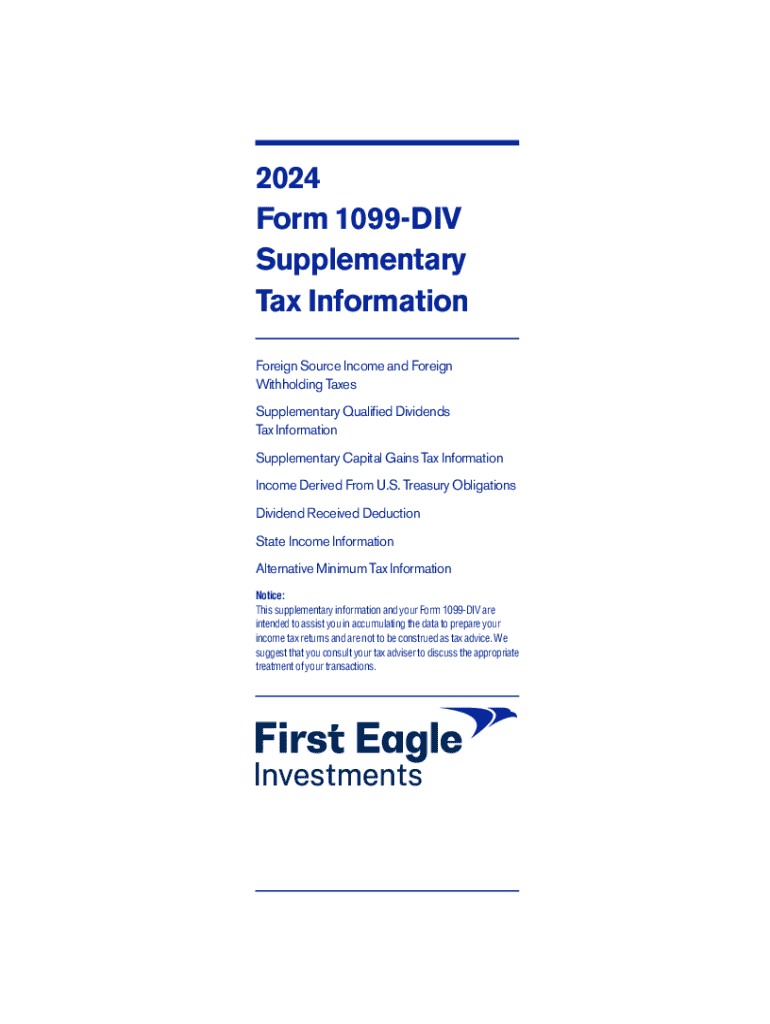

Get the free 2024 Form 1099-DIV Supplementary Tax Information

Get, Create, Make and Sign 2024 form 1099-div supplementary

How to edit 2024 form 1099-div supplementary online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 form 1099-div supplementary

How to fill out 2024 form 1099-div supplementary

Who needs 2024 form 1099-div supplementary?

2024 Form 1099- Supplementary Form: A Comprehensive Guide

Overview of 2024 Form 1099-

The 2024 Form 1099-DIV is a critical tax form that reports dividends and distributions from corporate stock and mutual funds. This form is used to provide essential information to the IRS and taxpayer about dividend income, ensuring that individuals and businesses meet their tax obligations.

Accurate reporting of dividend income is vital for both taxpayers and the IRS, as it aids in the assessment of tax liabilities and prevents tax evasion. Furthermore, the 2024 version of Form 1099-DIV introduces several important updates that reflect changes in tax law and reporting requirements.

Key changes for the 2024 tax year include:

Understanding dividend income

Dividend income represents a significant portion of earnings for many investors and can come in several forms. Primarily, dividends are categorized into two types: qualified dividends and ordinary dividends. Understanding these distinctions is crucial for properly reporting income on your tax return.

Qualified dividends are taxed at a lower capital gains rate, while ordinary dividends are taxed at the regular income tax rate. For taxpayers, the requirement to file Form 1099-DIV typically arises when they receive over $10 in dividends during the tax year.

Detailed breakdown of Form 1099- sections

Form 1099-DIV is structured into several key sections that require specific information from both the payer and the recipient. Understanding these sections ensures accurate reporting and compliance with IRS regulations.

Part : Payer information

The first section captures details about the payer, including the name, address, and taxpayer identification number (TIN). Accurate payer identification is essential, as it helps the IRS track the source of dividends.

Part : Recipient information

This section includes the recipient's name, address, and TIN. Common mistakes include typos in the TIN or incorrect addresses, resulting in potential delays or issues with filing.

Part : Dividend distributions

Here, taxpayers report different types of dividend distributions, including qualified dividends and any non-dividend distributions. Accurate classification is important for the taxpayer’s income tax calculations and the IRS's assessment.

Part : Additional information

This section encompasses other income types reported on Form 1099-DIV, highlighting the need for thoroughness to avoid discrepancies that could lead to scrutiny from the IRS.

Step-by-step instructions for completing Form 1099-

Filing a Form 1099-DIV requires careful organization and accuracy. This step-by-step guide will help you navigate the complexities of the form.

Step 1: Gather necessary information

Before you begin filling out the form, gather the following:

Step 2: Filling out each section

Follow these guidelines for filling out each box accurately:

Step 3: Submission guidelines

Once completed, Form 1099-DIV must be submitted to the IRS and a copy provided to the recipient. Submission can be done electronically or via mail, and it's crucial to adhere to deadlines, typically set for January 31 for delivery to recipients and February 28 for IRS submission.

Utilizing pdfFiller for form completion

pdfFiller is an invaluable tool for completing Form 1099-DIV efficiently. Users can access the form online, making it easy to fill out, edit, and manage.

Features of pdfFiller for editing and signing

When using pdfFiller, users benefit from features such as:

Benefits of using a cloud-based platform

Choosing pdfFiller comes with added advantages such as access from anywhere, ensuring that you can work on your forms anytime and from any device. The platform’s security features guarantee that sensitive information remains protected, providing peace of mind during the filing process.

Common mistakes and how to avoid them

Despite best efforts, errors can occur when completing Form 1099-DIV. Common mistakes include incorrect TINs, misreported dividend amounts, and not issuing the form timely.

FAQs related to Form 1099-

Here are some frequently asked questions that can help clarify the filing process:

Errors in data entry

Data entry errors, especially with names and TINs, can lead to significant issues during audits. It’s crucial to double-check all information for accuracy before finalizing your submission.

Consequences of incorrect reporting

Failing to report accurately can result in penalties from the IRS, including fines and potential audits. Understanding the importance of precise reporting cannot be overstated.

Special considerations for 2024

The 2024 tax year may bring additional complexities, especially with recent tax law changes impacting how dividend income is reported. Individual and corporate filers should review these changes closely.

For example, changes in the treatment of foreign dividends and adjustments to qualified dividend requirements could affect how tax liabilities are calculated. It is prudent to consult IRS guidelines for precise and compliant filings.

Interactive tools and resources

pdfFiller offers a variety of interactive tools and resources to assist in the tax filing process. Users can access tax calculators tailored for dividend income that provide valuable insights into potential tax liabilities.

Also, webinars and tutorials available through pdfFiller can further educate users on filing requirements and best practices, ensuring preparedness for the tax filing season.

Glossary of key terms

Understanding key tax terms associated with Form 1099-DIV is essential for both experienced and novice filers. This glossary outlines important terminology...

Customer support and help from pdfFiller

For additional support with Form 1099-DIV, pdfFiller offers comprehensive customer service resources. Users can access live support for immediate assistance, ensuring that their filing questions are promptly addressed.

Moreover, pdfFiller provides resources for managing tax-related documents and community forums where users can exchange tips and strategies for effective tax filing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute 2024 form 1099-div supplementary online?

Can I edit 2024 form 1099-div supplementary on an iOS device?

Can I edit 2024 form 1099-div supplementary on an Android device?

What is 2024 form 1099-div supplementary?

Who is required to file 2024 form 1099-div supplementary?

How to fill out 2024 form 1099-div supplementary?

What is the purpose of 2024 form 1099-div supplementary?

What information must be reported on 2024 form 1099-div supplementary?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.