Get the free 2025 low-income senior assessment freeze application ptax-340

Get, Create, Make and Sign 2025 low-income senior assessment

Editing 2025 low-income senior assessment online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 low-income senior assessment

How to fill out 2025 low-income senior assessment

Who needs 2025 low-income senior assessment?

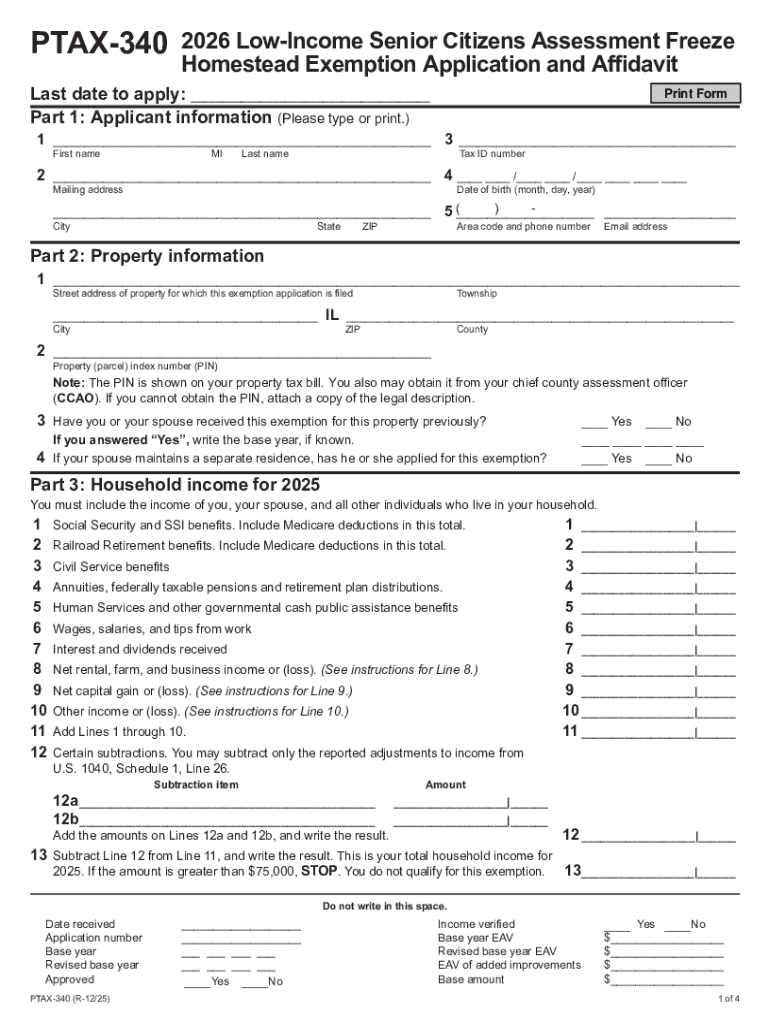

Understanding the 2025 Low-Income Senior Assessment Form

Overview of the 2025 low-income senior assessment form

The 2025 low-income senior assessment form serves as a crucial tool for identifying seniors who qualify for various assistance programs. Its purpose revolves around ensuring that low-income seniors receive the appropriate support and services necessary for their well-being and quality of life. This assessment is pivotal for state and federal agencies to allocate resources efficiently and address the needs of this vulnerable demographic.

Understanding who should utilize this form is equally important. Primarily, it targets seniors aged 65 and older who find themselves struggling financially. However, other age groups may also apply due to specific circumstances that warrant consideration. The assessment not only determines eligibility for financial assistance but also helps seniors tap into essential social services, housing assistance, healthcare benefits, and more.

Eligibility criteria

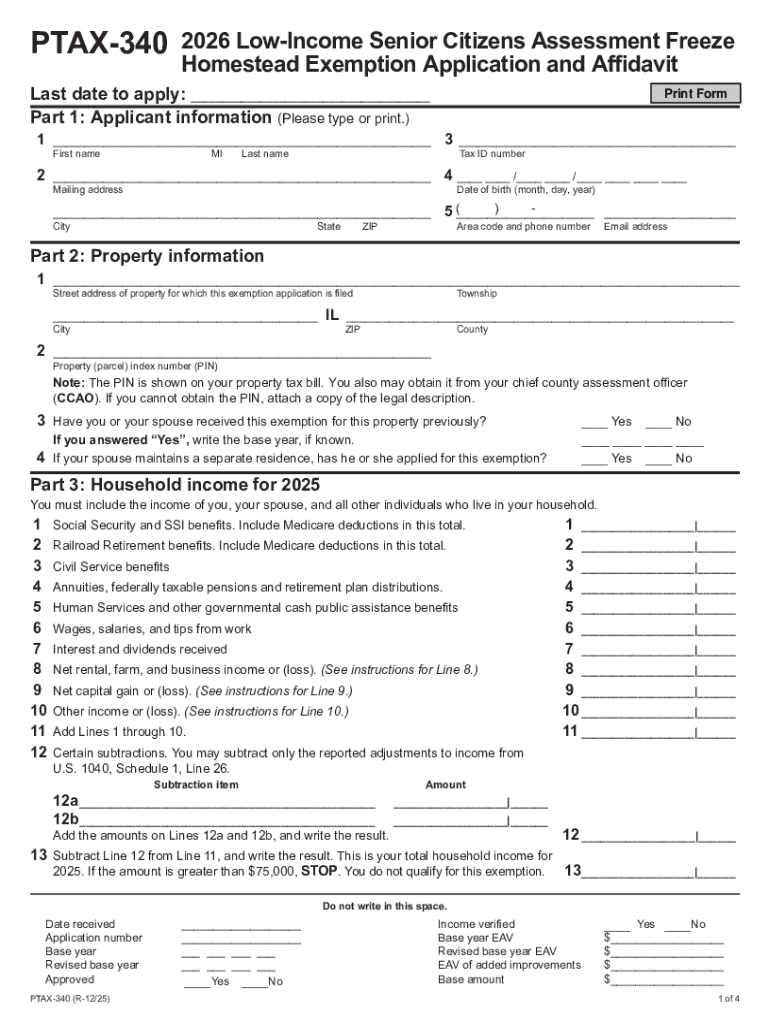

To qualify for low-income senior assistance, applicants must meet specific eligibility criteria. The first criterion is an income assessment, which generally involves adhering to predetermined income thresholds set by both federal and local government standards. For instance, the 2025 thresholds might dictate that applicants cannot exceed a certain annual income level to be considered low-income. Typically, these thresholds vary by state, reflecting local living costs.

Age is another significant factor, where applicants must be at least 65 years old for many programs. Additional considerations may also come into play, including residency status. Seniors must often prove that they are legal residents of the state or country where they apply. Asset limits are frequently imposed as well, meaning that aside from income, the total value of assets a senior possesses might influence their eligibility. This ensures that only those genuinely in need receive financial aid.

Preparing to complete the form

Before filling out the 2025 low-income senior assessment form, applicants should gather all necessary documents and information to avoid delays or complications. This preparation step is critical as it leads to a seamless application process. One must have proof of income readily available, such as pay stubs, pension statements, or documentation confirming Social Security benefits. These documents validate the claimed financial status, supporting the application.

Identification requirements are also crucial; applicants may need to submit a government-issued photo ID to establish identity and age accurately. Additionally, supporting documents like tax returns, bank statements, or detailed financial records might be necessary to present a complete financial picture. The more organized the applicant is with this information, the easier and quicker the form can be filled out.

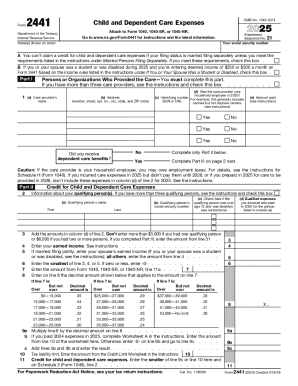

Step-by-step instructions for filling out the form

Filling out the 2025 low-income senior assessment form requires attention to detail. The first section is typically dedicated to personal information. Here, applicants need to provide their full name, contact details, and most importantly, their Social Security number. This personal data secures the application and ensures that each submission is correctly linked to the individual.

Next, the financial information section centers on detailing various income sources. Applicants should list all relevant income streams, such as employment, pensions, or Social Security. It's essential to include accurate amounts, as any discrepancies can lead to complications. The household information section follows; it asks for details about dependents and other household members. Providing accurate data here is crucial to assess any additional financial responsibilities an applicant may have. Lastly, there's often a section for additional comments or requests, where applicants can clarify their needs or highlight specific circumstances.

Editing and finalizing your form

Once the form is filled out, editing and finalizing it comes next. Utilizing tools like pdfFiller can simplify the editing process considerably. Users can modify their forms directly, adding or correcting information without the hassle of starting from scratch. This platform allows for modifications to be made effortlessly, positioning pdfFiller as an essential ally in document management.

Best practices suggest that applicants should thoroughly review their submission to catch any errors before it is sent. Having a second pair of eyes from a friend or family member helps ensure that all information is correct and complete, thereby navigating potential delays or rejections.

Signing and submitting the form

An electronic signature is often required to finalize the 2025 low-income senior assessment form. Using pdfFiller, adding an eSignature is straightforward and quick, providing a secure method to authenticate the application. This feature is particularly valuable, as it enhances the user experience by allowing submissions without the traditional paper-based hassle.

Once signed, applicants must decide on the submission method: electronic or paper-based. Electronic submissions are generally quicker and provide an immediate confirmation, while paper submissions might take longer. It is essential to be aware of any important deadlines related to submission, as missing these could delay access to critical assistance.

Tracking your application status

After submitting the 2025 low-income senior assessment form, tracking the application status is essential. There are various methods to check the status; most agencies provide online tracking features or hotlines where applicants can make inquiries. Having the submission reference number handy facilitates this process.

For personalized updates, contacting the appropriate authorities directly can yield the most accurate information. It’s important for applicants to remain proactive in this phase, ensuring that they are aware of any additional requirements or follow-up actions necessary for their applications.

Troubleshooting common issues

While completing the 2025 low-income senior assessment form, applicants may encounter common problems. For instance, missing or incomplete information might lead to automatic rejections or delays. It’s crucial to double-check all fields and ensure that nothing is overlooked before submission.

Incorrect income reporting is another prevalent issue. Given that financial thresholds play a key role in eligibility, accurately reporting all income sources is critical. Applicants should take the time to review their financial documents to avoid any discrepancies. Solutions include maintaining detailed records and using proper software like pdfFiller to assist with clarity and accuracy in reporting.

Frequently asked questions (FAQs)

Understanding the frequency of application is crucial for managing expectations. Many applicants wonder how often they need to reapply for the Low-Income Senior Assessment. Typically, it is advisable to reapply annually, although specific program requirements may dictate otherwise. Regular updates ensure that any changes in financial status are documented and accounted for in ensuring the continued eligibility of services.

Another common question is about the consequences of income changes after submission. It is essential to report such changes immediately to the administering agency. Failing to do so may result in ineligibility for assistance or potential penalties. Staying in communication with relevant agencies is key in maintaining transparency.

Additional tools and resources

There are various tools and resources available to aid seniors in navigating the 2025 low-income senior assessment form's complexities. Downloadable guides provided by pdfFiller offer step-by-step assistance to ensure applicants can accurately complete their forms. Additionally, interactive tools designed for calculating eligibility help simplify the application process, allowing seniors to assess their qualifications before submission.

Furthermore, accessing customer support for assistance is invaluable. Seniors can access live chat, email support, or phone assistance, ensuring that help is readily available as they embark on this important application journey.

Importance of accurate reporting

Accurate reporting on the 2025 low-income senior assessment form has far-reaching implications. Providing incorrect information can have serious consequences, ranging from delayed processing to outright denial of assistance. Such inaccuracies can hinder seniors from accessing vital resources designed to support their specific needs.

Compliance with local regulations is equally important, as eligibility guidelines often adhere to strict legal standards. Thus, maintaining precision in reporting not only secures individual benefits but also aligns with community standards, fostering a system that effectively supports those in need.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 2025 low-income senior assessment without leaving Google Drive?

How do I edit 2025 low-income senior assessment in Chrome?

Can I create an eSignature for the 2025 low-income senior assessment in Gmail?

What is 2025 low-income senior assessment?

Who is required to file 2025 low-income senior assessment?

How to fill out 2025 low-income senior assessment?

What is the purpose of 2025 low-income senior assessment?

What information must be reported on 2025 low-income senior assessment?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.