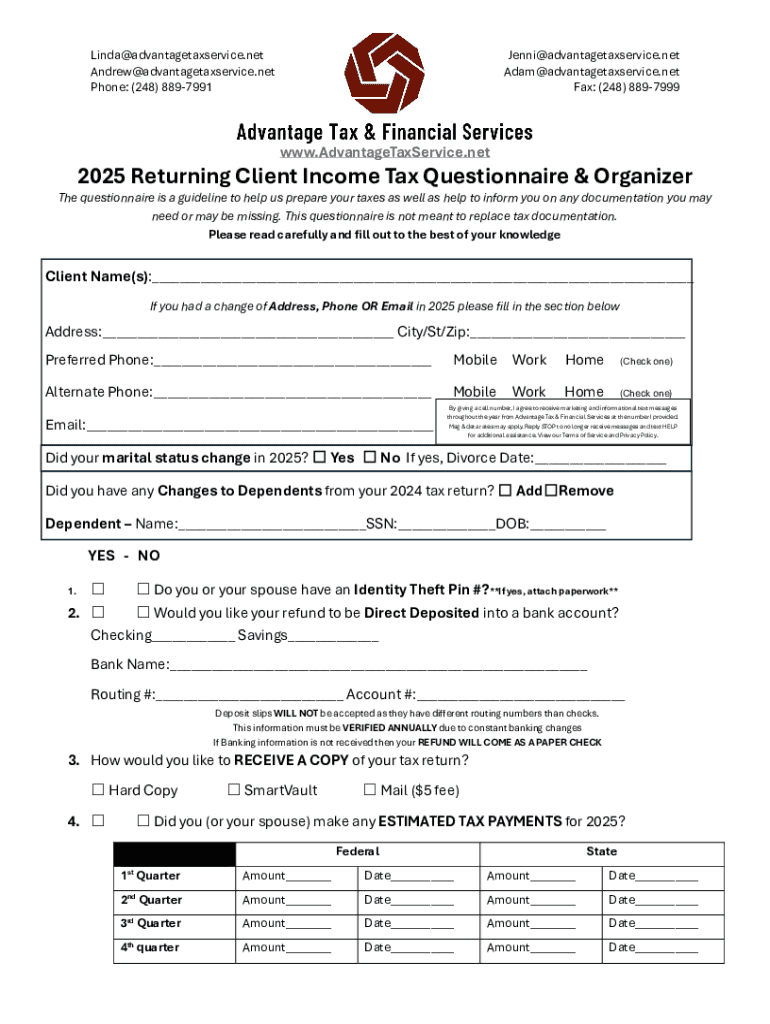

Get the free About Advantage Tax & Financial ServicesHighland, MI

Get, Create, Make and Sign about advantage tax amp

Editing about advantage tax amp online

Uncompromising security for your PDF editing and eSignature needs

How to fill out about advantage tax amp

How to fill out about advantage tax amp

Who needs about advantage tax amp?

About Advantage Tax Amp Form: A Comprehensive Guide

Understanding the Advantage Tax benefit

The Advantage Tax is designed to provide financial relief and support to eligible individuals and teams. By offering various benefits through deductions and credits, the program aims to assist taxpayers in lowering their overall tax burdens. Commonly, individuals who meet specific income qualifications or who have dependents may apply for this tax advantage, which helps them save money and encourages investment in both personal and business ventures.

The eligibility criteria usually revolve around income thresholds, family size, and specific circumstances like disability. The importance of the Advantage Tax benefit cannot be overstated, as it not only alleviates financial pressure for individuals but also promotes a fairer tax system that rewards responsible financial behavior.

Key benefits of the Advantage Tax

One of the most appealing aspects of the Advantage Tax is its financial advantages. Individuals and businesses can experience significant cost savings through reductions in annual tax obligations. These savings can manifest through rebates, which taxpayers receive after filing, thus encouraging financial planning and investment. Over the long term, this tax benefit can lead to substantial increases in disposable income or reinvestment into a business, making it a vital part of smart financial strategy.

Beyond the financial aspect, the filing process for the Advantage Tax has been simplified. Thanks to tools like pdfFiller, taxpayers can experience a streamlined procedure for submitting essential documents. This means less paperwork and complexity, allowing users to focus on maximizing their tax refunds rather than getting bogged down in administrative tasks.

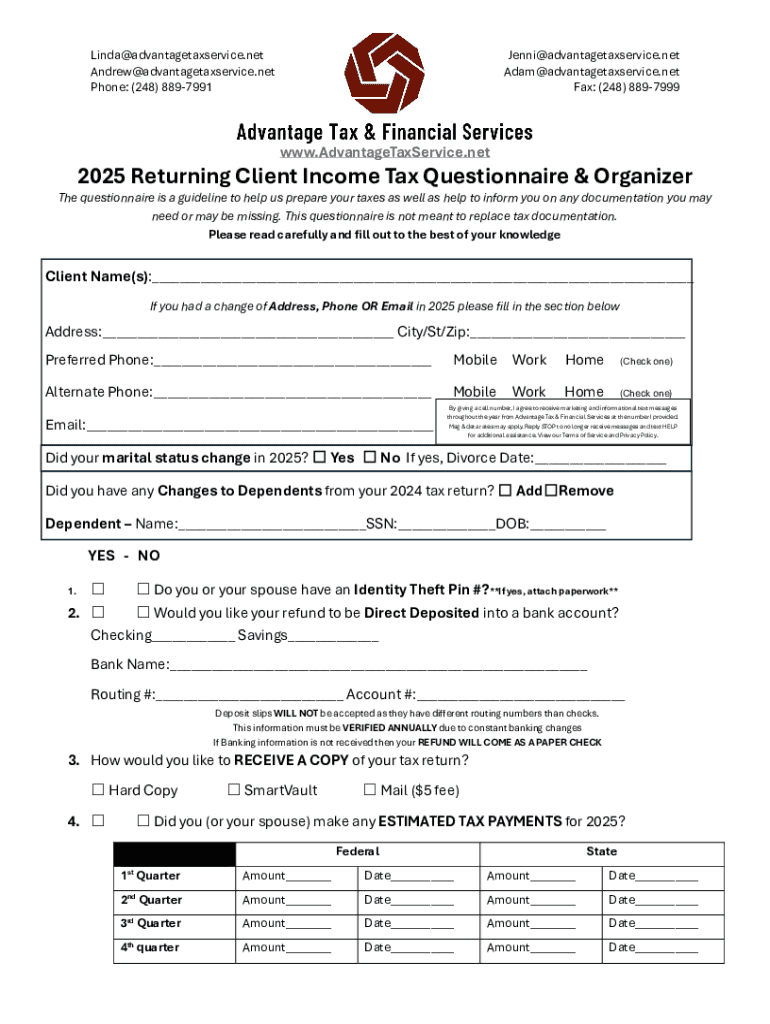

Essential forms and documentation

To successfully file for the Advantage Tax, taxpayers must complete certain key forms. The primary document include the Advantage Tax Application Form, which captures all relevant personal and financial information necessary for evaluation. Furthermore, a Support Documents Checklist ensures that individuals and businesses supply all required information, such as proof of income, dependents, and other qualifying factors that could affect their eligibility.

Accessing these forms is straightforward, particularly with pdfFiller's easy-to-navigate interface. Users can follow a simple, step-by-step guide to locate and download the necessary forms in PDF format. This ensures that taxpayers can start the filing process without unnecessary delays.

Step-by-step guide to filling out the Advantage Tax form

Filling out the Advantage Tax Form is a structured process that begins with gathering all required information. First, users must compile personal details, including name, address, and Social Security number, alongside income information relevant to the tax year. Previous tax records are also essential for reference and verification purposes.

Navigating the Advantage Tax Form involves completing various sections designed to capture detailed financial data. pdfFiller offers an interactive guide on how to proceed through the form, thus minimizing common mistakes. Taxpayers should pay careful attention to inputting figures and reviewing sections before submission to avoid errors that could delay processing.

Lastly, if any modifications to the form are necessary, users can easily utilize pdfFiller’s editing tools. Adding signatures and notes directly within the platform streamlines the process and ensures compliance with submission requirements.

Collaborating on the Advantage Tax form

For teams, collaborating on the Advantage Tax Form can enhance accuracy and efficiency. pdfFiller’s collaborative tools allow team members to work together on the same document, reviewing entries and discussing necessary edits in real-time. This feature is particularly advantageous for businesses with multiple stakeholders involved in the financial documentation process.

Sharing forms securely among team members is a paramount concern. pdfFiller provides guidelines ensuring that only authorized individuals have access to sensitive information, and version control features enable users to track changes easily. These practices promote accountability and enhance overall document integrity.

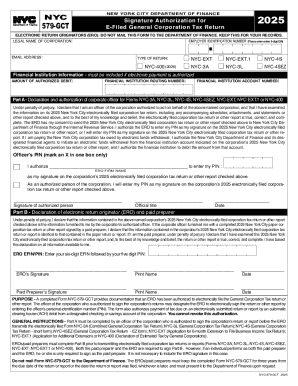

Signing and submitting the Advantage Tax form

Once the Advantage Tax Form is completed, the next step is to sign and submit it. The eSignature process within pdfFiller is not only user-friendly but also enhances the security of document handling. Users can set up their electronic signatures quickly, which can be applied anytime without the need for printing or scanning.

Submitting the completed forms is straightforward with various methods available, including electronic submission directly through the platform. Taxpayers should take note of important deadlines to ensure timely submissions, as late submissions can result in penalties or missed opportunities for tax credits and rebates.

Managing your Advantage Tax documents

After filing for the Advantage Tax benefit, managing tax-related documentation becomes crucial. Individuals and teams should adopt strategies for organizing their digital workspace to easily find important documents when needed. pdfFiller offers cloud storage options that enable users to keep everything in one easily accessible location, minimizing the risk of losing crucial paperwork.

In addition, tracking important dates for tax filing and notifications is vital. pdfFiller’s calendar integration features allow users to set reminders about upcoming deadlines, ensuring that no essential filings are overlooked throughout the year.

Troubleshooting common issues

When filing for the Advantage Tax benefit, questions or concerns may arise. Common issues include difficulties with form submissions or miscalculations on tax documents. An FAQ section often addresses these common concerns, helping users to troubleshoot effectively and resolve issues swiftly.

Additionally, if users encounter persistent problems or have specific inquiries, reaching out for assistance is essential. pdfFiller offers customer support, and community resources and forums provide a platform for users to share their experiences and find solutions to shared challenges.

Staying informed about changes in Advantage Tax regulations

Tax regulations, including those governing the Advantage Tax, can change frequently. Taxpayers must stay informed about annual updates to ensure compliance and maximize benefits. Resources such as tax advisory groups or online federal updates can provide valuable insights and guidance.

Continued education is critical in managing one’s tax responsibilities. Participating in webinars, workshops, or subscribing to tax-related newsletters can also empower users to stay informed and educated about tax matters, including fluctuations in qualifying factors for benefits.

Summary of key takeaways

Utilizing pdfFiller for filing the Advantage Tax Form offers numerous advantages, primarily through enhanced usability features and comprehensive support throughout the tax process. Users experience not only efficiency in form management but also the peace of mind that comes with knowing they can access expert resources and community support.

This comprehensive approach ensures that individuals and teams can navigate their financial obligations confidently, resulting in fruitful tax outcomes and optimized refunds.

Maximizing your experience with pdfFiller

Beyond the Advantage Tax Form, pdfFiller offers a wealth of additional features that cater to versatile document management solutions. Users can leverage these tools not only for taxes but for all kinds of workflows, which enhances productivity and collaboration across various sectors.

Moreover, by exploring subscription benefits, users gain access to premium features that can further streamline their document creation and editing processes, ensuring they have everything necessary for efficient tax filing and management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete about advantage tax amp online?

How do I edit about advantage tax amp online?

How do I fill out about advantage tax amp on an Android device?

What is about advantage tax amp?

Who is required to file about advantage tax amp?

How to fill out about advantage tax amp?

What is the purpose of about advantage tax amp?

What information must be reported on about advantage tax amp?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.