NJ NJ-1040-HW 2025-2026 free printable template

Get, Create, Make and Sign NJ NJ-1040-HW

How to edit NJ NJ-1040-HW online

Uncompromising security for your PDF editing and eSignature needs

NJ NJ-1040-HW Form Versions

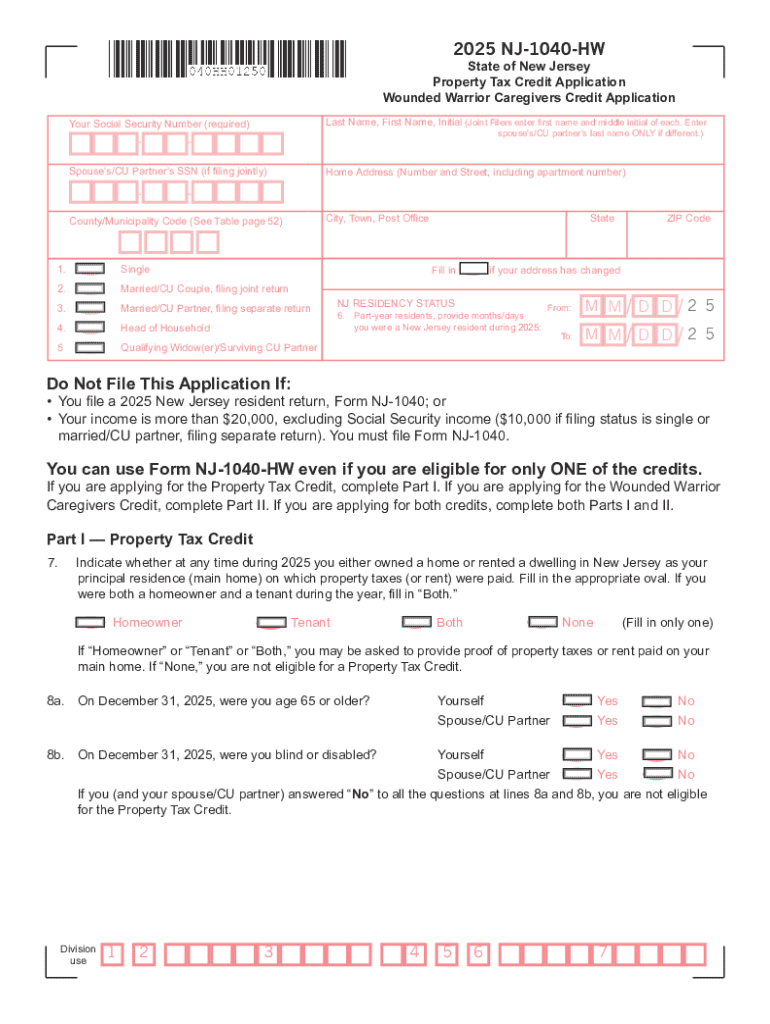

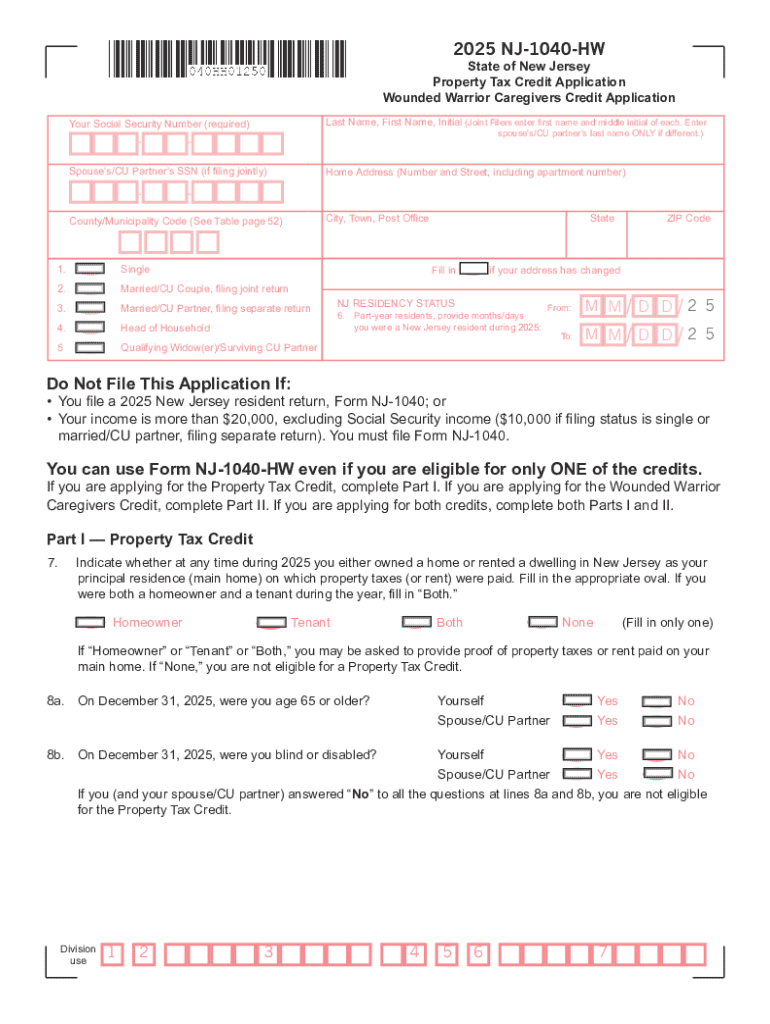

How to fill out NJ NJ-1040-HW

How to fill out 2025 nj-1040 resident income

Who needs 2025 nj-1040 resident income?

2025 NJ-1040 Resident Income Form: A Comprehensive How-to Guide

Overview of the NJ-1040 resident income form

The NJ-1040 form is the primary income tax return for residents of New Jersey. This form is used to report various types of income, claim exemptions, and determine the amount of tax owed to the state. Any individual who is considered a resident of New Jersey for the tax year needs to file this form. This includes those who have established a permanent home in New Jersey or who have lived in the state for 183 days or more.

Filing the NJ-1040 accurately is vital not only for legal compliance but also for ensuring that any potential refunds are processed efficiently. Residents who fail to file or file inaccurately may face penalties or delayed refunds, making it essential to understand the requirements thoroughly.

Key terminology and concepts

Understanding New Jersey's tax system requires familiarity with certain key terms and concepts that are unique to the state. 'Gross Income' refers to all income received in money, goods, or services that is not exempt from tax. 'Exemptions' reduce the amount of income that is taxable, while 'Deductions' are amounts that can be subtracted from income to arrive at the taxable amount. Understanding these terms will help residents make more informed decisions when completing their tax forms.

Another crucial distinction to note is between fiscal year and calendar year. New Jersey uses the calendar year for individual income taxes, meaning that income earned between January 1 and December 31 must be reported for that tax year. This impacts how you calculate and report your earnings.

Required information and documentation

Filing the NJ-1040 form requires several key pieces of information and documentation. First, personal information such as your name, Social Security Number, and residency status are essential. Joint filers must also include their spouse's information. Additionally, keeping records of all income sources is critical. This includes wages from employment, income from investments, and any other business income earned during the tax year.

Essential documents you will need include W-2 forms received from employers, 1099 forms for reported income from various sources, and proof of any other earnings. Organizing these documents beforehand can streamline the process of completing the NJ-1040.

Step-by-step instructions for completing the NJ-1040 form

Completing the NJ-1040 form can be straightforward if you follow a step-by-step approach.

Common challenges and how to overcome them

Filing your NJ-1040 can come with common challenges, particularly when navigating income from multiple states. If you earned income from outside New Jersey, ensure to accurately report that income and look into potential credits to avoid double taxation. Understanding specific requirements for various tax credits is also crucial; be aware of the documentation required to claim them successfully.

Another common issue arises from discrepancies between reported income and what the state has on file. Maintaining meticulous records and keeping documentation on hand can prevent issues during potential audits.

Tools for efficient form management

Utilizing technology can streamline the process of managing your NJ-1040 form. pdfFiller offers a suite of tools for editing, signing, and collaborating on your tax documents efficiently. Its online features allow you to upload your NJ-1040 form, fill it out digitally, and share it with professionals for review.

Interactive tools on pdfFiller provide real-time collaboration, so multiple parties can discuss and adjust entries on the document before submission. eSignature capabilities enhance convenience while ensuring your files are stored securely in the cloud, allowing easy access when you need it.

Important deadlines and filing options

Awareness of critical deadlines is essential for a smooth tax season. For the 2025 tax year, individuals will typically need to file their NJ-1040 forms by April 15, unless that date falls on a weekend or holiday, in which case the deadline adjusts accordingly. Filing options include online submission through platforms like pdfFiller for immediate processing or traditional paper submission.

Delays in filing can lead to penalties, which can accumulate quickly, making it vital to adhere to deadlines. If you believe you might miss the deadline, consider applying for an extension beforehand.

Additional support and resources

New Jersey offers various taxpayer assistance programs that individuals can utilize for clarifications on processes and deadlines. State resources include the New Jersey Division of Taxation, which has accessible contact information for direct inquiries. Additionally, many online forums and community groups provide peer support and guidance.

Utilizing these resources can simplify the filing process by providing insights and answering specific questions that may arise during the completion of your NJ-1040 form.

Quick links

To assist with your NJ-1040 filing, here are some quick links that provide direct access to necessary resources:

People Also Ask about

Who gets the NJ tax rebate?

How much do you get for NJ Homestead rebate?

How does the NJ Homestead rebate work?

Is 1040 the same as w2?

How to apply for homestead rebate in NJ?

What is the home owners rebate in NJ?

Who is required to file NJ-1040?

What is NJ-1040 tax form?

How do I get a NJ-1040 form?

Who qualifies for the NJ Homestead rebate?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit NJ NJ-1040-HW from Google Drive?

How do I edit NJ NJ-1040-HW online?

Can I create an eSignature for the NJ NJ-1040-HW in Gmail?

What is 2025 nj-1040 resident income?

Who is required to file 2025 nj-1040 resident income?

How to fill out 2025 nj-1040 resident income?

What is the purpose of 2025 nj-1040 resident income?

What information must be reported on 2025 nj-1040 resident income?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.