Get the free 2025 Form IL-4562 Instructions - Illinois Department of Revenue

Get, Create, Make and Sign 2025 form il-4562 instructions

Editing 2025 form il-4562 instructions online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 form il-4562 instructions

How to fill out 2025 form il-4562 instructions

Who needs 2025 form il-4562 instructions?

2025 Form -4562 Instructions: Your Comprehensive Guide

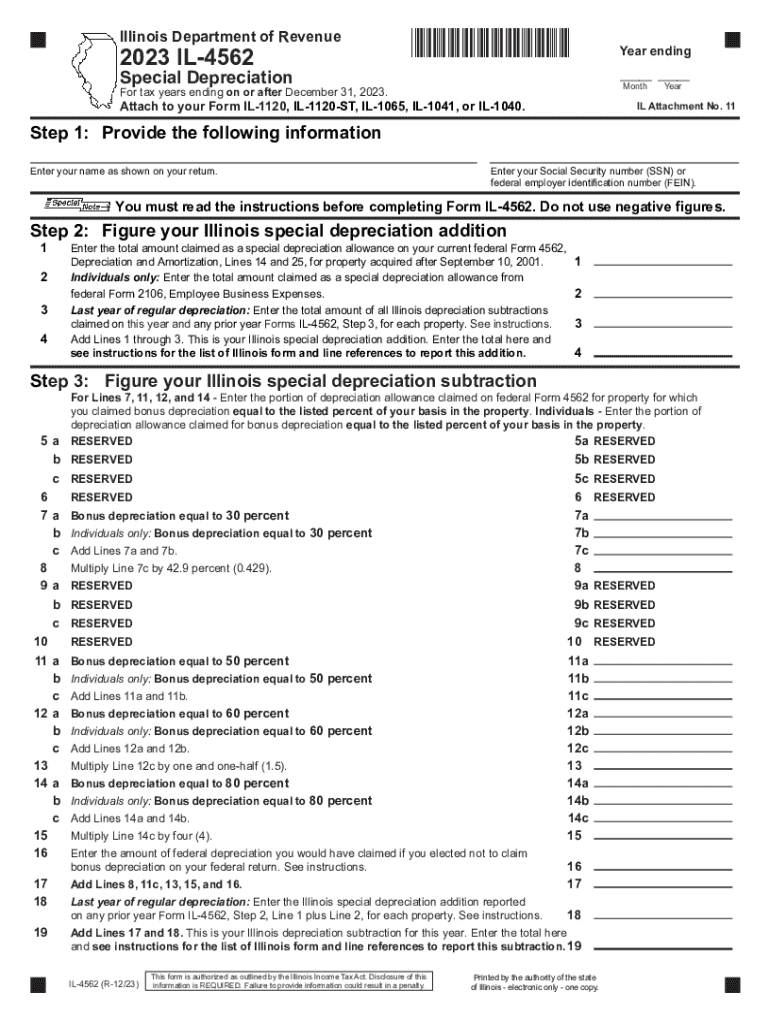

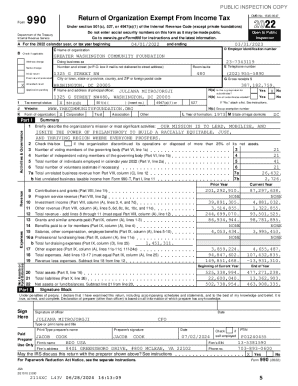

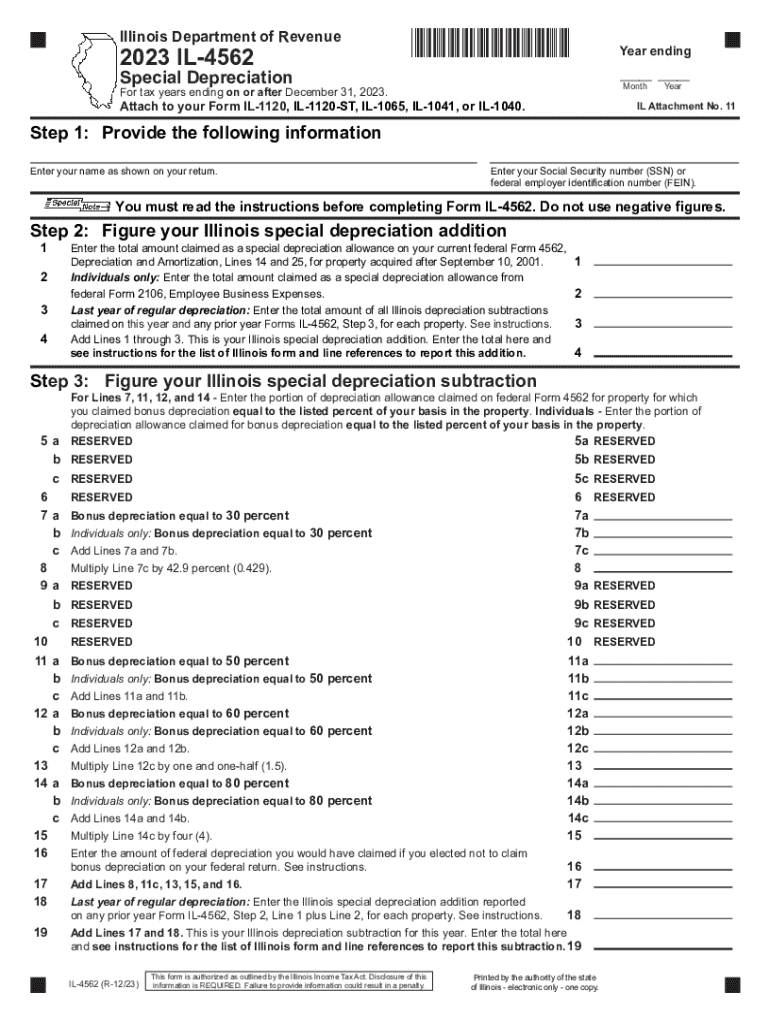

Understanding Form -4562

Form IL-4562 is a crucial document used in Illinois for reporting special depreciation additions. This form allows taxpayers to recognize additional depreciation expenses when they place qualified property into service. It is particularly relevant for individuals and businesses that seek to maximize their depreciation deductions, thereby reducing their taxable income. Understanding this form not only helps in effective tax planning but also ensures compliance with state regulations.

Applicable both to individual taxpayers and businesses, the IL-4562 comes into play when specific types of property, especially certain machinery and equipment, are purchased and utilized. The form is essential for claiming bonus depreciation, which can significantly impact taxpayers' state income tax returns.

Who should file Form -4562?

Any taxpayer in Illinois who has incurred eligible expenditures for property that can be depreciated is required to file Form IL-4562. This includes small business owners, corporations, and individuals who have purchased equipment, vehicles, or other assets that qualify for special depreciation under state law.

Common scenarios necessitating this form include when a business purchases new machinery or upgrades existing equipment. Moreover, real estate developers investing in new properties also utilize this form to secure their depreciation allowances. Meeting the criteria set by the state ensures taxpayers maximize their deductions effectively.

Key dates and deadlines

Filing deadlines for Form IL-4562 align with the Illinois income tax return deadlines. For the 2025 tax year, returns are typically due by April 15 of the following year. It's crucial to note that if you’re submitting your return electronically, some deadlines might slightly differ based on processing times.

Failure to file on time can lead to penalties that might amount to a percentage of the balance due. Timely submission not only helps avoid unnecessary fees but also ensures that taxpayers retain their eligibility for any credits or carryovers.

Preparing to file Form -4562

Proper preparation is essential for filling out Form IL-4562 accurately. Gather all necessary documentation, including purchase receipts, invoices, and records of any prior depreciation taken on the property you intend to claim. Having a clear record of these items ensures no eligible deductions are missed, which can greatly impact tax liability.

Understanding Illinois's specific tax regulations related to special depreciation is equally important. Illinois might have different laws governing depreciation from the federal guidelines, affecting how taxpayers compute their depreciation additions. Familiarizing yourself with these regulations can prevent misunderstandings that could lead to inaccuracies in your filing.

Step-by-step instructions for completing Form -4562

Filling out Form IL-4562 can be straightforward if approached methodically. Begin by completing the header section, which requires basic taxpayer identification information, including name, address, and Social Security or Employee Identification Number.

Next, move on to Part I, where you will need to identify your assets. Clearly list each asset eligible for depreciation, providing specific details such as the description, date placed in service, and cost basis. It's essential to only include assets that meet the state's qualifications to prevent any complications.

For Part II, calculate your Illinois Special Depreciation Addition by determining the eligible costs associated with each asset. This section often causes confusion, so be cautious. Be mindful of any limitations imposed by Illinois tax laws on what amounts can be treated as additions. Compile your results for clarity.

Part III of the form focuses on Special Depreciation Subtraction. Here, you'll compute any necessary reductions based on previous depreciation deductions, ensuring you adjust for any claims previously submitted. Conclude your filing process by thoroughly reviewing the entire form to confirm accuracy and remedy any calculation errors.

Common mistakes to avoid

As with any tax-related form, there are specific pitfalls to look out for when filing Form IL-4562, particularly due to the updates and changes implemented for the 2025 tax year. Understanding the ongoing differences from previous years is vital—missing out on the latest rules and adjustments can lead to significant mistakes. Make sure you're fully briefed on all updates before starting your application.

To avoid common mistakes, aim for a thorough review of the form before submission. Double-check the asset information and calculations to ensure that everything aligns. Taxpayers often overlook small discrepancies, leading to potential issues with audits or state income tax penalties.

Utilizing pdfFiller for Form -4562

Using pdfFiller to complete your Form IL-4562 streamlines the filing process tremendously. This cloud-based platform offers a range of features designed to assist in document management. It allows you to upload, edit, and fill out the form efficiently without wasting time sifting through paper documents.

With interactive tools and templates available on pdfFiller, taxpayers can navigate through Form IL-4562 intuitively. Incorporating eSigning features, pdfFiller also simplifies the finalization process, enabling users to sign their forms electronically and share them securely.

After filing your Form -4562

Once you have successfully filed Form IL-4562, it becomes essential to track the status of your submission. Tools are available that allow you to confirm receipt of your form and check for any issues that may arise post-filing. Staying on top of your submission helps avert any surprises down the road.

Additionally, understanding what to expect regarding potential audits is crucial. An audit can occur if discrepancies are found in your submission or if random checks are conducted by the Illinois Revenue Department. Preparing for possible inquiries by maintaining organized records related to your assets and could lend you an advantage.

Additional filing resources

For those seeking further information, the Illinois Department of Revenue offers numerous resources related to taxes, including guidelines and updates pertinent to Form IL-4562. Fostering a well-rounded understanding of these resources can aid taxpayers in navigating their obligations.

Moreover, consider reaching out to a tax professional if there are any uncertainties while completing the form. They offer expertise on the specifics of Illinois tax regulations, ensuring every detail of your return is in compliance and accurately filed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 2025 form il-4562 instructions from Google Drive?

Where do I find 2025 form il-4562 instructions?

How can I edit 2025 form il-4562 instructions on a smartphone?

What is 2025 form il-4562 instructions?

Who is required to file 2025 form il-4562 instructions?

How to fill out 2025 form il-4562 instructions?

What is the purpose of 2025 form il-4562 instructions?

What information must be reported on 2025 form il-4562 instructions?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.