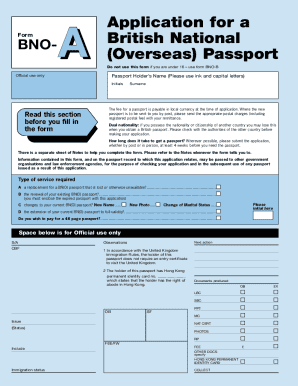

Get the free 4. Step 2 - Marijuana Establishment License Application Instructions

Get, Create, Make and Sign 4 step 2

How to edit 4 step 2 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 4 step 2

How to fill out 4 step 2

Who needs 4 step 2?

4 Step 2 Form: A Comprehensive Guide to Efficient Document Management

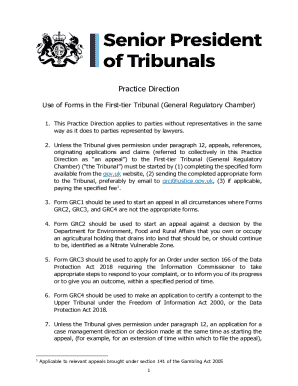

Understanding the 4 Step 2 Form

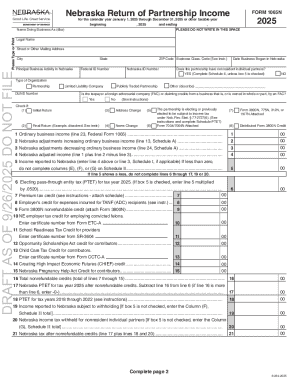

The 4 Step 2 Form serves as an essential tool for documenting various essential processes in both corporate and individual settings. This form is designed to streamline documentation for tax purposes, especially concerning employer obligations, partner compensation, and withholding. It allows for clear record-keeping that can drive efficiency and compliance.

Common use cases include income tax calculations, employee withholding verification, and inter-partner agreements related to compensation. This versatility makes it a favorite among financial professionals, accountants, and teams managing payroll operations. By using this form, individuals ensure that they meet all fiscal responsibilities while maintaining accurate records.

Who needs to use the 4 Step 2 Form?

The target audience for the 4 Step 2 Form encompasses a diverse set of individuals and organizations. Primarily, professionals involved in payroll, human resources, and financial planning are at the forefront. Additionally, self-employed individuals and small business owners can benefit significantly from understanding how to utilize this form.

Requirements for submission are straightforward but essential. Users must have accurate information regarding their financial and tax obligations, including details about employer withholding and any variations in partner compensation. Therefore, ensuring that the documentation is complete and accurate is vital for successful processing.

Benefits of using the 4 Step 2 Form

Leveraging the 4 Step 2 Form can greatly benefit document management workflows. One of the most significant advantages is the streamlined document management it offers. It simplifies the otherwise complex process of financial documentation by providing clear fields for entering relevant data.

Additionally, its accessibility features are noteworthy. With pdfFiller, users can fill out the 4 Step 2 Form from anywhere, fostering an environment of flexibility and convenience. This capability is crucial for teams working remotely or needing to access documents on the go.

Collaboration potential is a pivotal benefit as well. The form allows multiple users to input data, comment, and review collectively, significantly enhancing teamwork and reducing errors. This collaborative approach is vital, particularly in larger organizations where different departments are involved in the documentation process.

How to fill out the 4 Step 2 Form: A step-by-step guide

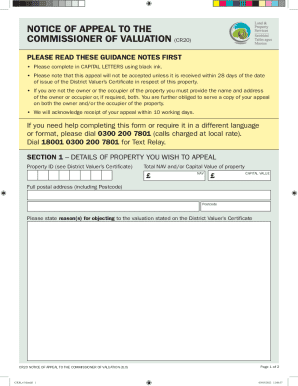

Filling out the 4 Step 2 Form involves a systematic approach to ensure accuracy and completeness. The first step is gathering necessary information. Users must collect personal identification information, financial statements, and any relevant documentation concerning their tax responsibilities. This initial step lays the groundwork for a seamless filling process.

Step 2 involves actually completing the form fields. Detailed instructions for each section should be followed carefully to avoid common pitfalls. Entering precise information is crucial, as inaccuracies can lead to processing delays or errors in tax submissions.

The next step is to review the completed form thoroughly. Verification is crucial here; users should cross-check the entered data for common mistakes such as misentered figures or incorrect personal information. A comprehensive review can save time and resources during the submission process.

Finally, finalize and submit the form. Utilizing pdfFiller's eSign feature ensures secure submission, protecting vital data from unauthorized access. After submission, saving and storing the form for future reference is wise, particularly for ongoing or upcoming tax obligations.

Interactive tools for improving your experience

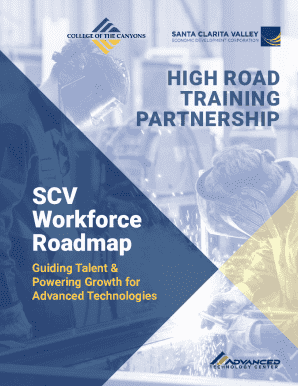

Harnessing the power of interactive tools can enhance the user experience when dealing with the 4 Step 2 Form. The pdfFiller editor provides robust functionalities essential for editing, signing, and annotating the form. Users can easily make adjustments and ensure their document meets all necessary guidelines.

Implementing the pdfFiller form library introduces users to a variety of templates, making it easier to find the right format for different scenarios. This functionality boosts efficiency, allowing individuals and teams to focus on completing their documentation tasks.

Utilizing the document tracking tools can also significantly enhance the user experience. Monitoring submission statuses and collaborator contributions allows teams to stay updated on the process and resolve any issues that may arise promptly. This kind of oversight contributes to the overall efficiency of document management.

Advanced strategies for managing your 4 Step 2 Form

For those looking to improve their handling of the 4 Step 2 Form, it’s critical to maintain compliance with current regulations. Staying updated with changes in tax laws and employer responsibilities is vital for businesses and individual stakeholders. Regularly reviewing tax guidelines can help avoid complications down the line.

Equally important are best practices for document security. Employing pdfFiller’s security features is essential for protecting sensitive information recorded within the form. Utilizing password protections and encryption can avert unauthorized access and maintain the confidentiality of personal and financial data.

Collaboration among teams is another key aspect. Establishing effective communication channels and utilizing collaborative tools available on pdfFiller can ensure everyone involved in the process is on the same page. Improving communication reduces confusion and fosters a more productive working environment as teams navigate the complexities of the 4 Step 2 Form.

Frequently asked questions (FAQs)

What happens if I make an error on the 4 Step 2 Form? It's crucial to correct any errors swiftly. If you've already submitted the form, contact the relevant authority to understand the correction processes available. Ensuring every detail is accurate can prevent fines or delays.

How often should I update my 4 Step 2 Form? Ideally, this form should be reviewed and updated annually, especially after any significant changes in employer obligations or partner arrangements. This regular check ensures that the document remains relevant and accurate.

Can I share my 4 Step 2 Form with others? Yes, the form can be shared among partners or team members for collaborative input. Secure sharing tools on pdfFiller can facilitate this process while maintaining the necessary data privacy.

What should I do if I have issues submitting the form? In cases of submission issues, double-check your internet connection and the form for completion accuracy. If problems persist, pdfFiller’s support resources can provide assistance.

Case studies: Successful usage of the 4 Step 2 Form

Real-life examples illustrate the practical value of the 4 Step 2 Form. Many teams have successfully improved their tax filing processes by incorporating systematic usage of this form. Companies report decreased processing times and enhanced accuracy in documentation, resulting in fewer audits and penalties.

Key takeaways from these case studies emphasize the importance of regular training and updates to form usage protocols. Consistent practice leads to higher accuracy rates and better overall compliance with tax-related obligations, benefiting both the organization and its employees.

Conclusion: The importance of mastering your 4 Step 2 Form

Mastering the 4 Step 2 Form significantly enhances document management efficiency. It not only simplifies complex tax-related processes but also ensures that individuals and organizations stay compliant with regulations. By fully utilizing features offered by pdfFiller, users can create a seamless experience that promotes collaboration and accuracy.

Encouragement to utilize pdfFiller for a seamless document experience is essential. Users can benefit from the multitude of interactive tools and resources available, ensuring that they are always equipped to handle their documentation needs efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 4 step 2 online?

Can I create an eSignature for the 4 step 2 in Gmail?

How do I complete 4 step 2 on an iOS device?

What is 4 step 2?

Who is required to file 4 step 2?

How to fill out 4 step 2?

What is the purpose of 4 step 2?

What information must be reported on 4 step 2?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.