Get the free Online (Form 990, 990EZ, or 990PF) Fax Email Print

Get, Create, Make and Sign online form 990 990ez

Editing online form 990 990ez online

Uncompromising security for your PDF editing and eSignature needs

How to fill out online form 990 990ez

How to fill out online form 990 990ez

Who needs online form 990 990ez?

Comprehensive Guide to Filing Form 990 and 990-EZ Online

Understanding Form 990 and Form 990-EZ

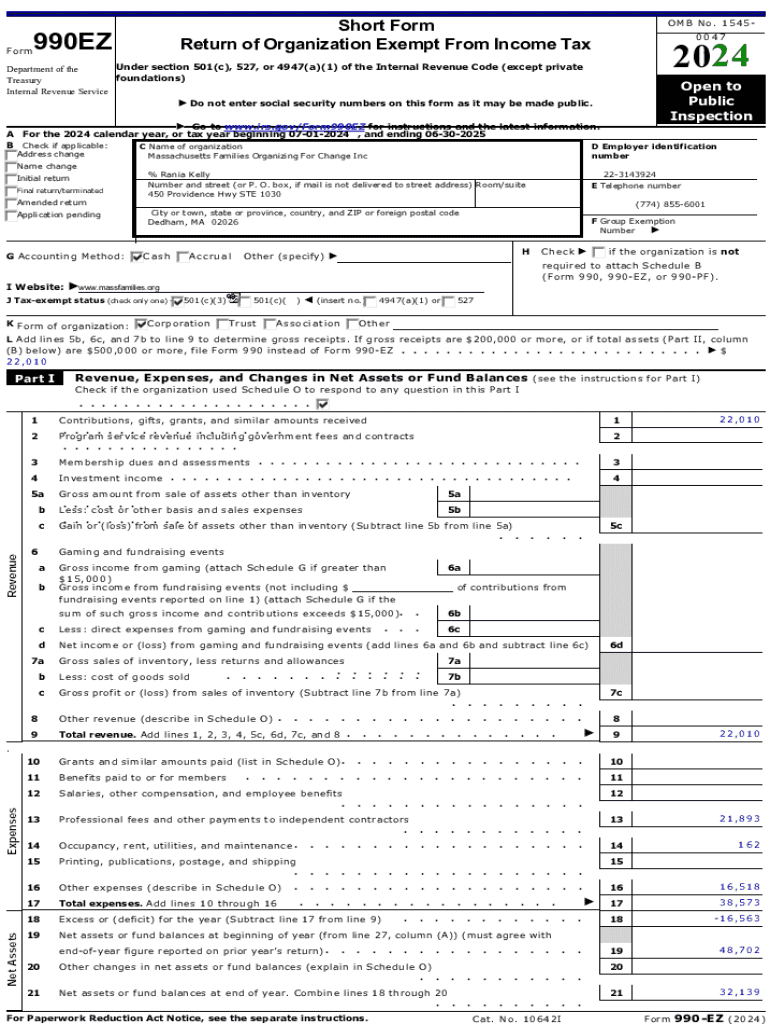

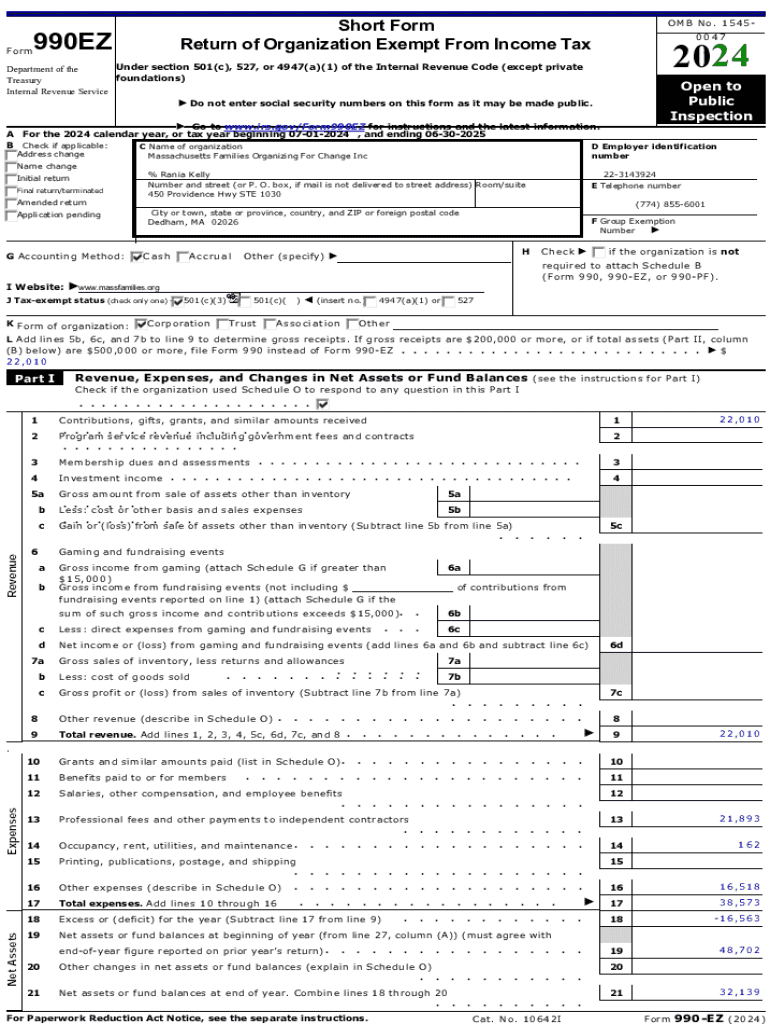

Form 990 and Form 990-EZ are essential annual tax returns for tax-exempt organizations in the United States. These forms are much more than mere tax documents; they provide a comprehensive overview of the organization’s financial health, operational activities, and governance practices. Both forms serve the IRS by aiding in the oversight of tax-exempt entities to ensure their compliance with federal tax laws, which is crucial for maintaining their tax-exempt status.

Tax-exempt organizations are required to file one of these forms annually, as they inform the IRS and the public about the organization’s financial situation, including revenue sources, expenses, and mission activities. Not only does filing Form 990 or 990-EZ fulfill a legal obligation, but it also enhances transparency and accountability, essential elements for securing public trust.

Who needs to file?

The choice between filing Form 990 and 990-EZ depends largely on the size and financial structure of the organization. Generally, organizations with gross receipts under $200,000 and total assets under $500,000 can opt for Form 990-EZ. However, those meeting or exceeding these thresholds are mandated to file the more comprehensive Form 990. It's crucial to note that certain organizations, such as churches and governmental entities, may be exempt from filing altogether.

Understanding the nuances between these forms is vital. For many smaller nonprofits, the simplicity of Form 990-EZ may be appealing, but as an organization grows and its financial activities become more intricate, it may be necessary to transition to the more detailed Form 990. Failing to file the appropriate form could lead to penalties, including the revocation of tax-exempt status.

Preparing to file your form 990 or 990-EZ online

Before diving into the online filing of Form 990 or 990-EZ using pdfFiller, you need to gather essential documentation. Accurate preparation helps to avoid common pitfalls that could delay or complicate your filing process. Essential documents include financial statements, revenue records, and relevant program information, all of which contribute to accurately reporting your organization’s activities and finances.

Common mistakes often involve providing incomplete information, such as not including all sources of revenue or failing to accurately report expenses. It’s also beneficial to review previous years’ filings to maintain consistency. Ensuring that all documents are ready beforehand will streamline your filing experience.

Setting up your pdfFiller account

Creating a pdfFiller account is the first step towards efficiently filing your Form 990 or 990-EZ. Start by visiting pdfFiller's website and clicking on the 'Sign Up' button to create a new account. You'll need to provide a valid email address and create a password. Once your account is set up, you can explore the platform's features designed to simplify your filing experience.

pdfFiller offers numerous tools that enhance the filing process, including form autofill capabilities, cloud storage, and collaboration features, which allow multiple team members to contribute to the document in real-time. Leveraging these features not only saves time but also ensures that your filing is accurate and compliant.

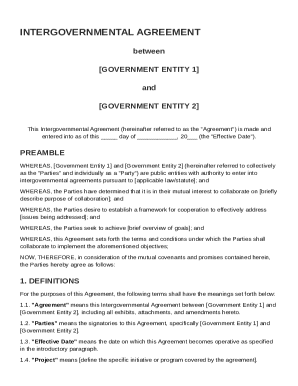

Navigating the online form 990 and 990-EZ filing process

Accessing Form 990 or 990-EZ through pdfFiller is straightforward. Once logged into your account, use the search bar to locate the specific form you need. Select either Form 990 or Form 990-EZ based on your organization’s eligibility. pdfFiller's user-friendly interface allows you to quickly find and access forms without any hassle.

Completing the form can be organized into several key sections. Start by filling out the organizational information accurately; this includes your organization's name, address, and tax identification number. Following this, report your revenue and expenses, detailing sources of income and areas of expenditure. Highlight important operational data about your programs, provide a financial overview, and ensure all required supporting documents are attached to your submission.

Utilizing interactive tools

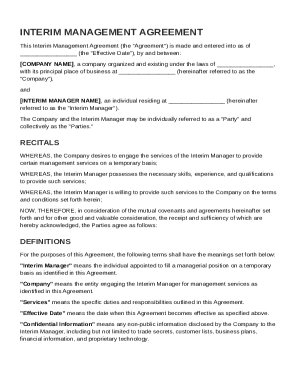

pdfFiller excels in providing interactive tools that facilitate a more efficient completion of your online form. One standout feature is the platform's auto-fill function, which automatically populates fields based on previously entered data, significantly reducing time spent on repetitive entries. Additionally, pdfFiller offers customizable templates, ensuring that all required fields are included from the outset.

Moreover, the editing tools allow for immediate changes, meaning that if financial data needs to be corrected, adjustments can be made on the fly without starting anew. These features empower users to navigate the filing process with assurance, knowing they have the necessary tools to meet compliance requirements effortlessly.

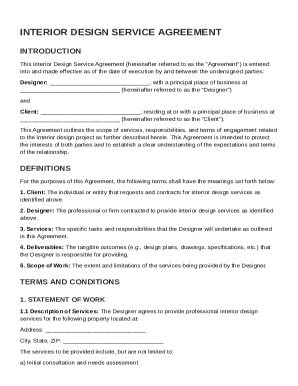

eSigning and collaborating on Form 990-EZ

In the world of tax filings, electronic signatures have become a game-changer, particularly for Form 990-EZ. pdfFiller offers secure eSignature options that comply with federal and state laws, providing validity to your submission without the need for physical printouts. This not only streamlines the filing process but also enhances security by maintaining a digital trail of signatures.

Collaboration is equally vital in preparing and signing your forms. pdfFiller allows multiple team members to work on the document concurrently. By sharing the document with your assistant treasurer or any other designated team members, you can ensure collective input while tracking changes, which helps to keep the process organized and efficient.

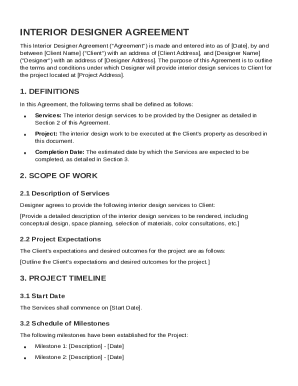

Finalizing and e-filing your form 990 or 990-EZ

Before submitting your Form 990 or 990-EZ online, it’s critical to go through a review checklist. Ensure that all information is accurate, complete, and in compliance with IRS requirements. It’s also advisable to double-check for any missing pages or supporting documentation that may bolster your submission. Accuracy is not just a matter of compliance; it prevents delays and potential audit red flags.

Filing electronically through pdfFiller is a straightforward process. Once you’re confident that everything is in order, simply follow the prompts to e-file your form. After submission, expect to receive confirmation that your filing was successful, along with any follow-up steps you may need to take to finalize the process.

Understanding confirmation and follow-up

After e-filing your Form 990 or 990-EZ through pdfFiller, you will receive a confirmation notice that acts as a receipt for your submission. This confirmation is important; it confirms that your filing has been received and provides a reference for any future inquiries. Keep an eye out for any additional communications from the IRS, as they may follow up with questions or requests for further documentation.

Tracking the status of your submission is made easy with pdfFiller; you can check the progress of your filing directly through your account. This added layer of oversight ensures that you remain informed throughout the process, allowing for prompt action if the IRS requires any clarifications.

Common issues and troubleshooting tips

While filing Form 990 or 990-EZ may seem straightforward, various issues can arise during the process. Frequent questions include how to address discrepancies in financial data or what to do if the IRS rejects a filing. It's essential to understand the common errors that can delay processing times or lead to penalties. These may range from simple clerical mistakes to missing required information.

When faced with technical issues while using the pdfFiller platform, it is beneficial to know your troubleshooting options. pdfFiller offers robust customer support; users can reach out via chat or email for immediate assistance. Additionally, familiarizing yourself with the help center can provide instant solutions to frequent issues, helping to expedite the filing process.

Additional benefits of using pdfFiller for form 990 filing

pdfFiller not only simplifies the process of filing Form 990 and 990-EZ but also serves as a year-round document management solution. Users can organize and store prior filings and all relevant documentation in one secure location. This helps maintain compliance and makes future filings much more efficient.

Moreover, staying updated with tax regulations is crucial for all tax-exempt organizations. pdfFiller makes it easy to access filing updates, ensuring that your organization remains compliant with state and federal requirements. Utilizing pdfFiller allows nonprofits to maintain their tax-exempt status and remain transparent in their operations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send online form 990 990ez for eSignature?

Can I create an electronic signature for the online form 990 990ez in Chrome?

How do I fill out the online form 990 990ez form on my smartphone?

What is online form 990 990ez?

Who is required to file online form 990 990ez?

How to fill out online form 990 990ez?

What is the purpose of online form 990 990ez?

What information must be reported on online form 990 990ez?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.