Get the free Buy Auto Insurance Online with Instant Proof of Insurance

Get, Create, Make and Sign buy auto insurance online

Editing buy auto insurance online online

Uncompromising security for your PDF editing and eSignature needs

How to fill out buy auto insurance online

How to fill out buy auto insurance online

Who needs buy auto insurance online?

Buy auto insurance online form: A comprehensive guide

Understanding auto insurance

Auto insurance is a contract between the vehicle owner and an insurance company that protects against financial loss in the event of an accident or theft. It is essential not only for compliance with state laws but also for safeguarding your personal finances. There are several types of auto insurance coverage, including liability, collision, comprehensive, personal injury protection, and uninsured motorist coverage.

Liability insurance covers damages to other people and their property when you are at fault, while collision insurance helps pay for repairs to your own vehicle after an accident. Comprehensive coverage protects against non-collision incidents like theft or weather-related damage. Policy service options vary based on individual needs, making it critical for car owners to evaluate their situation carefully.

Why choose online auto insurance?

Buying auto insurance online provides unmatched convenience and accessibility. With just a few clicks, you can gather quotes, compare plans, and customize your coverage options tailored to your specific needs. Online platforms often allow for immediate policy purchases, ensuring you are insured as quickly as possible.

Additionally, online auto insurance enables comparison shopping, which can save you both time and money. You can analyze different quotes side-by-side, considering factors like premiums, coverage limits, and deductibles. This transparency in pricing encourages you to make informed choices that align with your budget.

Preparing to buy auto insurance online

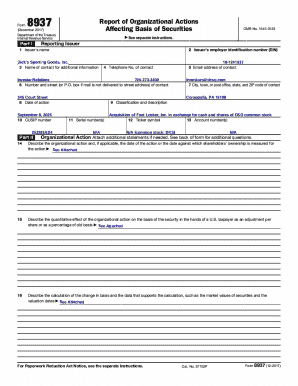

Before you start filling out the buy auto insurance online form, gather all necessary information related to your vehicle and personal details. This includes your vehicle’s make, model, and year, as well as information about your driving history, including any accidents or tickets. Providing accurate information is crucial for receiving the most accurate quotes.

Assessing your auto insurance needs is equally important. Consider your driving habits, the amount of time you spend on the road, and your typical mileage. Evaluate your budget constraints in relation to policy premiums and understand state requirements that could affect your coverage options.

How to find the best online auto insurance form

Finding reliable insurance providers is crucial for ensuring you receive excellent service and coverage. Look for companies with strong financial stability, responsive customer service, and positive online reviews. Conducting thorough research helps prevent future headaches and ensures you partner with an insurer that meets your needs.

Obtaining quotes from various insurers is an essential step in the buying process. Understanding the components of these quotes, including premium costs, coverage limits, and deductibles, will give you a clearer picture of what you can expect in terms of service and financial commitment.

Filling out the online auto insurance form

Filling out the buy auto insurance online form is a straightforward process if you are prepared. Begin by navigating to the insurance provider’s website and locate the online form. Enter your personal information accurately, including your name, address, and date of birth.

Make sure to input key vehicle details, such as the vehicle identification number (VIN), make, model, and year. Customize your coverage options based on your assessment of needs. Common pitfalls to avoid include not correcting errors, skipping questions, or failing to disclose important information. This can lead to higher premiums or claim denials in the future.

Managing your auto insurance online

Once you've purchased your auto insurance, managing your policy online is easy and streamlined. Accessing your policy and important documents typically involves logging into your online account, where you can view coverage details, payment history, and documents related to your policy. This centralization of information allows for efficient management of your coverage and options.

Making changes to your policy as your life circumstances evolve is essential. You can easily update personal information, add or remove vehicles, and adjust coverage limits online. Being proactive about these changes can help you maintain adequate coverage and optimal premiums.

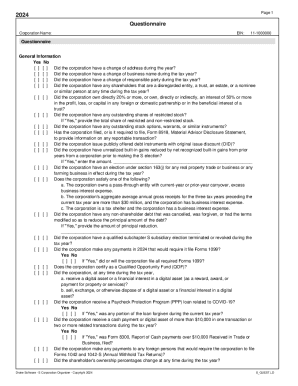

Utilizing features on the pdfFiller platform

pdfFiller offers extensive features that streamline the editing and submission of your auto insurance forms. When using pdfFiller, you can effortlessly make edits to PDF documents before submission, ensuring that every detail is precise. The eSignature capabilities enhance the process, allowing you to sign documents digitally, making the entire operation seamless without the need for printing.

Collaboration tools within pdfFiller also empower users to share their forms effortlessly. Family members can be included in discussions regarding insurance options, and advice from financial advisors or insurance agents can be sought conveniently during the editing process.

FAQs about buying auto insurance online

Many individuals have concerns regarding online auto insurance purchases. One common question is whether buying auto insurance online is safe. The good news is that reputable insurance companies invest in securing their websites and protecting customer information, making online purchases just as safe as traditional methods.

Time is another consideration. Typically, completing the purchase of auto insurance online can take as little as 30 minutes to an hour, depending on how prepared you are with your information. It is also important to note that you can change your policy even after purchasing; insurers usually provide options for policy adjustments as your needs evolve.

Next steps after purchasing auto insurance

Once you have successfully purchased your auto insurance, it’s vital to know the next steps, especially if you find yourself needing to file a claim. Initiating a claim can often be done through the insurer’s website, where you will find the necessary forms and information required to proceed. Ensure that you gather all relevant documentation—including photographs and repair estimates—to support your claim.

Policy renewals and understanding changes in coverage or rates are also critical components of your insurance journey. Insurance policies generally need to be reviewed annually; this allows for adjustments based on your changing needs and any potential discounts you may qualify for. Be proactive; gather all documents before renewal to avoid unexpected premium hikes.

Special considerations for auto insurance

When purchasing auto insurance, be mindful that coverage needs can vary significantly based on the type of vehicle. Specialty cars, such as classic, luxury, or electric vehicles, often come with unique coverage needs. Classic cars might require classic car insurance, while electric vehicles may be more costly to insure due to their technology. Being aware of these specifics can ultimately protect your investment.

Moreover, auto insurance for young drivers presents its own challenges. Newly licensed drivers often face higher premiums due to inexperience. Families should consider strategies such as enrolling young drivers in defensive driving courses or keeping them on the family policy to mitigate costs while maintaining adequate coverage.

Leveraging technology for your insurance needs

With advancements in technology, managing your auto insurance needs has never been easier. The pdfFiller platform features mobile capabilities that allow users to create, edit, and manage their insurance documents from anywhere, ensuring you are always equipped with the information you need. You can enjoy on-the-go access to your forms, making it easy to review and make changes when necessary.

Using mobile apps dedicated to insurance management not only saves time but also enhances your ability to stay organized. This is particularly useful when it comes to collecting information for claims or keeping track of policy documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit buy auto insurance online on an iOS device?

How can I fill out buy auto insurance online on an iOS device?

Can I edit buy auto insurance online on an Android device?

What is buy auto insurance online?

Who is required to file buy auto insurance online?

How to fill out buy auto insurance online?

What is the purpose of buy auto insurance online?

What information must be reported on buy auto insurance online?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.