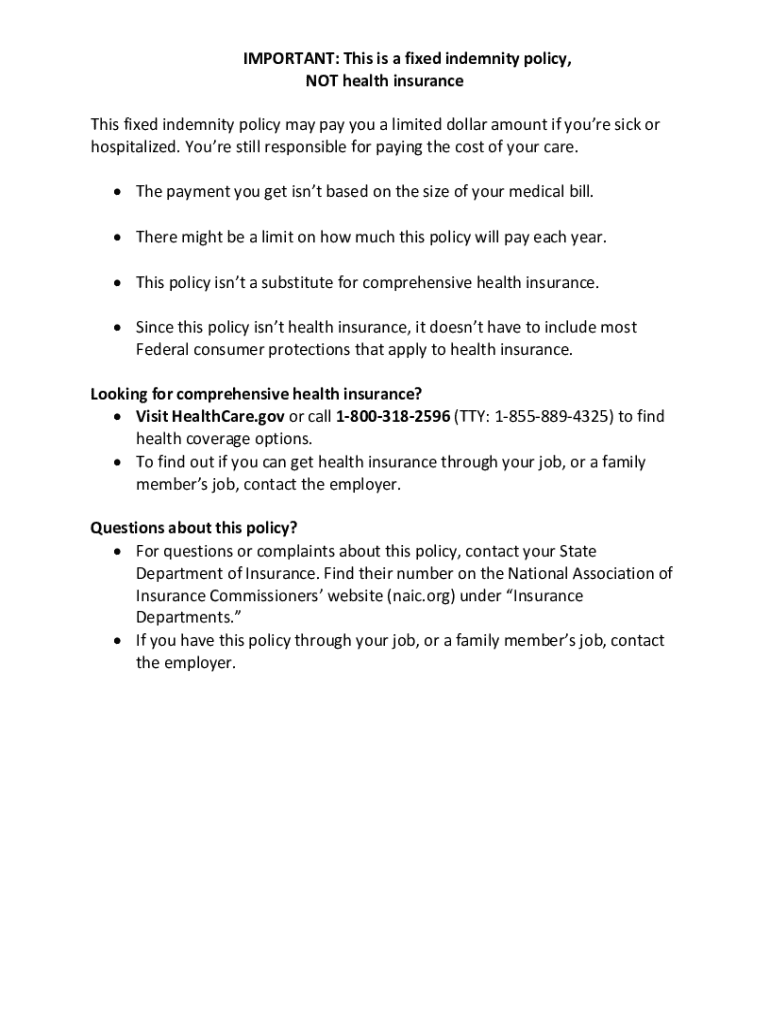

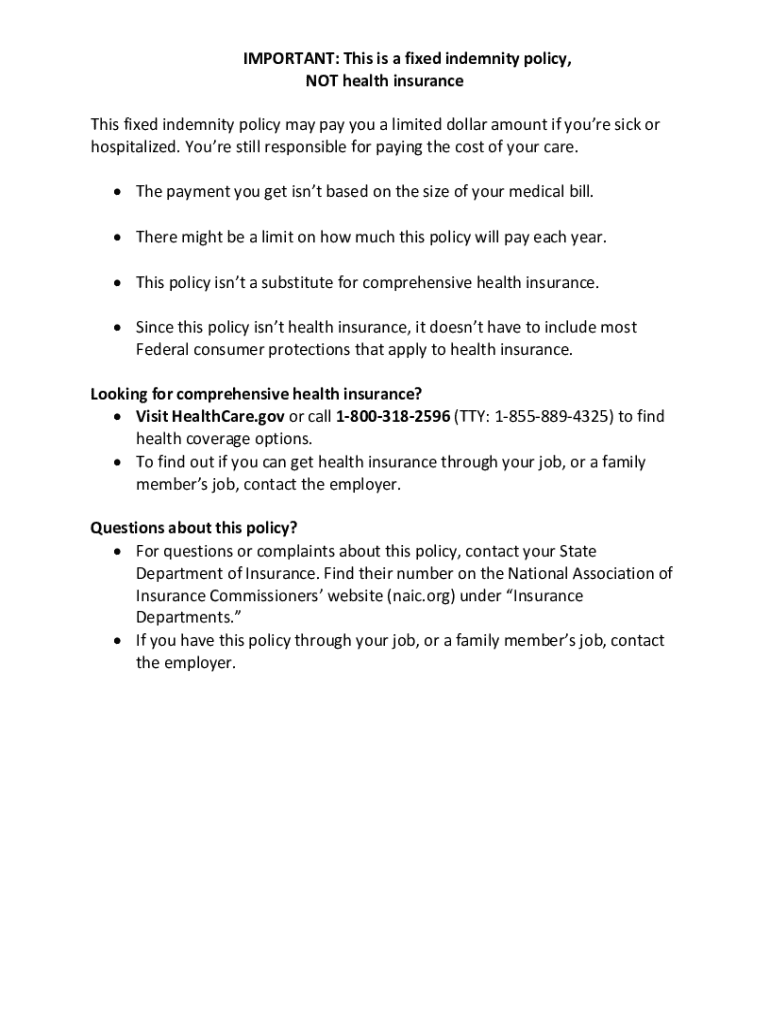

Get the free This is fixed indemnity policy, NOT health insurance This ...

Get, Create, Make and Sign this is fixed indemnity

How to edit this is fixed indemnity online

Uncompromising security for your PDF editing and eSignature needs

How to fill out this is fixed indemnity

How to fill out this is fixed indemnity

Who needs this is fixed indemnity?

This is Fixed Indemnity Form: A Comprehensive Guide

Understanding fixed indemnity insurance

Fixed indemnity insurance is designed to provide policyholders with a set benefit amount for specific medical services or events, rather than reimbursing the actual costs incurred. This approach simplifies the insurance process, focusing on predetermined payouts while allowing for greater flexibility and predictability. Fixed indemnity plans often act as a supplemental option to traditional health insurance, filling gaps that may leave consumers vulnerable to unexpected medical expenses.

Key features of fixed indemnity policies

Unlike traditional health insurance that covers a percentage of costs following a deductible, fixed indemnity policies provide set amounts for a variety of healthcare services, regardless of the actual cost. Common features include:

Advantages of fixed indemnity insurance

One of the main advantages of fixed indemnity insurance is its straightforward payment structure, making it easier for policyholders to anticipate their costs. Additionally, because benefits are predictable and predetermined, individuals often appreciate the financial reliability it offers. This insurance type allows greater choice regarding healthcare providers since there are generally no network restrictions. Consequently, it can serve as an efficient financial tool for individuals navigating their healthcare options.

Situations where fixed indemnity insurance is beneficial

Fixed indemnity plans may be particularly attractive for certain groups, such as:

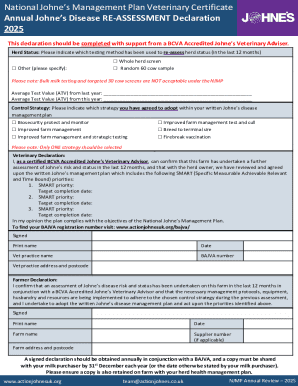

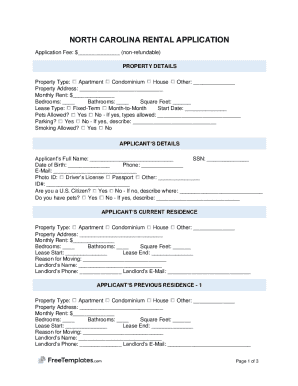

Overview of the fixed indemnity form

The fixed indemnity form functions as the official documentation required to apply for or claim benefits from a fixed indemnity insurance plan. Understanding its purpose and the necessary information is crucial for ensuring smooth processing of claims and maintaining accurate insurance records.

Purpose of the fixed indemnity form

The primary purpose of the fixed indemnity form is to collect relevant personal, financial, and insurance information to facilitate benefit payments from the insurer. Accurate and complete submission aids in minimizing potential delays in processing claims.

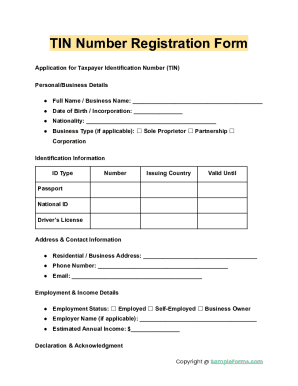

Types of information required

Key information generally required on the fixed indemnity form includes:

Commonly included sections in the form

Typically, the fixed indemnity form includes sections for detailing the nature of the claim or incident, patient information, and fields for the claimant's signature and submission date. These sections are crucial for authenticating the claim and ensuring its accurate processing.

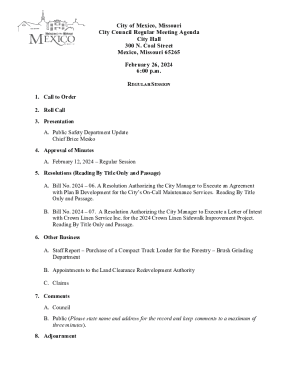

Step-by-step guide to completing the fixed indemnity form

Completing the fixed indemnity form accurately ensures efficient processing and helps avoid common pitfalls. This guide provides a clear, systematic approach to filling out the form correctly.

Gathering required documentation

Before you begin filling out the form, collect the following essential documents:

Filling out the fixed indemnity form

When filling out the fixed indemnity form, accuracy is critical. Follow these steps:

Personal information section

Provide your full name, current address, and contact information accurately. Double-check for typos or errors.

Income information

Disclose your income information honestly and responsibly to avoid complications later in the insurance process.

Insurance information

Make sure to include policy details that match your documents to guarantee smooth processing. Verify that the policy number and coverage options are correctly listed.

Reviewing your completed form

Once filled out, review the completed form against a checklist to ensure nothing is amiss, potentially preventing delays in processing.

Submitting the form

After ensuring all information is accurate, you can submit the form through various methods, including online submission, traditional mail, or fax, depending on your insurer’s preferences.

Interactive tools and resources

Leveraging technology can significantly enhance your experience with the fixed indemnity form, streamlining both completion and management.

Accessing the fixed indemnity form on pdfFiller

Finding the fixed indemnity form on pdfFiller is straightforward. Visit their website, use the search function to locate the form, and follow the prompts for download or completion.

Utilizing pdfFiller to edit and eSign

pdfFiller offers interactive tools that allow users to fill the form directly in the browser. Additionally, you can utilize eSignature options to sign documents electronically, speeding up the process.

Save and share options

Once your form is complete, pdfFiller provides various options to save documents securely to your account or share them directly with necessary parties without compromising confidentiality.

Troubleshooting common issues with fixed indemnity forms

Even with diligence, issues can occasionally arise when working with fixed indemnity forms. Understanding common problems and pathways to resolution can ease anxiety and improve efficiency.

Frequently encountered errors

Common pitfalls to watch for include:

How to rectify mistakes

If you discover errors after submitting your form, consult your insurance provider for instructions on rectification. They typically provide guidance on how to amend and resubmit necessary information.

Contacting support for help

pdfFiller offers robust customer support resources, allowing you to get immediate assistance for any issues you encounter. Reach out via chat, email, or phone for expedited resolution.

Managing your fixed indemnity insurance documents

Efficiently managing your fixed indemnity insurance documents ensures you have easy access to vital information. Here are some practices to keep in mind.

Organizing your insurance documents

Maintain clear organization in your insurance documentation by using folders—both digital and physical—to sort different types of documents such as policies, claims, and correspondence with insurers. Keeping everything well-organized will save time and reduce stress.

Keeping track of policy changes and updates

As policies can change over time, it’s essential to stay informed about updates or amendments to your fixed indemnity plan. Regularly review any notifications from your insurer, and keep your documents up to date.

Renewal and claims process management

Understand your renewal date and prepare any necessary documentation in advance to ensure a hassle-free process. Moreover, manage your claims effectively by promptly submitting required forms and following up on status updates as necessary.

Conclusion: The value of fixed indemnity forms in healthcare planning

The importance of comprehensive documentation like the fixed indemnity form cannot be overstated in healthcare planning. It serves not only as a vehicle for securing benefits but also as a reference point for understanding policy specifics and coverage areas.

Leveraging pdfFiller for seamless document management

Using pdfFiller allows users to efficiently manage fixed indemnity forms, ensuring easy access, editing, and submission of critical documents. By adopting this platform, individuals can streamline their healthcare documentation processes, leading to a more organized and less stressful experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get this is fixed indemnity?

Can I create an electronic signature for the this is fixed indemnity in Chrome?

How do I fill out the this is fixed indemnity form on my smartphone?

What is this is fixed indemnity?

Who is required to file this is fixed indemnity?

How to fill out this is fixed indemnity?

What is the purpose of this is fixed indemnity?

What information must be reported on this is fixed indemnity?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.