Get the free California Power of Attorney Form - LegalTemplates

Get, Create, Make and Sign california power of attorney

How to edit california power of attorney online

Uncompromising security for your PDF editing and eSignature needs

How to fill out california power of attorney

How to fill out california power of attorney

Who needs california power of attorney?

California Power of Attorney Form: A Comprehensive How-to Guide

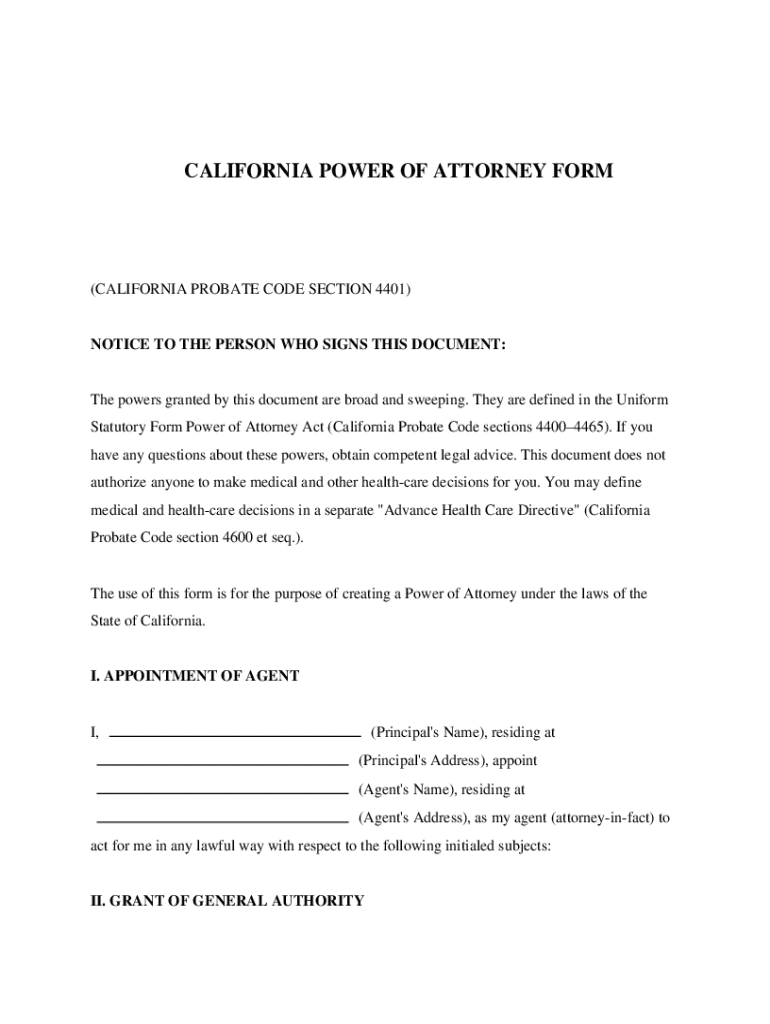

Understanding power of attorney (POA) in California

Power of Attorney (POA) in California is a legal document that allows individuals, known as principals, to authorize another person, called an agent or representative, to act on their behalf in various matters. The primary purpose of a POA is to ensure that decisions can be made even when the principal is incapacitated or unavailable. Having a POA in California is crucial because it provides clarity about who can make important decisions concerning health, finances, and legal matters, thereby minimizing the risk of disputes among family members during critical times.

California recognizes two primary types of power of attorney: Durable and Non-Durable. A Durable POA remains effective even if the principal becomes incapacitated, while a Non-Durable POA ceases to be valid upon the principal’s incapacitation. Additionally, there are specialized forms such as Medical Power of Attorney, which pertains specifically to health care decisions, and Financial Power of Attorney, which grants authority over financial matters. Understanding these distinctions is essential for choosing the right POA that meets your personal needs.

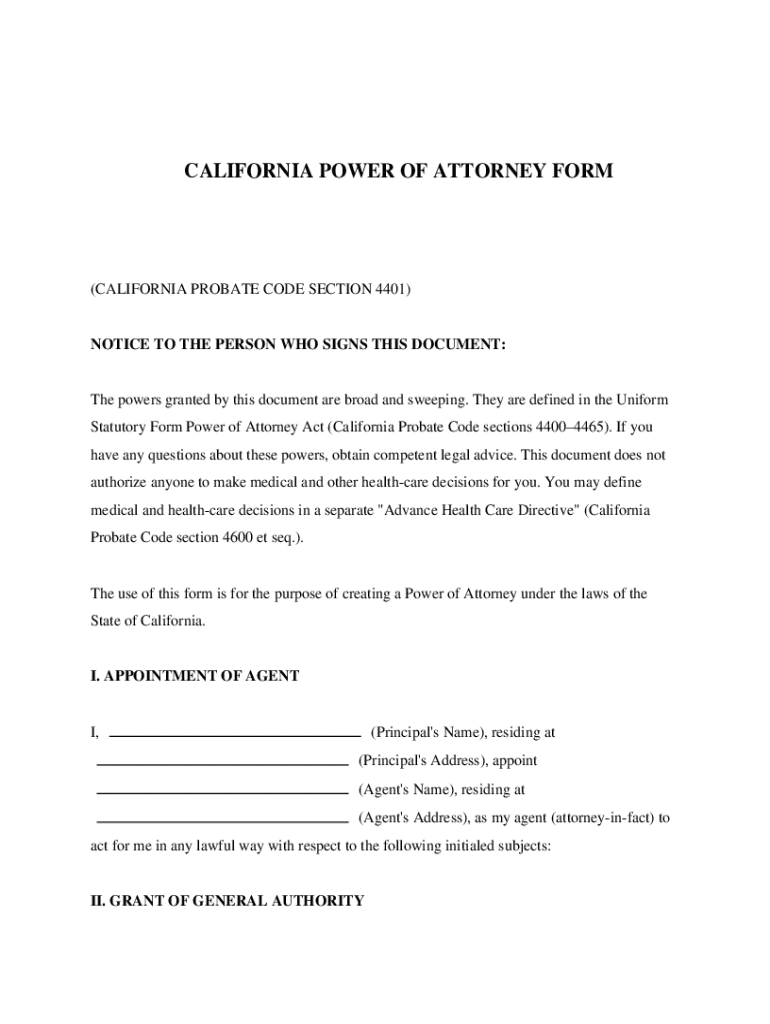

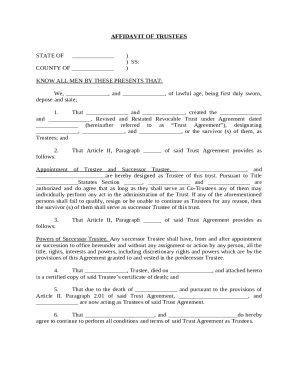

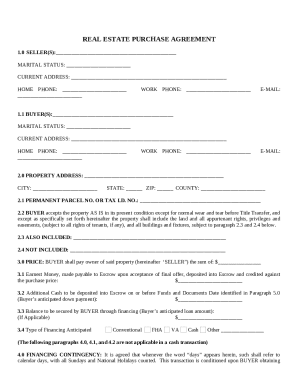

Overview of California power of attorney form

The California Power of Attorney Form is a legally recognized document designed to grant authority to your chosen agent over specified matters. This form varies based on specific needs—ranging from general POA, which grants broad powers to the agent, to limited POA, which gives authority over specific tasks. The California statute provides templates that assist individuals in creating a valid POA, ensuring that it complies with state laws.

Key components of the form include the identities of the principal and the agent, the powers being granted, and any limitations on those powers. The form must be completed meticulously to avoid ambiguity—each section invites a clear definition of responsibilities, making it a pivotal tool for effective decision-making when the principal cannot voice their choices.

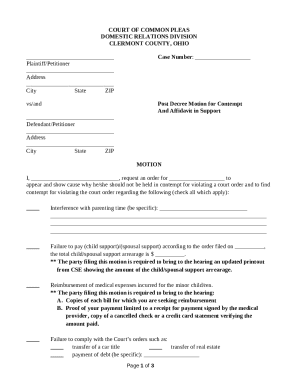

Step-by-step guide to filling out the California power of attorney form

Filling out the California Power of Attorney form involves several important steps. First, gather all required information, which includes personal details of both the principal and the agent, as well as the specific powers you wish to grant. Identifying these details helps to streamline the process and ensures that nothing is overlooked.

Second, download the California POA form. You can easily access the relevant version of the form from resources like pdfFiller—just select the form that meets your needs, whether it's a general or limited POA. Third, complete the form carefully. When filling it out, be sure to include:

Finally, ensure that the legal requirements are met. This includes obtaining the necessary signatures from both the principal and the agent, as well as fulfilling any witness and notary requirements that California mandates to maintain the legality of the document.

Editing and customizing the California power of attorney form

Once you have filled out the California Power of Attorney form, you might find the need to edit or customize it further. pdfFiller offers the perfect solution, allowing users to edit PDF forms with ease. The intuitive platform provides interactive tools that make customizing your POA straightforward—whether adjusting the scope of authority or adding additional clauses as required.

Moreover, with collaborative features, multiple users can access and edit the document simultaneously. This is particularly beneficial for teams or family members who may want to weigh in on the responsibilities being assigned to the agent, ensuring everyone’s voices are heard before finalizing any decisions regarding the principal’s legal and financial affairs.

Signing and managing your power of attorney document

After finalizing the California Power of Attorney documentation, the signing process must be conducted carefully. pdfFiller also provides eSigning options, allowing for a secure, convenient way to execute your document, even if physical presence is not possible. Electronic signatures are legally binding in California, making it a practical choice for many.

Managing your POA document post-signing is crucial. With pdfFiller, you can store your POA securely in the cloud, making it accessible whenever needed. Sharing options make it easy to provide copies to trusted individuals or financial institutions that may require access to this document. Regularly monitoring for any legal updates or changes to California laws regarding POA will also ensure your document remains valid and effective.

Rights and authorizations under the California power of attorney

The California Power of Attorney bestows certain rights and authorizations upon the appointed agent. Primarily, these rights can include managing the principal's financial affairs, dealing with investments, and making medical decisions where applicable. However, it is essential to establish clear limitations to prevent misuse of power. The authority granted can encompass a wide range of decisions, but there are constraints to ensure the principal's interests are protected.

Additionally, California law provides legal protections for the principal. For example, agents have a fiduciary duty to act in the best interests of the principal and cannot make decisions that might benefit themselves at the principal's expense. This legal structure reinforces the trust inherent in the principal-agent relationship, as agents are held accountable for their actions.

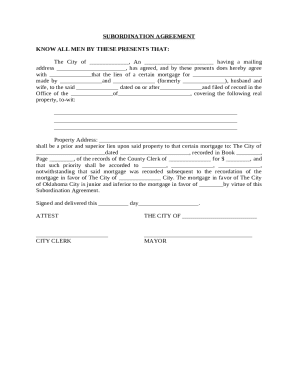

Additional authorizations (optional extensions)

Sometimes, a standard Power of Attorney may not encompass all the necessary powers you require. In such cases, you can include additional authorizations for specific medical decisions, such as end-of-life care or advanced treatment protocols. Additionally, options to manage financial transactions beyond the standard powers can be defined, including handling complex investments or real estate transactions.

When entering into real estate or property management authorizations, it’s essential to specify the limits of the agent’s authority to prevent overreach. These optional extensions allow you to tailor the POA to fit your unique situation, ensuring the agent can act in accordance with your wishes.

Revoking your power of attorney in California

At any point, if you feel that a Power of Attorney is no longer necessary or if you wish to change your agent, it is possible to revoke the POA. There are specific circumstances under which revocation is advisable, such as when there has been a change in relationships, the agent has become untrustworthy, or the principal has regained capacity to make their own decisions.

To officially revoke a Power of Attorney, you must complete a revocation form and notify the agent, as well as any institutions or parties that were previously informed about the POA. Notifying all relevant parties is essential to ensure that the revocation is effective and recognized.

FAQs about California power of attorney

There are common questions and concerns regarding California Power of Attorney that individuals might face. For instance, many wonder what happens if the principal does not name an agent, or if the agent is unwilling or unable to act. It's essential to have contingency plans, such as naming alternate agents, to ensure there is always someone available to step in if necessary.

Another frequent inquiry covers the process of establishing a POA. Ensure that you pay careful attention to detail to avoid common mistakes that can lead to invalidation. Seeking legal assistance can provide clarity, especially if your situation involves complex family dynamics or substantial financial assets.

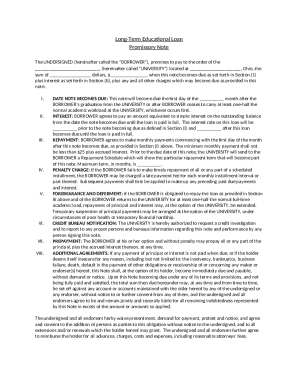

Using tax professionals with power of attorney

Appointing a tax professional under a Power of Attorney can streamline financial management, especially if the principal is unable to handle their tax information or related responsibilities. Tax professionals can act on behalf of the taxpayer, accessing information that can provide insights needed for effective decision-making regarding tax obligations.

Ensuring compliance with tax laws is critical, and having a knowledgeable tax representative can minimize complications arising from audits or unpaid taxes. Establishing a POA specifically for tax purposes can help facilitate communication between the taxpayer and the IRS, allowing for smooth management of tax forms and information.

Final considerations

Regularly reviewing your California Power of Attorney documentation is vital. Changes in personal circumstances, family dynamics, or legal regulations can impact your POA’s relevance. Involving legal counsel in your POA matters ensures that you remain informed about these factors and any adjustments necessary.

Moreover, staying proactive about changes in California POA laws protects your interests and maintains the legal effectiveness of your documents. As life evolves, communicating with trusted advisors helps ensure that all documents, including your Power of Attorney, align smoothly with your current needs and intentions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get california power of attorney?

How can I fill out california power of attorney on an iOS device?

How do I edit california power of attorney on an Android device?

What is california power of attorney?

Who is required to file california power of attorney?

How to fill out california power of attorney?

What is the purpose of california power of attorney?

What information must be reported on california power of attorney?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.