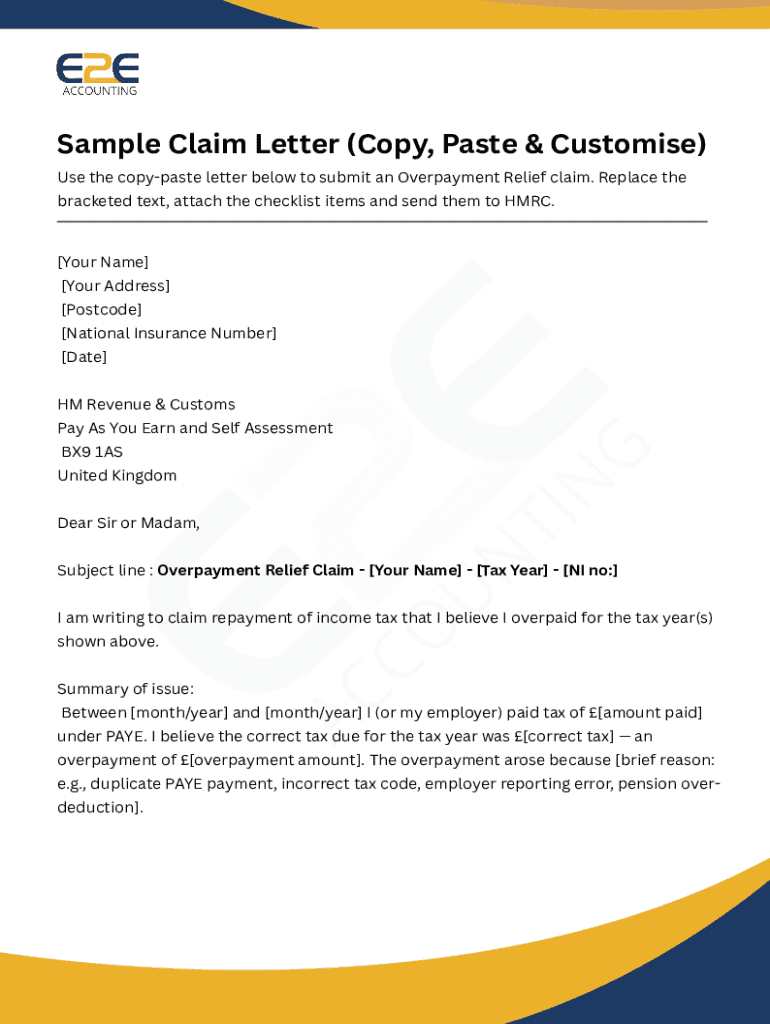

Get the Free Overpayment Relief Claim Letter Template to Edit ...

Get, Create, Make and Sign overpayment relief claim letter

How to edit overpayment relief claim letter online

Uncompromising security for your PDF editing and eSignature needs

How to fill out overpayment relief claim letter

How to fill out overpayment relief claim letter

Who needs overpayment relief claim letter?

Overpayment Relief Claim Letter Form: Your Complete Guide

Understanding overpayment relief claims

Overpayment relief claims are essential tools that individuals can use to address situations where excess payments have been made in various contexts, such as taxes, benefits, or loans. The primary goal of these claims is to rectify financial errors, ensuring that claimants receive refunds or reductions in future payments. Overpayment often occurs due to miscalculations, changes in income, or erroneous information provided by financial institutions or government agencies.

Common scenarios leading to overpayment include underreporting income affecting tax refunds, receiving incorrect unemployment benefits, or mistakenly overpaying a loan due to conflicting information from a lending office. Understanding the circumstances surrounding these claims allows claimants to effectively navigate their claims and seek rightful recovery.

Legal framework around overpayment claims

Various laws and regulations govern overpayments, depending on the jurisdiction and specific circumstances. For instance, in the United States, federal guidelines dictate how agencies address overpayments, emphasizing the importance of accurate record-keeping and transparency. Claimants are protected under consumer rights, which mandate that they receive clear information regarding any debts, potential overpayments, and the respective processes for dispute.

Understanding these rights empowers individuals to advocate for their interests effectively. Knowledge of relevant legislation ensures that claimants are aware of the proper steps to take and whom to contact, increasing their likelihood of a favorable outcome.

Importance of filing an overpayment relief claim letter

Filing an overpayment relief claim letter is crucial for several reasons. Firstly, correcting overpayment addresses financial discrepancies that could otherwise weigh heavily on a claimant's financial health. The benefits are not limited to monetary recoveries; they extend to peace of mind, allowing individuals and teams to move forward without the burden of unresolved financial issues.

The financial implications of an overpayment relief claim can be significant. Claimants may reclaim funds that can be directed towards savings or necessary expenses, ultimately affecting their economic stability. For some, these recoveries might mean the difference between managing financial obligations comfortably or facing additional hardship.

When to file a claim

Filing a claim is often time-sensitive. Claimants should aim to submit their claims as soon as they identify discrepancies because many agencies have strict deadlines, often requiring claims to be filed within a certain period after overpayment is acknowledged. Factors that may influence the timing of a claim include the complexity of the overpayment situation, the deadline imposed by the agency or institution, and the urgency of the recovery needed by the claimant.

Step-by-step guide to completing the overpayment relief claim letter form

Step 1: Gather required documents

Before filling out your overpayment relief claim letter form, it's essential to gather all relevant documents. These can include pay stubs, tax forms, previous correspondence with the financial institution or government office, and documentation highlighting the perceived overpayment. Ensuring that you have all necessary information at hand can make the process less daunting and increases the accuracy of your submission.

Organizing your paperwork by categorizing it according to the relevant sections of the claim letter can streamline your process. Consider creating a checklist to ensure nothing is overlooked.

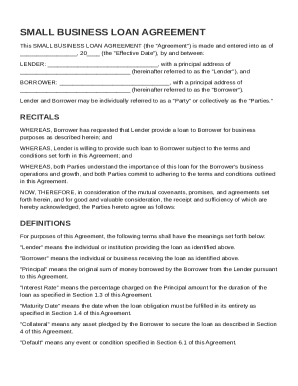

Step 2: Fill out the claim letter form

Completing the claim letter form requires attention to detail. Start with the personal information section. Accurately provide your name, address, contact information, and any relevant identification numbers as requested. Errors at this stage could delay processing.

In the ‘claim details’ section, clearly disclose the nature of the overpayment and the amount in question. It is important to be as informative as possible, citing relevant dates and previously held communications where applicable. Add supporting evidence to substantiate your claim; this can include copies of payment receipts, letters, or any correspondence that supports your assertion of overpayment.

Step 3: Review and edit your form

Before submitting your claim, take time to proofread the document. Small errors can lead to misunderstandings that might delay processing. Look for common mistakes, such as typos in your personal information, discrepancies in the data provided, or specific amounts that could lead to confusion. Seeking feedback from a trusted peer can offer a fresh perspective and catch errors you may have missed.

Step 4: Sign and date your letter

A legally binding signature is critical in formal documents like this claim letter. Utilize the eSigning options available through pdfFiller, which allow you to sign your document digitally—this offers convenience and adds an extra layer of security to your submission. Legally, your signature indicates that you are attesting to the accuracy of your claims and your intention for recovery.

Step 5: Submit your claim

The last step of the process is to submit your claim. Depending on the agency or institution, you may have various options for submission, such as email, physical mail, or an online portal. Make sure to follow the specific instructions provided for submission to avoid unnecessary delays. After submission, keep track of your claim status through any available tracking system provided by the institution or agency handling your case.

Interactive tools to assist in your claim process

Utilizing interactive tools can significantly enhance your efficiency in managing your overpayment relief claim. For instance, pdfFiller offers a variety of document management features that make editing and signing documents straightforward. With these capabilities, you can fill out your claim letter form, integrate necessary modifications, and share it securely with your team or legal representative when needed. Collaborative features allow for real-time contributions, accommodating input from various stakeholders involved in the claim.

Calculators to estimate overpayment amounts

To gain a clearer understanding of the potential overpayment, consider using available online calculators specifically designed to assess overpayments. These tools can simplify the complexity of analyzing past payments by providing quick estimates based on your input. To use these calculators effectively, enter your income data, identify the applicable rates or benefits, and review the outputs to gather accurate overpayment estimates.

Frequently asked questions (FAQs) regarding overpayment relief claims

Claimants often have numerous concerns about the overpayment relief claim process. Typical worries revolve around the need to reveal financial information and its implications on privacy. Transparency is essential for overpayment relief, and legal protections generally safeguard claimants’ financial data from misuse; however, it’s critical to understand the information required beforehand.

Another common question pertains to what happens after submission. After filing your claim, respondents typically have a specified amount of time—often ranging from 30 to 90 days—to process and respond, depending on the category of claim being filed. Claimants are encouraged to reach out proactively if they do not hear back within the timeframe to ensure that their claims are being addressed.

Real-life examples of successful claims

Reading about successful overpayment relief claims can provide motivation and practical insight for your case. In one example, an individual discovered they had been overpaid unemployment benefits due to a misunderstanding of their work status. By filing a detailed claim outlining the overpayment and providing documented evidence of legitimate work returns, they not only corrected the record but also received a refund of excess payments.

Another case involved a small business that miscalculated employee bonuses, resulting in significant overpayments to several staff members. By promptly filing an overpayment claim with supportive documentation showing the agreed-upon bonus structures, the business was able to recover funds efficiently. These examples underscore the necessity of maintaining detailed records and being proactive about correcting financial discrepancies.

Best practices for managing overpayment claims

Effective management of overpayment claims hinges significantly on diligent record-keeping. Maintain thorough and organized records of all payment transactions, correspondence, and details surrounding overpayments. A digital filing system can enhance accessibility and ensure that all pertinent documents are easily retrievable when needed.

Communication with financial institutions is equally crucial. Develop skills to articulate your concerns clearly and succinctly, and always document conversations. Creating a log of communications can also support your claims, especially if you encounter any difficulties. Sample dialogue for discussions could be structured around factual statements, asking direct questions regarding your claim's status, and expressing any concerns about delays.

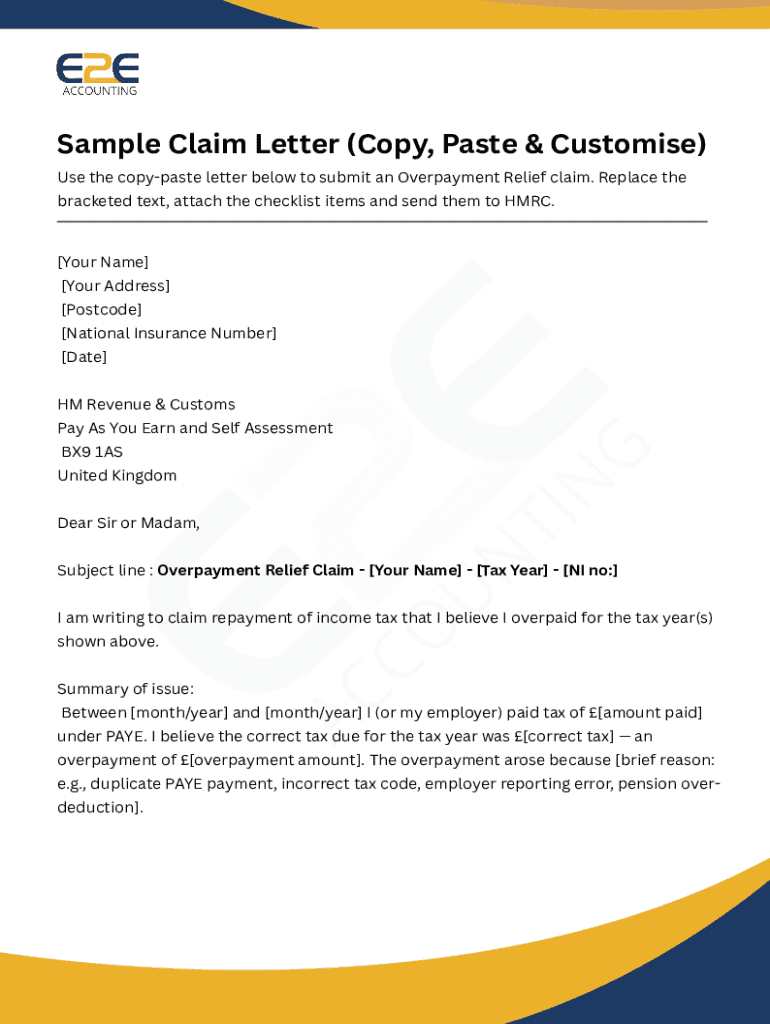

Overpayment relief claim form template & interactive features

To simplify your claim process, consider downloading a customizable template for the overpayment relief claim letter form from pdfFiller. Using a standard template ensures that you include all necessary information while allowing you to tailor it to your unique situation. Modifications can be made easily, saving you time and effort in formatting.

Within pdfFiller, take advantage of the interactive features, such as eSigning and collaborative options. These functionalities enable you to create an efficient workflow, expedite approvals, and streamline collaborative efforts if you need assistance from team members or legal counsel during your claim process.

Insights on preventing future overpayments

To minimize the risk of future overpayments, implementing a regular payment monitoring schedule is crucial. Establishing a routine to review financial statements and payment confirmations can help you identify discrepancies early, allowing for prompt corrections before they escalate.

Additionally, staying informed about policies and changes relevant to your financial engagements is essential. Subscribe to newsletters or alerts from the appropriate governmental or institutional websites that govern your payments. This proactive approach ensures that you remain aware of any changes that might affect your payout and helps you avoid potential overpayment situations down the line.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send overpayment relief claim letter to be eSigned by others?

Where do I find overpayment relief claim letter?

How do I execute overpayment relief claim letter online?

What is overpayment relief claim letter?

Who is required to file overpayment relief claim letter?

How to fill out overpayment relief claim letter?

What is the purpose of overpayment relief claim letter?

What information must be reported on overpayment relief claim letter?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.