Get the free Joseph Belcik v. Commissioner of Internal Revenue

Get, Create, Make and Sign joseph belcik v commissioner

How to edit joseph belcik v commissioner online

Uncompromising security for your PDF editing and eSignature needs

How to fill out joseph belcik v commissioner

How to fill out joseph belcik v commissioner

Who needs joseph belcik v commissioner?

Understanding the Joseph Belcik . Commissioner Form: A Comprehensive Guide

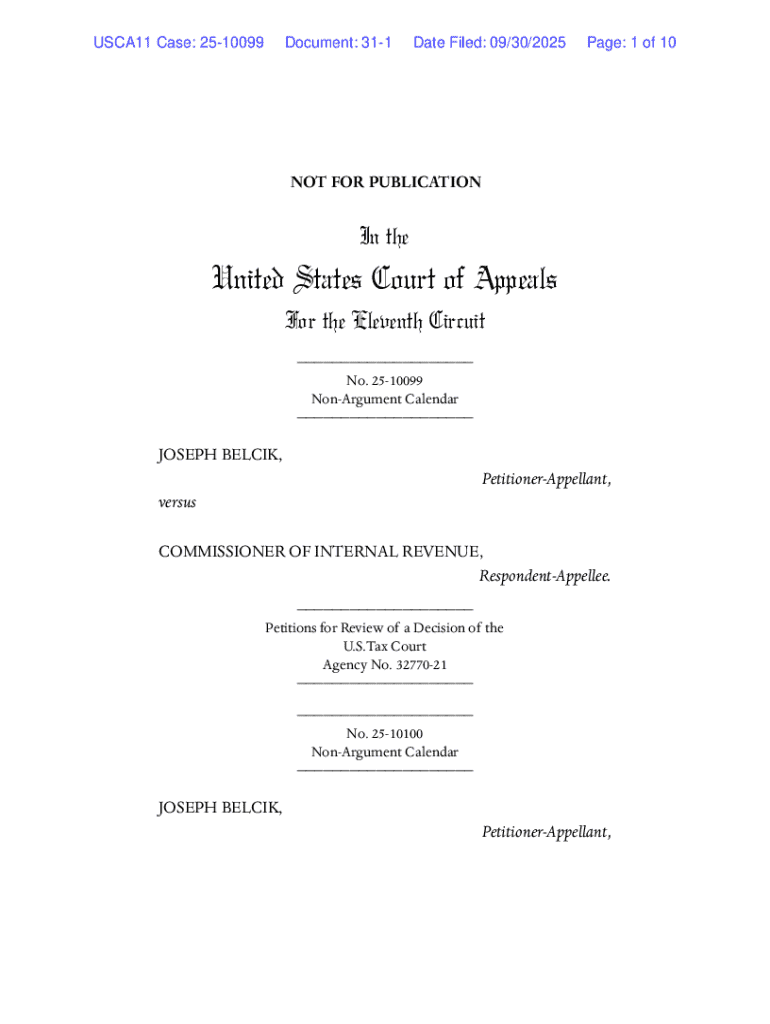

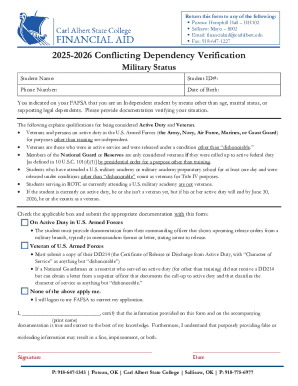

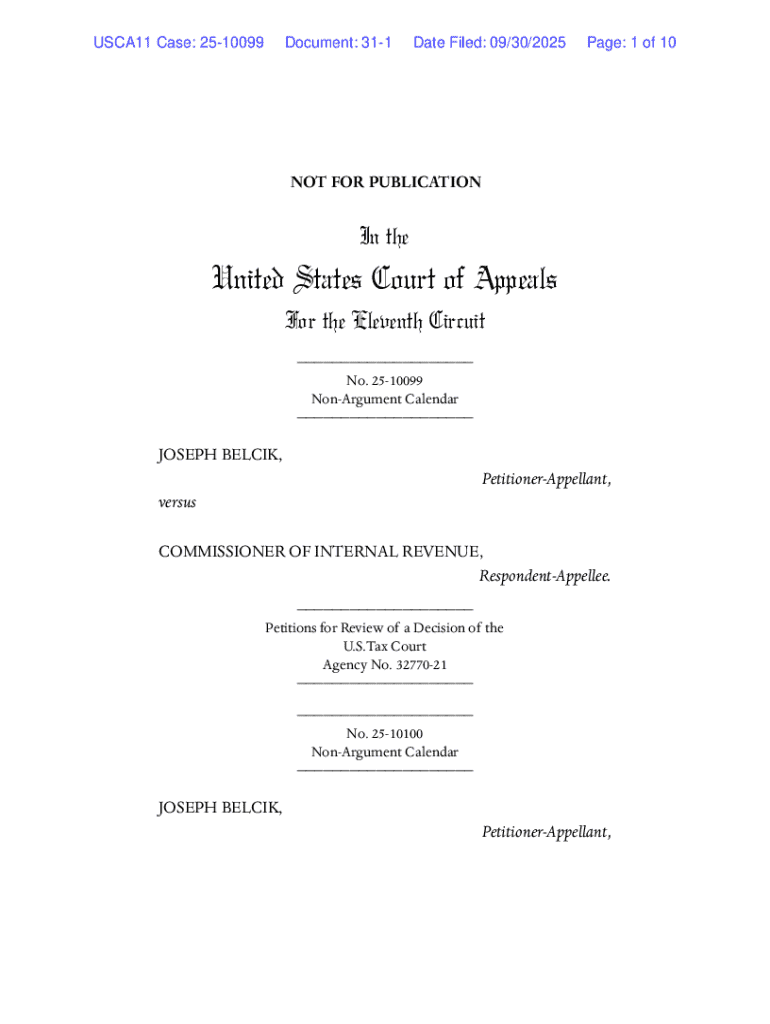

Overview of Joseph Belcik . Commissioner Case

The Joseph Belcik v. Commissioner case is an important legal examination within the realm of tax law. It centers around tax compliance issues pertaining to self-employment income and the obligations that arise from various forms of tax documentation. The key parties involved are Joseph Belcik and the Commissioner of the Internal Revenue Service (IRS), with Belcik contesting certain determinations made regarding his tax filings.

This case is notable not only for its detailed exploration of self-employment tax responsibilities but also for the implications it holds for taxpayers and tax professionals navigating similar issues. Understanding the essence of this case can illuminate potential risks and highlight crucial considerations for individual tax compliance, particularly in the realm of income reporting and deductions.

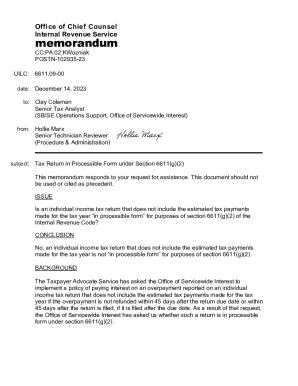

Understanding the Commissioner Form

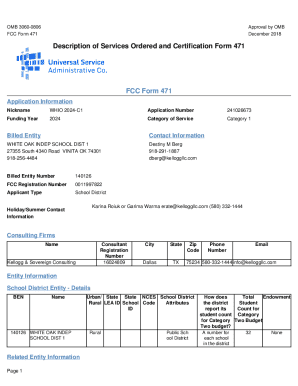

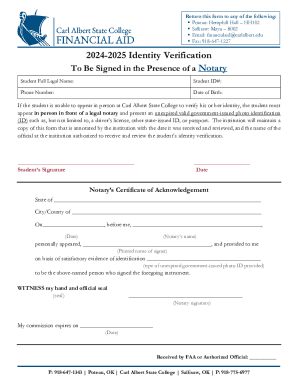

The Commissioner Form central to this case serves as a pivotal tax document that individuals must complete when facing direct inquiries from the IRS related to compliance or specific income reporting discrepancies. This form's primary purpose is to report income accurately, claim applicable deductions, and to affirm the taxpayer's responsibility to adhere to tax laws.

Different types of forms may be associated with the Joseph Belcik v. Commissioner case, reflecting the diverse nature of tax issues encountered. These forms capture essential data, facilitate timely communication with tax authorities, and offer taxpayers an avenue to clarify misunderstandings or errors in their tax returns.

Step-by-step instructions for completing the Commissioner Form

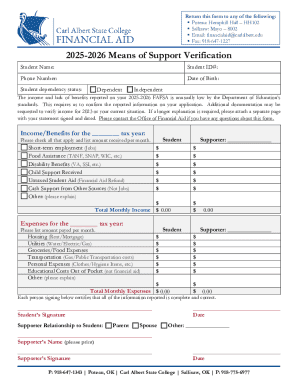

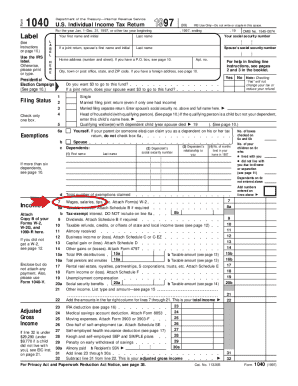

Completing the Commissioner Form accurately is crucial to avoid misunderstandings with the IRS. Start by gathering all required documents, including W-2s, 1099 forms, income statements, and records of any deductions you plan to claim. Accurate preparation leads to more effective reporting, which is vital given the complexities shown in the Joseph Belcik case.

Next, it's essential to understand each section of the form. Inputting personal information must be done with precision, detailing your name, address, and Social Security number correctly. When reporting income, reflect all earnings appropriately, including income from self-employment, as outlined specifically in the conclusions drawn in the case. This is where the nuances of tax compliance become especially relevant.

Then move on to deductions and credits, which must correspond to legitimate expenses incurred during the tax year. For example, if you claim expenses related to a home office, ensure that you have documented proof available, as it can become a point of contention similar to those encountered in the case.

Lastly, never neglect to sign and date the form. Electronic signatures such as those offered by pdfFiller can streamline this process, making it swift while retaining legal validity.

Common mistakes to avoid when filing the form

Filing the Commissioner Form accurately is paramount. One prevalent issue is the submission of inaccurate information, which can lead to costly penalties or further inquiries from the IRS. It’s crucial to double-check figures, especially when reporting income, ensuring you're consistent across all related documents.

Missing deadlines is another common pitfall that can complicate tax situations. Ensure you are aware of key dates related to tax submission for the current year to sidestep potential penalties. Not adhering to these timelines can spark further issues, heightening the urgency of compliance beyond what is typically expected.

Lastly, it’s essential to grasp the legal implications of the information you provide. Understanding the potential ramifications—similar to those evident in the Belcik case—will help reinforce the importance of thoroughness and responsibility in your submissions.

Editing and prepping your Commissioner Form

Utilizing tools like pdfFiller can drastically enhance your efficiency when editing the Commissioner Form. Begin by leveraging the editing features to input the required information seamlessly. From text fields to checkboxes, customizing your form to meet your exact needs is pivotal, particularly as accuracy in tax documentation directly impacts compliance and potential disputes.

Collaboration is another key feature that pdfFiller offers. When working with team members or tax professionals, sharing the form becomes vital in elevating the quality of submissions. Utilize cloud-sharing options integrated within pdfFiller to streamline communication and feedback, ensuring that everyone involved is on the same page regarding the information presented.

eSigning your Commissioner Form

The advantages of eSigning cannot be understated. It provides a faster, more efficient way to finalize your Commissioner Form, eliminating the need for physical paperwork, which can lead to delays in processing. eSigned documents are legally valid and help save on postage fees as well.

Using pdfFiller’s eSignature functionality is straightforward. Simply select the document for signing, choose the eSignature option, and directly place your signature where required. The platform also allows for easy tracking of signatures, ensuring you have visibility into the signing process, which is particularly beneficial for team collaborations.

Managing your form after submission

Once your Commissioner Form is submitted, keeping track of its status is critical. Utilizing tools available through pdfFiller allows you to monitor the submission’s progress, keeping you informed of any updates or requirements from the IRS. Staying proactive about your form’s status can mitigate potential issues before they escalate.

If follow-up requests or issues arise from the IRS, having a clear strategy in place is essential. Familiarize yourself with the procedure to respond to inquiries, ensuring that you have all necessary documentation readily accessible. This preparedness indicates a proactive approach similar to what is needed in navigating tax complexities.

Legal considerations post-submission

Understanding the potential outcomes following the submission of your form is crucial. The results can range from favorable resolutions, where your claims are accepted, to unfavorable responses requiring adjustments or further inquiries. Each outcome carries specific implications for your tax situation, highlighting the need for accurate and compliant reporting.

If the case demands additional legal actions, knowing the steps to take is vital. Consulting with a tax professional can help you navigate the complexities and prepare for any necessary follow-up, like filing appeals or providing additional documentation as needed. This proactive approach can protect against further issues, reinforcing how essential meticulous preparation and understanding of tax laws are.

FAQs regarding the Joseph Belcik . Commissioner Form

Common inquiries about the Commissioner Form often revolve around its function, what to do if you receive a dispute from the IRS, and how to best prepare for compliance. Taxpayers frequently question the specifics of income adjustments post-filing and how to handle discrepancies noted by the IRS.

It is advisable to seek clear guidance from tax professionals or consult IRS resources to find answers to these prevailing questions. Engaging with experts not only provides insights into handling the form correctly but also offers reassurance when navigating complex tax issues.

Final recommendations for successful filing

To maintain compliance with tax regulations, adhere to best practices in filing. This includes keeping meticulous records of all forms, deadlines and communications with the IRS. Regularly consulting tax guidelines and resources can further empower you to file correctly and mitigate potential issues down the line.

Employ pdfFiller's tools to simplify your documentation process. With options for editing, eSigning, and collaborating on forms, you are equipped to navigate the intricacies of tax filing efficiently. The ease of use provided by the pdfFiller platform enables you to focus on critical compliance tasks without the burden of cumbersome paperwork.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my joseph belcik v commissioner in Gmail?

How do I execute joseph belcik v commissioner online?

How do I edit joseph belcik v commissioner online?

What is joseph belcik v commissioner?

Who is required to file joseph belcik v commissioner?

How to fill out joseph belcik v commissioner?

What is the purpose of joseph belcik v commissioner?

What information must be reported on joseph belcik v commissioner?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.