Get the free Form 9325 or EF Notice: Notifying a Taxpayer after IRS ...

Get, Create, Make and Sign form 9325 or ef

Editing form 9325 or ef online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 9325 or ef

How to fill out form 9325 or ef

Who needs form 9325 or ef?

Navigating Form 9325: Your Comprehensive Guide to the EF Form

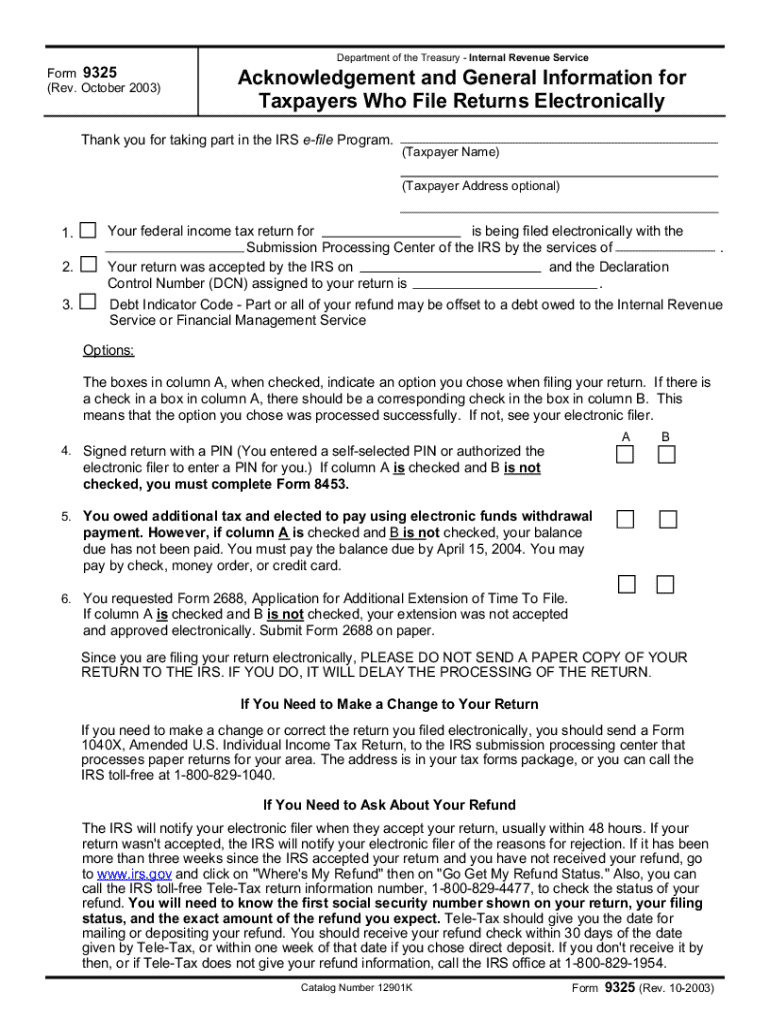

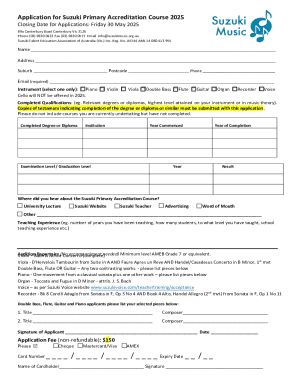

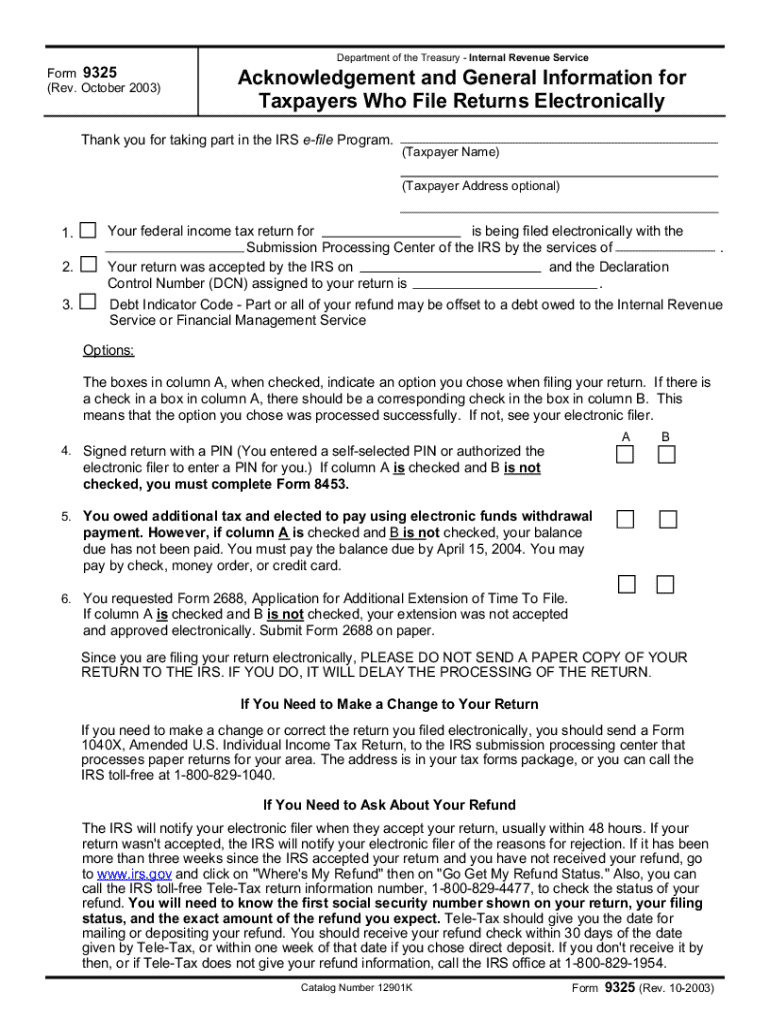

Understanding Form 9325

Form 9325, also known as the EF Form, is an essential tool for confirming the successful electronic filing of a tax return. This acknowledgment form is used by the IRS to inform taxpayers and their preparers about the status of their submission. In today’s tax filing process, where more returns are submitted electronically than ever before, having an EF Form serves as a vital record that verifies your return was transmitted successfully.

Essentially, the purpose of Form 9325 is to enhance transparency in the filing process, providing taxpayers with a confirmation that their tax return is in the hands of the IRS. For those engaging in electronic filing, this form is a safeguard to ensure compliance and to facilitate any inquiries regarding their status.

Who needs to file Form 9325?

Understanding who needs to file Form 9325 clarifies its importance in the tax ecosystem. Both individuals and organizations that file electronically may need to use this form. Tax preparers, in particular, are often required to submit this form on behalf of their clients.

Key details about Form 9325

An important feature of Form 9325 is its role as an acknowledgment document. This acknowledgment serves multiple purposes, mainly to inform taxpayers that their electronic submission has been received and is being processed by the IRS. It is crucial for maintaining records and can be used as proof of filing.

Having this affirmation is particularly significant for taxpayers who wish to ensure their timely compliance with tax regulations and to avoid any potential misunderstandings or disputes with the IRS regarding submission status.

Components of the form

Form 9325 consists of several key components that facilitate the acknowledgment process. Each section caters to specific pieces of information necessary for proper identification and acknowledgment. Below are the primary sections included in the form:

Step-by-step guide to completing Form 9325

Completing Form 9325 is a straightforward process, but it requires careful attention to detail. Here’s how to navigate the procedure:

Accessing the form

To find a fillable version of Form 9325 online, taxpayers can visit the IRS official website or utilize platforms like pdfFiller, where the form is easily accessible. Users seeking a physical copy can also request it directly through IRS offices or order it as part of their tax preparation packages.

Filling out the form

When filling out the form, ensure you're including accurate information in each section. Pay attention to the following common mistakes to avoid:

Signing and submitting the form

Once completed, the electronic signature can be added using pdfFiller’s eSigning options. After the signature is secured, users can submit the form electronically through the IRS e-file system or using an authorized e-file provider.

Editing and managing your Form 9325 on pdfFiller

Using pdfFiller for Form 9325 not only simplifies the filling process but also enhances document management. Accessing the platform enables users to edit and manage their forms with ease. Here’s how pdfFiller's features support your filing process:

Using pdfFiller's editing tools

PdfFiller's robust platform allows users to edit PDFs without hassle. With a few clicks, users can correct errors or update information in their Form 9325, ensuring accuracy before submission.

Tracking changes and collaborating

Another advantage is the ability to track changes and collaborate with team members. PdfFiller’s sharing options facilitate teamwork, enabling multiple users to contribute to a single form while maintaining document integrity through version control.

Additional considerations for taxpayers

After submitting Form 9325, it’s crucial to understand what happens next. The IRS will process the electronic acknowledgment, and generally, taxpayers can expect to receive feedback regarding the status of their return within a few weeks.

What happens after submission?

It’s important to monitor submission acknowledgments. The IRS provides a timeline by which taxpayers should receive official confirmation. This acknowledgment can take anywhere from 24 hours to several weeks, depending on the volume of submissions during peak filing times.

Consequences of not filing on time

Failure to submit Form 9325 on time can lead to significant repercussions for taxpayers. Potential penalties may arise, along with accruing interest on any unpaid taxes. It is crucial to file correctly and on time to avoid these penalties and maintain compliance with tax obligations.

Troubleshooting common issues with Form 9325

Even with careful attention, taxpayers may encounter issues when filling out Form 9325. Being aware of common mistakes can help mitigate these problems before they arise. Some common filing mistakes include errors in taxpayer information, incorrect Submission IDs, or incomplete sections.

How to seek help

If problems occur during submission, it’s important to have a plan for resolution. The IRS provides resources for taxpayers facing difficulties, including their website and dedicated helplines. Additionally, tax professionals can offer guidance and support, ensuring a smoother submission process.

Leveraging pdfFiller for your document needs

PdfFiller is the ultimate solution for cloud-based document management, providing unparalleled accessibility and security. This system allows users to work on documents from any device, eliminating geographic barriers in document handling.

Benefits of a cloud-based document management system

Accessibility is only part of the equation; pdfFiller also integrates robust security features to protect sensitive information. These measures ensure that users’ data remains confidential and secure during the filing process.

Comparison with other solutions

Unlike other document management solutions, pdfFiller stands out with its seamless interface and extensive features tailored for document creation, editing, and management. This helps streamline the entire filing process, making it an optimal choice for individuals and teams alike.

FAQs about Form 9325

Understanding Form 9325 can raise various questions. Here are some frequently asked questions that clarify common concerns:

User testimonials and success stories

Real-life experiences from users of pdfFiller illustrate its impact on simplifying the filing process. Many users report that the platform has significantly streamlined their document creation and management, allowing for smoother filing experiences.

Reviews of pdfFiller tools

Users frequently praise pdfFiller's editing and eSigning processes, which effectively reduce the time and effort required to complete essential forms like Form 9325. The platform’s intuitive design and helpful features have garnered positive feedback across the board.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my form 9325 or ef in Gmail?

How do I fill out the form 9325 or ef form on my smartphone?

How do I edit form 9325 or ef on an iOS device?

What is form 9325 or ef?

Who is required to file form 9325 or ef?

How to fill out form 9325 or ef?

What is the purpose of form 9325 or ef?

What information must be reported on form 9325 or ef?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.