AZ DoR Form 301 2025-2026 free printable template

Get, Create, Make and Sign AZ DoR Form 301

How to edit AZ DoR Form 301 online

Uncompromising security for your PDF editing and eSignature needs

AZ DoR Form 301 Form Versions

How to fill out AZ DoR Form 301

How to fill out arizona form 301

Who needs arizona form 301?

A Comprehensive Guide to Arizona Form 301 Form

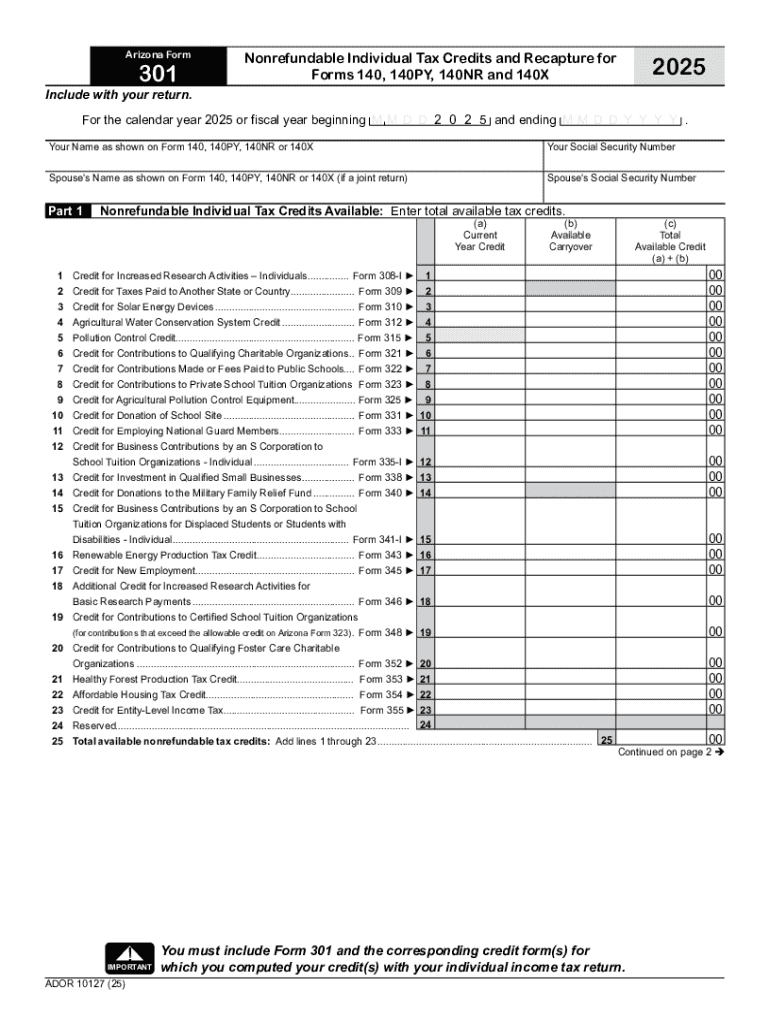

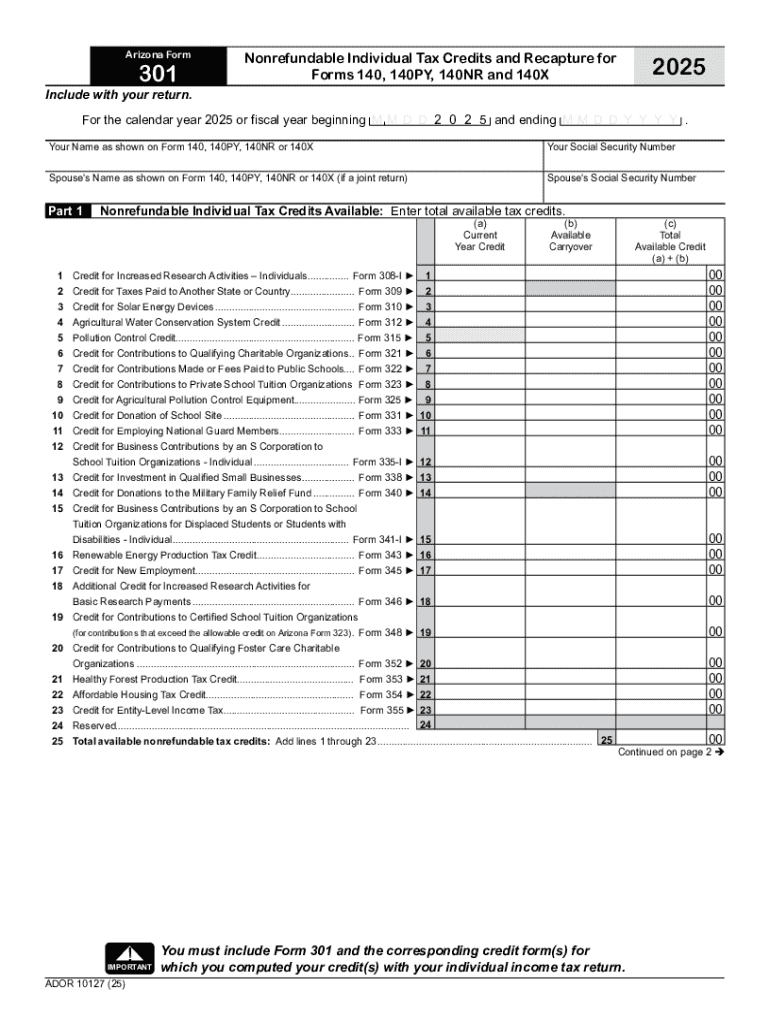

Overview of Arizona Form 301

Arizona Form 301 is a critical document for taxpayers claiming specific tax credits in the state of Arizona. This form is essential for individuals and businesses seeking to optimize their tax liabilities and take advantage of available incentives designed to stimulate economic growth within the state. Understanding the nuances of Form 301 can lead to significant financial benefits during tax season, ensuring that you receive maximum credits for which you are eligible.

Who needs to use Form 301?

Various individuals and business entities may need to utilize Arizona Form 301, particularly those aimed at claiming the credits associated with the state tax plan. Specifically, this includes:

Eligibility criteria vary, but common scenarios for using Form 301 include individuals applying for credits like the Arizona Credit for Increased Research Activities or businesses benefitting from the Job Creation Tax Credit.

Key features of Arizona Form 301

The primary purpose of Arizona Form 301 is to allow taxpayers to claim specific credits that can reduce their overall tax liability. By leveraging this form, taxpayers can simplify their tax filing processes while maximizing their returns through applicable credits sanctioned by the state. Understanding these features is crucial for effective financial planning.

Benefits of using Form 301

Using Arizona Form 301 offers several advantages, listed below:

Incorporating these credits can lead to substantial financial savings, making Form 301 an indispensable resource for eligible taxpayers.

Step-by-step instructions for completing Arizona Form 301

Completing Arizona Form 301 requires careful attention to detail. Here's a breakdown of the entire process for optimal submission.

Gathering necessary information

Before filling out the form, it's essential to gather all pertinent personal and financial information, including:

Gathering accurate information is crucial as errors can delay processing and affect your tax benefits.

Filling out the form

When filling out Arizona Form 301, it is divided into several sections that require specific information:

Common pitfalls to avoid include leaving sections incomplete and failing to provide supporting documentation. Taking your time to fill the form systematically can prevent these issues.

Reviewing your submission

After completing the form, it's crucial to review all sections to ensure completeness. Use the following checklist before submission:

Double-checking your information can save time and prevent complications. Ensure you have a final copy of the completed form for your records.

Editing and managing your Form 301 with pdfFiller

Using pdfFiller, you can efficiently manage Arizona Form 301. The platform offers intuitive editing tools that allow you to modify your PDFs easily without any hassle.

Using pdfFiller for efficient document editing

With pdfFiller, you can edit forms interactively, making it easy to insert your information accurately. The platform also provides real-time collaboration features, which allow teams to work together seamlessly.

eSigning your Form 301

Once the form is completed, signing is a breeze using pdfFiller's eSigning functionality. Here are the steps to securely electronically sign your form:

eSigning is advantageous over traditional methods as it ensures security, reduces time spent on physical paperwork, and allows for convenience from any device.

Submitting Arizona Form 301

Once you have completed and signed your Arizona Form 301, submitting it is the next crucial step. You have options for submission, including both electronic and paper filing.

How to submit your form

For those opting for electronic submission, ensure that you follow the guidelines set forth by the Arizona Department of Revenue. Alternatively, if you prefer the paper route, print your form and mail it to the appropriate address provided by the state. It is also important to be aware of any deadlines to avoid late penalties.

Tracking and managing your submission

After submitting your form, keeping track of its status becomes essential. You can verify your submission status through the Arizona Department of Revenue’s online portal, where you can also access FAQs and resources for further inquiries regarding your submission.

FAQs regarding Arizona Form 301

Navigating tax forms can be a complex endeavor, and questions often arise. Below are some common questions and their answers related to Arizona Form 301.

These FAQs can provide clarity and ease the confusion surrounding common issues faced by users when navigating Arizona Form 301.

Resources for further assistance

For additional support regarding Arizona Form 301, you can reach out to the Arizona Department of Revenue directly. Their official contact details offer taxpayers ways to seek direct assistance.

Contacting Arizona Department of Revenue

The Arizona Department of Revenue provides phone numbers and email contacts for inquiries related to tax code, credits, and more. Utilizing these resources can enhance your understanding and ease the filing process.

Utilizing online tools and platforms

pdfFiller is an excellent tool for comprehensive tax preparation. With its interactive features and easy access to multiple forms, it allows taxpayers to manage all their tax forms including the Arizona Form 301 efficiently.

Recent updates and changes to Arizona Form 301

As tax laws continually evolve, it’s crucial to stay informed about the latest changes related to Arizona Form 301 for tax year 2025. This includes potential updates to eligible tax credits, specific filing processes, and deadlines.

What’s new for tax year 2025

Some recent amendments may impact the available credits, so it's advisable to review the state's official announcements and updates to ensure compliance and eligibility. Understanding these nuances can significantly affect your overall tax strategy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my AZ DoR Form 301 in Gmail?

How can I get AZ DoR Form 301?

How do I edit AZ DoR Form 301 straight from my smartphone?

What is Arizona Form 301?

Who is required to file Arizona Form 301?

How to fill out Arizona Form 301?

What is the purpose of Arizona Form 301?

What information must be reported on Arizona Form 301?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.