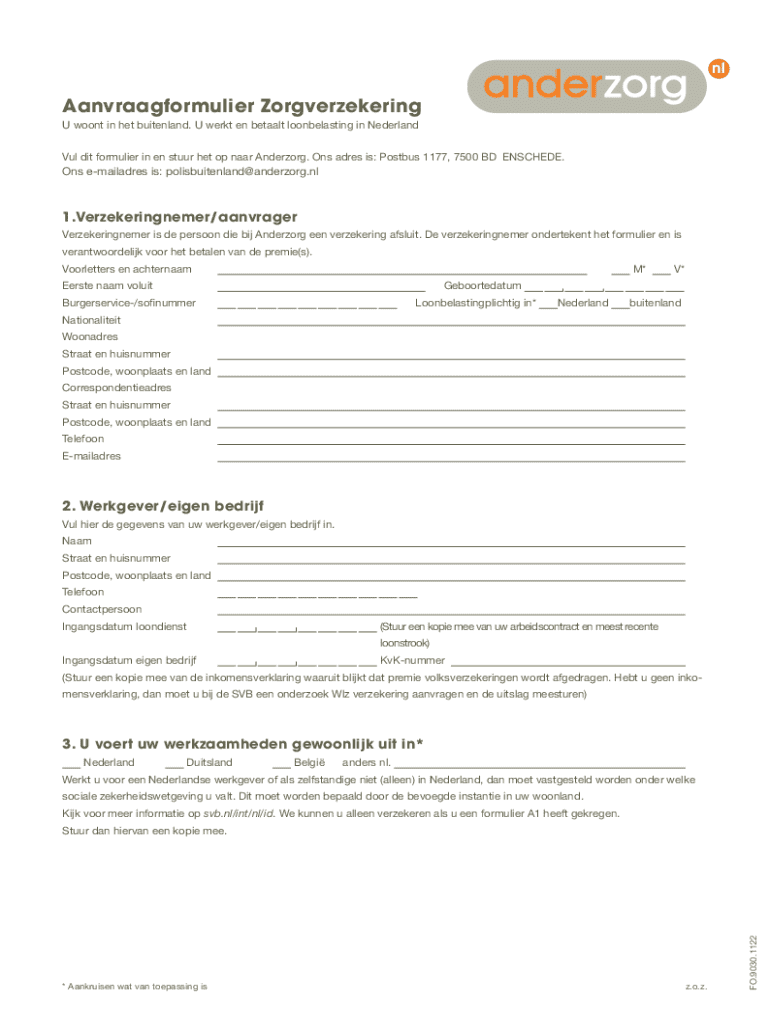

Pak de gratis Ben ik voor zorg verzekerd als ik in het buitenland woon?

Ophalen, creëren, maken en ondertekenen pak de gratis ben

Online pak de gratis ben bewerken

Ongecompromitteerde beveiliging voor uw PDF-bewerkingen en eSignature-behoeften

Invullen pak de gratis ben

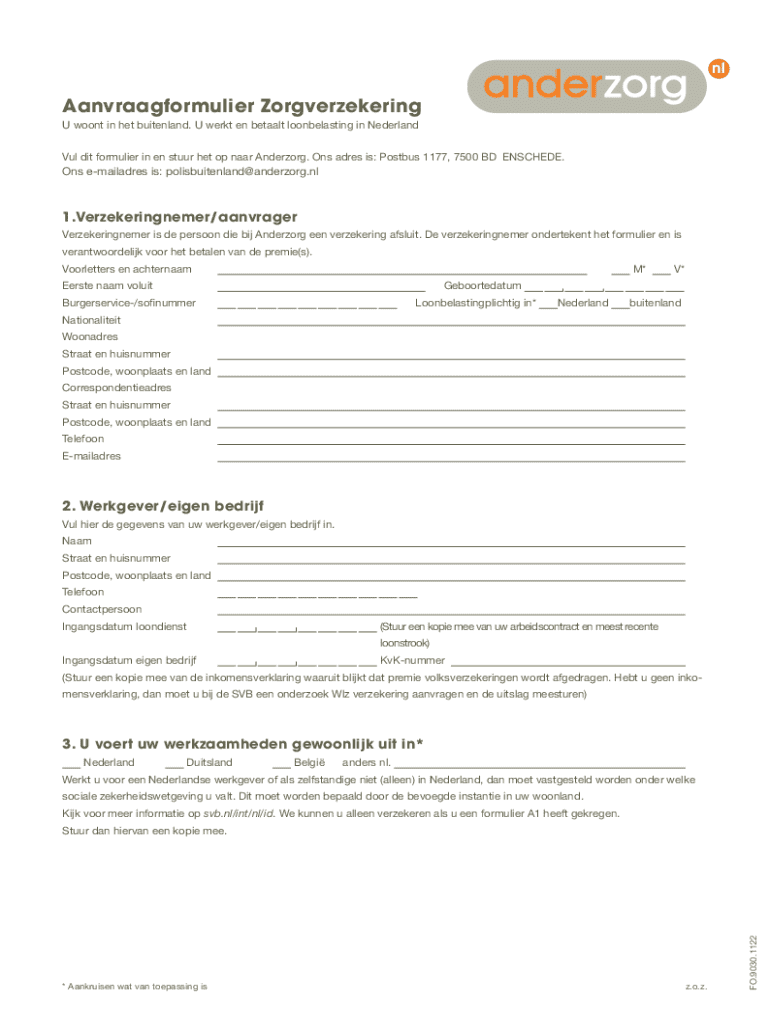

Hoe u ben ik voor zorg invult

Wie heeft ben ik voor zorg nodig?

How to Fill Out the Free BEN Form

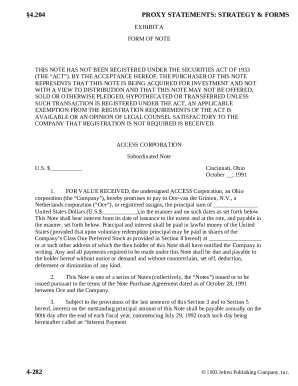

Overview of the BEN Form

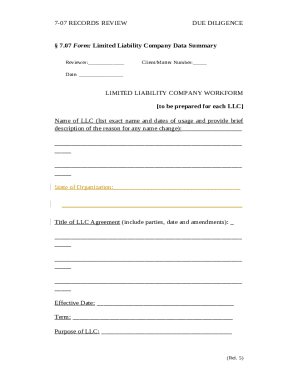

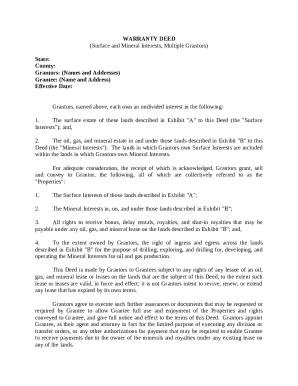

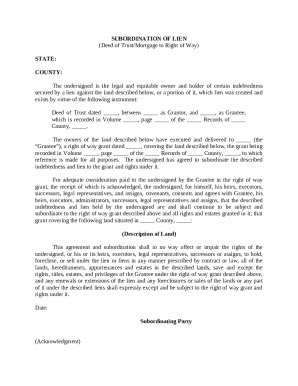

The BEN Form, often referred to as the Business Entity Notice Form, plays a pivotal role in the realm of finance, specifically for companies seeking to streamline their operations and financial reporting. This document is essential for entities to provide critical information about their financial status and business structure, thereby facilitating smooth interactions with tax authorities and other regulatory bodies.

One key feature of the BEN Form is its ability to clarify the roles and responsibilities of various business entities, which is especially important for tax and legal compliance. This form not only assists in the accurate reporting of a business's financial position but also enhances the efficiency of administrative procedures.

Importance of the Free BEN Form

The Free BEN Form holds significant weight for individuals and businesses alike. For entrepreneurs and freelancers, this form aids in establishing legitimacy with financial institutions, especially when applying for loans or grants. Businesses, particularly small and medium ones, use the BEN Form to ensure compliance with tax regulations and financial disclosures, thereby safeguarding themselves against potential legal pitfalls.

Moreover, during audits or inquiries from tax agencies, the BEN Form serves as a comprehensive declaration of a business’s financial practices. This bolstered transparency can lead to improved relations with partners and clients, thus fostering trust and credibility within the marketplace.

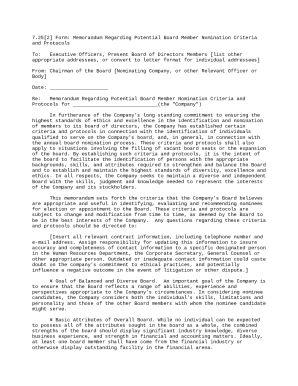

Who should use the Free BEN Form?

The Free BEN Form is crucial for various stakeholders in the business ecosystem. Entrepreneurs, especially those just starting out, utilize this form to communicate their business structures, operational strategies, and financial positions to potential partners, investors, and government bodies. Freelancers also find this document beneficial when detailing their independent work status and financial operations.

In the realm of business, both small local enterprises and larger international firms can leverage the BEN Form to enhance their reporting practices. For small businesses, this form can streamline operations and secure necessary funding. On the other hand, international firms may utilize it to comply with cross-border regulatory requirements, ensuring smooth partner payments and adherence to diverse finance productivity standards.

Step-by-Step Guide to Completing the Free BEN Form

Required information

To successfully complete the Free BEN Form, certain key pieces of information are required. Users must provide personal identification details, including their name, contact number, and email address. Additionally, businesses need to include relevant credentials such as their legal business name, tax identification number, and other supporting documentation that verifies their operational legitimacy.

Detailed breakdown of each section

The form is divided into several sections that require specific data. Section one typically captures personal information, where accuracy in spelling and formats is paramount. Section two focuses on financial disclosures, demanding clear and precise reporting. This ensures that both the organization and its stakeholders can accurately assess its financial standing.

Tips for accurate completion

To ensure the BEN Form is completed accurately, it’s advisable to double-check all entered information. Utilizing digital platforms such as pdfFiller can enhance the accuracy of your forms, allowing users to highlight errors or misfields efficiently. Additionally, obtaining necessary signatures from stakeholders can reassure compliance and legitimacy.

Common mistakes to avoid

While filling out the BEN Form, many individuals overlook crucial details that can derail their applications or reports. Common mistakes include omitting essential information, which might lead to delays or rejection of the form. Misunderstanding specific terminologies can also pose challenges, so it’s beneficial to familiarize oneself with financial lingo before diving into the document.

Furthermore, users should avoid submitting forms without a thorough review since discovering errors post-submission can lead to complicated rectification processes. Ensuring that all required appendices and documents are attached is equally important.

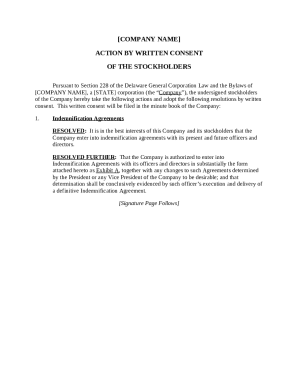

Submitting the Free BEN Form

eSigning with pdfFiller

Once the BEN Form is completed, submitting it via eSigning techniques provided by pdfFiller can secure a legally binding endorsement. The integrated signing features ensure that no matter the digital device you are using, presenting a valid signature is straightforward.

Sharing and collaborating on the form

pdfFiller also promotes sharing capabilities, allowing teams to collaborate on the BEN Form seamlessly. Whether seeking feedback or just ensuring every detail is perfect, this platform facilitates easy communication, thus enhancing workflows for businesses.

Managing your completed BEN Form

Accessing your document anytime

The beauty of using pdfFiller lies in its cloud storage benefits, making it possible to access your completed BEN Forms anytime, anywhere. Users can rest easy knowing their documents are secure yet accessible, enhancing document management solutions.

Editing and revising the form

If revisions are necessary, pdfFiller’s intuitive interface allows easy editing of the completed BEN Form. Users can update information as it changes, which is especially relevant for businesses experiencing rapid growth or significant transitions in their operations.

FAQs about the BEN Form

Many users often have questions regarding the BEN Form's completion and processing. Common inquiries include understanding eligibility to use the form, submission deadlines, and how to rectify mistakes identified after submission. It is advisable to consult the guidelines provided with the form or reach out to customer support for precise answers.

Clarifying concerns about specific definitions related to finance productivity and compliance can also simplify the form-filling experience, ensuring you approach your submissions with confidence.

Additional tools available with pdfFiller

Beyond the BEN Form, pdfFiller offers a wide array of other tools designed to enhance document creation and management. Users can tailor documents per individual needs, encouraging a more personalized approach to workflows. These solutions, including comprehensive document management features and customization options for various forms, can significantly enhance business efficiency and accuracy.

With the diverse portfolio of features available, pdfFiller serves as an essential partner for businesses seeking to optimize their operations through effective document solutions.

Voor veelgestelde vragen over pdfFiller

Hieronder vindt je een lijst met de meest voorkomende vragen van klanten. Kun je het antwoord op je vraag niet vinden, neem dan gerust contact met ons op.

Kan ik een elektronische handtekening maken om mijn pak de gratis ben in Gmail te ondertekenen?

Hoe vul ik pak de gratis ben in met mijn mobiele apparaat?

Hoe vul ik pak de gratis ben in op een Android-apparaat?

Wat is ben ik voor zorg?

Wie moet ben ik voor zorg indienen?

Hoe vul je ben ik voor zorg in?

Wat is het doel van ben ik voor zorg?

Welke informatie moet worden gerapporteerd op ben ik voor zorg?

pdfFiller is een end-to-end-oplossing voor het beheren, maken en bewerken van documenten en formulieren in de cloud. Bespaar tijd en moeite door uw belastingformulieren online op te stellen.