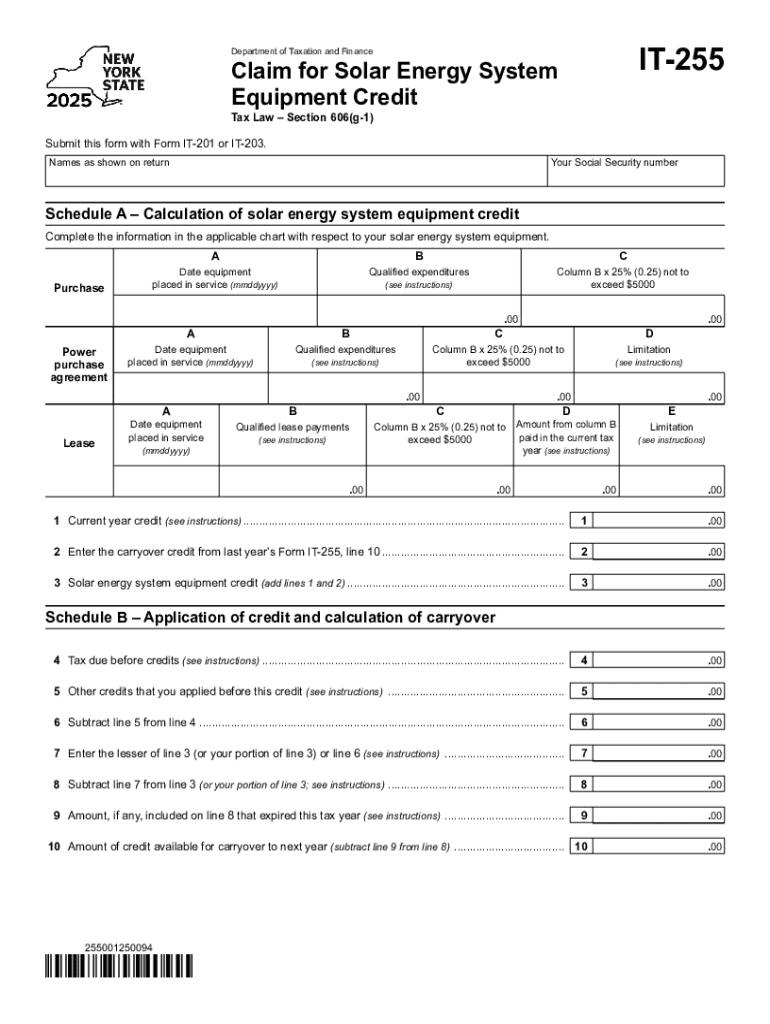

NY IT-255 2025-2026 free printable template

Get, Create, Make and Sign NY IT-255

Editing NY IT-255 online

Uncompromising security for your PDF editing and eSignature needs

NY IT-255 Form Versions

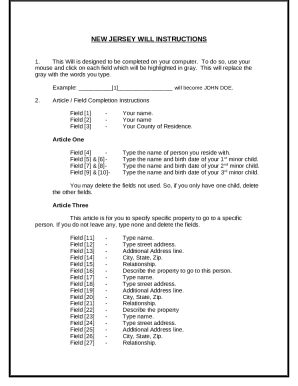

How to fill out NY IT-255

How to fill out form it-255 claim for

Who needs form it-255 claim for?

Comprehensive Guide on Form IT-255 Claim for Form

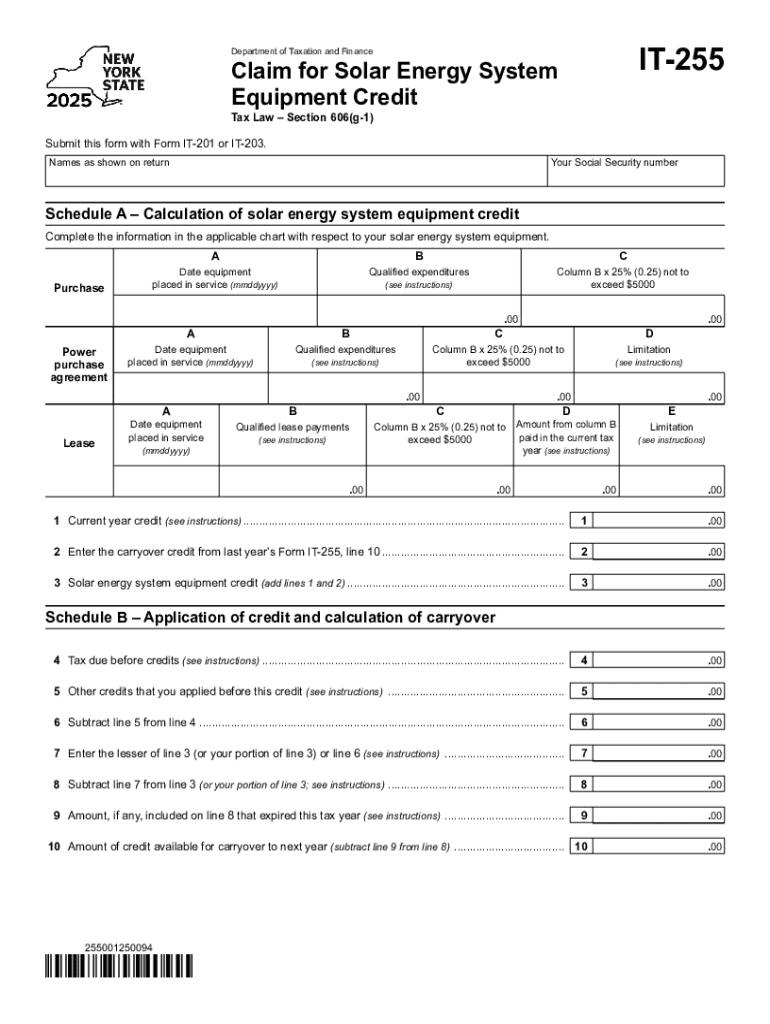

Understanding Form IT-255

Form IT-255 serves as a critical document in the tax filing process, allowing eligible taxpayers to claim certain deductions and credits that reduce their taxable income. This form specifically addresses claims for personal income tax credits available to New York State residents. Its significance lies in its ability to help taxpayers maximize potential savings, making the tax filing experience not just a requirement but an opportunity for financial benefit.

Primarily, this form is designed for individuals who have incurred expenses that qualify under New York state tax law. Using Form IT-255 can differentiate whether a taxpayer receives a refund or pays additional taxes. By understanding how to utilize this form, individuals can take advantage of the financial assistance available to them, especially if they meet the necessary requirements.

Eligibility criteria for Form IT-255

To successfully file Form IT-255, taxpayers must meet specific eligibility criteria that dictate who can claim this benefit. Typically, this form is open to individuals and families who have established residency in New York and have incurred qualified expenses. The primary requirement is that these expenses must directly relate to activities or conditions that can lead to educational benefits or other allowable deductions.

Common situations that qualify for tax benefits include education-related expenses, such as tuition, fees, and books. Additionally, certain unreimbursed job expenses can also be submitted. It's crucial to note that individuals who fail to meet state residency requirements or who have not incurred eligible expenses are explicitly excluded from claiming benefits on this form.

How to obtain Form IT-255

Acquiring Form IT-255 is a straightforward process, as it is readily available through several channels. Taxpayers can obtain the form by visiting the official New York State Department of Taxation and Finance website, where the form is available for download in PDF format. Additionally, local tax offices often provide printed copies of the form, ensuring broad accessibility.

For a seamless experience, pdfFiller users can directly download Form IT-255 from the site, which offers tools for editing and completing the document efficiently. This ensures that form accessibility is not just about obtaining a physical or digital copy but also utilizing the right tools to fill it out correctly.

Step-by-step guide to filling out Form IT-255

Filling out Form IT-255 requires careful preparation to ensure all necessary information is provided accurately. Before you start, gather essential documents such as your W-2 forms, receipts for qualified expenses, and any other relevant financial records that may support your claim. Having these documents at hand will streamline the process.

Each section of Form IT-255 serves a distinct purpose and must be completed with precision. Typically, the form consists of the following sections:

One common mistake to avoid when filling out Form IT-255 is misreporting income. Ensure that figures are exactly as documented in official statements to prevent discrepancies that could delay your refund or result in penalties.

Submitting Form IT-255

Once Form IT-255 is accurately completed, the next step is to submit it properly. Taxpayers can submit their claims either online through the New York State Department of Taxation and Finance, which offers an electronic filing option, or by mailing the completed form to the designated address indicated on the form itself. Each method has its own processing times and requirements, so be sure to follow the specific guidelines provided.

It's vital to keep track of important deadlines for submission to ensure eligibility for deductions. Typically, the deadline for filing Form IT-255 aligns with the general tax filing deadline, which is often April 15. However, if you are making amendments or filing extensions, awareness of adjusted deadlines is equally crucial.

Understanding benefits and incentives

Utilizing Form IT-255 can yield significant savings for taxpayers. Eligible individuals can potentially receive tax credits that directly lower their taxable income, which not only reduces the amount owed but can also increase refunds. The most common benefits associated with this form include credits for educational expenses and deductions for job-related costs.

By leveraging Form IT-255, taxpayers open themselves up to explore additional tax benefits such as the Earned Income Tax Credit (EITC) or Child Tax Credit (CTC). Each of these can offer substantial financial relief, particularly for qualifying families. It's beneficial for users to familiarize themselves with these opportunities, as combined tax credits can result in additional financial gains.

Document management tips

Once you have completed Form IT-255, it's essential to maintain proper document management practices to safeguard your financial records. Saving a digital copy of the completed form not only helps in keeping your records organized but also facilitates easier access for future reference. A good practice is to utilize pdfFiller's advanced features to digitize your documents securely.

In a collaborative environment, collaborating on Form IT-255 can enhance efficiency, especially for teams managing multiple claims. Utilizing pdfFiller features for collaboration enables team members to fill out, edit, or sign forms seamlessly, ensuring that every detail is captured correctly, reducing errors commonly associated with teamwork.

Support and resources

For questions and assistance regarding Form IT-255, a variety of support resources are available. Tax professionals can provide personalized advice tailored to a taxpayer's specific situation, ensuring accurate filing and optimal benefit claims. Furthermore, reaching out to the New York State Department of Taxation and Finance for official guidance can clarify uncertainties.

Additionally, pdfFiller offers interactive tools, such as calculators that help estimate potential claims based on inputted data. This added functionality equips users to anticipate outcomes effectively, alleviating anxiety surrounding the tax filing process.

Frequently asked questions

After submitting Form IT-255, taxpayers may wonder what happens next. Expect to receive a confirmation from the New York State Department of Taxation and Finance regarding the receipt of your claim. Processing times can vary based on the volume of submissions, typically ranging from a few weeks to several months. Being prepared and following up on the status of your submission can enhance transparency.

If a mistake is discovered after submission, it's important to know if Form IT-255 can be amended. Yes, taxpayers can submit an amended claim for corrections. This process requires filling out the correct forms to update any information originally provided, ensuring that the taxpayer maintains accuracy in their filing record.

Real-life scenarios

To illustrate the effectiveness of Form IT-255, consider real-life scenarios where taxpayers have successfully utilized the form for claiming benefits. For example, a recent graduate used Form IT-255 to claim educational expenses for their master’s degree, which resulted in a significant tax refund that helped pay off student loans. Such success stories highlight the importance of actively utilizing available tax incentives.

Moreover, testimonials from users emphasize their positive experiences. Many find the form straightforward when using pdfFiller, mentioning the ease of collaborating with family members or financial advisors to ensure accurate completion and submission.

People Also Ask about

How does the NYS solar tax credit work?

Can you write off solar panels on taxes?

Can you claim the solar tax credit more than once?

What is the NYS solar tax credit for 2023?

What is the solar property tax credit in NYC?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my NY IT-255 in Gmail?

Can I create an eSignature for the NY IT-255 in Gmail?

How can I fill out NY IT-255 on an iOS device?

What is form it-255 claim for?

Who is required to file form it-255 claim for?

How to fill out form it-255 claim for?

What is the purpose of form it-255 claim for?

What information must be reported on form it-255 claim for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.