Get the free Tax Preparation & Payroll Services St Michael MN55376

Get, Create, Make and Sign tax preparation amp payroll

Editing tax preparation amp payroll online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax preparation amp payroll

How to fill out tax preparation amp payroll

Who needs tax preparation amp payroll?

Tax preparation and payroll form: A comprehensive how-to guide

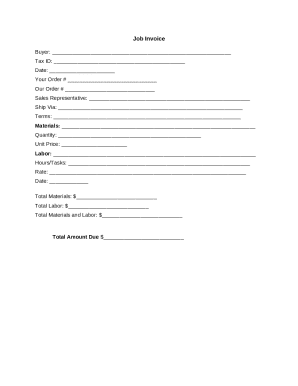

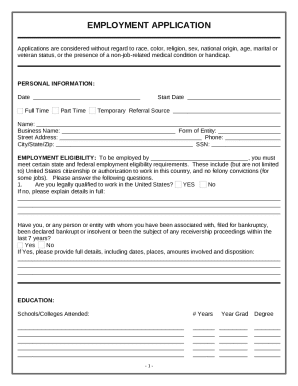

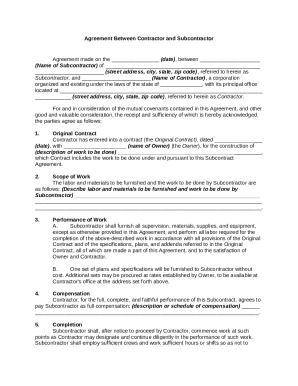

Understanding the tax preparation & payroll form

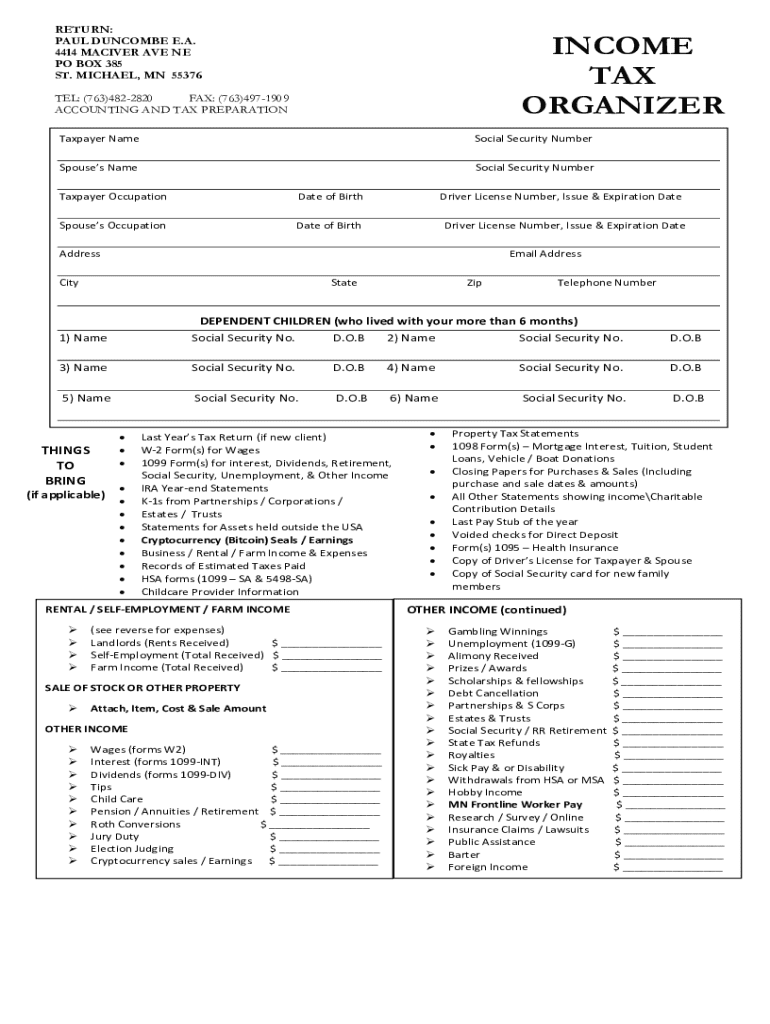

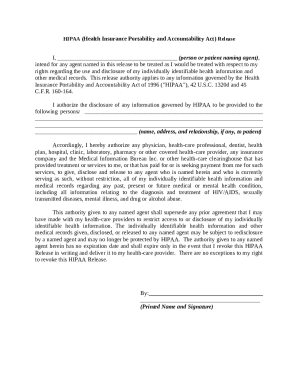

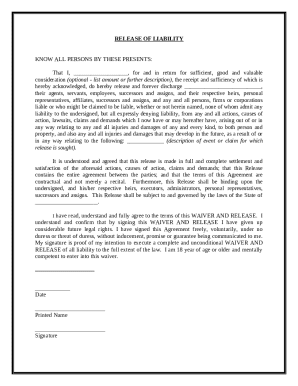

The tax preparation and payroll form serves a crucial role in both personal finance and corporate administration. This form consolidates vital information regarding income, deductions, and other financial details that play a decisive role in calculating an individual or company's tax liabilities. Accurate completion of this form is essential for ensuring compliance with legal obligations and minimizing potential penalties associated with errors or omissions.

Legal requirements for tax preparation and payroll management often vary between jurisdictions; however, generally accepted guidelines necessitate thorough documentation to support reported figures. Businesses must maintain accurate payroll records to reflect employee earnings, tax withholdings, and any benefits. The IRS mandates specific documentation, and understanding these requirements is crucial for both business owners and individuals aiming for peace of mind and profitability.

Key components of the tax preparation & payroll form

The tax preparation and payroll form comprises several essential components that need precise attention. Key sections include personal information, financial information, employment details, and deductions and credits. Each section serves to gather specific information that contributes to the overall tax calculation.

Common mistakes to avoid include omitting necessary signatures, providing incorrect Social Security Numbers, or failing to include all sources of income. Such errors can lead to delays or financial penalties, underscoring the necessity for careful review.

Step-by-step instructions for filling out the tax preparation & payroll form

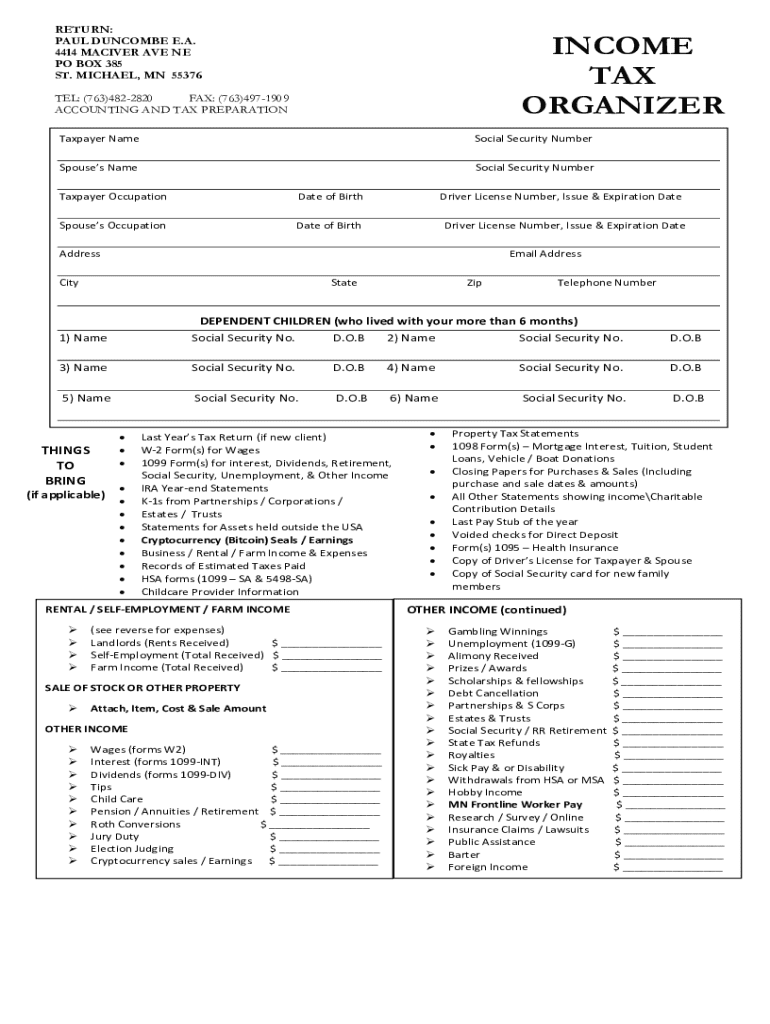

Filling out the tax preparation and payroll form can feel daunting, but breaking it down into manageable steps simplifies the process. The first step involves gathering necessary documentation, which includes W-2 forms, 1099s, and other income statements. Organizing this paperwork by category can help streamline the flow of information during completion.

Each of these steps requires clear attention to detail, preventing miscommunication and ensuring your taxes reflect an accurate financial picture.

Managing and editing your tax preparation & payroll form

With modern technology, managing and editing your tax preparation and payroll form has never been easier. Utilizing tools like pdfFiller allows you to edit documents seamlessly. You can quickly navigate through sections and make changes without the hassle of traditional paper methods.

To edit your form online, begin by uploading your document to the cloud platform. Then, use intuitive editing tools to input necessary changes, ensuring you save frequently to safeguard your progress. Once finalized, pdfFiller allows you to easily retrieve your filled forms at any time, reinforcing the importance of keeping your administrative processes streamlined.

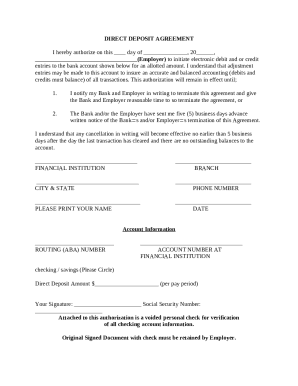

eSigning your tax preparation & payroll form

eSigning your tax preparation and payroll form has become increasingly popular due to its convenience and legal standing. The e-signature process eliminates the need for printing, signing, and scanning, allowing for a completely digital workflow. Legal considerations must be taken into account, ensuring the e-signed document meets the criteria established by the Electronic Signatures in Global and National Commerce (ESIGN) Act.

Using pdfFiller simplifies the e-signature process. You just upload the document, add your signature electronically, and save it digitally. This ensures that your document remains secure while providing an auditable trail of consent, giving you peace of mind in your administrative practices.

Collaborating on your tax preparation & payroll form

Effective collaboration is vital when managing tax preparation and payroll forms, especially in team environments. Sharing the form with team members or tax professionals can lead to vital insights and improvements. Utilizing pdfFiller’s collaboration tools enables seamless feedback and editing, allowing multiple users to add notes or modifications in real time.

Best practices for collaboration include assigning roles, creating specific timelines for reviews, and ensuring all team members understand their responsibilities. Keeping communication open fosters a proactive bookkeeping environment that enhances the quality of the final submission.

Submitting your tax preparation & payroll form

Once your tax preparation and payroll form is complete, the next critical step is the submission process. Understanding the different submission methods—online filing, mailing hard copies, or delivering in person—can influence your timeliness and documentation accuracy. Many individuals and organizations prefer online methods due to speed and tracking capabilities.

Understanding deadlines is crucial as well; late submissions can incur penalties that add unnecessary costs. Tracking your submission status post-filing further mitigates risks associated with errors.

Troubleshooting common issues

Mistakes can happen while filling out your tax preparation and payroll form, but knowing how to address them is essential for maintaining compliance. If you discover an error after submission, the IRS allows you to amend your tax return while providing guidelines on how to do so. This corrective action ensures that you remain compliant and minimize any potential penalties.

If you need to update payroll information post-submission, communicate promptly with payroll providers or tax authorities, ensuring that all required documents are adjusted accordingly. Plus, seek help from resources such as the IRS website or professional accountants if you face complexities during these processes.

Enhancing your tax preparation process with technology

Integrating technology into your tax preparation process can yield substantial benefits when managing the tax preparation and payroll form. Platforms like pdfFiller not only enhance editing and signing but also offer tools for document management that streamline overall efficiency. Cloud-based solutions provide accessibility from anywhere, ensuring vital documents are safe and easily retrievable.

Comparatively, traditional paper methods often entail more risks, such as loss or damage, which can complicate workflows. Embracing modern technology safeguards your business administration from potential pitfalls while enhancing profitability by focusing on more strategic business decisions.

Frequently asked questions (FAQs)

Navigating tax preparation and payroll form can generate numerous questions, especially for new users. Clarifying common queries provides a clearer path forward. For instance, many individuals might wonder why specific documents are required, or how to ensure they're utilizing the correct forms.

Understanding these concerns can lead to more effective processes and greater confidence in handling tax-related responsibilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get tax preparation amp payroll?

How do I complete tax preparation amp payroll online?

Can I sign the tax preparation amp payroll electronically in Chrome?

What is tax preparation & payroll?

Who is required to file tax preparation & payroll?

How to fill out tax preparation & payroll?

What is the purpose of tax preparation & payroll?

What information must be reported on tax preparation & payroll?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.