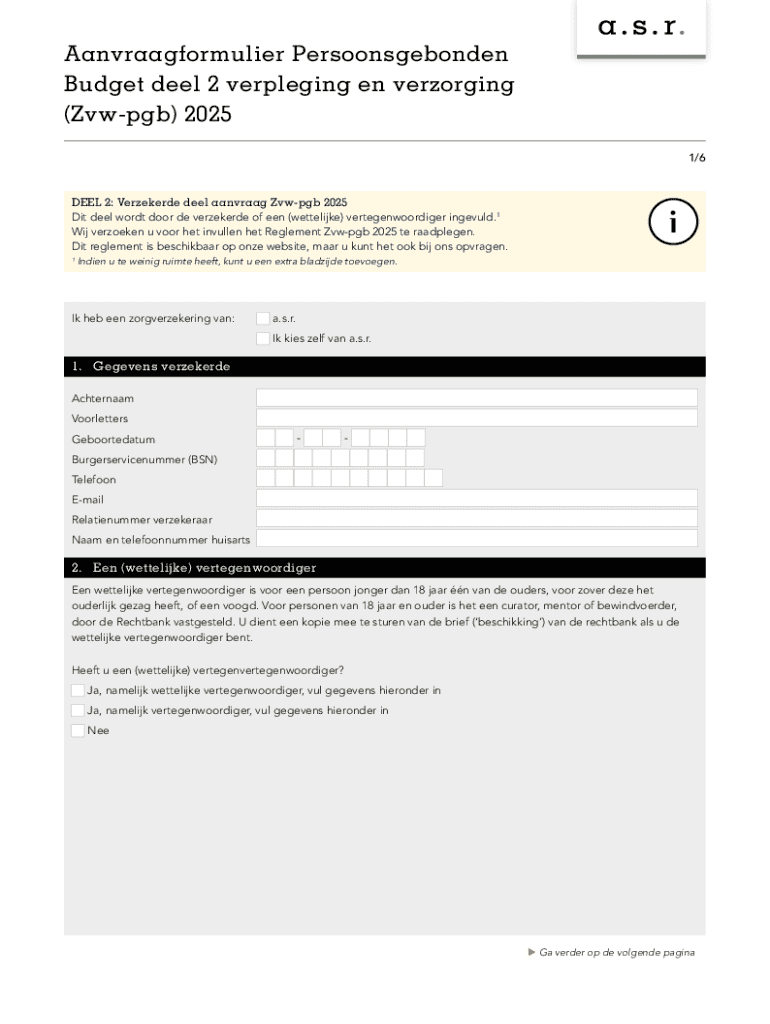

Pak de gratis Budget deel 2 verpleging en verzorging

Ophalen, creëren, maken en ondertekenen pak de gratis budget

Online pak de gratis budget bewerken

Ongecompromitteerde beveiliging voor uw PDF-bewerkingen en eSignature-behoeften

Invullen pak de gratis budget

Hoe u budget deel 2 verpleging invult

Wie heeft budget deel 2 verpleging nodig?

Maximize Your Financial Control with the Pak de Gratis Budget Form

Understanding the pak de gratis budget form

The pak de gratis budget form is a powerful tool designed to help individuals and teams get a clear grasp of their financial situation. This form not only simplifies the process of budgeting but also incorporates interactive elements that make it engaging and intuitive to use. With budgeting being a fundamental aspect of personal finance, having an accessible resource is crucial for anyone aiming to take control of their spending and savings.

Budgeting is vital in managing personal finances, as it helps identify discrepancies between income and expenditures. This tool is especially beneficial for families and teams who need collaborative features for effective financial planning. Utilizing the pak de gratis budget form can guide users toward achieving financial stability and realizing their savings goals.

The target audience for the pak de gratis budget form encompasses individuals looking to gain insight into their finances and families or teams working together towards shared financial goals. This versatility makes the form an ideal solution for various budgeting needs.

Benefits of using the pak de gratis budget form

Using the pak de gratis budget form offers a range of benefits, providing users with a comprehensive overview of their financial situation. This advantages transparency, encouraging responsible spending and saving habits. Moreover, the form's user-friendly design makes it easy to access and manage budgets seamlessly without complex procedures.

Another notable advantage is the collaborative features, which allow families and teams to work together towards financial targets. By centralizing financial information, all members can contribute insights, making it easier to maintain control over household budgets and planning.

Features of the pak de gratis budget form

The pak de gratis budget form boasts several interactive elements that engage users and make budget management straightforward. This form's compatibility with various devices ensures that users can access their budgets from anywhere, which is essential for those with busy lifestyles. It leverages technology to facilitate seamless updates and modifications.

Customization is another critical feature, allowing users to tailor the budget form to fit their unique financial situations. Whether it's creating additional expense categories or setting specific savings goals, the form adapts to meet personal needs. Furthermore, secure eSigning and document management solutions offered by pdfFiller enhance the overall user experience by ensuring information remains protected.

Step-by-step instructions on how to use the pak de gratis budget form

To get started with the pak de gratis budget form, follow these step-by-step instructions for seamless usage.

Customizing the pak de gratis budget form

Customizing the pak de gratis budget form is essential for aligning it with personal financial goals. Users can add additional expense categories as necessary, such as irregular monthly bills or one-time expenses, ensuring a realistic reflection of their financial landscape.

Setting savings goals within the form can visualize targets and track progress. With pdfFiller’s editing tools, users can personalize the budget form to suit their unique needs, making it a powerful asset in their financial toolkit.

Using the pak de gratis budget form for financial planning

The pak de gratis budget form is not just for tracking as it also serves as a valuable resource for financial planning. Users can set up monthly financial goals based on their budget analysis. For example, if certain categories reveal overspending, adjustments can be made quickly.

Additionally, built-in analytics allow users to track their progress over time. By assessing real-time feedback, budgets can be adjusted more efficiently, leading to improved financial management skills.

Comparative analysis: Other budget forms vs. pak de gratis budget form

When comparing the pak de gratis budget form with other budget forms available, several key differentiators emerge. The pak de gratis budget form excels in its interactive features and collaborative capabilities, which are often lacking in traditional templates.

Users consistently prefer pdfFiller for budget creation due to its intuitive interface and access to additional tools that enhance budgeting experiences. Real user testimonials highlight its effectiveness in transforming financial habits and promote a communal approach to budgeting.

Troubleshooting common issues with the pak de gratis budget form

Despite its user-friendly nature, users may encounter some common issues while using the pak de gratis budget form. These can range from difficulties in data entry to tech-related glitches. Fortunately, pdfFiller’s comprehensive support system addresses these frequently encountered problems with solutions and guidance.

For additional help, users can contact support or access community forums where tips and advice are shared among users. This collaborative environment fosters a sense of community, encouraging users to derive maximum value from their budgeting journey.

Leveraging additional features of pdfFiller

Beyond the pak de gratis budget form, pdfFiller offers a broad range of additional document templates related to personal finance. These include expense trackers, savings planners, and goal-setting documents — all designed to enhance overall financial management.

Integrating other tools within pdfFiller enhances the budgeting experience further, making it easier to manage multiple aspects of personal finance in one place. Educational resources and learning materials for financial literacy lay a solid foundation for users to make informed financial decisions.

Preparing for future budget planning

Looking ahead, notable trends in personal finance management suggest an increasing reliance on technology for budgeting solutions. Users can expect upcoming features in pdfFiller that will enhance the budgeting experience, making it even more interactive and user-friendly.

Encouraging users to share their budgeting stories and successes can foster a supportive community, where shared experiences further enhance financial literacy and collective growth in personal finance management.

Mensen vragen ook over

Wie krijgt een pgb uitbetaald?

Wat valt er onder verpleging pgb?

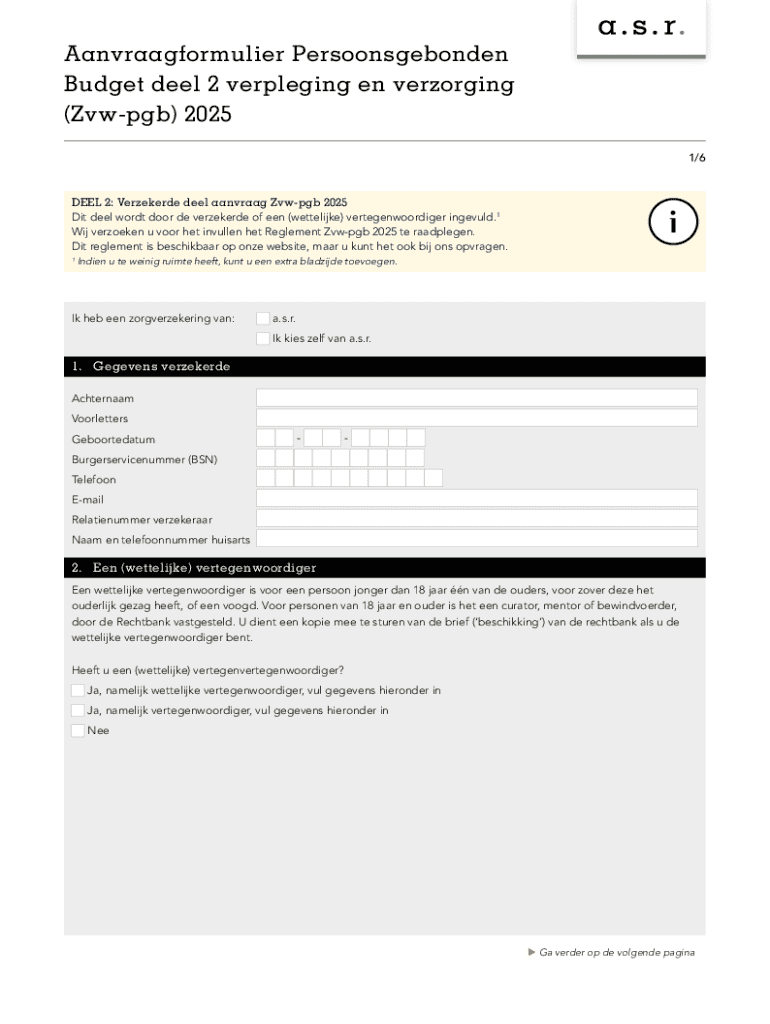

Hoe kan ik een pgb aanvragen bij ASR?

Wie komt in aanmerking voor een pgb?

Voor veelgestelde vragen over pdfFiller

Hieronder vindt je een lijst met de meest voorkomende vragen van klanten. Kun je het antwoord op je vraag niet vinden, neem dan gerust contact met ons op.

Waar kan ik pak de gratis budget vinden?

Hoe kan ik pak de gratis budget bewerken in Chrome?

Kan ik het pak de gratis budget elektronisch ondertekenen in Chrome?

Wat is budget deel 2 verpleging?

Wie moet budget deel 2 verpleging indienen?

Hoe vul je budget deel 2 verpleging in?

Wat is het doel van budget deel 2 verpleging?

Welke informatie moet worden gerapporteerd op budget deel 2 verpleging?

pdfFiller is een end-to-end-oplossing voor het beheren, maken en bewerken van documenten en formulieren in de cloud. Bespaar tijd en moeite door uw belastingformulieren online op te stellen.