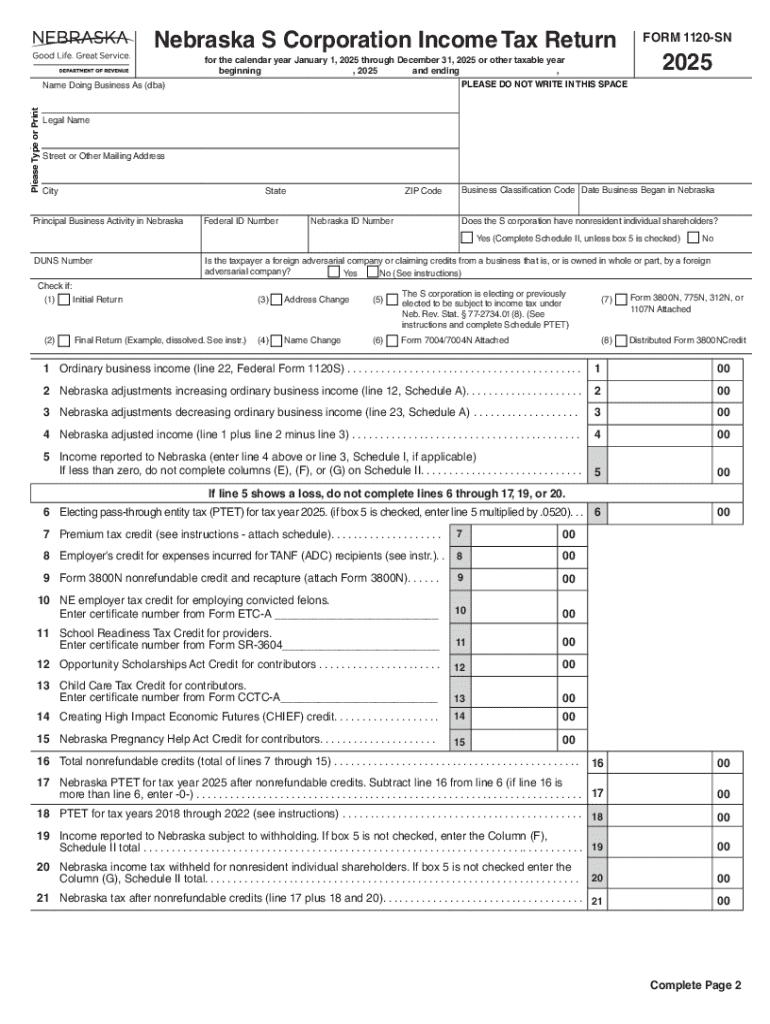

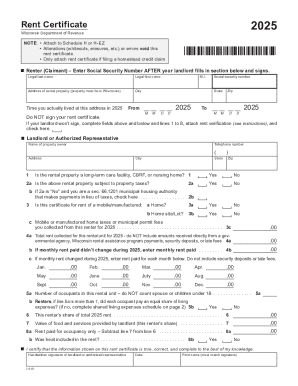

Get the free 2025 Income Tax FormsNebraska Department of Revenue

Get, Create, Make and Sign 2025 income tax formsnebraska

How to edit 2025 income tax formsnebraska online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 income tax formsnebraska

How to fill out 2025 income tax formsnebraska

Who needs 2025 income tax formsnebraska?

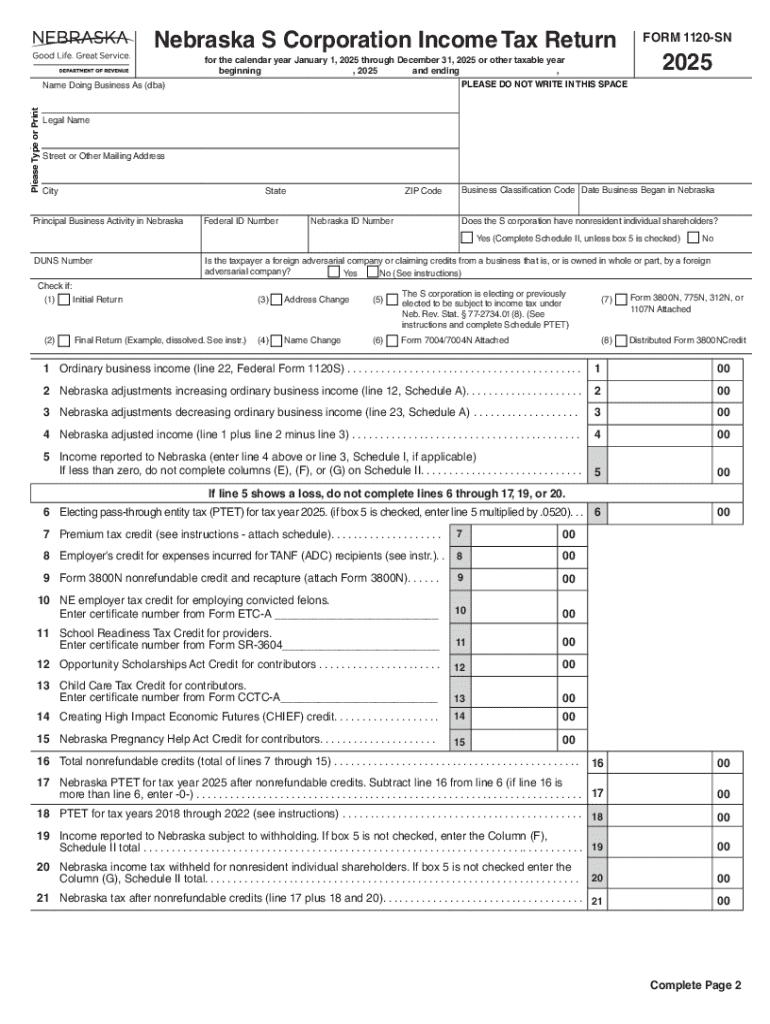

2025 Income Tax Forms: Nebraska Form Guide

Overview of Nebraska income tax forms for 2025

Understanding Nebraska's income tax forms for 2025 is crucial for both residents and nonresidents navigating their tax obligations. The income tax forms are vital to meeting state requirements and can impact overall tax liability. Changes in tax laws and forms can result in different deductions or adjustments, so it's important to stay updated.

For the 2025 tax year, several amendments have been introduced that may affect how you file your taxes, including altered forms and updated instructions. Nebraska taxpayers will find different tax forms tailored for individuals, which cater to various income situations and adjustments. Knowing which forms apply to you is the first step toward successful tax filing.

Key Nebraska income tax forms

Form 1040N: Nebraska Individual Income Tax Return

The primary form for individual income tax in Nebraska is Form 1040N. This form is mandated for residents and nonresidents earning income from Nebraska sources. The information provided on this form determines your tax obligations, exemptions, credits, and potential refunds.

To complete Form 1040N, taxpayers should gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Pay close attention to instructions to ensure accurate calculations, as errors can lead to delayed refunds or penalties.

Form 1040N Schedule : Nebraska Individual Income Tax Adjustments

Schedule I serves as a supplement to Form 1040N, allowing taxpayers to report adjustments to their gross income. Common adjustments include contributions to qualifying retirement accounts and amounts for student loan interest. Filling out Schedule I accurately is crucial for determining your taxable income.

To complete Schedule I, follow these steps: First, gather documentation for all adjustments you plan to claim. Next, refer to the instructions on the schedule to ensure the proper calculation of each adjustment. Finally, accurately report the total on your Form 1040N.

Form 1040N Schedule : Nebraska Tax Computation

Schedule II is crucial for taxpayers who need to calculate their tax liability based on taxable income. This form provides a structured approach to determining the Nebraska tax rate applicable to your income level, ensuring compliance and correctness in your tax filings.

Begin by referencing the income amount from your Form 1040N and use the tax tables provided in the instructions to establish your tax due. Make sure to account for any credits or previously paid taxes, as these can reduce your overall liability.

Form 4922: Nebraska Property Tax Refund Claim

Property owners can claim a refund on their property taxes through Form 4922. Understanding the requirements, including income thresholds and eligibility criteria, is essential for accessing this benefit. This form is specifically for Nebraska residents and includes specific fields that must match up with provided documentation.

To apply for a property tax refund, check the eligibility requirements and complete the form as instructed. Submit it along with any necessary documentation to ensure you receive your refund promptly.

Instructions for filing income tax forms in Nebraska

The filing process for Nebraska income tax in 2025 involves several key steps. First, gather all necessary documents related to income, deductions, and credits. This includes W-2s, 1099s, and any relevant receipts for deductions. Ensure that you categorize and prepare everything to simplify your filing.

Once your documents are organized, decide whether you will file electronically or via paper forms. Electronic filing generally expedites the process and reduces the likelihood of errors. Paper filing can also be an option, but be mindful of postal timelines to avoid missing deadlines. All forms must be submitted to the Nebraska Department of Revenue before the state’s tax deadline.

Best practices include reviewing forms multiple times for accuracy and checking the specific instructions accompanying each form to avoid errors that could lead to delays or penalties.

Utilizing pdfFiller for your Nebraska income tax forms

pdfFiller provides an efficient solution for preparing and submitting Nebraska income tax forms. The platform allows users to access templates for all necessary forms and customize them according to their specifics. With its user-friendly interface, individuals can quickly edit forms directly online without the hassle of printing or scanning.

To use pdfFiller effectively for Nebraska tax forms, follow these steps: Start by logging into your pdfFiller account and navigating to the template section. From there, locate the Nebraska forms relevant to your needs. You can easily fill out, save, and export these documents. This seamless process enhances productivity and accuracy.

eSigning your forms with pdfFiller

eSigning is another advantage of using pdfFiller, allowing users to simplify the signature process significantly. By using the eSignature feature, you can securely sign your forms digitally without printing them out. This eliminates unnecessary paperwork and drastically reduces turnaround time.

To eSign, upload your completed Nebraska tax form to pdfFiller, click on the 'eSign' button, and follow the prompts to add your signature. You can also invite others to sign the document if needed, streamlining collaboration.

Collaborating with others: Sharing your tax forms easily

pdfFiller not only allows for easy editing and signing, but it also supports collaboration. If you are part of a team or family filing, simply share your tax forms directly through the platform. By inviting others to view and edit, everyone can contribute to ensuring accuracy and completeness.

To share your document, use the 'Share' feature in pdfFiller, providing the necessary permissions. This ensures that all collaborators can make necessary adjustments or reviews seamlessly.

Frequently asked questions about Nebraska income tax forms for 2025

As taxpayers prepare to file their Nebraska income taxes for 2025, numerous questions often arise. Common queries include queries about allowed deductions and how they impact tax debts or refunds. Taxpayers frequently want clarity regarding adjustments on Schedule I and how to ensure they are maximizing their refunds without error.

Another major concern addresses the refund process – what individuals can expect after filing. Typically, refunds are processed within a few weeks, but situations involving discrepancies or missing information can delay this timeline. Knowing common mistakes – such as incorrect calculations or failing to include documentation – can significantly enhance the filing experience.

Resources and tools for completing your Nebraska income tax forms

Utilizing the correct resources is essential for effectively completing Nebraska income tax forms. The Nebraska Department of Revenue provides comprehensive resources, including official guides that detail the various forms, changes for the current tax year, and what documentation is needed for each form.

In addition to governmental resources, tools offered by pdfFiller can enhance the completion process. Calculation tools and tax software can aid individuals in accurately computing their tax obligations. Additionally, educational materials provided by pdfFiller serve as excellent support for expanding your knowledge and understanding of filing requirements.

Further assistance for Nebraska taxpayers

For residents seeking further assistance in preparing their income tax forms, several options are available. The Nebraska Department of Revenue offers a helpline specifically for tax inquiries, providing assistance on filing questions, deadlines, and changes to tax laws. Tax professionals can also provide invaluable services, especially for individuals with complex tax situations such as entrepreneurs or freelancers.

Additionally, using the support features built into pdfFiller gives you access to personalized help for filling out your forms. Support channels may include live chat, FAQ sections, and comprehensive guides tailored to your needs.

Related forms and documents

In addition to the primary income tax forms, Nebraska taxpayers may encounter various related forms required for specific situations. Business owners may need to complete additional documents to account for business income, expenses, and appropriate deductions. Freelancers and self-employed individuals often have unique tax needs that necessitate additional paperwork.

Understanding what forms may be required in conjunction with your individual income tax return is essential in ensuring compliance and minimizing audit risks. Resources like pdfFiller enable users to easily access and manage these additional forms efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 2025 income tax formsnebraska from Google Drive?

How do I edit 2025 income tax formsnebraska straight from my smartphone?

How do I complete 2025 income tax formsnebraska on an iOS device?

What is 2025 income tax forms Nebraska?

Who is required to file 2025 income tax forms Nebraska?

How to fill out 2025 income tax forms Nebraska?

What is the purpose of 2025 income tax forms Nebraska?

What information must be reported on 2025 income tax forms Nebraska?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.