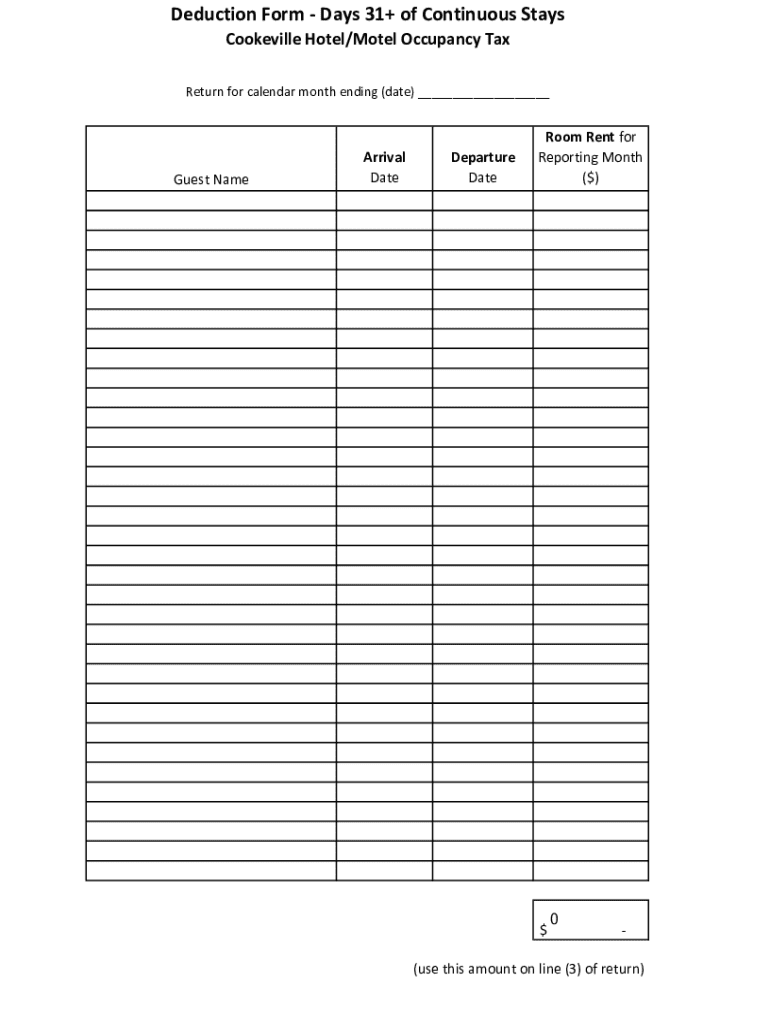

Get the free Deduction Form - Federal Gov't

Get, Create, Make and Sign deduction form - federal

How to edit deduction form - federal online

Uncompromising security for your PDF editing and eSignature needs

How to fill out deduction form - federal

How to fill out deduction form - federal

Who needs deduction form - federal?

Deduction Form - Federal Form: A Comprehensive How-to Guide

Understanding federal deduction forms

Federal deduction forms play a crucial role in the tax filing process, serving as essential documents that taxpayers use to report their income and claim allowable deductions. These forms are designed to help both individuals and businesses decrease their taxable income and ultimately save money on taxes. Understanding the various federal deduction forms is key to maximizing any potential tax benefits.

The importance of these forms cannot be overstated. Proper use of deduction forms can lead to significant tax savings, ensuring that taxpayers pay only what they owe rather than overpaying. Familiarity with these forms will also create a more efficient filing experience.

Types of federal deduction forms

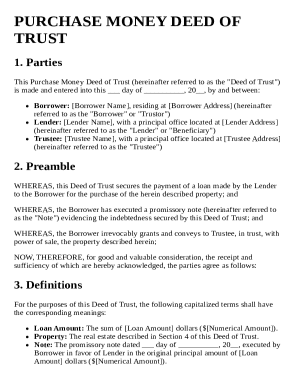

There are several types of federal deduction forms, each designed to address different tax situations. The most commonly used form is the Form 1040, which serves as the standard individual income tax return. Within this primary form, taxpayers can report their income and claim deductions directly on the form or through accompanying schedules.

Preparing to use the deduction forms

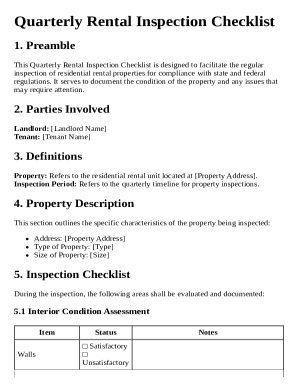

Preparation is fundamental to accurately filling out federal deduction forms. The first step involves gathering essential documentation that supports your deductions. This could include receipts, bank statements, and records of expenses throughout the year. Keeping these documents organized will save time and stress in the long run.

Equally important is the identification of eligible deductions. Taxpayers should distinguish between personal and business-related deductions. Common deductions include but are not limited to mortgage interest payments, medical expenses, charitable contributions, and certain educational expenses. Familiarizing oneself with these deductions makes the filing process smoother and maximizes potential savings.

Step-by-step guide to filling out federal deduction forms

Navigating the structure of federal deduction forms can seem daunting, but understanding their layouts can significantly ease this process. Most federal forms begin with basic information like your name and Social Security number, followed by sections where you will report income and claim deductions.

When filling out Form 1040, ensure you accurately list all sources of income. Include adjustments to income, followed by the deductions you're claiming. For itemized deductions, use Schedule A to detail your eligible expenses. This is where meticulous documentation becomes vital.

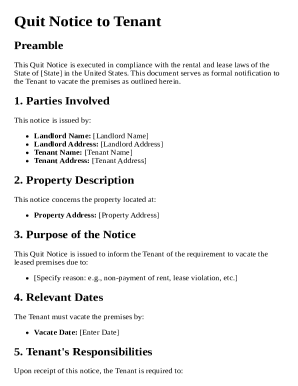

Editing and signing your deduction forms

Once you’ve filled out your federal deduction forms, it’s crucial to review them for accuracy. pdfFiller simplifies this with its document management features. Users can easily import forms and make necessary edits, ensuring your information is complete and accurate before submission.

After editing, electronic signing is the next step. pdfFiller offers a straightforward platform for eSigning documents, making the process efficient and secure. There are legal considerations that surround digital signatures, but pdfFiller is compliant with federal laws, ensuring the authenticity of your signatures and the integrity of your documents.

Collaborating on deduction forms with your team

If you are part of a team working on filing taxes, sharing deduction forms for review is essential. pdfFiller provides an intuitive interface for collaboration, allowing team members to access the same documents simultaneously. This feature promotes transparency and ensures that everyone can contribute to the completion of tax forms.

Managing permissions and tracking changes is equally important in a collaborative environment. With pdfFiller, you can set permissions to determine who can view, edit, or comment on specific documents. Utilizing these tools effectively helps manage feedback and maintains a smooth workflow.

Common pitfalls to avoid when filing deduction forms

When filing your federal deduction forms, common pitfalls could derail your efforts. One significant issue is submitting incomplete forms. Taxpayers often overlook essential fields like additional income sources or specific deduction categories, leading to delayed processing or potential penalties.

Miscalculating deductions is another common problem that can arise from a hurried filing experience. It’s essential to double-check entries and calculations before submission. Moreover, staying aware of federal filing deadlines is crucial, as missing these can lead to significant repercussions, including penalties and interest on unpaid taxes.

Managing and archiving your files

After filing your federal deduction forms, proper management and archiving of your tax documents are vital. Organizing your digitally stored files using categories such as year, type of deduction, and documenting changes helps streamline access in the future. pdfFiller provides a secure platform for storing these records, keeping them accessible and protected.

Being able to access past forms is crucial for next year’s filing process. pdfFiller allows you to retrieve archived forms quickly, providing a helpful resource for preparing your upcoming tax documents. Utilizing cloud storage capabilities streamlines workflow, ensuring all necessary records are always at your fingertips.

FAQs regarding federal deduction forms

Several questions commonly arise about federal deduction forms. One of the most often asked questions is which forms are the most common. Taxpayers typically use Form 1040 and Schedule A for itemized deductions.

Another frequent inquiry is how to determine eligibility for additional deductions. The IRS website provides valuable resources, and consulting a tax professional can also offer clarity tailored to individual circumstances.

Leveraging pdfFiller for comprehensive document solutions

Beyond federal deduction forms, pdfFiller offers various other forms and templates that simplify the document process across numerous needs. Its extensive library allows users to access essential documents quickly, removing the hassle commonly associated with tax season.

The cloud-based platform presents notable benefits such as accessibility from any location, secure storage options, and continuous updates to conform with the latest tax regulations. These features empower individuals and teams to maintain organized records and navigate their filing responsibilities efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit deduction form - federal online?

Can I create an electronic signature for the deduction form - federal in Chrome?

How can I edit deduction form - federal on a smartphone?

What is deduction form - federal?

Who is required to file deduction form - federal?

How to fill out deduction form - federal?

What is the purpose of deduction form - federal?

What information must be reported on deduction form - federal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.