Get the free SIMPLE IRA Salary Reduction Agreement Form

Get, Create, Make and Sign simple ira salary reduction

Editing simple ira salary reduction online

Uncompromising security for your PDF editing and eSignature needs

How to fill out simple ira salary reduction

How to fill out simple ira salary reduction

Who needs simple ira salary reduction?

A Comprehensive How-to Guide on the Simple IRA Salary Reduction Form

Understanding Simple IRA salary reduction

A Simple IRA (Savings Incentive Match Plan for Employees Individual Retirement Account) is a popular retirement plan for small businesses and their employees. Designed for those with fewer than 100 employees, it provides a straightforward approach to retirement savings with tax advantages. Employees can save for retirement while benefiting from employer matching contributions, making it an appealing option for both parties.

The key benefit for employees is that contributions are made pre-tax, effectively lowering taxable income and allowing earnings to grow tax-deferred until withdrawal. For employers, offering a Simple IRA can enhance employee satisfaction and retention without complex administrative requirements relative to other retirement plans.

How salary reduction works

In a Simple IRA, salary reduction contributions are a way for employees to contribute a portion of their salary directly to their retirement savings without being subject to immediate tax. Employees can choose to contribute a percentage of their pre-tax salary, which not only boosts their retirement savings but also reduces their current year's taxable income.

For the 2023 tax year, the contribution limit for employees is set at $15,500, with an additional catch-up contribution of $3,500 for those aged 50 and above. Employers are required to either match employee contributions up to 3% of compensation or provide a non-elective contribution of 2% of the employee's salary, enhancing the impact of these salary reductions.

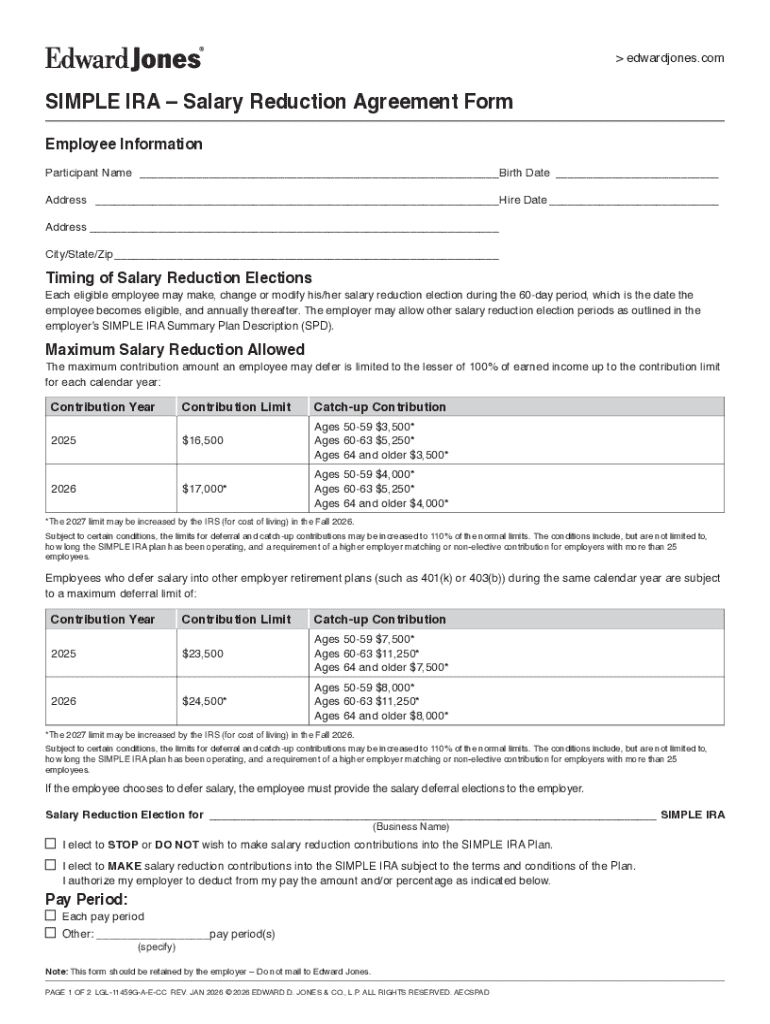

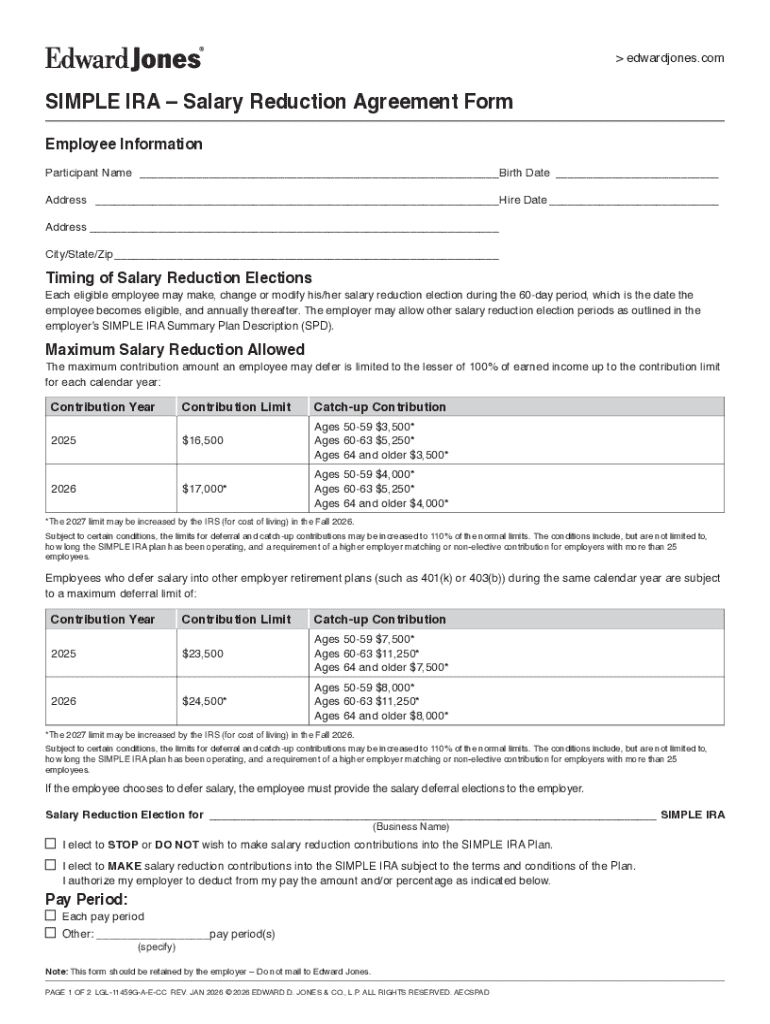

Key features of the Simple IRA salary reduction form

The Simple IRA Salary Reduction Form serves as a critical document for employees interested in participating in the plan. This form requires specific information to ensure proper setup and management of contributions, including personal identification details and employment information.

Additionally, the form should specify the type of contributions employees intend to make, ensuring that the chosen limits are adhered to while providing an overview of any employer matching contributions, which further incentivizes participation.

Step-by-step instructions for filling out the Simple IRA salary reduction form

Filling out the Simple IRA Salary Reduction Form is straightforward, but accuracy is essential to ensure smooth processing. Here's a step-by-step guide to assist you through the process.

Once the form is filled out, it’s crucial to review your entries for accuracy to avoid common mistakes such as typos in your Social Security number or incorrect contribution percentages which can impact your retirement savings.

Optional customizations and considerations

After submitting the Simple IRA Salary Reduction Form, employees may find themselves wanting to adjust their contributions. Fortunately, making changes to salary reduction amounts is acceptable, but it requires submitting a new form.

Understanding how contributions impact overall financial health is also critical. Immediate benefits include reduced current taxable income, while long-term advantages manifest as increased retirement savings that can significantly improve financial security in retirement.

Submission process for the form

After completing your Simple IRA Salary Reduction Form, the next step is submission. Employees can typically submit the form directly to their employer, ensuring it’s processed in a timely manner.

Keeping a copy of the submitted form for personal records is also advisable, ensuring you have a reference point for future adjustments or inquiries.

Managing your Simple IRA plan

Once your Simple IRA is established and contributions are underway, managing your plan becomes crucial. Monitoring your contributions regularly helps to track growth and ensure you are on track to meet your retirement goals.

An experienced advisor can guide you through investment choices and help fine-tune your contributions based on changing financial circumstances.

Frequently asked questions (FAQs)

Navigating the Simple IRA Salary Reduction Form can raise several questions. Here are some of the most commonly asked queries about this essential document.

Having clear answers to these questions equips employees with the knowledge necessary to engage with their retirement plan confidently.

Conclusion: Empowering your financial future through pdfFiller

Understanding the Simple IRA Salary Reduction Form is a vital step in empowering your financial future. Utilizing pdfFiller allows users to seamlessly edit PDFs, eSign, collaborate, and manage documents from a single, cloud-based platform.

By leveraging pdfFiller’s interactive tools and comprehensive resources, individuals can navigate document creation and management effortlessly, ensuring their retirement planning needs are met efficiently and effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get simple ira salary reduction?

How do I fill out simple ira salary reduction using my mobile device?

Can I edit simple ira salary reduction on an iOS device?

What is simple ira salary reduction?

Who is required to file simple ira salary reduction?

How to fill out simple ira salary reduction?

What is the purpose of simple ira salary reduction?

What information must be reported on simple ira salary reduction?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.