Get the free Return of Organization Exempt From Income Tax 1545-0047

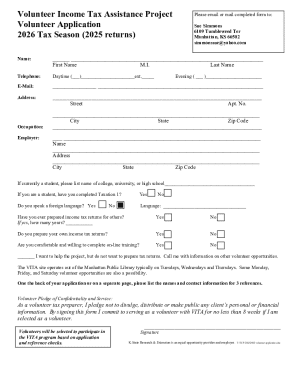

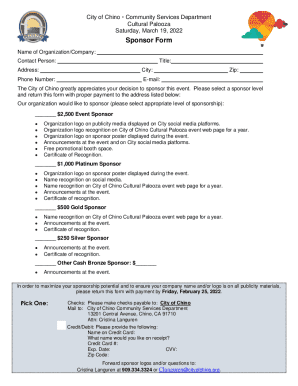

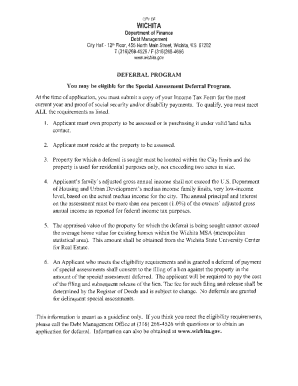

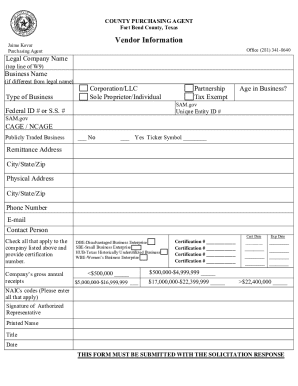

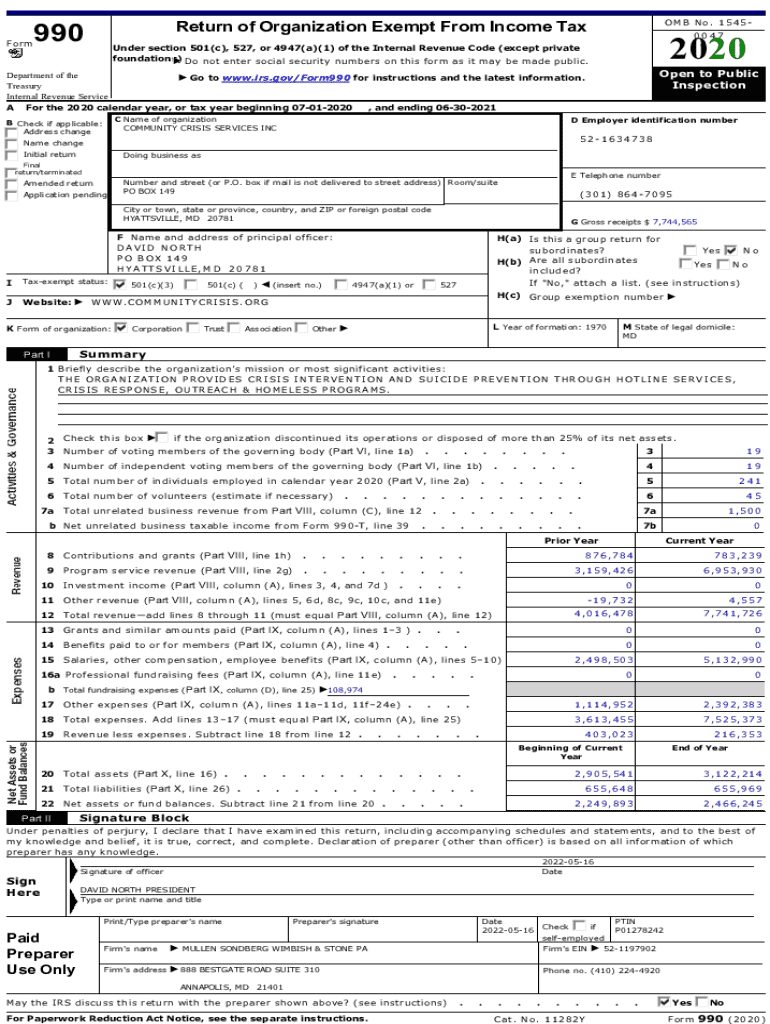

Get, Create, Make and Sign return of organization exempt

How to edit return of organization exempt online

Uncompromising security for your PDF editing and eSignature needs

How to fill out return of organization exempt

How to fill out return of organization exempt

Who needs return of organization exempt?

Return of Organization Exempt Form: How-to Guide Long-Read

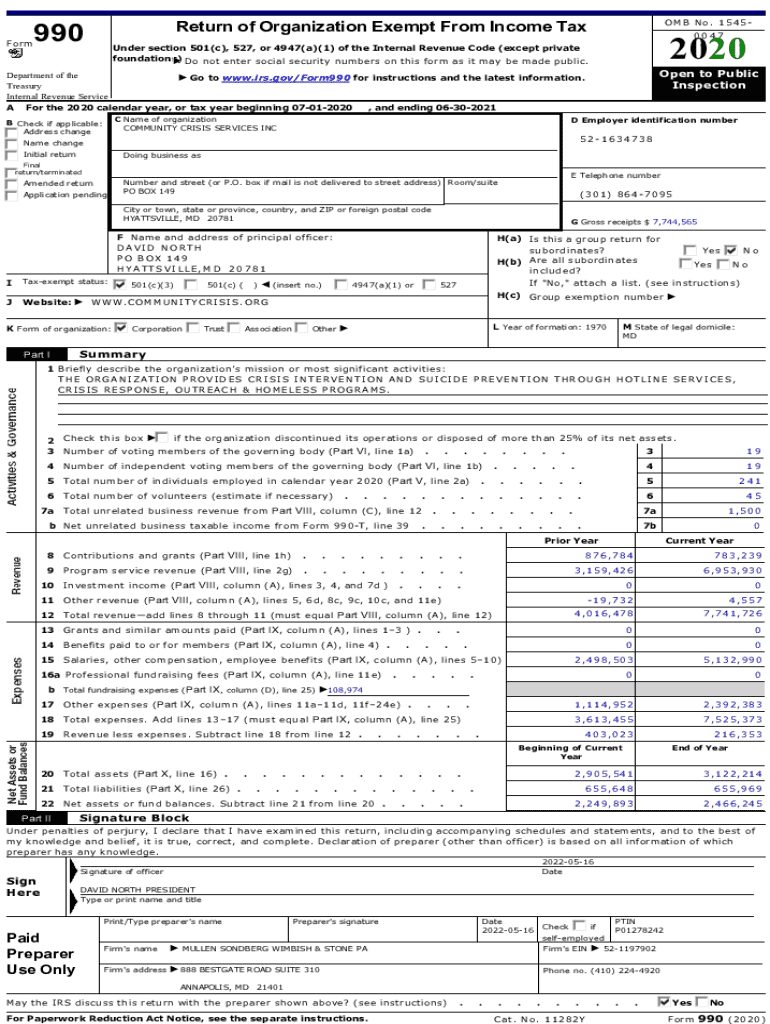

Understanding the Return of Organization Exempt Form

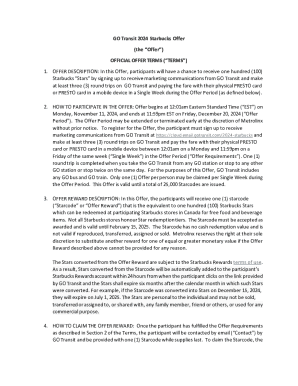

The Return of Organization Exempt Form, commonly known as Form 990, is a vital document that tax-exempt organizations must file annually with the Internal Revenue Service (IRS). This form serves several purposes, including providing transparency regarding an organization's financial activities and confirming its status as a charitable entity. By completing this form, tax-exempt organizations can maintain compliance with federal regulations, which is crucial for preserving their tax-exempt status.

Understanding the significance of the Return of Organization Exempt Form is crucial for both the organization and the public it serves. Proper submission not only showcases the organization’s financial health but also how effectively it uses donations to fulfill its mission. This information can influence public trust and encourage contributions, making the form indispensable.

Who needs to file this form?

Several types of organizations are required to file the Return of Organization Exempt Form. This includes nonprofit organizations such as charities, educational institutions, and religious organizations. Generally, organizations with 501(c)(3) tax-exempt status must submit this form. It is essential to determine your organization's eligibility criteria, which often include income thresholds and the nature of activities undertaken.

Key components of the form

The Return of Organization Exempt Form comprises various sections that require detailed information about the organization. The form includes sections on financial data, organizational structure, and mission-related activities. Each part must be completed accurately to reflect the organization’s financial status and operations.

In general, the structure includes the header section, which collects information such as the organization’s name, Employer Identification Number (EIN), and address, followed by numerous financial and narrative sections that elaborate on operational expenditures, sources of income, and detailed descriptions of activities undertaken by the organization.

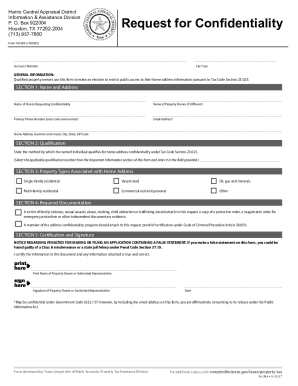

Required documentation

To support the completion of the Return of Organization Exempt Form, several documents must be gathered. These typically include financial records such as income statements and balance sheets, along with documentation of loans, grants, and other significant funding sources. A summary of any special projects or program activities undertaken during the year also plays a critical role in backing up the claims made in the form.

Step-by-step instructions for filling out the form

Step 1: Gather your information

Before beginning to complete the Return of Organization Exempt Form, it is essential to gather all necessary organizational information. This includes not only your organization's name and EIN but also the names and addresses of key officials, and details about your mission and major programs. Accuracy and completeness are critical, as any discrepancies can lead to filing issues.

Step 2: Complete the header section

The header section demands specific fields to be filled out accurately. This includes the organization’s legal name, the appropriate EIN, and the primary address. Make sure to double-check for typos or missing digits, as this information is used for official correspondence from the IRS.

Step 3: Fill in financial information

The financial section of the form is crucial for the IRS's understanding of your organization’s financial activities. Here, you’ll report various income and expenditures, which should align with your submitted financial statements. Provide detailed explanations for significant fluctuations or changes in income compared to previous years.

Step 4: Provide organizational purpose and activities

Articulate the mission and activities of your organization in a clear and concise manner. This section is an opportunity to illustrate how the funds are utilized to serve your beneficiaries. Use examples of successful programs or initiatives to demonstrate impact effectively and enhance transparency.

Step 5: Review and verify

After completing the form, conducting a thorough review is crucial. Check against a checklist to ensure every section is filled out correctly. It’s advisable to have a second party review the information, allowing an unbiased set of eyes to catch any potential mistakes or omissions.

Tools for effective form management

With the advancement in technology, several interactive tools are now available to assist organizations in efficiently managing their tax documents. pdfFiller, for example, offers users the capability to electronically fill out the Return of Organization Exempt Form with ease.

Using pdfFiller allows organizations to interact with their documents directly, edit, sign, and share them without hassle. The interface is user-friendly, providing options to customize the document according to specific needs while ensuring compliance with IRS regulations.

eSignatures and collaboration

Utilizing eSignature functionalities through pdfFiller promotes efficient collaboration. Team members can sign documents remotely, ensuring that critical deadlines are met. Moreover, this feature encourages seamless communication among stakeholders, regardless of their location.

Filing your form: Deadlines and submission format

It is crucial to adhere to specified filing deadlines to maintain compliance. For most organizations, the Return of Organization Exempt Form must be submitted by the 15th day of the 5th month after the end of the organization’s accounting period. For example, if your fiscal year ends on December 31, your form is due by May 15 of the following year.

Organizations also have the option of filing electronically or through mail. While electronic submission is often more efficient and provides instant confirmation, mailing can be beneficial for those who prefer physical documentation. Each method has its own pros and cons, and tax-exempt organizations should choose what best suits their needs.

Common pitfalls and challenges

Filing the Return of Organization Exempt Form can be fraught with challenges, particularly for first-time filers. Common mistakes include omitting essential details, inconsistent information with previous filings, or errors in financial reporting. Awareness of these pitfalls can significantly enhance the submission process.

If your form is rejected, don’t panic. Pay attention to any communication from the IRS, as they will identify the issues that led to rejection and provide guidance on corrective measures. It’s vital to respond promptly and ask any necessary questions to ensure compliance moving forward.

Frequently asked questions

Common queries arise regarding the Return of Organization Exempt Form, particularly concerning amendments and organizational changes. If there are significant changes within your organization, such as shifts in leadership or programming, it is essential to update the IRS promptly to maintain transparency.

If you need to amend a filed form, you can typically do so by submitting a corrected return. Be sure to highlight the corrections made and clarify the reasons for the amendments. Many organizations also seek assistance when filing due to complexities in compliance, so consider accessing available resources.

Maintaining your tax-exempt status

After submitting the Return of Organization Exempt Form, it's essential to stay informed about update expectations. Organizations can typically anticipate feedback from the IRS within a few months after filing, depending on the volume of submissions the agency is handling. Organizations should develop a timeline for ongoing compliance and documentation requirements.

Best practices for maintaining tax-exempt status include keeping updated financial records, ensuring timely submission of tax documents, and holding regular reviews of compliance status. Proper documentation plays an essential role, not just for current filings but for future operational planning.

Additional resources for organizations

To further aid nonprofits in completing the Return of Organization Exempt Form, several resources are available. The IRS provides comprehensive guidelines and resources on their official site, encouraging organizations to stay updated on changing rules and requirements consistently.

Apart from tax guidance, pdfFiller serves as an invaluable tool in your documentation management strategy, enhancing your organization’s workflow beyond mere tax filings. With functionalities that streamline document processes, organizations can maintain focus on their missions while ensuring compliance with tax regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my return of organization exempt directly from Gmail?

How do I edit return of organization exempt in Chrome?

How do I edit return of organization exempt on an iOS device?

What is return of organization exempt?

Who is required to file return of organization exempt?

How to fill out return of organization exempt?

What is the purpose of return of organization exempt?

What information must be reported on return of organization exempt?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.