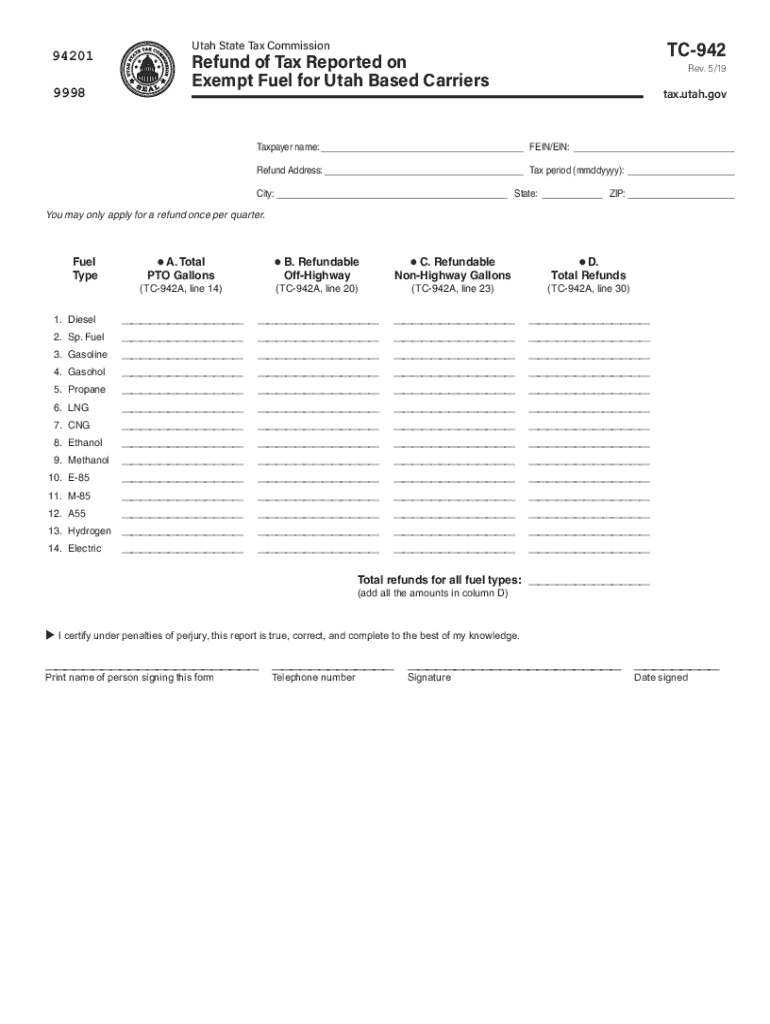

Get the free tc-972 Refund of Tax Reported on Exempt Fuel for Utah Based ...

Get, Create, Make and Sign tc-972 refund of tax

Editing tc-972 refund of tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tc-972 refund of tax

How to fill out tc-972 refund of tax

Who needs tc-972 refund of tax?

Guide to the TC-972 Refund of Tax Form

Understanding the TC-972 refund of tax form

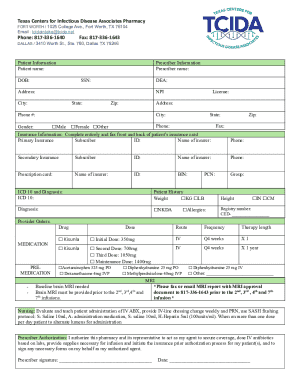

The TC-972 refund of tax form is a specific document required when individuals or entities file for a tax refund. This form is essential for claiming a refund on taxes previously overpaid. Typically issued by state tax authorities, the TC-972 form serves as a formal request for the return of funds that were erroneously collected or over-assessed.

The primary purpose of the TC-972 form is to streamline the refund process. It ensures that taxpayers can easily communicate their refund requests without excessive confusion or delays. Individuals, businesses, and non-profit organizations who believe they have overpaid on their taxes need to utilize this form to facilitate an efficient resolution.

When to file the TC-972 form

Filing the TC-972 form is crucial for individuals who qualify under specific eligibility criteria. Key eligibility factors include having paid more tax than required within a particular tax period or having filed an amended return that reflects reduced tax responsibility. Understanding these conditions helps in preventing unnecessary complications.

Key deadlines typically revolve around the tax year in question. Most taxpayers must file the TC-972 within a certain period from the original due date of the tax return. Alternatively, it can also be a few years after the payment was made for specific refund claims depending on local regulations.

Preparing to complete the TC-972 form

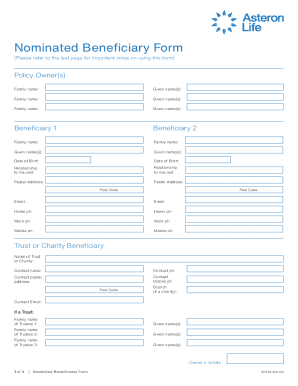

Before filling out the TC-972 form, it is essential to gather all necessary documentation to support your claim. Key supporting documents often include proof of payment, previous tax returns, and any correspondence from tax authorities regarding your inquiry.

Tax identification information, such as your Social Security number or Employer Identification Number (EIN), must be readily accessible. Effective organization of these documents will facilitate a smoother filing process and help avoid unnecessary delays.

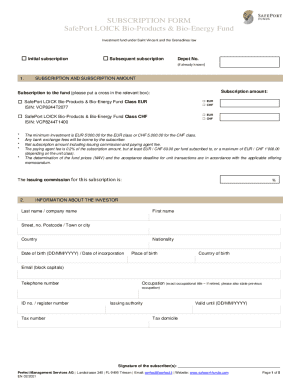

When choosing how to submit the TC-972 form, you can opt for digital submission or traditional paper filing. Digital submission offers many benefits, including speedy processing and ease of tracking your submission, especially when using platforms like pdfFiller.

Step-by-step guide to filling out the TC-972 form

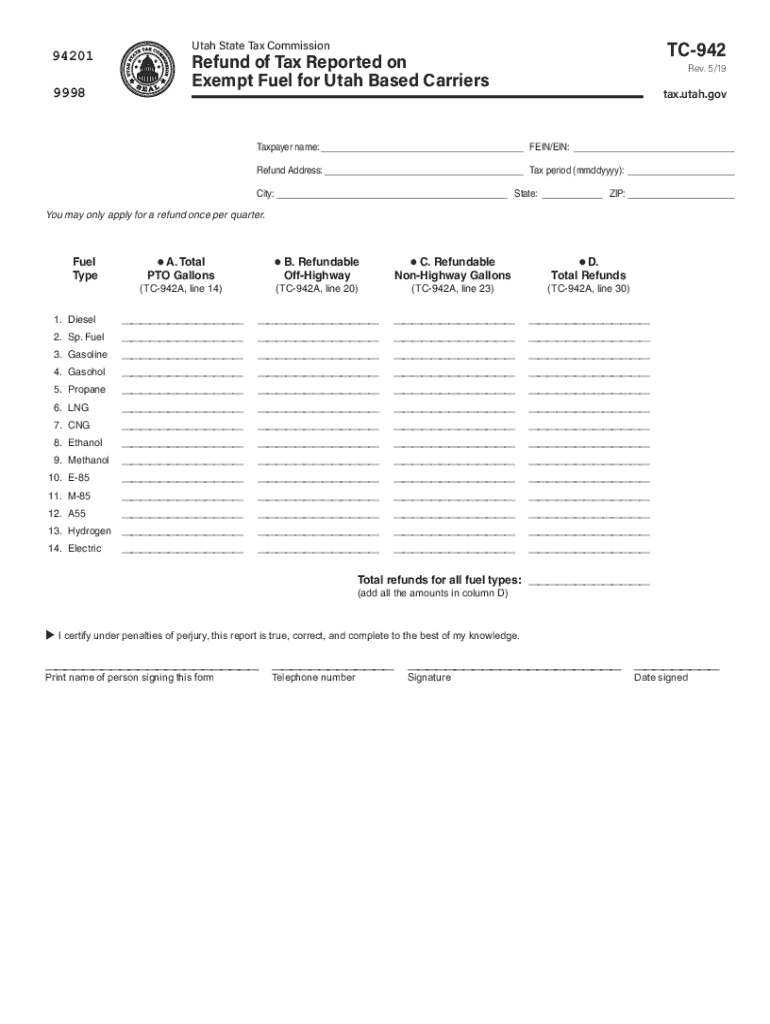

A thorough understanding of the TC-972 form is essential to ensure accuracy. The form is generally broken down into several sections, detailing taxpayer information, refund amounts, and the reasons for the refund request. Starting with the personal information section, ensure all entries align with your valid identification documents.

Common mistakes include incorrect identification numbers and omitting details about your refund request. These errors can lead to processing delays or rejection of your claim.

Using tools available on pdfFiller, such as editing features and templates, can significantly reduce common errors and streamline the overall filing process.

Editing and managing your TC-972 form

One of the standout features of using pdfFiller is its extensive editing capabilities. After completing your TC-972 form, you may find discrepancies that need addressing. With pdfFiller, you can easily make corrections, enhancing your form's overall quality without the need to start from scratch.

Additionally, pdfFiller allows for formatting options and customization of your form layout, ensuring it meets your preferences before submission. You can save different versions, reducing the risk of data loss and facilitating easy access to your documents from any device. This flexibility is crucial during tax season.

eSigning your TC-972 form

eSigning the TC-972 form is a crucial step that lends legal recognition to your submission. An electronic signature is not only efficient but also valid under the law, making it a preferred choice for many. When using pdfFiller, eSigning is simplified with step-by-step instructions guiding users through the process.

Moreover, pdfFiller enables collaboration with other signatories, making it easier to complete the signing process swiftly. Including multiple parties while minimizing delays can be beneficial, especially when dealing with various stakeholders on tax-related documents.

Submitting your TC-972 form

After completing and signing the TC-972 form, the next step is submission. You have the option of submitting your form online through your tax authority’s website or mailing a physical copy, depending on your preferences or requirements. Each method has distinct advantages, with online submissions typically being faster and more trackable.

To ensure that your submission is received, many tax authorities provide confirmation processes. Maintaining a connection to track your submission status enhances your peace of mind, ensuring you know where your claim stands.

After submission: What to expect

After submitting your TC-972 form, the processing timeline will depend on various factors, including your tax authority's backlog. Generally, you can expect a timeline ranging from a few weeks to several months, depending on the specifics of your request. Patience is critical, and it's essential to be prepared for potential follow-up requests for additional information.

It's crucial to stay vigilant during this period. If your tax authority reaches out, respond promptly with the requested information to assist in the seamless processing of your refund claim. Familiarize yourself with common issues, such as discrepancies in transaction descriptions, to effectively resolve complications quickly.

Frequently asked questions about the TC-972 form

Despite its straightforward nature, the TC-972 refund of tax form can lead to confusion due to its specific requirements. Many individuals may question their eligibility or the necessary documentation. Addressing these common misconceptions is essential to improving user experience and encouraging a smoother filing process.

For any additional queries, tax help software can immensely aid in understanding tax laws and ensuring compliance. Those seeking clarity on their submission process or documentation requirements should utilize available resources for complete guidance.

Streamlining your future tax form submissions

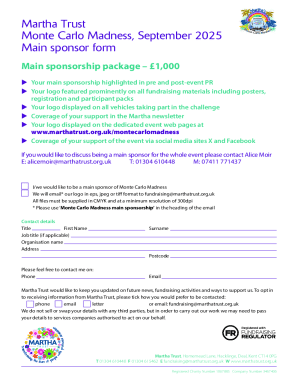

Utilizing pdfFiller for tax forms revolutionizes the submission process. The platform offers unparalleled document management solutions, which cater to individual and team needs alike. With comprehensive features designed to streamline your filing process, pdfFiller greatly reduces the burden often associated with tax season.

To maintain an organized approach during tax season, it is advisable to compile all relevant documents well ahead of deadlines. Features such as auto-save and access from any device will ensure you are well-prepared for any future tax obligations, making tax filing stress-free and efficient.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute tc-972 refund of tax online?

How do I edit tc-972 refund of tax on an iOS device?

How do I fill out tc-972 refund of tax on an Android device?

What is tc-972 refund of tax?

Who is required to file tc-972 refund of tax?

How to fill out tc-972 refund of tax?

What is the purpose of tc-972 refund of tax?

What information must be reported on tc-972 refund of tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.