Get the free Seven Complete Years of Beacon to Draw to a close

Get, Create, Make and Sign seven complete years of

How to edit seven complete years of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out seven complete years of

How to fill out seven complete years of

Who needs seven complete years of?

Seven Complete Years of Form: Your Comprehensive Guide to Completion and Management

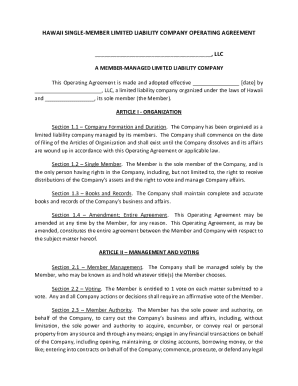

Understanding the seven complete years of form

The seven complete years of form is a crucial document typically required for various administrative processes, particularly in finance, immigration, or legal matters. Its primary purpose is to provide a comprehensive overview of a person's personal, financial, and employment history over the past seven years. Accurate completion of this form is essential, as inaccuracies can lead to delays or rejections in applications where precise information is a critical factor.

Completing the seven complete years of form accurately ensures that all relevant data is presented cohesively. This not only facilitates smoother processing by authorities but also builds credibility and trust. Any discrepancies may raise flags and lead to potential consequences, highlighting the importance of meticulous detail in every section of the form.

Key components of the seven complete years of form

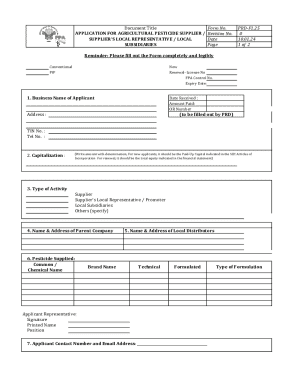

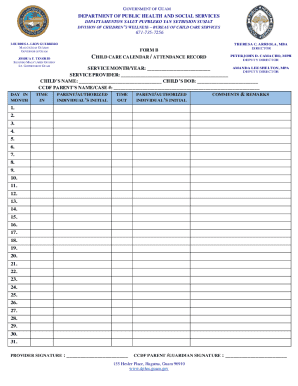

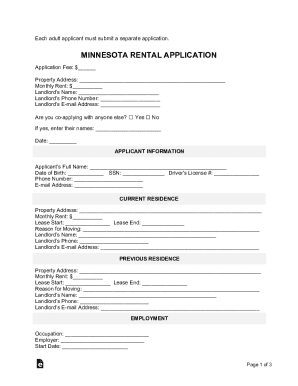

A well-structured seven complete years of form consists of several key components. Understanding these sections is vital for providing thorough and precise information. Below is a detailed breakdown of these essential components:

Pre-filling preparation

Before diving into the filling process, gathering all necessary documents is essential. Understanding what documents you need makes the task more manageable and organized. Here's a list of required documents to assist you in the pre-filling stage:

Organizing this information in advance not only simplifies the process but also ensures that you understand the relevance of each section in the form. Each part plays a unique role in presenting a full picture of your history, thus its accurate portrayal is indispensable.

Step-by-step instructions for completing the form

Completing the seven complete years of form can seem daunting, but with following a structured approach, the process can be made easier. Here’s a concise guide to help you efficiently complete the form:

Common mistakes to avoid

When filing the seven complete years of form, certain common mistakes can hinder the process. Recognizing these errors upfront can save you time and aggravation later. Here are some common pitfalls to watch out for:

Editing and reviewing your completed form

Once the form is completed, reviewing and editing it is crucial. pdfFiller offers tools designed both for streamlined editing and for comprehensive adjustments. Here’s how to utilize these tools effectively:

Signing and submitting the form

After thorough review, it’s time to sign and submit your completed seven complete years of form. Here are the steps to do so securely:

Managing your completed form

Post-submission, keeping your completed seven complete years of form organized is essential for future reference. Here’s how to manage your document effectively:

Frequently asked questions (FAQs)

Certain questions arise frequently regarding the seven complete years of form process. Below are some common inquiries and their responses:

Advanced tips for teams and individuals

If you’re part of a team or manage multiple submissions, leveraging advanced features in pdfFiller can greatly enhance your workflow. Here are strategies for effective collaboration and document management:

Conclusion: streamlining your form management with pdfFiller

The process of filling out the seven complete years of form can be daunting, but with the right resources and strategies in place, it becomes manageable. Utilizing tools like pdfFiller empowers users to seamlessly edit, eSign, collaborate, and manage documents from a single, cloud-based platform.

By embracing a comprehensive solution for form management, individuals and teams can ensure streamlined processing, reduce errors, and enhance overall efficiency. As you tackle your seven complete years of form, remember the benefits that pdfFiller provides to simplify your tasks and ensure your documents remain precise and organized.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit seven complete years of from Google Drive?

How do I make changes in seven complete years of?

Can I edit seven complete years of on an iOS device?

What is seven complete years of?

Who is required to file seven complete years of?

How to fill out seven complete years of?

What is the purpose of seven complete years of?

What information must be reported on seven complete years of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.