Pak de gratis /BTW-nr

Ophalen, creëren, maken en ondertekenen pak de gratis btw-nr

Hoe pak de gratis btw-nr online bewerken

Ongecompromitteerde beveiliging voor uw PDF-bewerkingen en eSignature-behoeften

Invullen pak de gratis btw-nr

Hoe u btw-nr invult

Wie heeft btw-nr nodig?

Pak de gratis btw-nr form: Your Complete Guide

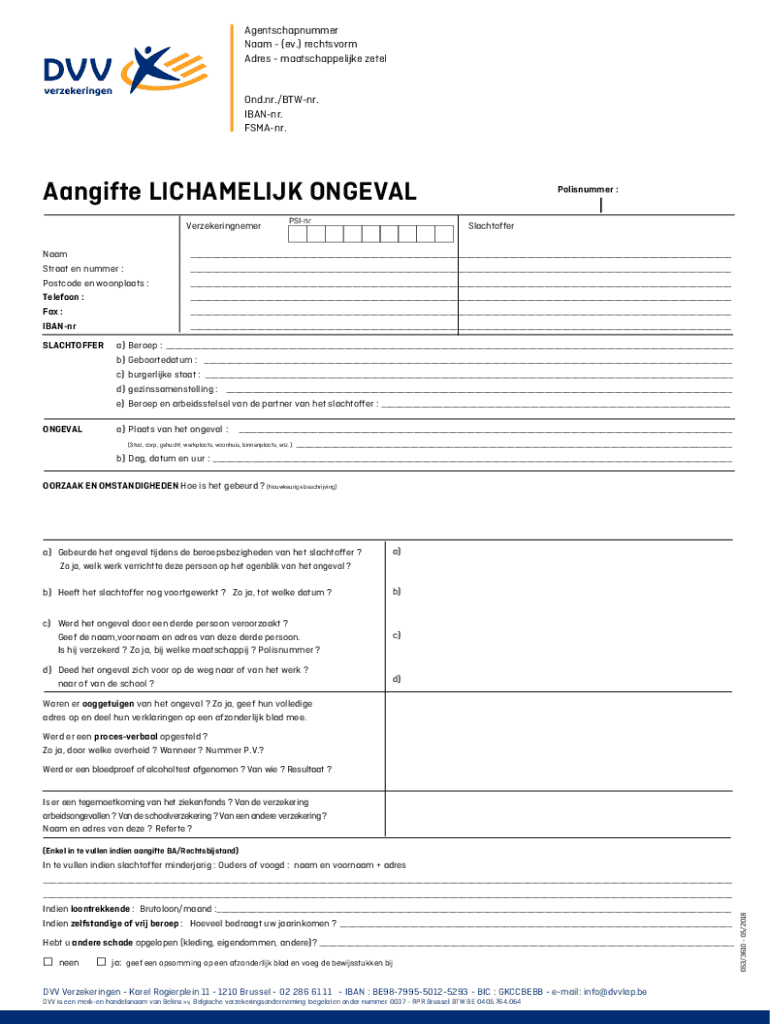

Overview of the gratis btw-nr form

The gratis btw-nr form is a critical document in the Netherlands that allows businesses to obtain a Value Added Tax (VAT) number at no cost. This form serves as the first step for entrepreneurs looking to register for VAT, an essential requirement for legally conducting business activities within the Dutch market. Obtaining a VAT number is important as it enables businesses to charge VAT to their customers, reclaim VAT on their expenses, and ensures compliance with tax regulations.

Individuals and organizations looking to start a business or extend their operations in the Netherlands benefit greatly from the gratis btw-nr form. This form not only simplifies the process of registration but also facilitates access to important tax-related benefits, boosting overall business efficiency.

Eligibility criteria for applying

To apply for the gratis btw-nr form, certain eligibility criteria must be met. Primarily, individuals or businesses that engage in taxable activities in the Netherlands, whether selling goods or services, are eligible. This covers a wide range of entities including freelancers, small business owners, and even larger corporations that operate within the Dutch jurisdiction.

Organizations, such as non-profits or educational institutions, can also qualify for a VAT number under specific conditions. Before filling out the form, applicants should ensure they possess the necessary paperwork, such as personal identification, business registration details, and any relevant permits.

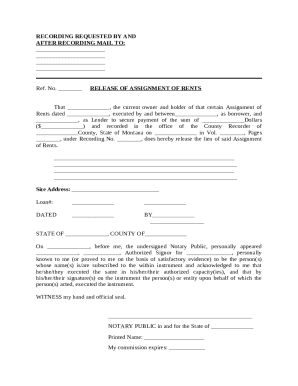

Step-by-step guide to accessing the gratis btw-nr form

Accessing the gratis btw-nr form is straightforward. The easiest way to find this essential document is through the official tax authority's website or directly on pdfFiller. To streamline your search on pdfFiller, simply enter 'gratis btw-nr form' in the search bar. This will promptly display the available templates.

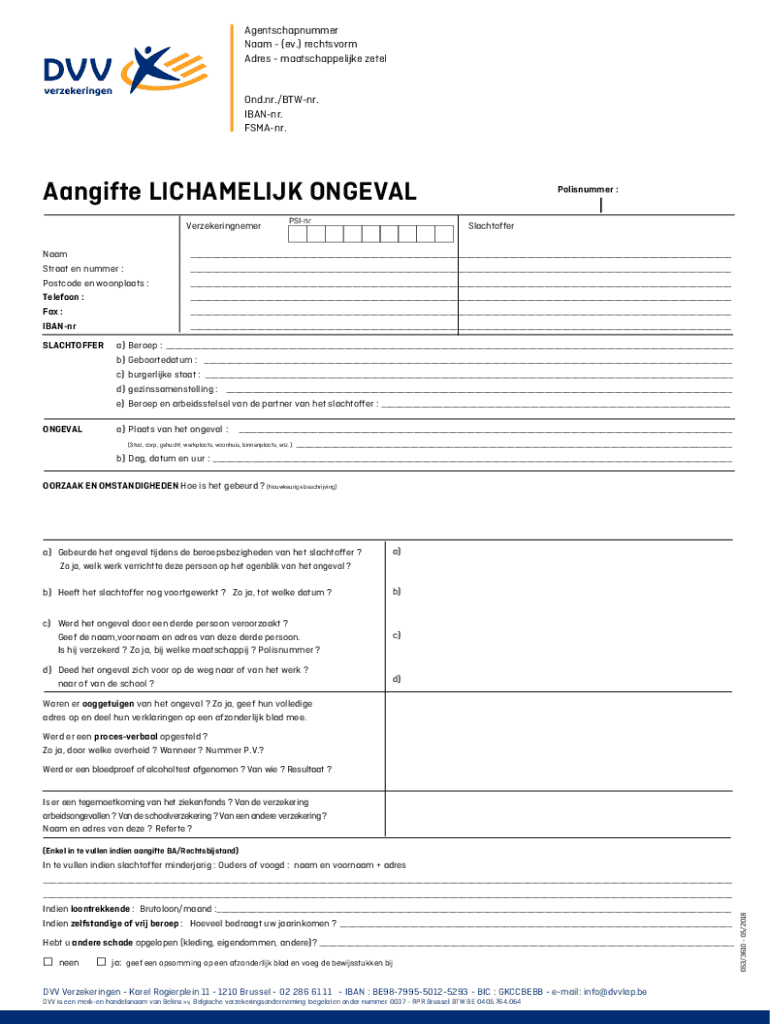

Detailed instructions for filling out the form

Filling out the gratis btw-nr form requires careful attention to detail. The form is typically divided into several sections that need to be completed accurately. The personal information section asks for essential details, including your full name, home address, and contact information. Ensure that all names are spelled correctly and contact information is up-to-date.

In the business details section, you will need to provide specifics about your business type, registration number, and turnover estimates. It's crucial to double-check numbers and details to avoid processing delays. Incorrect or incomplete information can lead to longer processing times or even denial of the VAT application.

Interactive tools for form completion

pdfFiller offers various interactive features that enhance the form completion process. Tools such as autofill can streamline data entry, allowing you to populate repeated information effortlessly. Additionally, pdfFiller supports electronic signatures, eliminating the need for printing and scanning.

To effectively utilize these tools, start by inputting data into the appropriate fields — the autofill will suggest matching entries from the documents you’ve used before. When ready to sign, select the signing tool, follow the prompts, and insert your electronic signature directly onto the form.

Common mistakes to avoid when filling out the form

Many applicants fall into common pitfalls when submitting the gratis btw-nr form. One frequent mistake is overlooking sections that require detailed input, such as failing to provide a complete list of business activities. Missing or vague information can complicate processing.

Another common error is incorrect data formatting, particularly in numerical entries like your tax identification number. To ensure your application is processed smoothly, always revisit your application before submission. Taking the time to double-check the entry will save you from unnecessary delays.

Submitting the gratis btw-nr form

Once you’ve completed the gratis btw-nr form, it’s time to submit your application. You have multiple options, including online and paper submissions. Online submission through the pdfFiller platform is recommended for its speed and efficiency — you can easily upload and send the filled form directly to the tax authority.

If you prefer submitting a paper application, ensure to print the completed form accurately, sign it, and include any required supplementary documents. Pay close attention to submission deadlines; failing to send your application on time may result in delays in receiving your VAT number.

What to expect after submission

After you’ve submitted your gratis btw-nr form, there are a few key points to be aware of. Processing times can vary depending on the volume of applications the tax authority is handling, but typically, you can expect a response within a few weeks. Communication about the outcome will most commonly occur via email, where you’ll receive confirmation if your application has been successful.

Once you receive your VAT number, make sure to keep it secure and easily accessible. This number will be crucial for all your future business transactions, including invoicing customers and filing tax returns.

Managing your VAT number effectively

Once you've acquired your VAT number, effectively managing it is essential for your business operations. Maintain accurate bookkeeping to track sales and expenses related to VAT; this attention to detail will assist during tax filing periods. Using designated accounting software can further streamline this process.

pdfFiller can also aid in document management by allowing you to organize all relevant VAT-related documents in one place. This consolidated approach helps ensure that your business remains compliant with VAT regulations while facilitating efficient operations.

Troubleshooting and FAQs

Many queries arise regarding the gratis btw-nr form, especially concerning its application process. Common FAQs include questions about eligibility, filling out specific sections, and the implications of delays in processing. If you encounter issues, pdfFiller provides a wealth of resources, including video tutorials and articles, to guide you through any hurdles.

For specific inquiries or more complex situations, you can always reach out to the customer service team at your local tax authority for personalized assistance. Ensuring that you have accurate information at your fingertips is critical for a smooth application experience.

User testimonials and success stories

Many individuals and businesses have successfully navigated the process of obtaining their VAT number using the gratis btw-nr form. User testimonials highlight how streamlined the pdfFiller platform is, making form completion and submission jargon-free. Stories of entrepreneurs who quickly progressed from registration to successful operations showcase how crucial this form is in foundational steps.

Quotes from satisfied users reflect the platform's effectiveness: 'Using pdfFiller for my VAT application couldn’t have been easier! The guide made everything clear and straightforward.' Such positive feedback emphasizes the value of both the form and the platform.

Final insights on the value of pdfFiller

Choosing pdfFiller for processing the pak de gratis btw-nr form ensures that users have access to a comprehensive suite of document management tools. From easy editing to electronic signatures, pdfFiller empowers users to handle all their document-related needs seamlessly. The platform's flexibility enables business users to work from anywhere, optimizing productivity.

In conclusion, obtaining the gratis btw-nr form not only simplifies the VAT registration process but also positions entrepreneurs for future business success. By effectively leveraging pdfFiller’s robust tools, individuals and teams can stay organized, compliant, and operationally efficient.

Mensen vragen ook over

Hoe lang is een Nederlands btw-nummer?

Hoe ziet een NL btw-nummer eruit?

Wat is het btw-nummer voor Nederland?

Hoe schrijf je een btw-nummer correct?

Voor veelgestelde vragen over pdfFiller

Hieronder vindt je een lijst met de meest voorkomende vragen van klanten. Kun je het antwoord op je vraag niet vinden, neem dan gerust contact met ons op.

Waar kan ik pak de gratis btw-nr vinden?

Hoe kan ik wijzigingen aanbrengen in pak de gratis btw-nr zonder Chrome te verlaten?

Hoe voltooi ik pak de gratis btw-nr op een Android-apparaat?

Wat is btw-nr?

Wie moet btw-nr indienen?

Hoe vul je btw-nr in?

Wat is het doel van btw-nr?

Welke informatie moet worden gerapporteerd op btw-nr?

pdfFiller is een end-to-end-oplossing voor het beheren, maken en bewerken van documenten en formulieren in de cloud. Bespaar tijd en moeite door uw belastingformulieren online op te stellen.