Get the free TC-889 Mineral Production Withholding Tax Exemption Certificate. Forms & Publica...

Get, Create, Make and Sign tc-889 mineral production withholding

How to edit tc-889 mineral production withholding online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tc-889 mineral production withholding

How to fill out tc-889 mineral production withholding

Who needs tc-889 mineral production withholding?

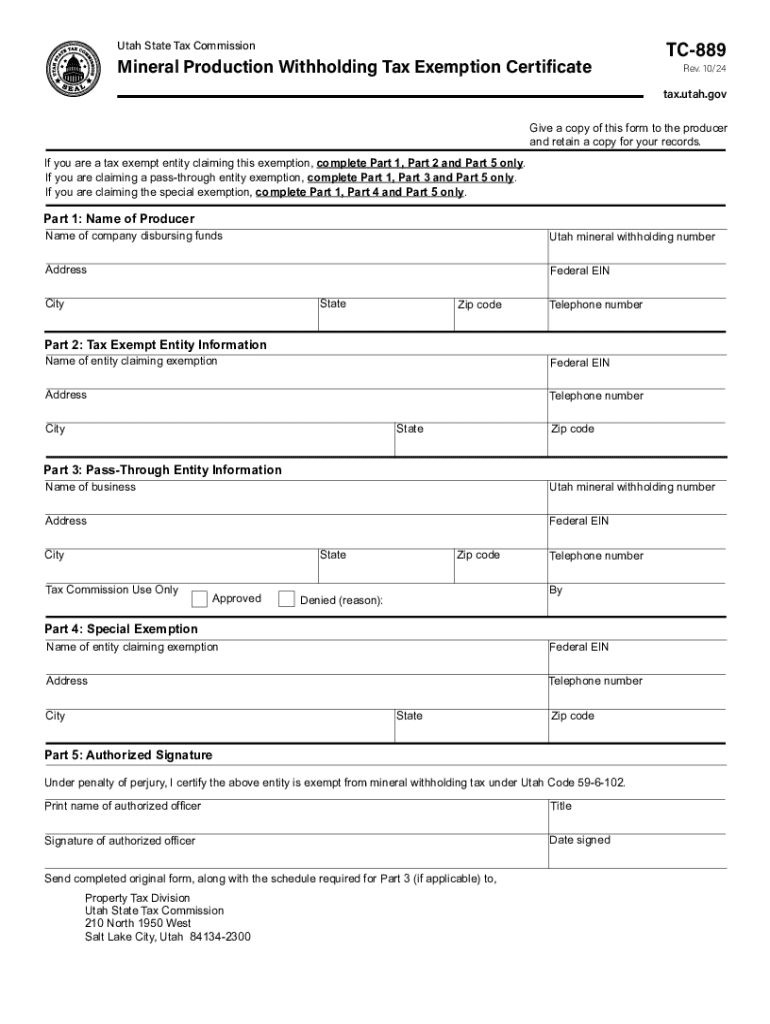

tc-889 Mineral Production Withholding Form: A Comprehensive Guide

Understanding the tc-889 mineral production withholding form

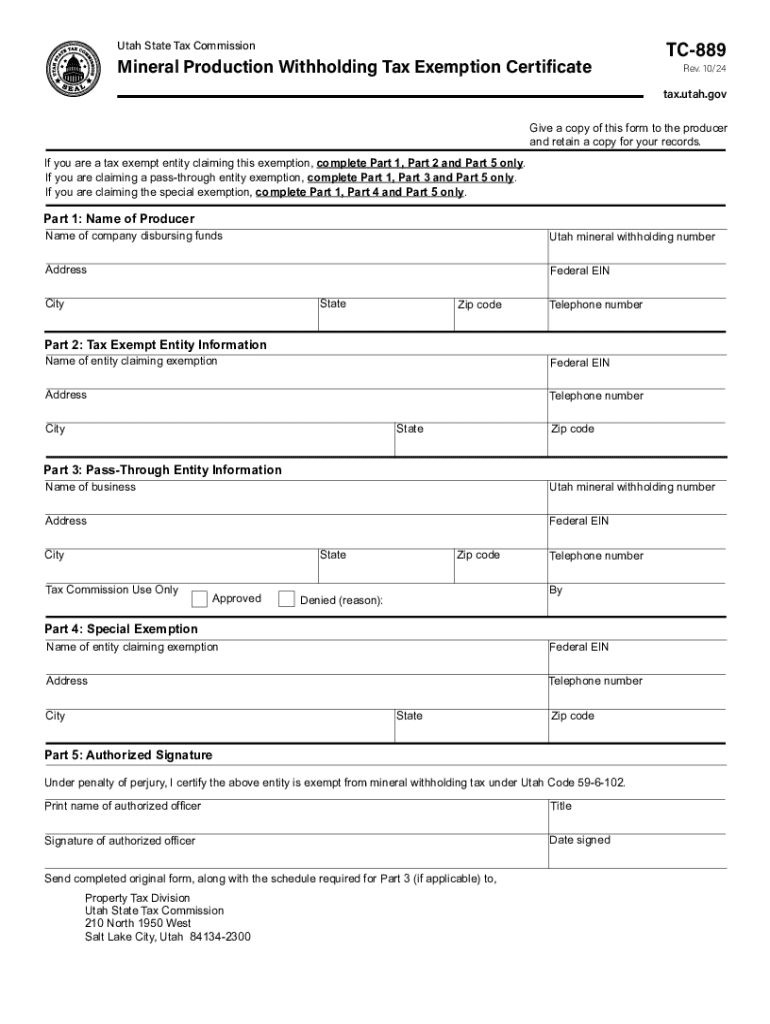

The tc-889 mineral production withholding form is a crucial document used by mineral producers for tax compliance in the United States. This form is specifically designed to report withholding tax related to mineral production. Its importance lies in the role it plays in ensuring the correct amount of tax is withheld from payments made to mineral producers, which helps in both accurate tax reporting and the avoidance of potential penalties for non-compliance.

Individuals and entities engaged in the production of minerals—including oil, gas, and other resources—are generally required to file the tc-889 form. This ensures that the appropriate withholding tax is remitted to tax authorities based on the income generated from their production activities.

Key components of the tc-889 form

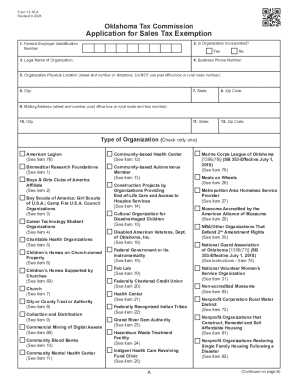

Filing the tc-889 includes several sections that must be accurately completed to comply with tax regulations. The form consists of four main sections: Identification of Taxpayer, Mineral Production Details, Withholding Information, and Certification and Signature.

Each section requires specific information, such as the taxpayer’s identification details, data regarding the mineral production (including amounts and types), and the withholding amounts calculated based on applicable rates. It is essential to pay close attention to these details to avoid common pitfalls that could lead to inaccurate filings.

Common mistakes to avoid include failing to provide complete taxpayer identification, incorrectly reporting production amounts, and miscalculating withholding tax, which could result in delayed processing or penalties.

Step-by-step instructions for completing the tc-889 form

Completing the tc-889 form can be straightforward if you follow these systematic steps. Start with gathering all necessary documentation, which includes tax identification numbers, records of mineral production, and relevant financial details that will inform your entries on the form.

Once you have all the necessary information, proceed to fill out Section 1, providing accurate taxpayer identification. Ensure your Social Security Number or Employer Identification Number is correct to avoid confusion with tax authorities.

In Section 2, carefully report your mineral production details. It’s vital to record the exact amounts produced and specify the minerals involved to ensure your withholding amounts in Section 3 are accurate.

Moving on to Section 3, calculate the correct withholding amount based on your production data and applicable rates. Finally, review all your entries for accuracy before signing in Section 4 to certify your submission.

Editing and managing your tc-889 form with pdfFiller

pdfFiller provides comprehensive tools for editing the tc-889 mineral production withholding form seamlessly. You can access the form directly from your browser and utilize interactive tools to make modifications without needing to print anything out.

Once you've completed your tc-889 form, you can save or download it in multiple formats. Whether you opt for electronic filing or prefer to print it for submission, pdfFiller streamlines the process, saving you valuable time.

eSigning and collaborating on the tc-889 form

One of the standout features of pdfFiller is its eSignature capability, which allows users to sign the tc-889 form electronically. This method enhances efficiency and ensures that your document is signed securely and promptly. Not only does this save time, but it also keeps your workflow digital and organized.

To add your signature, simply follow the prompts on pdfFiller to draw, type, or upload a signature. Additionally, you can invite team members to collaborate on the form in real-time, supporting effective teamwork without the need for physical meetings or back-and-forth emailing.

Frequently asked questions (FAQs) about the tc-889 form

As with any tax-related document, questions often arise regarding the tc-889 mineral production withholding form. Common inquiries include what to do in case of mistakes after submission. It is important to review your filing diligently and, if errors are found, filing an amendment can rectify the issue.

Key deadlines for submitting the form must also be adhered to, which varies based on your specific state tax regulations. Missing the deadline could incur penalties, so it’s wise to familiarize yourself with these critical timelines.

Interactive tools to guide you through the tc-889 process

To aid your filing process, pdfFiller offers several interactive tools, including a completion checklist that ensures you don’t miss any essential steps while filling out the tc-889 form.

These tools collectively simplify the process, making it more manageable and less daunting for users.

Case studies: real-world application of the tc-889 form

Understanding the practical application of the tc-889 form can illuminate its significance. Successful filers often highlight the importance of accurate reporting in avoiding fines, as well as ensuring that deductions and credits available to them are properly claimed, which can significantly affect their bottom line.

Lessons learned from filing errors often revolve around the need for precise record-keeping and understanding tax laws relating to mineral production withholding. Those who revisit and refine their filing practices frequently express greater confidence in managing their tax obligations.

Related document templates on pdfFiller

pdfFiller offers a range of document templates beyond the tc-889 form. Users can access other relevant tax forms that might complement their needs, streamlining operations across various document types.

Whether you are looking for related tax forms or entirely different document types, pdfFiller provides a user-friendly platform to manage them all. This can save time while ensuring compliance across the board.

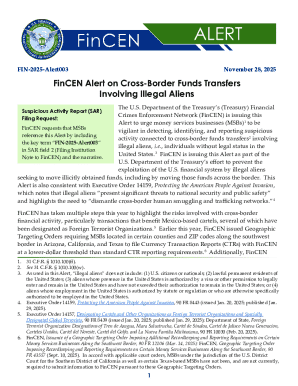

Keeping up with changes in mineral production tax regulations

Tax regulations regarding mineral production and withholding can frequently change. Staying informed about these changes is vital for compliance and optimizing tax liability. Users should utilize resources and tools offered by pdfFiller to keep abreast of updates that could influence the tc-889 form.

By regularly reviewing updated guidelines and regulations, tax professionals and mineral producers can adapt their strategies accordingly, minimizing risks associated with non-compliance.

User experiences: reviews and feedback on pdfFiller

Users of the tc-889 mineral production withholding form via pdfFiller have expressed high satisfaction levels, particularly regarding the ease of filling out and submitting their forms electronically. Testimonials emphasize how the platform enhances their efficiency and reduces complications typically associated with tax paperwork.

Overall, the comprehensive features of pdfFiller make it a valuable resource, not just for tax forms but for all document management needs, emphasizing the empowerment users gain over their paperwork.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit tc-889 mineral production withholding from Google Drive?

Where do I find tc-889 mineral production withholding?

How do I edit tc-889 mineral production withholding in Chrome?

What is tc-889 mineral production withholding?

Who is required to file tc-889 mineral production withholding?

How to fill out tc-889 mineral production withholding?

What is the purpose of tc-889 mineral production withholding?

What information must be reported on tc-889 mineral production withholding?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.