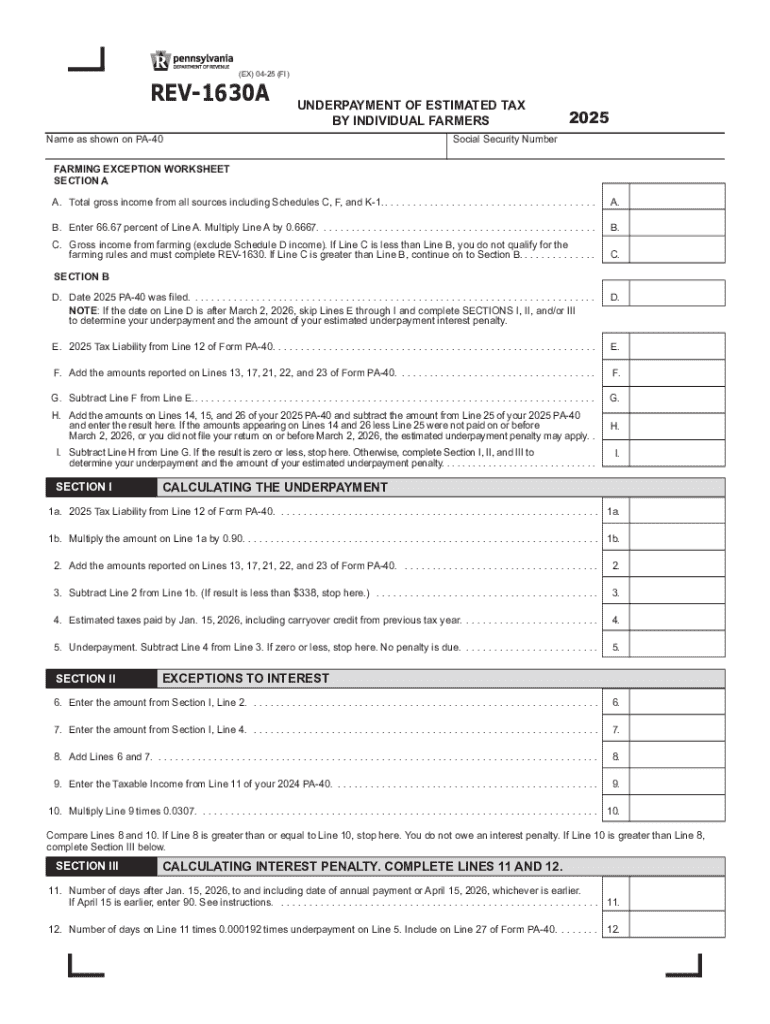

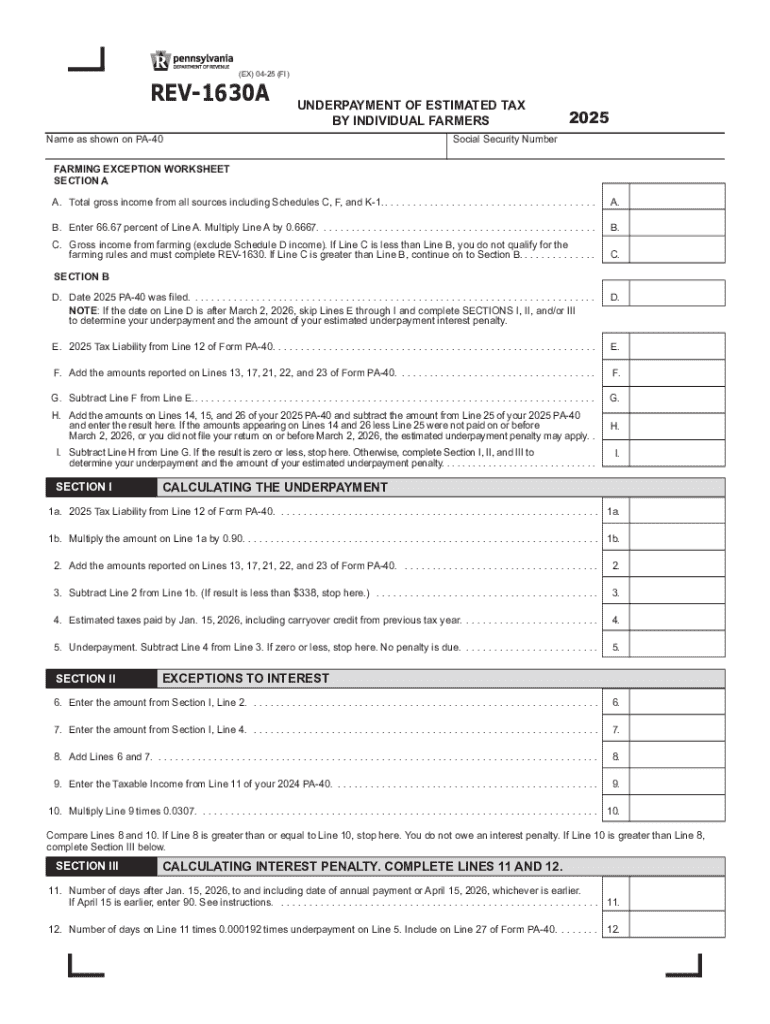

Get the free 2025 Underpayment of Estimated Tax by Farmers (REV-1630A). Forms/Publications

Get, Create, Make and Sign 2025 underpayment of estimated

Editing 2025 underpayment of estimated online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 underpayment of estimated

How to fill out 2025 underpayment of estimated

Who needs 2025 underpayment of estimated?

2025 Underpayment of Estimated Tax Form: A Comprehensive Guide

Understanding underpayment of estimated taxes

Estimated taxes are payments made towards your expected annual tax bill, typically required for self-employed individuals, freelancers, and corporations. Unlike traditional withholding, where the employer deducts taxes from an employee's paycheck, estimated tax payments are typically made quarterly based on projected income, deductions, and credits.

Ensuring your estimated tax payments are accurate is crucial. Underpayment can result in significant penalties during tax season and may complicate your financial situation. The tax landscape is ever-changing, and in 2025, taxpayers will need to be vigilant about new legislative changes that could affect their tax obligations.

The IRS has specific guidelines for estimated tax payments, and using the 2025 underpayment of estimated tax form correctly is essential for compliance. Understanding your responsibilities can help mitigate risks and ensure you are prepared come tax season.

Who is required to pay estimated taxes?

Not everyone is required to pay estimated taxes. Generally, individuals and self-employed taxpayers must pay estimated taxes if they expect to owe at least $1,000 in tax after subtracting withholding and refundable credits. If you're self-employed, freelancers, or have irregular income, you fall under this category.

Entities such as corporations also have different stipulations. Corporations generally must make estimated payments if they expect to owe tax. Failure to meet these requirements could lead to unexpected tax liabilities, underscoring the need for careful monitoring.

Factors influencing underpayment of estimated taxes

There are numerous reasons taxpayers may find themselves underpaying their estimated taxes. One of the most common issues arises from changes in income. If you earn significantly more or less than in previous years, your estimated tax payments should be adjusted accordingly.

Penalties for underpayment can become quite severe. The IRS typically imposes a penalty if you pay less than 90% of your current year’s tax liability or if you underpay your previous year’s tax. Understanding how penalties are calculated can help you avoid unnecessary costs and ensure you're compliant with your payment obligations.

Timelines for making estimated tax payments

The IRS has established specific deadlines for estimated tax payments in 2025. These payments are typically due quarterly, with the first payment due on April 15, continuing in June, September, and concluding in January of the following year.

Keeping track of these deadlines is crucial to avoid penalties. Many taxpayers find it beneficial to set reminders or use calendar tools to ensure deadlines are met.

Tools and resources for managing estimated tax payments

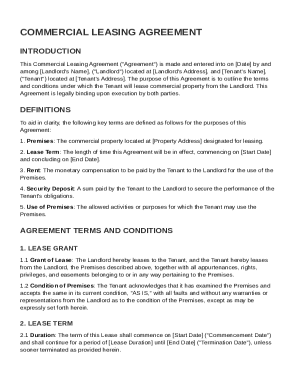

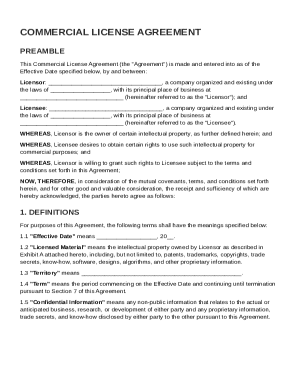

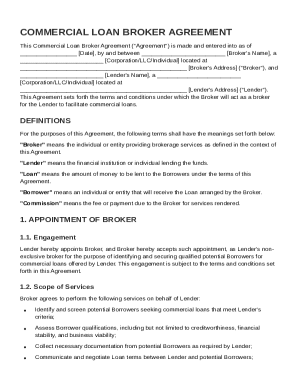

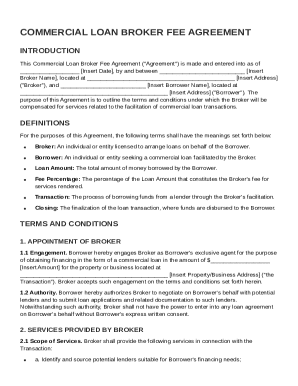

Navigating tax filings can be considerably simplified with the right tools. pdfFiller offers a wealth of features to create and manage essential tax documents like the 2025 underpayment of estimated tax form. Users can take advantage of accessible templates specifically designed for this purpose.

Additionally, interactive tools available through pdfFiller can enhance your ability to calculate estimated payments and avoid underpayment scenarios. Collaboration features also make it easier for teams to share information and progress, ensuring everyone is aligned with financial obligations.

Step-by-step guide to filing the estimated tax payment form

Accessing the 2025 underpayment form through pdfFiller is straightforward. First, visit their homepage and locate the 2025 tax templates. Once you've selected the estimated tax form, begin entering your information.

Before submission, review your form thoroughly. Common mistakes include miscalculating totals, omitting necessary information, and failing to sign the document. Use the validation checks available in pdfFiller to enhance the accuracy of your submission.

Submission and payment of your estimated taxes

After completing your underpayment of estimated tax form, it’s time to submit and make your payment. The IRS offers multiple payment methods, including electronic submission options that are quick and efficient.

Tracking your payments is essential to avoid issues with underpayment. Consider utilizing tracking services or simply keeping a detailed record of all payments made, including dates and amounts.

Understanding your rights and obligations

As a taxpayer, it's important to be aware of your rights and obligations. If you think you have overpaid your estimated taxes, the IRS allows you to claim a refund through the appropriate forms.

Documentation supporting your payment history is essential for resolving any potential disputes or inquiries.

Managing your tax responsibilities for future years

Planning ahead is vital to avoid underpayment in the subsequent year like 2026. Setting up a detailed payment schedule allows you to allocate funds proactively and address potential fluctuations in income.

By maintaining organized records, you can better prepare for tax obligations, ensuring you remain in compliance with IRS regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 2025 underpayment of estimated in Gmail?

Can I sign the 2025 underpayment of estimated electronically in Chrome?

How do I fill out 2025 underpayment of estimated using my mobile device?

What is 2025 underpayment of estimated?

Who is required to file 2025 underpayment of estimated?

How to fill out 2025 underpayment of estimated?

What is the purpose of 2025 underpayment of estimated?

What information must be reported on 2025 underpayment of estimated?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.