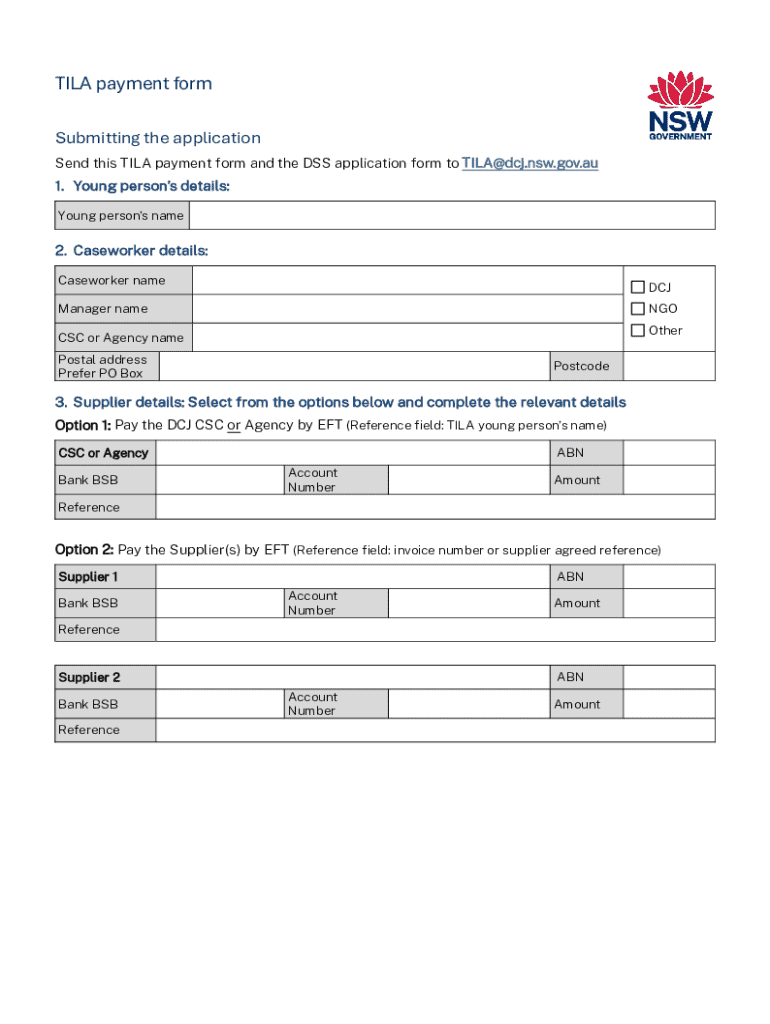

Get the free TILA application form. Transition to Independent Living Allowance application form

Get, Create, Make and Sign tila application form transition

How to edit tila application form transition online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tila application form transition

How to fill out tila application form transition

Who needs tila application form transition?

A Comprehensive Guide to the Tila Application Form Transition Form

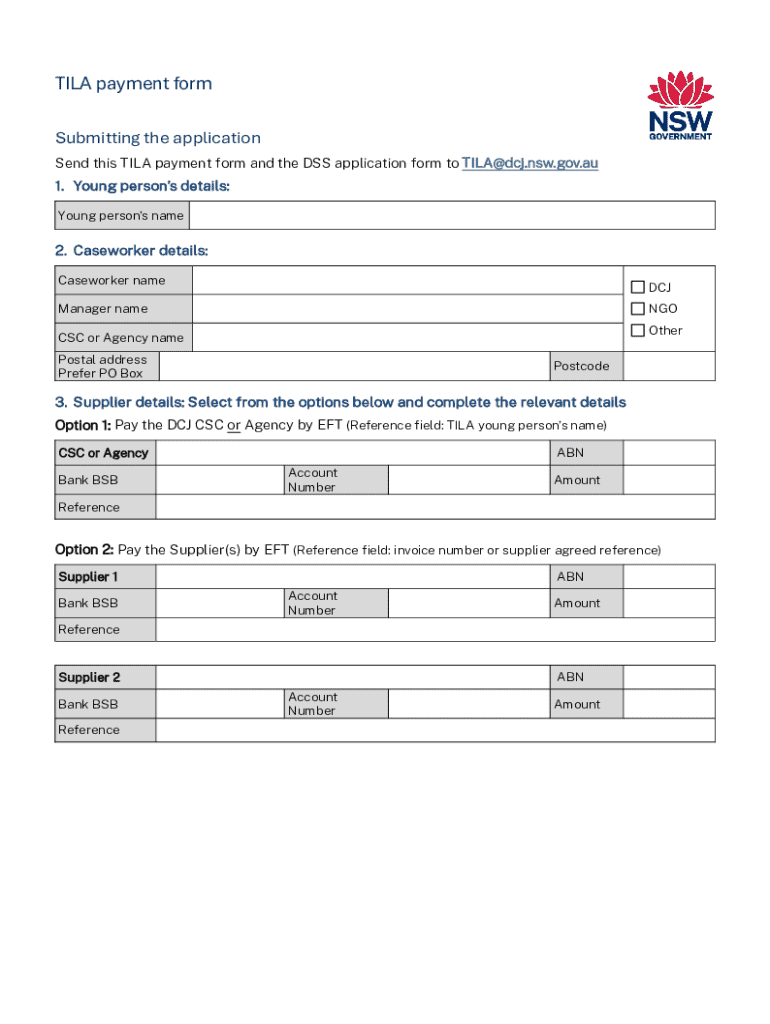

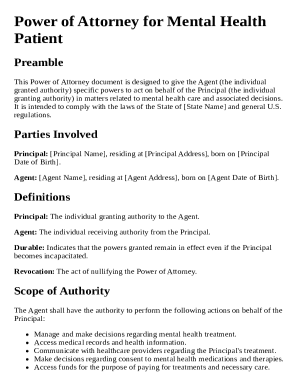

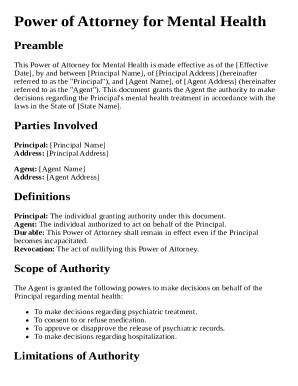

Understanding the tila application form

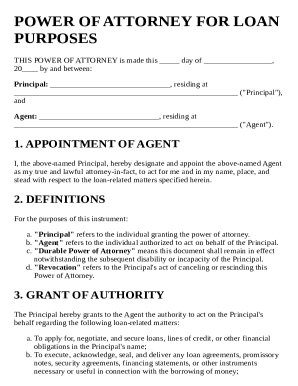

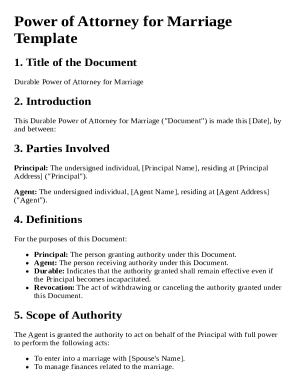

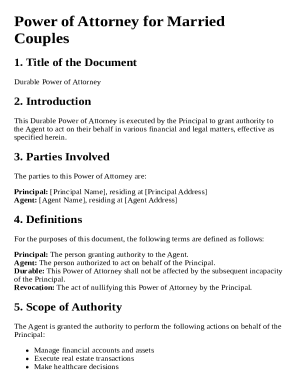

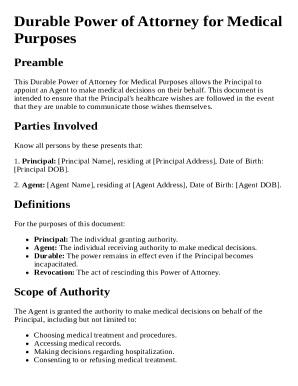

The Tila Application Form, known formally as the Truth in Lending Act Application Form, is a crucial document designed to ensure transparency in lending practices. Its primary purpose is to provide potential borrowers with clear and precise information about loan terms, costs, and obligations before they enter into an agreement. This form plays a central role in protecting consumers and promoting fair lending practices.

The Transition Form, on the other hand, is specifically tailored for situations where borrowers shift from one type of mortgage or lending product to another. This form serves as an essential bridge in the application process, guiding both lenders and borrowers through the nuances of transitioning loans. It's critical to understand the differences between standard application submissions and transition applications, as these distinctions are pivotal in correctly completing the form.

How to access the tila application form

Accessing the Tila Application Form on the pdfFiller platform is a straightforward process, catering to users seeking efficient document solutions. To find the specific form template, users can begin by navigating to the pdfFiller website and utilizing the search functionality provided on the homepage.

The following is a step-by-step guide to locating the Tila Application Form Transition Form template on pdfFiller:

To access the form, you need to create a pdfFiller account. This requirement serves to maintain document security and ensure that users can save their progress. Individuals and teams looking to utilize the transition form must provide basic credentials, such as an email address and a password, to get started.

Step-by-step instructions for filling out the tila application form

Filling out the Tila Application Form Transition Form involves diligence and accuracy, particularly across several key sections. Each section has specific requirements that ensure complete and correct submissions.

Here’s a detailed breakdown of the sections included in the transition form:

Best practices for completing each section effectively include reviewing the content for accuracy, consulting financial records for the most up-to-date information, and utilizing resources or financial advisors if you encounter complexities.

Common errors often arise from transcribing mistakes or misunderstanding the requirements, so double-checking your entries can save time and help ensure a smoother processing experience.

Editing and customizing the tila application form

One of the powerful features of the pdfFiller platform is the ability to edit and customize the Tila Application Form Transition Form after it's filled out. Utilizing pdfFiller's robust editing tools, you can modify any information to reflect accurate or updated data.

To initiate editing, follow these steps:

In addition, pdfFiller allows you to insert your electronic signatures and initials directly within the document. This feature simplifies the signing process and is particularly useful when collaborating with others.

To eSign a document, simply navigate to the signature section and follow the prompts provided within the platform. Collaborating on shared documents is seamless, ensuring that all stakeholders can review and approve documents as necessary.

Managing your tila application form

Effective management of your Tila Application Form Transition Form involves organizing, saving, and retrieving documents efficiently through the pdfFiller platform. Once your document is filled out, pdfFiller automatically saves your form, but proper organization will help you find it easily later.

Here are some tips for managing your form:

Proper document management will not only enhance your productivity but will also facilitate timely follow-ups and reduce the risk of missing important updates from your lender.

Troubleshooting common issues with the tila application form

Encountering issues with the Tila Application Form Transition Form can be frustrating, yet many of these problems can be resolved quickly with the right knowledge. Common issues include access problems, data entry mistakes, and submission challenges.

Here’s a look at some frequent issues and solutions:

If you encounter persistent issues, pdfFiller provides excellent customer support options. Users can contact support through email, phone, or chat for prompt assistance.

Conclusion of the application process

Upon submitting your Tila Application Form Transition Form, it's essential to understand the next steps in the process. Following submission, the processing timeline may vary depending on your lender’s workload and the specifics of your application. Typically, applicants can expect a response within a few business days.

It's crucial to follow up with relevant stakeholders during this period. Maintain communication with your lender and be proactive about meeting any further information requests. Doing so can speed up the application process significantly, and reflect positively on your preparedness as a borrower.

Additional features of pdfFiller for document management

In addition to the Tila Application Form, pdfFiller offers a variety of other forms and templates that can enhance your document creation experience. Whether you require tax forms, legal documents, or simply need templates for everyday business tasks, pdfFiller has resources to meet your needs.

Utilizing a comprehensive document management platform like pdfFiller brings numerous advantages, including:

These features not only streamline your document management but also empower you to take charge of your paperwork efficiently.

Contact pdfFiller for support and further information

Questions or concerns regarding the Tila Application Form Transition Form or pdfFiller's features can be directed to their support team. Users have several options to reach out, including email, phone calls, and chat functionalities available directly on the pdfFiller website.

Additionally, pdfFiller offers a range of resources, such as FAQs and support documentation, which can prove invaluable for users looking to enhance their proficiency with the platform or resolve specific issues.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify tila application form transition without leaving Google Drive?

How do I make changes in tila application form transition?

Can I edit tila application form transition on an iOS device?

What is tila application form transition?

Who is required to file tila application form transition?

How to fill out tila application form transition?

What is the purpose of tila application form transition?

What information must be reported on tila application form transition?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.