Get the free plan disclosure booklet and participation agreement

Get, Create, Make and Sign plan disclosure booklet and

Editing plan disclosure booklet and online

Uncompromising security for your PDF editing and eSignature needs

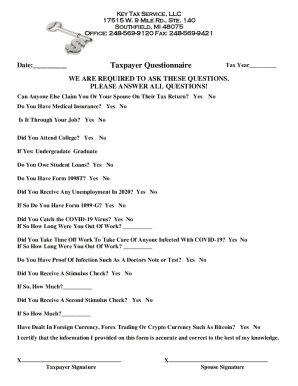

How to fill out plan disclosure booklet and

How to fill out plan disclosure booklet and

Who needs plan disclosure booklet and?

Complete Guide to the Plan Disclosure Booklet and Form

Understanding the plan disclosure booklet

A plan disclosure booklet is a key document that outlines the particulars of an insurance policy or benefits plan. It serves as an informative resource for policyholders, detailing everything from coverage specifics to limitations on benefits. In essence, this booklet is your roadmap for navigating the complexities of your plan.

The importance of the disclosure booklet in document management cannot be overstated. It helps ensure that individuals understand their rights, responsibilities, and the scope of their coverage. This not only facilitates informed decisions but also promotes transparency between policyholders and providers.

Purpose of the plan disclosure form

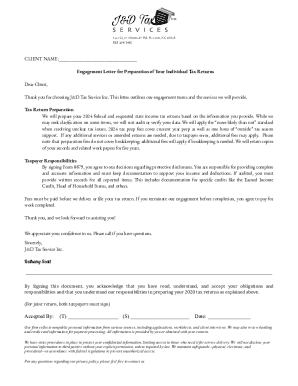

The plan disclosure form is a vital tool in the document management process, functioning primarily as a formal agreement between the policyholder and the insurer. This form collects essential information needed to validate eligibility and execute coverage.

Necessary information included in the form typically encompasses personal identification data, policyholder information, and beneficiary designations. This ensures that all relevant parties' information is accurate and up-to-date, minimizing the risk of complications when claims are made.

Proper completion of the plan disclosure form is crucial, as any inaccuracies can lead to unnecessary delays or even denial of benefits. Ensure that every piece of information provided is correct, as this form lays the groundwork for your policy implementation.

Step-by-step guide to completing the disclosure booklet and form

Before diving into the paperwork, preparation is key. Gather all necessary documentation to streamline the process. You’ll need identification proof, prior plan documents, and relevant financial information. This collection of materials will empower you to provide complete and accurate information.

Completing the disclosure booklet requires close attention. Start by filling out the coverage sections meticulously. Specify any exclusions and limitations clearly. Additionally, document the benefits and services accurately, as this will serve you in future claims.

Completing the disclosure form is equally significant. Accurately entering personal information is essential for a smooth claims process. Take the time to review and verify every detail you've provided. Finally, remember to sign the form for it to hold legal validity.

Tools and resources for editing and managing your documents

Utilizing a service like pdfFiller can significantly enhance your experience with document management. With its intuitive platform, you can create, edit, and manage your plan disclosure booklet and form with ease. This tool features a comprehensive set of tools for PDF editing that can elevate your efficiency.

Key features include eSigning for legal compliance, ensuring your documents adhere to necessary regulations. Moreover, Collaboration features allow for seamless sharing among team members, which can be particularly useful when multiple stakeholders are involved.

Accessibility is another major advantage of utilizing cloud-based solutions. You can access your documents from anywhere and at any time, ensuring that you're always equipped with the latest information regarding your insurance plan.

Common mistakes to avoid when filling out disclosure documents

When navigating your plan disclosure booklet and form, be aware of common pitfalls that can lead to delays or denials. Overlooking critical information, for example, can compromise the completeness of your submission, resulting in unnecessary friction with the insurer.

Additionally, misunderstanding policy terms can create misconceptions about your coverage. Before filling out the forms, take time to read and understand all terms and conditions. Finally, ensure you keep copies of your documents for your personal records. This way, you have a direct reference for future claims or questions.

Frequently asked questions about plan disclosure booklets and forms

It's common to have questions about what to do if you lose your plan disclosure documents. You should contact your insurance provider immediately for a replacement to avoid any gaps in coverage or claims processing.

Updating your information on these forms is also crucial, particularly after significant life changes such as marriage or moving. Regular communication with your insurer can ensure that all your information remains current.

Specific concerns may arise based on the type of insurance plan you hold. Variations in plans can lead to differing requirements and state-specific regulations that must be adhered to. Familiarize yourself with these specifics to ensure a smooth experience.

Real-life scenarios: Successfully navigating your disclosure

Consider case studies of individuals who have successfully completed their plan disclosure forms. These case studies highlight the importance of attention to detail and proper guidance when navigating complex insurance documents.

Testimonials from users of pdfFiller further reinforce its efficiency in managing disclosure documents. Users often mention how the platform’s intuitive interface and collaborative features made their experience not only manageable but also efficient.

Illustrative examples provide further clarity on the editing and collaborating features of pdfFiller, showing how users can make real-time changes and comments, thus streamlining the document management process.

Strategies for ongoing document management

Maintaining your plan disclosure booklet is an ongoing responsibility. Regularly review your documents to ensure all information reflects any changes to your circumstances or the policy itself. Additionally, consider setting calendar reminders for periodic assessments of your plan.

Integrating your plan disclosure booklet with other document management tools can further enhance your efficiency. Using systems that allow for easy updates and quick access can streamline your experience, ensuring that you always have vital information at your fingertips.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit plan disclosure booklet and online?

Can I create an electronic signature for signing my plan disclosure booklet and in Gmail?

How do I edit plan disclosure booklet and straight from my smartphone?

What is plan disclosure booklet?

Who is required to file plan disclosure booklet?

How to fill out plan disclosure booklet?

What is the purpose of plan disclosure booklet?

What information must be reported on plan disclosure booklet?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.