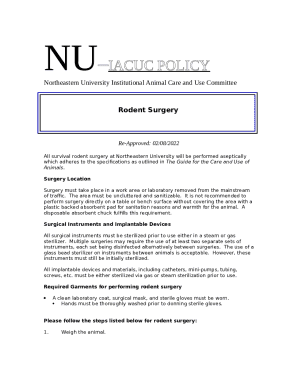

IRS Form 8881 2025-2026 free printable template

Get, Create, Make and Sign IRS Form 8881

How to edit IRS Form 8881 online

Uncompromising security for your PDF editing and eSignature needs

IRS Form 8881 Form Versions

How to fill out IRS Form 8881

How to fill out form 8881 rev december

Who needs form 8881 rev december?

A comprehensive guide to form 8881 rev December form

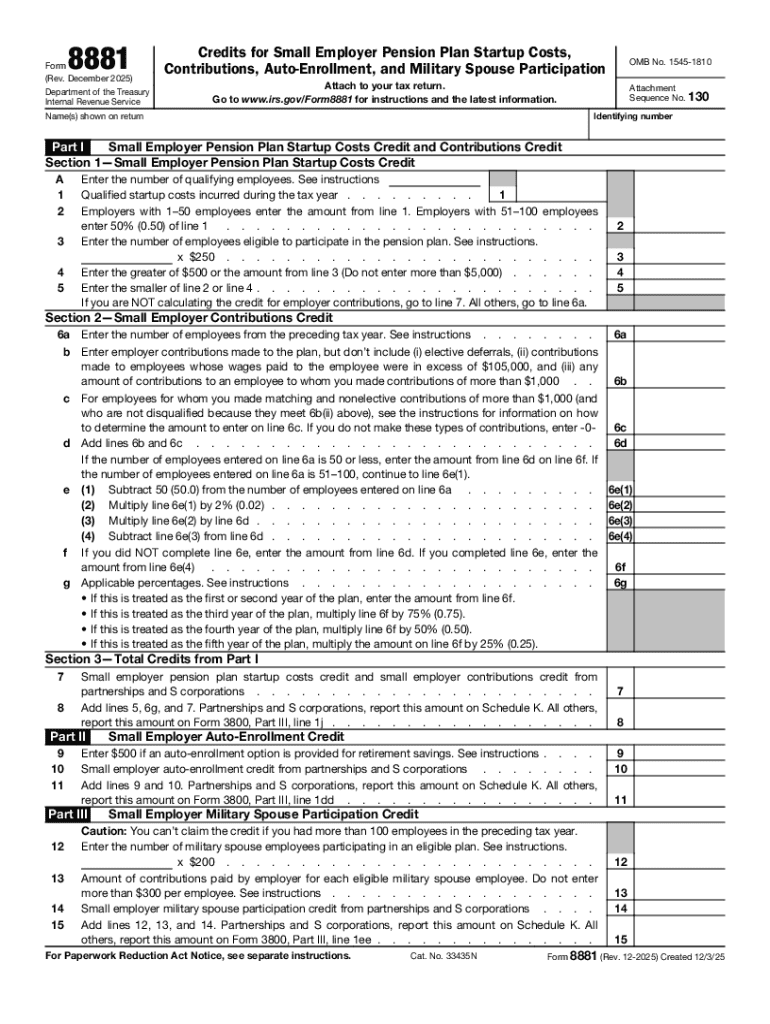

Understanding Form 8881

Form 8881 is utilized by eligible small businesses to claim a credit for startup costs incurred in establishing a qualified pension plan. This form is crucial for businesses setting up retirement savings plans to encourage employee participation and ensure compliance with IRS regulations.

This tax credit is specifically aimed at small employers, providing financial relief for the costs associated with creating a pension plan. Not only does Form 8881 facilitate tax credit claims for the small employer pension plan startup costs, but it also plays an integral role in promoting increased retirement savings among employees.

Who needs to file this form?

Any small business seeking tax credits related to retirement plan startup costs is required to file Form 8881. This includes those who are incorporating auto-enrollment features in their plans or those that employ military spouses as part of their workforce.

Typically, small businesses with 100 or fewer employees are eligible. If a company is starting a pension plan, this form is essential for documenting the initiative and applying for credits that offset part of the costs.

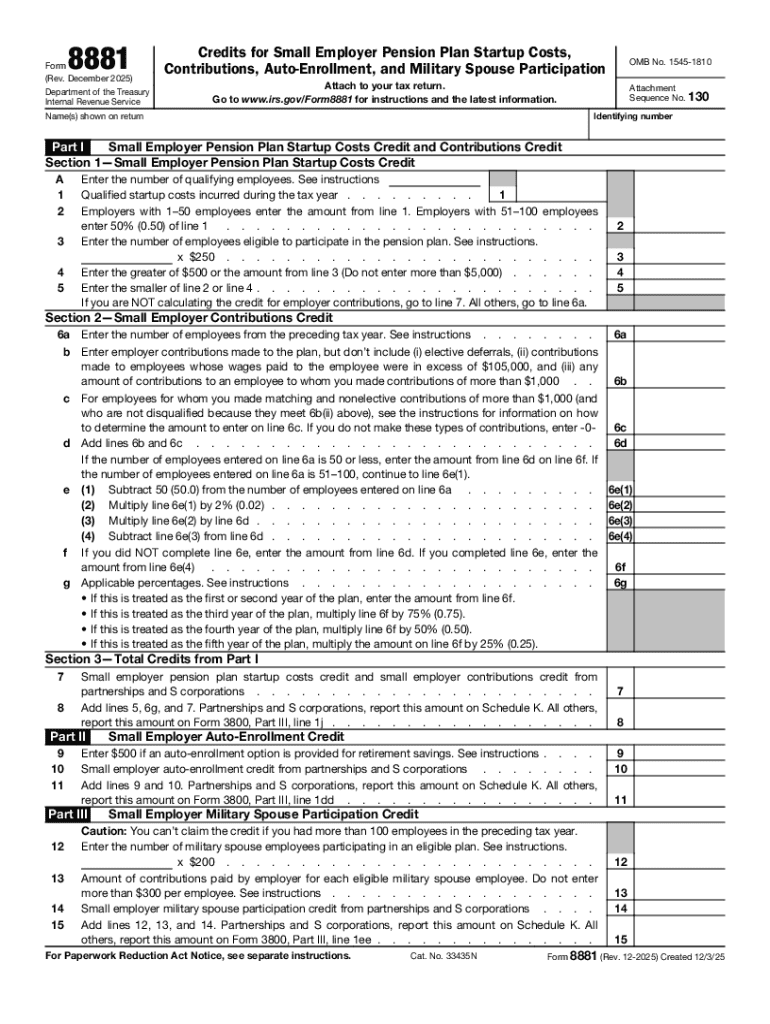

Key components of the form

Form 8881 comprises several sections, each designed to capture essential data regarding the employer's retirement plan setup costs, employee coverage, and more. It requires users to provide a detailed account of qualified plan startup expenditures, demonstrating eligibility for the tax credits.

Each section must be filled out thoroughly. Understanding the interplay of these elements is crucial to ensure compliance with IRS guidelines and maximize potential tax benefits.

Preparation for filing Form 8881

Before filling out Form 8881, it's critical to gather all necessary documentation to support your claims. Employers should have receipts for all costs associated with the pension plan, including administrative fees, employee communication expenses, and any professional services utilized during the planning process.

It's also imperative to ensure you meet all eligibility criteria outlined by the IRS. The business must have at least one employee and must be considered a small business according to the IRS's small business definition.

Filling out Form 8881: A step-by-step guide

Filling out Form 8881 requires careful attention to detail. Start by entering your personal or business information accurately on the first part of the form. This foundational step ensures that the IRS can correctly associate your claims with your business.

Next, report each qualified purchase and cost associated with the pension plan. Ensure that every expenditure is well-documented to support your claim for tax credits effectively. The IRS offers specific guidelines on what constitutes eligible expenses, which can help avoid confusion in reporting.

After listing your expenses, calculate the available tax credits using the percentages mandated by the IRS. Be diligent in applying these percentages to avoid common pitfalls.

Finally, before submitting, conduct a final review of the form. Check for any clerical errors, missing information, or miscalculated credits.

Common FAQs about Form 8881

One of the most frequently asked questions concerning Form 8881 involves the protocol for correcting errors after submission. In such situations, it's necessary to file an amended form. This ensures any mistakes are rectified officially and that the IRS accounts for the corrections in its records.

Businesses often also ask about the submission deadlines for this form. Form 8881 typically is filed alongside your business tax return, making it essential to understand your specific filing dates based on your business structure.

Special considerations

With the revised version of Form 8881 released in December, businesses need to be aware of any updates that may affect their eligibility or tax credit calculations. Staying informed about these revisions can significantly impact financial planning and tax strategy.

Engaging a tax professional can provide invaluable assistance, ensuring compliance with all requirements and optimizing available credits. Selecting the right professional involves researching their experience with Form 8881, their general tax knowledge, and how well they understand the specific needs of small businesses.

Interactive tools for complete management

Utilizing online platforms such as pdfFiller can enhance the process of completing Form 8881. The platform allows users to fill out forms easily, offering tools for e-signatures and smooth digital collaboration.

Employing pdfFiller's secure document management system can simplify the process by keeping all relevant documentation in one place and facilitating efficient access and edits. Users can benefit from cloud storage, ensuring that all documents are accessible anywhere.

Advanced insights for professionals

For tax professionals, analyzing the broader tax implications related to Form 8881 can provide insights into client strategies. Beyond the immediate benefits, understanding how this credit aligns with long-term business plans can position a firm as a valuable advisor to its clients.

Additionally, examining case studies of successful utilizations of Form 8881 can illuminate best practices and common errors. These real-world examples are critical for refining practices and enhancing advisory roles.

Engaging with the community

Encouraging users to share their experiences with Form 8881 can help foster a supportive community. Insightful discussions about challenges and tips could benefit many businesses navigating the filing process.

Building a network of support through online forums and groups can empower small businesses, allowing them to learn from others similarly affected by the complexities surrounding retirement plan setups and tax credits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit IRS Form 8881 from Google Drive?

How can I get IRS Form 8881?

How do I complete IRS Form 8881 on an Android device?

What is form 8881 rev december?

Who is required to file form 8881 rev december?

How to fill out form 8881 rev december?

What is the purpose of form 8881 rev december?

What information must be reported on form 8881 rev december?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.