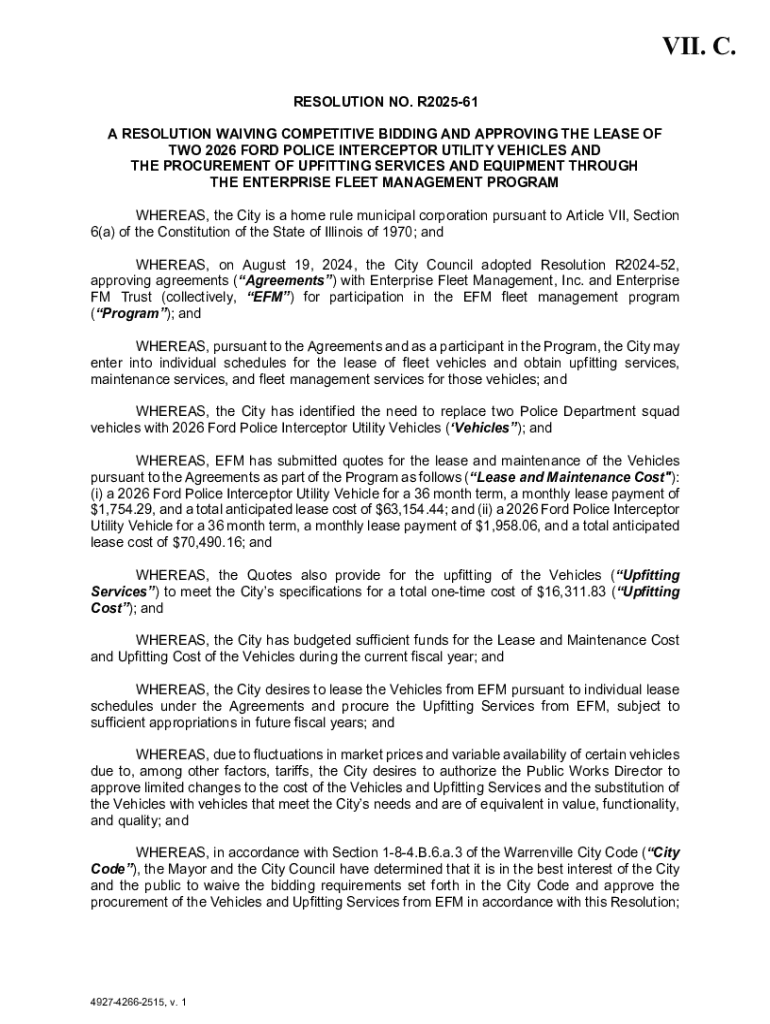

Get the free VII. C.

Get, Create, Make and Sign vii c

How to edit vii c online

Uncompromising security for your PDF editing and eSignature needs

How to fill out vii c

How to fill out vii c

Who needs vii c?

Form: How-to Guide for Managing Your Document Needs

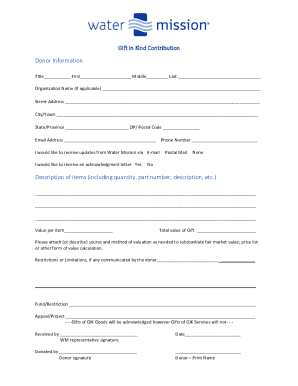

Understanding the Form

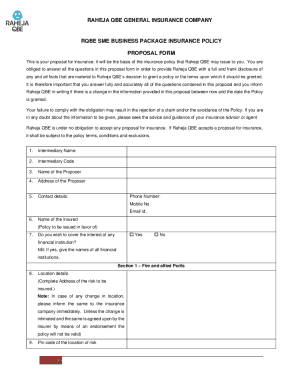

The VII C Form serves as a critical component in various administrative and financial transactions, often required in self-assessments for tax purposes. Primarily utilized in the United States, this form is crucial for individuals and entities reporting income, deductions, and other relevant financial data to ensure compliance with federal tax laws.

Not only does it provide a structured way to report information, but its accuracy can significantly impact the financial assessments made by the IRS. An incorrect form can lead to penalties or extended audits, making its correct usage even more crucial.

Who needs to use the Form?

Both individuals and organizations engaged in financial activities may find the VII C Form necessary. For instance, freelancers, business owners, and employees claiming specific expenses need to complete this form periodically. It's especially critical during tax season when all firms need to ensure accurate reporting of deductions to reduce liabilities.

Moreover, teams managing corporate finances should be well-versed in using this form to facilitate accurate bookkeeping and fulfill compliance requirements. Understanding when this form applies makes it easier to maintain organized financial records.

Getting started with the Form

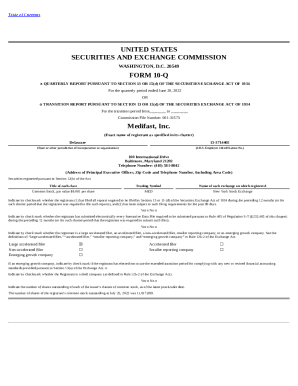

To begin using the VII C Form, first, you need to access a reliable source to obtain the document. pdfFiller is an excellent platform to find and download the VII C Form as it provides a user-friendly interface and multiple file format options, ensuring you get the version that best suits your needs.

Moreover, having the right format is crucial, especially if you plan to store it digitally. PdfFiller allows you to choose various formats, including PDF, DOC, and more, catering to different editing and saving preferences.

Setting up your account on pdfFiller

Creating an account on pdfFiller is the next step to streamline your document management processes. The registration process is straightforward: simply click on 'Sign Up,' enter your email address, and create a password.

By having an account, you gain access to powerful tools for managing your documents, including options for editing, storing, and sharing forms securely. This added layer of organization simplifies the record-keeping process and keeps your documents accessible from any device.

Filling out the Form

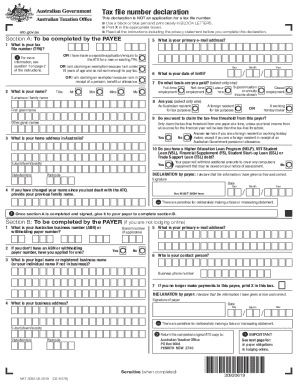

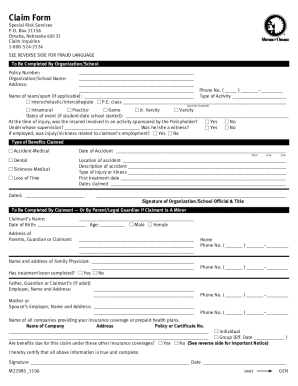

Completing the VII C Form requires careful attention to detail. The key sections of this form include personal information, income details, deductions, and verification. Each of these areas plays a vital role in the completeness and accuracy of your submission.

To avoid common pitfalls, make sure to double-check your information and refer to official guidelines when necessary. Many users often find discrepancies in reported incomes, which can lead to inquiries from tax authorities. Understanding how to fill in each section correctly will help mitigate these issues.

Step-by-step instructions for completing the form

When filling out the VII C Form, start by writing your name, address, and social security number in the designated sections. Next, provide details about your income sources—whether they are employment, investments, or freelance work. Ensure that you have documentation to back up the reported figures.

The deductions section is equally important. List all eligible deductions meticulously, as they can significantly reduce your taxable income. Finally, review the verification section, where you'll confirm that all information provided is correct. Remember to sign and date the form before submission.

Utilizing interactive tools on pdfFiller

PdfFiller enhances the document completion process through the use of smart fill tools, which allow users to automate repetitive tasks. By leveraging these tools, users can significantly reduce the time spent managing forms, giving them more time to focus on critical tasks.

Additionally, the auto-save feature ensures that your progress is not lost, making it an essential aspect of the document management experience. This feature allows you to work on the VII C Form at your convenience, without the fear of losing information.

Editing the Form

Once the VII C Form is filled out, editing may be necessary, and pdfFiller provides robust tools to modify text, alter fields, or update information easily. This flexibility allows for corrections to be made promptly, contributing to a clean and accurate final submission.

Real-time collaboration features stand out, enabling multiple users to work on the document concurrently. This function not only enhances efficiency but also fosters teamwork, especially when multiple stakeholders need to contribute data or approve changes.

Tips for effective document edits

Maintaining clarity and professionalism in your edits is vital. Be sure to keep your language clear and concise throughout the document. Using bullet points or lists can help present information in an organized manner, making it easier for anyone reviewing the form.

Additionally, it's wise to read through the entire form after making changes to ensure everything flows well. Common edits often include correcting income figures or ensuring deduction claims are comprehensive and backed by adequate documentation.

Signing the Form

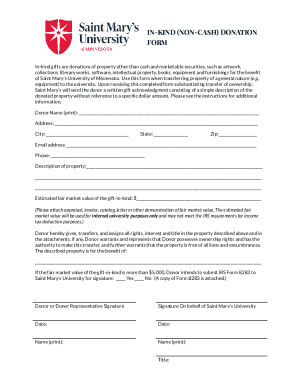

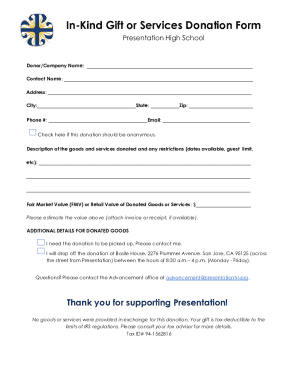

In an age where digital transactions are commonplace, e-signatures have emerged as a convenient and secure way to finalize documents like the VII C Form. These electronic signatures hold the same legal weight as handwritten signatures, ensuring compliance and acceptance across various platforms.

PdfFiller simplifies the signing process by offering users customizable signature options. Whether you're looking to type, draw, or upload a signature image, pdfFiller’s tools cater to your preferences.

Managing and storing the Form

After completing the VII C Form, consider how you will save and store it. PdfFiller offers various options for downloading your form, allowing you to choose an appropriate format based on your future needs. Storing your document in cloud storage enables access anywhere and anytime, which is increasingly critical in today's fast-paced environment.

The benefits of cloud storage extend beyond accessibility—it also enhances security. Utilizing a cloud-based platform ensures that your documents are stored safely while being easy to retrieve, share, or manage.

Sharing the Form with relevant parties

Sharing your VII C Form with necessary parties is crucial, especially in collaborative environments. PdfFiller allows users to share documents directly through email or generate a link that can be sent to collaborators without compromising the document's integrity.

Through pdfFiller, you can set permissions to control who can view or edit the form, ensuring that sensitive information is only accessible to authorized users. This control is essential for maintaining the confidentiality and security of your documents.

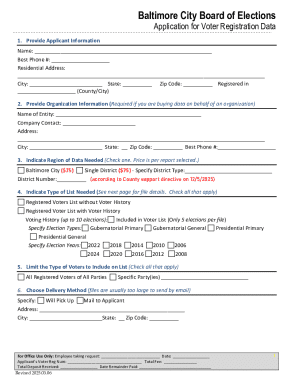

Frequently asked questions (FAQs)

Users often have significant questions about the VII C Form, especially regarding how to fill it out effectively or the deadlines for submission. Understanding the nuances of this form helps clarify its various applications and assists in meeting compliance requirements.

It's common to encounter unique scenarios that may not be immediately addressed in standard guidelines. Hence, staying informed is key to successfully navigating the complexities around financial documentation.

Example case studies

Real-life applications of the VII C Form demonstrate the importance of effective document management. For example, a freelance graphic designer reported benefits in accurately claiming expenses through this form, thereby reducing their tax burden significantly when completing their self-assessment for 2022.

Another case involved a small business ensuring compliance during an audit using the VII C Form—a proactive measure that paid off as it simplified the review process and reduced potential penalties.

Government resources and relevant publications

For detailed resources regarding the VII C Form, users can refer to official government guidelines. The IRS website provides up-to-date information about tax forms, deadlines, and specific instructions that may influence how you fill out your VII C Form.

Moreover, keeping informed about the recent changes to the VII C Form is essential, ensuring adherence to current regulations and practices which may affect reporting for the fiscal years 2019, 2020, and 2022.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my vii c directly from Gmail?

How can I send vii c to be eSigned by others?

Where do I find vii c?

What is vii c?

Who is required to file vii c?

How to fill out vii c?

What is the purpose of vii c?

What information must be reported on vii c?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.