Get the free Form NYC-579-GCT Signature Authorization for E-Filed ...

Get, Create, Make and Sign form nyc-579-gct signature authorization

How to edit form nyc-579-gct signature authorization online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form nyc-579-gct signature authorization

How to fill out form nyc-579-gct signature authorization

Who needs form nyc-579-gct signature authorization?

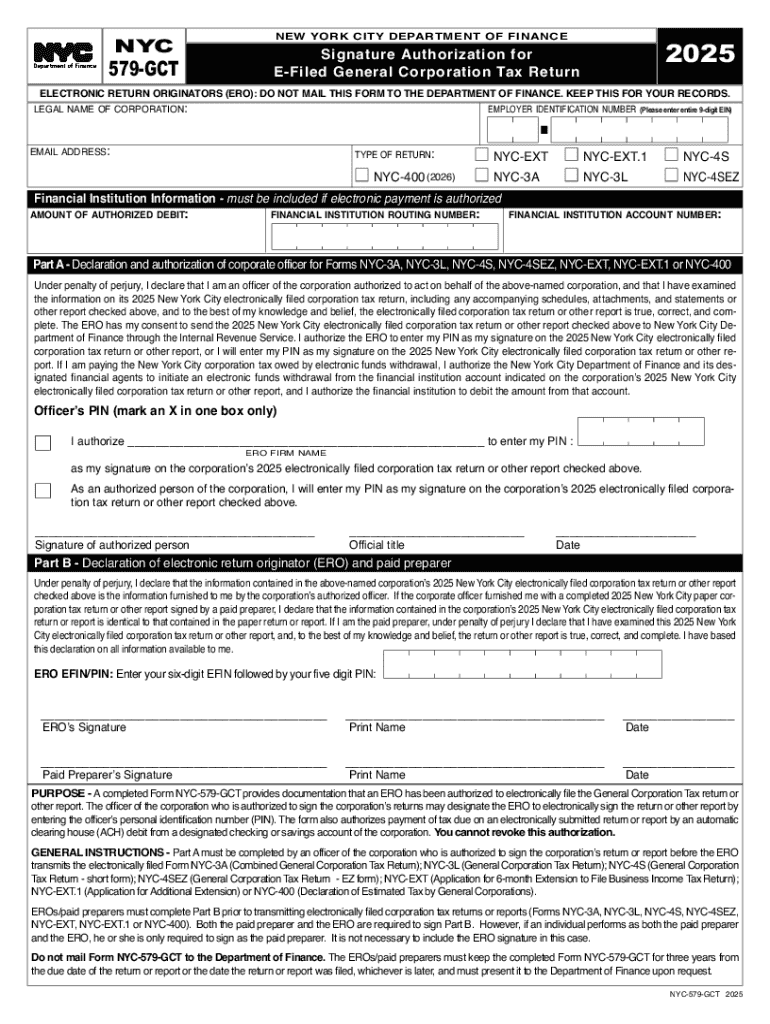

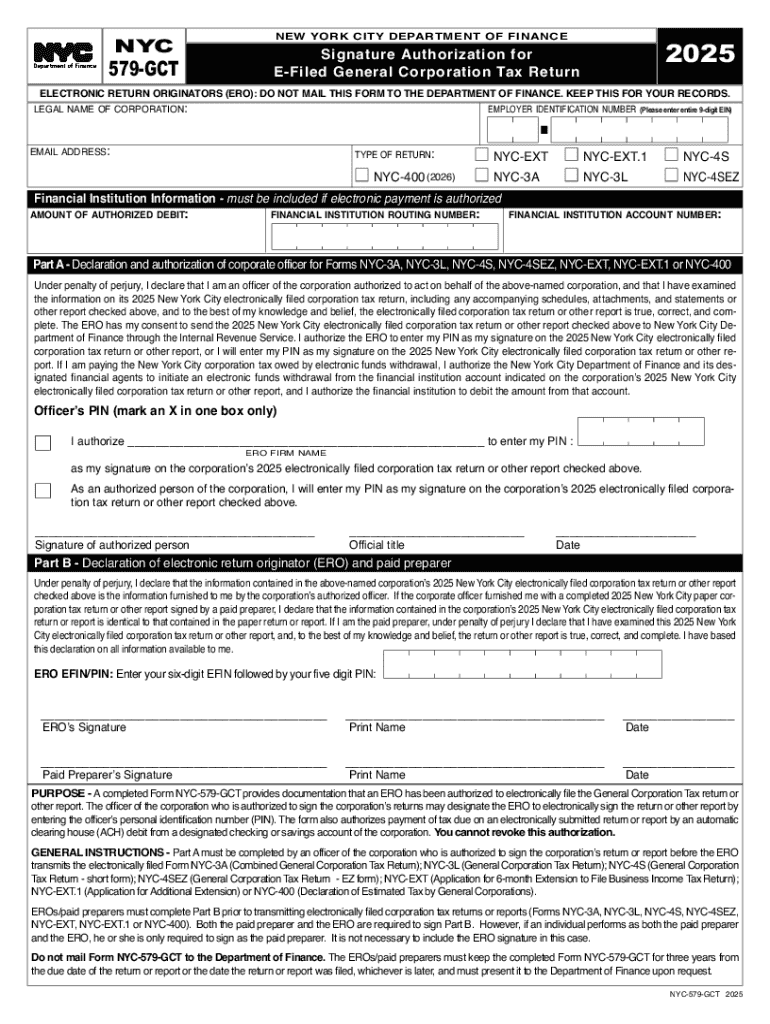

Understanding the NYC-579-GCT Signature Authorization Form

Overview of the NYC-579-GCT Signature Authorization Form

The NYC-579-GCT Signature Authorization Form is a critical document utilized by corporations operating in New York City to authorize individuals to act on their behalf concerning General Corporation Tax matters. This form serves as an official declaration that specific individuals have been granted the authority to manage and execute corporate tax responsibilities, simplifying the administration of corporate affairs.

The importance of the NYC-579-GCT form cannot be overstated for corporations needing to navigate the complex landscape of tax compliance in New York City. Regulators require the identification of authorized representatives to ensure compliance with local tax laws, and this form meets that requirement effectively. By submitting the form, corporations provide clarity regarding who is empowered to make decisions related to the General Corporation Tax.

Who needs to use the NYC-579-GCT form?

The NYC-579-GCT form is essential for all corporations that are subject to the General Corporation Tax (GCT) in New York City. Corporations must submit this form when they designate individuals to handle their tax filings, ensuring those individuals are recognized by the NYC Department of Finance. The eligibility criteria require that the individual completing the form must have a direct relation to the corporation, either as a principal officer or a legal representative.

It’s important to note that not every entity needs to complete the NYC-579-GCT form. Certain categories, such as sole proprietorships or businesses that are not liable for GCT, are exempt from requiring this authorization. Additionally, corporations may choose to submit the form when there are changes in their corporate structure or personnel that impact who is authorized to act on their behalf.

Step-by-step instructions for completing the NYC-579-GCT form

Completing the NYC-579-GCT form requires some specific information to ensure accuracy and compliance with submission requirements. The primary elements needed include the corporate name, identification number, as well as the details of the authorized signatory. Each section of the form should be filled out carefully to reflect the correct corporate structure.

To fill out the form effectively, follow these steps:

It’s vital to ensure that the information is accurate and matches that of the corporation as registered with the NYC Department of Finance. Any discrepancies could delay processing or lead to potential issues with compliance.

Filing requirements for the NYC-579-GCT form

Once the NYC-579-GCT form is completed, the next step is filing it with the appropriate authorities. The form can be submitted online through the NYC Department of Finance website or delivered in person at designated locations. Understanding how and where to submit your form is crucial to avoid complications.

Key filing deadlines are also crucial. Corporations should submit the NYC-579-GCT form promptly to avoid potential penalties. Late submissions can result in fines and may complicate your corporation's standing with the tax department.

Tips for using the NYC-579-GCT Signature Authorization Form effectively

When submitting the NYC-579-GCT form, it’s crucial to ensure all details are correct and formatted according to the guidelines provided by the NYC Department of Finance. Many corporations often run into common mistakes such as failing to update signatories immediately after personnel changes or misidentifying the corporate name.

To ensure successful submission, consider the following best practices:

Following these tips can drastically reduce the risk of complications and promote smoother operations in corporate tax matters.

Interactive tools & resources

Utilizing tools such as pdfFiller can greatly enhance your experience with the NYC-579-GCT Signature Authorization Form. With pdfFiller’s PDF editing and signing capabilities, users can conveniently fill out, edit, and eSign this form without encountering traditional barriers. Such functionalities streamline the process, making it easier to manage important corporate documents.

Users can also access templates and sample forms available within pdfFiller’s extensive library. These resources provide examples of properly completed forms, serving as helpful guides during the filling process.

FAQs about the NYC-579-GCT Signature Authorization Form

The NYC-579-GCT form often raises several questions from corporate entities seeking clarity on procedures and compliance expectations. Understanding the nuances surrounding this form can significantly ease the completion and submission process.

Additional support

For further assistance regarding the NYC-579-GCT Signature Authorization Form, corporations can reach out directly to the NYC Tax Department. They provide various channels of communication, including phone support, email inquiries, and additional resources available on their website.

Additionally, pdfFiller offers robust support tailored to assist users in effectively completing and managing the NYC-579-GCT form. With a comprehensive user-friendly interface, pdfFiller helps mitigate any challenges associated with document preparation.

Integrating the NYC-579-GCT into your document management strategy

Incorporating the NYC-579-GCT form into your broader document management strategy is essential for corporations focused on compliance and efficiency. Adopting a cloud-based solution like pdfFiller enables organizations to streamline document creation, facilitating secure access and team collaboration.

With features designed for enhanced teamwork, pdfFiller allows multiple users to work on the same document concurrently, ensuring that updates and changes are reflected in real time. This collaborative platform is ideal for businesses looking to enhance their efficiency in handling important forms and documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form nyc-579-gct signature authorization?

How do I edit form nyc-579-gct signature authorization in Chrome?

How do I edit form nyc-579-gct signature authorization on an Android device?

What is form nyc-579-gct signature authorization?

Who is required to file form nyc-579-gct signature authorization?

How to fill out form nyc-579-gct signature authorization?

What is the purpose of form nyc-579-gct signature authorization?

What information must be reported on form nyc-579-gct signature authorization?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.