Get the free State Auditor Shad White discusses Project Momentum, the ...

Get, Create, Make and Sign state auditor shad white

Editing state auditor shad white online

Uncompromising security for your PDF editing and eSignature needs

How to fill out state auditor shad white

How to fill out state auditor shad white

Who needs state auditor shad white?

Understanding the State Auditor Shad White Form

Overview of the State Auditor Shad White Form

The State Auditor Shad White Form serves as a crucial tool for ensuring transparency and accountability in the management of taxpayer dollars. This form is designed for various stakeholders within the state of Mississippi, enabling them to report on financial matters that impact the state's budget and resource allocation. Its importance cannot be overstated, as accurate reporting is fundamental to preventing misuse and fraud.

Understanding the role of the State Auditor

The State Auditor serves as an essential figure in overseeing the financial operations within Mississippi. Responsible for auditing state agencies and ensuring compliance with financial regulations, the auditor's role involves detecting fraud, waste, and abuse of taxpayer dollars. Shad White, the current state auditor, has implemented various initiatives aimed at improving financial transparency and increasing public trust in government operations.

One notable initiative is the increased focus on the reporting of fraud and misuse, coupled with a commitment to educate the public about accountability. Auditor White's reports often lead to critical insights for communities across Mississippi, prompting necessary changes and enhancing the overall integrity of public finances.

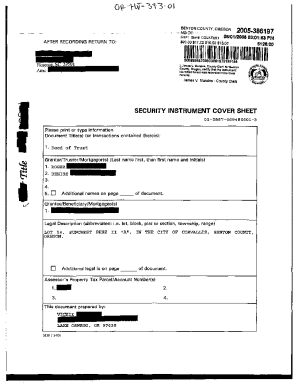

Types of forms and documentation

The State Auditor's office provides a variety of forms to facilitate reporting and compliance. These documents are essential for maintaining financial integrity and ensuring that funds are utilized correctly. Among these forms are:

The Shad White form specifically encompasses details outlined by the auditor’s office and is designed to address specific reporting requirements, ensuring proper handling of state funds. Its user-friendly format aids in enhancing clarity and efficiency.

Step-by-step guide to accessing the Shad White form

Accessing the State Auditor Shad White Form is a straightforward process. Here’s how you can obtain it through the official website:

How to effectively fill out the Shad White form

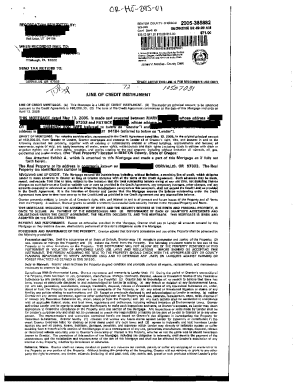

Filling out the State Auditor Shad White Form accurately is crucial for effective reporting. Each section of the form is designed to collect specific information, and understanding the requirements is key.

Common mistakes to avoid include neglecting to double-check figures, omitting required signatures, and failing to submit the form by designated deadlines. Taking the time to review your work can prevent unnecessary complications.

Editing and customizing your form

After downloading the Shad White form, you may find it beneficial to customize it. Using [pdfFiller], you can make adjustments easily. This platform offers robust features that allow users to edit forms without hassle.

Signing the Shad White form

Properly signing the Shad White form is essential for compliance with state regulations. eSigning is a legal way to finalize your documents without needing to print them physically, making the process faster and more efficient.

Remember that electronic signatures hold the same legal weight as handwritten ones; however, ensure compliance with any specific requirements associated with your form.

Collaborating with others on the form

If you're working with a team, collaborating on the Shad White form can streamline the process. [pdfFiller] provides various tools that facilitate team collaboration. Sharing the document allows for collective input and ensures accuracy.

Through these collaborative features, you can enhance the quality of your submissions and foster teamwork, which is invaluable in managing accountability and transparency.

Submitting the form

Submitting your completed Shad White form is the final step in the process. You have options for how to submit, each with its own procedures.

Ensure that you include any necessary accompanying documents and maintain copies for your records. Following up to confirm receipt is advisable as part of responsible management.

Troubleshooting common issues

Users may encounter various challenges while completing and submitting the Shad White form. Identifying common problems and knowing how to resolve them can save time and frustration.

For additional support, [pdfFiller] offers customer service options to help you navigate any technical difficulties.

Managing your documents after submission

After submitting the Shad White form, it's vital to manage your documents effectively. Proper storage and organization can streamline your future interactions with the State Auditor's office.

By managing your documents well, you can facilitate better communication with the State Auditor’s office and stay on top of potential queries regarding taxpayer funds.

Real-life case studies

Examining real-life instances where the Shad White form has played a critical role can provide insight into its effectiveness. Successful form submissions have led to positive changes in local policies and have helped curb financial misuse.

These case studies underline the form's impact and reinforce the importance of active community participation in financial oversight.

Best practices for ongoing compliance

Ongoing compliance with financial requirements is critical for maintaining the integrity of state operations. Keeping up with updates from the State Auditor’s office can ensure that you're aware of any changes to the forms or submission processes.

Implementing these best practices not only enhances compliance but also fosters a culture of accountability within organizations managing taxpayer funds.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my state auditor shad white in Gmail?

How can I send state auditor shad white for eSignature?

How do I make changes in state auditor shad white?

What is state auditor shad white?

Who is required to file state auditor shad white?

How to fill out state auditor shad white?

What is the purpose of state auditor shad white?

What information must be reported on state auditor shad white?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.