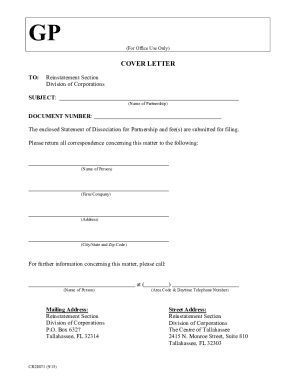

Get the free AUTHORIZATION FOR VOLUNTARY PAYROLL DEDUCTION FOR ... - eaglenet ozarks

Get, Create, Make and Sign authorization for voluntary payroll

How to edit authorization for voluntary payroll online

Uncompromising security for your PDF editing and eSignature needs

How to fill out authorization for voluntary payroll

How to fill out authorization for voluntary payroll

Who needs authorization for voluntary payroll?

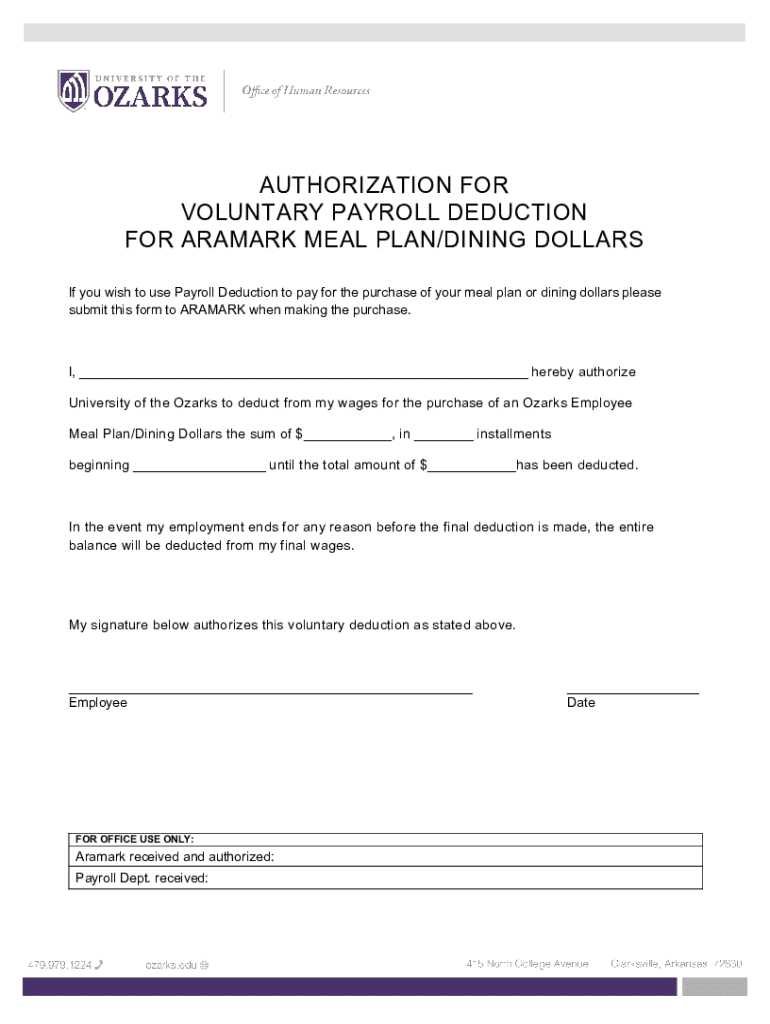

Understanding the Authorization for Voluntary Payroll Form

. Understanding the Authorization for Voluntary Payroll Form

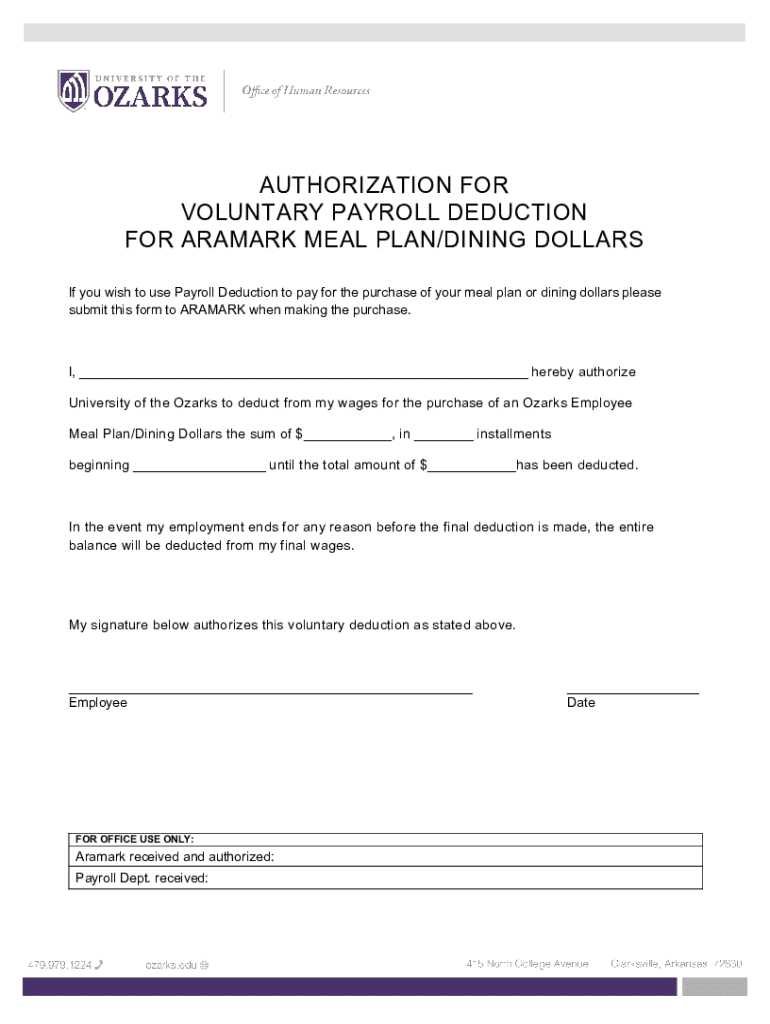

The Authorization for Voluntary Payroll Form plays a vital role in payroll processing. It allows employees to authorize specific deductions from their paychecks, which can include contributions to health benefits, retirement plans, or charitable donations. These deductions are voluntary, meaning that participation is not mandatory.

Without proper authorization, employers may face legal challenges or compliance issues related to payroll deductions. Therefore, securing employee consent through this form is critically important not only for smooth payroll operations but also for maintaining transparency and trust within the employer-employee relationship.

. Benefits of Using the Authorization for Voluntary Payroll Form

Utilizing the Authorization for Voluntary Payroll Form brings significant advantages to both employees and employers. For employees, the form simplifies the payroll process, allowing them to detail specific amounts they wish to be deducted from their paychecks. This grants employees greater control over their deductions, promoting financial literacy and responsibility.

Additionally, the form enhances transparency around financial transactions, making employees more informed about where their earnings are going. For employers, the payoff comes in streamlined payroll management. By having a standardized process for voluntary deductions, employers can ensure compliance with employment regulations and foster a positive work environment, ultimately leading to improved employee satisfaction and engagement.

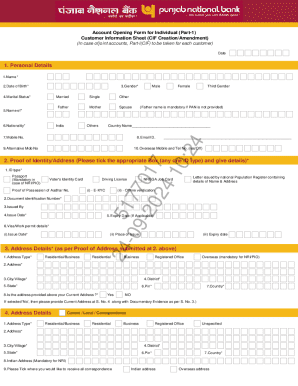

. Components of a Comprehensive Authorization for Voluntary Payroll Form

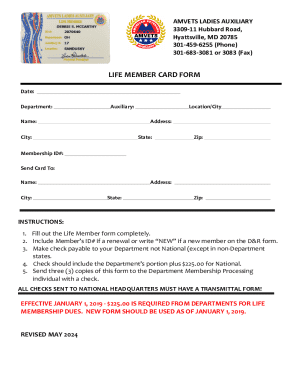

To properly function, an Authorization for Voluntary Payroll Form must include specific components. First, it should gather essential information such as employee details—which includes their name, employee ID, and department. Also crucial is the clarity on the specifics of the deductions, detailing the amount and frequency of deductions to avoid any misunderstandings.

The duration of the authorization should also be outlined clearly. Additionally, optional clauses may address the procedure for changing or revoking the authorization, providing flexibility to employees. Signatures and witnessing requirements will lend further legitimacy to the authorization form, safeguarding both the employee's and employer’s interests.

. Step-by-Step Instructions for Filling Out the Form

Filling out the Authorization for Voluntary Payroll Form effectively requires attention to detail. Start by gathering all necessary information for verification, which might include personal identification documents and relevant financial information. This will save time and ensure accuracy.

When completing the form, enter your personal details correctly and ensure the type and amount of payroll deduction are specified clearly. Before submission, review the form thoroughly for accuracy to avoid possible issues with payroll deductions.

Lastly, submit the form through the appropriate channels—whether digitally or via paper—and keep a copy for your personal records. This ensures that you have evidence of your authorization should any questions arise in the future concerning your deductions.

. Editing and Managing Your Voluntary Payroll Authorization

Life is dynamic, and so are your financial needs. There may come a time when you need to modify your authorization for voluntary payroll deductions. It's essential to know when and why changes may be necessary, whether due to changes in your financial situation or a shift in your charitable interests.

To initiate a change or modification request, contact your HR department and follow their outlined process. Typically, you will need to fill out a modification form stating the new details you wish to authorize.

If you decide to revoke your authorization altogether, understand any legal implications; this decision may affect your ongoing contributions to benefits or savings plans. Revoking should likewise be done formally, ensuring you follow the step-by-step guide provided by your employer.

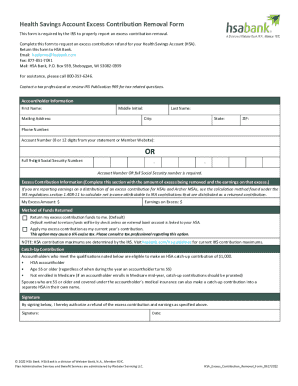

. Troubleshooting Common Issues

Even with a well-structured process, problems can arise regarding payroll deductions. Common issues include incorrect amounts being deducted or in some cases, missing deductions altogether. It's vital to act swiftly to resolve such discrepancies to ensure your financial plans remain intact.

The first step in resolving issues is to contact your HR or Payroll Department. Have your records at hand, such as pay stubs and the authorization form. Documenting the issues provides clarity and aids in addressing your concern effectively. Remember to follow up until you confirm that the deductions have been corrected accurately.

. Interactive Tools to Enhance the Experience

Employing tools like pdfFiller significantly enhances the experience of managing the Authorization for Voluntary Payroll Form. pdfFiller provides users with access to interactive templates, allowing for seamless document creation and editing. Such cloud-based solutions can be invaluable when dealing with sensitive payroll information.

Moreover, pdfFiller offers collaboration features that allow team members to work together to edit and finalize forms. With eSignature capabilities, users can expedite the approval processes, making document management as efficient as possible.

. Best Practices for Managing Payroll Authorizations

Maintaining an organized record of your voluntary payroll authorizations is crucial. Consider utilizing digital storage solutions for easy access to your forms. This ensures that you can quickly reference or modify your authorizations when needed, enhancing overall efficiency.

Additionally, establish a routine for reviewing and updating your authorizations regularly. Set reminders for annual reviews to ensure your preferences align with your current financial situation and to stay informed about any changes in payroll procedures that may impact your deductions.

. Common Questions About Voluntary Payroll Authorizations

Addressing common questions can help clarify the complexities surrounding the Authorization for Voluntary Payroll Form. For instance, employees often wonder if they can change their deduction amount anytime. While adjustments are usually permitted, they may be subject to the employer's specific policies.

Another frequent concern is about what happens if their employer changes payroll systems. Typically, as long as the new system accepts the same input for voluntary deductions, employees should not experience disruptions, but verification is always advisable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit authorization for voluntary payroll from Google Drive?

How can I get authorization for voluntary payroll?

How do I make edits in authorization for voluntary payroll without leaving Chrome?

What is authorization for voluntary payroll?

Who is required to file authorization for voluntary payroll?

How to fill out authorization for voluntary payroll?

What is the purpose of authorization for voluntary payroll?

What information must be reported on authorization for voluntary payroll?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.