tax regulations, ensuring that firms take advantage of tax incentives provided for export activities.

The importance of Form 1120-FSC cannot be overstated, as it offers significant compliance benefits. It ensures that businesses adhere to federal laws regarding foreign income, thereby avoiding audits or penalties associated with improper reporting. Proper usage of this form is essential for any corporation striving to leverage advantageous tax provisions meant for enhancing exports.

Who needs to fill out this form?

Any U.S. corporation that has established a foreign sales corporation and conducts transactions related to export sales generally needs to fill out Form 1120-FSC. This includes companies engaged in selling or leasing tangible and intangible property to foreign buyers. Additionally, corporations that earn income through royalties or dividends from their FSC are also required to report using this form.

Common scenarios that necessitate the use of Form 1120-FSC include businesses that ship products abroad or have foreign clients for products and services. Those unfamiliar with the tax requirements might overlook this critical filing, which could result in lost opportunities for tax reductions.

Key sections of Form 1120-FSC

Understanding the key sections of Form 1120-FSC is crucial for accurate completion and compliance. The form comprises several parts that gather essential information about the corporation and its financial activities related to the FSC. Each section must be filled out meticulously to ensure all relevant data is disclosed.

Section by section breakdown

1. Basic Information Requirements: This section requests fundamental details about the corporation, such as its legal name, address, and Employer Identification Number (EIN). Correctly filling out this information is vital as it identifies the company and links to all reported financial activities.

2. Income and Deductions: In this pivotal section, corporations must disclose their gross income derived from foreign sales, for instance, through product sales or service fees. Simultaneously, they can account for allowable deductions, which include operational costs directly tied to the income generated from the FSC.

3. Additional Information: Here, corporations need to provide specific disclosures relevant to their FSC activities, potentially including any partnerships, foreign stakeholders, or other material facts that might influence tax treatment.

Filling out Form 1120-FSC: Step-by-step instructions

Completing Form 1120-FSC entails several essential steps. Preparation is key to ensure all information is accurate and comprehensive, thus evading complications with the IRS.

Gathering necessary documentation

Before diving into the form, gather the following necessary documents and information:

Completing the form

Step 1: Entering Basic Information: Start by inputting the required data in the basic information section. Ensure accuracy to avoid future discrepancies with tax authorities.

Step 2: Calculating Income: For accurate reporting of revenue from foreign sources, carefully compile all foreign sales with corresponding income amounts. For instance, differentiate between income derived from various markets or product lines to ensure clarity.

Step 3: Deductions and Allowable Expenses: Document typical deductions such as cost of goods sold, shipping fees, or marketing expenses applicable to the foreign sales. This will strengthen the expense claims.

Step 4: Additional Reporting Requirements: Some disclosures on transactions with foreign persons or corporations may require supplemental documentation. Carefully review IRS guidelines to ensure completeness.

Reviewing your form

Double-checking your form is a critical step. Ensure that every entry is accurate and corresponds with supporting documentation. Errors can trigger audits or delayed processing, therefore meticulous attention to detail is essential.

Editing and managing your Form 1120-FSC

Managing Form 1120-FSC efficiently requires leveraging innovative tools such as pdfFiller. This platform enables seamless editing, e-signing, and collaborating on your forms without the hassle of handling paper.

Using pdfFiller to edit and complete your form

pdfFiller provides user-friendly interactive tools that simplify the editing process of Form 1120-FSC. With drag-and-drop features, you can easily adjust text, update corporate details, and add supplementary information as needed.

Signing your form

The signing process is crucial, and pdfFiller allows for e-signing directly within its platform. This feature streamlines compliance by enabling users to securely authenticate their forms, ensuring quicker submission and fewer delays.

Storing and managing your form

Effective document management is vital, especially when it involves sensitive tax data. Using cloud storage features provided by pdfFiller ensures your forms, including Form 1120-FSC, are organized and easily accessible whenever needed. Set reminders for important filing dates to stay ahead of deadlines.

FAQs about Form 1120-FSC

As businesses prepare to fill out the Form 1120-FSC, several frequent questions often arise that can clarify common uncertainties.

Common misconceptions and issues

Many individuals incorrectly assume that Form 1120-FSC only applies to large corporations. In reality, any company with foreign sales activity, regardless of size, may qualify and should complete this filing. Misunderstanding the requirements can lead to compliance issues.

Troubleshooting frequent errors

Some common errors include incorrect EIN entries, mismatched income figures, or failure to include all required deductions. Consistently reviewing IRS guidelines and checking entries against documentation can minimize these mistakes.

Contact information for further assistance

For any tax queries or issues, the IRS maintains dedicated helplines and online resources to assist businesses. Consulting a tax professional specializing in international commerce is often advantageous to navigate complex requirements.

Additional considerations and tips

Filing Form 1120-FSC requires awareness of specific deadlines to avoid late penalties. Typically, this form must be submitted by the 15th day of the 6th month after the tax year ends, thus making tax season critical for preparation.

Common mistakes to avoid

Common mistakes include neglecting to double-check entries, failing to include essential information, or submitting the form late. Each of these can hinder the process of claiming tax benefits.

Updates and revisions to Form 1120-FSC

Tax requirements can change, making it essential to stay informed about updates to Form 1120-FSC. Consulting the IRS website regularly ensures you have the latest forms and instructions, ultimately assisting in maintaining compliance.

Leveraging pdfFiller for your document needs

As a cloud-based document solution, pdfFiller offers invaluable benefits specifically tailored for users dealing with the Form 1120-FSC. Its flexibility allows for modifications and adaptations based on evolving business needs, enabling teams to efficiently manage their tax documentation.

Benefits of a cloud-based document solution

Features such as real-time collaboration, access from anywhere, and integrated storage options enhance the experience of filling out taxation-related forms. Users benefit from increased efficiency and centralized document management while reducing the risks of data loss or misfiled paperwork.

Collaboration features for teams

pdfFiller supports various collaboration features allowing teams to work seamlessly on the Form 1120-FSC. Whether sharing drafts or collectively reviewing submissions, these tools facilitate thorough documentation efforts while improving accountability and communication among team members.

People Also Ask about

What's an FSC form?

What does FSC stand for in tax?

What is a VA FSC vendor file request form?

Where to fax VA Form 10091?

What is va10091 form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IRS 1120-FSC for eSignature?

How do I execute IRS 1120-FSC online?

How do I fill out the IRS 1120-FSC form on my smartphone?

What is form 1120-fsc rev december?

Who is required to file form 1120-fsc rev december?

How to fill out form 1120-fsc rev december?

What is the purpose of form 1120-fsc rev december?

What information must be reported on form 1120-fsc rev december?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.