Get the free Business Classification Form - Fill Online, Printable ...

Get, Create, Make and Sign business classification form

How to edit business classification form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business classification form

How to fill out business classification form

Who needs business classification form?

Business Classification Form: How-to Guide

Understanding the business classification form

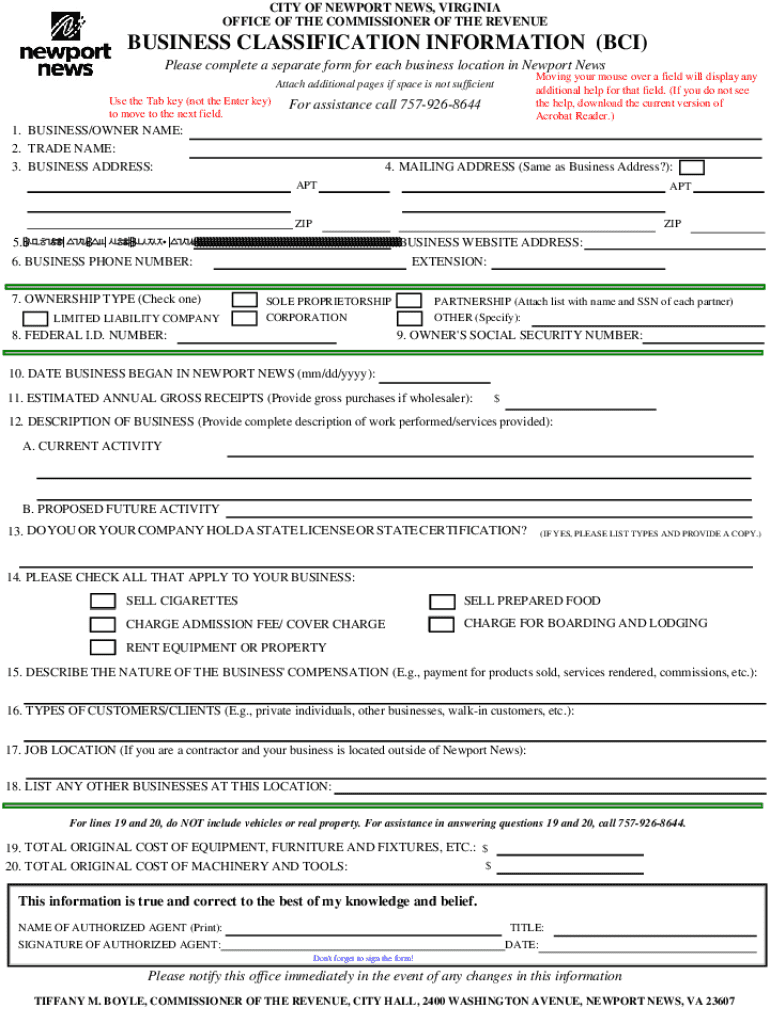

The business classification form is an essential document that assists in determining how a business is categorized, which can affect various aspects such as tax obligations, regulatory requirements, and legal liabilities. Accurate classification is critical because it influences the operational framework of a business and its corresponding legal requirements. For instance, a business classified as an LLC may enjoy limited liability protection, whereas a sole proprietorship does not.

What is the business classification form?

The business classification form serves as an official statement regarding the type of business entity one is operating. This form not only provides a legal classification but also sets the foundation for how the business will be treated under tax law. Common classifications include sole proprietorships, where the owner is personally liable for debts; partnerships, which involve two or more individuals sharing profits and liabilities; and corporations, which are separate legal entities that can shield owners from personal liability.

These classifications vary based on regulatory structures and the desired level of complexity in operations. For example, an LLC can provide the benefits of both corporate protection and pass-through taxation, making it a popular choice for small business owners.

Who needs to use the business classification form?

Every business entity aiming to operate legally must understand its classification and complete the business classification form. Eligible entities include individuals starting their businesses, small businesses looking for appropriate classification, corporations aiming for compliance, and partnerships that require a formal structure. Each entity type has unique characteristics that dictate filing requirements and tax implications.

Furthermore, the importance of accurate classification cannot be overstated. Misclassification could result in unexpected tax burdens and legal issues. Understanding the implications of each classification helps ensure compliance with local and federal regulations, allowing businesses to operate smoothly without unnecessary legal issues.

When is the business classification form due?

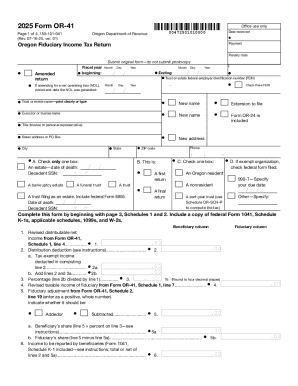

The filing deadlines for the business classification form can vary by state and the type of business entity. Generally, new business setups must file their classification forms at the time of registration. Additionally, many business entities are required to file annually to maintain compliance with regulatory agencies. These deadlines can be crucial not only for legal standing but also for tax considerations.

For instance, failing to file on time may lead to penalties and fines, jeopardizing the business's financial health. Late filings can complicate relationships with regulatory bodies and hinder business operations, leading to possible enforcement actions or increased scrutiny.

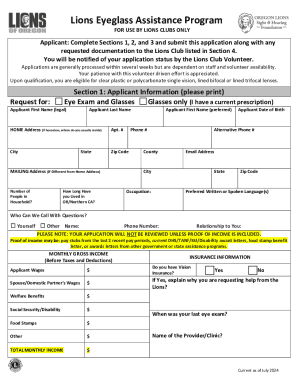

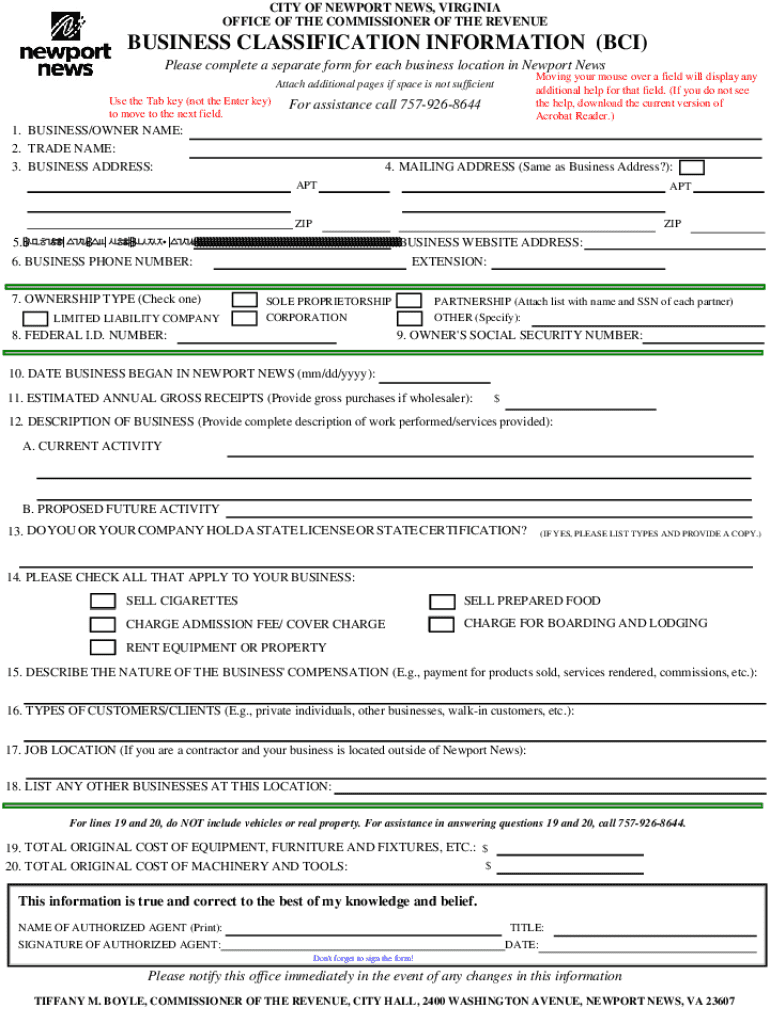

Step-by-step: How to fill out the business classification form

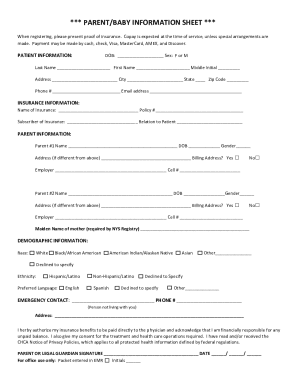

Filling out the business classification form is a straightforward process when you break it down into manageable steps. First, gather basic business information, including your business name, contact details, and any applicable registration numbers. Next, you will need to choose the type of business classification that best fits your entity. This is crucial as it will guide how your business is taxed and regulated.

The tax identification details section will require you to provide your Employer Identification Number (EIN) or Social Security Number (SSN). For LLCs and corporations, the EIN is particularly important as it signifies that your business is recognized as a separate entity for tax purposes.

Common mistakes to avoid when completing the form

Accuracy is key when completing the business classification form, and several common mistakes can lead to significant headaches. One prevalent error is misclassifying the type of business, which can result in improper tax treatment and legal exposure. Additionally, incomplete or incorrect information can delay processing or lead to denial of the application altogether.

Lastly, failing to meet filing deadlines can not only incur penalties but can also adversely affect your business's standing with tax authorities. Taking extra care during the completion process can save time and resources in the long run.

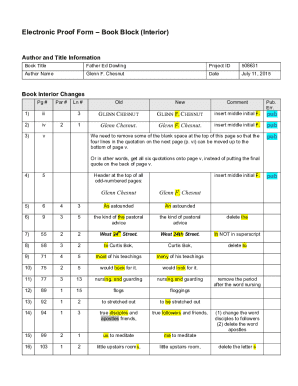

Tips for managing your business classification form

Efficient document management is vital for ensuring that your business remains compliant and organized. Keeping a well-maintained record of your business classification form and related documents is essential. Store and organize retained forms systematically to make retrieval easy during audits or when named in legal correspondence.

Consider tracking your filing dates and updates regularly to avoid any misstep. Utilizing tools like pdfFiller enhances your document management process with its user-friendly platform, allowing for seamless editing, eSigning, and collaboration on documents. It simplifies the filing process considerably, ensuring everything is handled with electronic accuracy.

FAQs about the business classification form

Many questions arise regarding the business classification form, particularly concerning changes and corrections after submission. Can I change my business classification later? Yes, however, it usually requires a formal reapplication and possible reassessment of your tax obligations. What happens if I file incorrectly? You may be subject to penalties, so it's essential to rectify any mistakes quickly. Lastly, obtaining a copy of your completed form is generally straightforward; most agencies offer online access or provide copies upon request.

Interactive tools for effective form completion

Utilizing interactive tools can significantly streamline the completion of your business classification form. Platforms like pdfFiller provide editable templates specifically tailored for this purpose. By leveraging eSignature functionality, you can expedite the approval process, ensuring your forms are signed promptly without delays.

Real-time collaboration features enable teams to work together efficiently, allowing inputs from different stakeholders to be integrated seamlessly. This ensures that every detail is accurate, reducing the risk of errors that could lead to complications down the line.

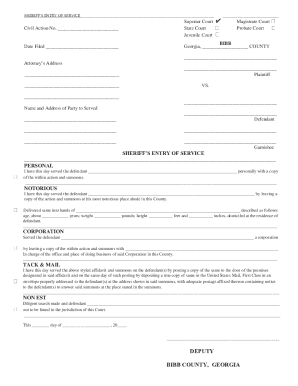

What to do after submitting your business classification form

Once you’ve submitted your business classification form, it's important to maintain a record of your submission for future reference. This will not only assist you during any eventual audits or inquiries but also aids in tracking the status of your classification. Keeping any confirmation or correspondence from the relevant authorities is advisable.

Understanding the follow-up process is equally essential; many states provide a timeline for processing applications, which can vary. You should know what to expect in terms of confirmation and possible feedback, ensuring you're prepared for any follow-up actions required.

Additional tips for business classification decisions

Choosing the right classification for your business is essential as it can impact your operations, liability, and tax responsibilities. When assessing your classification, consider several criteria: the nature of your business operations, potential liabilities, and your future growth plans. Each phase of your business journey might require re-evaluation to determine if your current classification is still optimal.

Resources for further assistance, such as industry-specific guidelines or consultations with professionals like CPA or legal advisors, can provide insights that ensure you make informed choices.

Explore more with pdfFiller

Incorporating pdfFiller into your workflow allows you to enhance your document management effectively. The cloud-based solutions offered by pdfFiller provide the flexibility needed for modern business operations. By utilizing a platform designed for document creation, editing, and management, you can streamline your processes to improve efficiencies across all areas of your business.

The benefits of a cloud-based document solution include accessibility, collaborative features, and storage capabilities that keep your documentation secure yet readily available whenever necessary. You can integrate pdfFiller into your daily operations to improve performance and maintain organization from anytime and anywhere.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit business classification form online?

How do I edit business classification form in Chrome?

Can I create an electronic signature for signing my business classification form in Gmail?

What is business classification form?

Who is required to file business classification form?

How to fill out business classification form?

What is the purpose of business classification form?

What information must be reported on business classification form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.