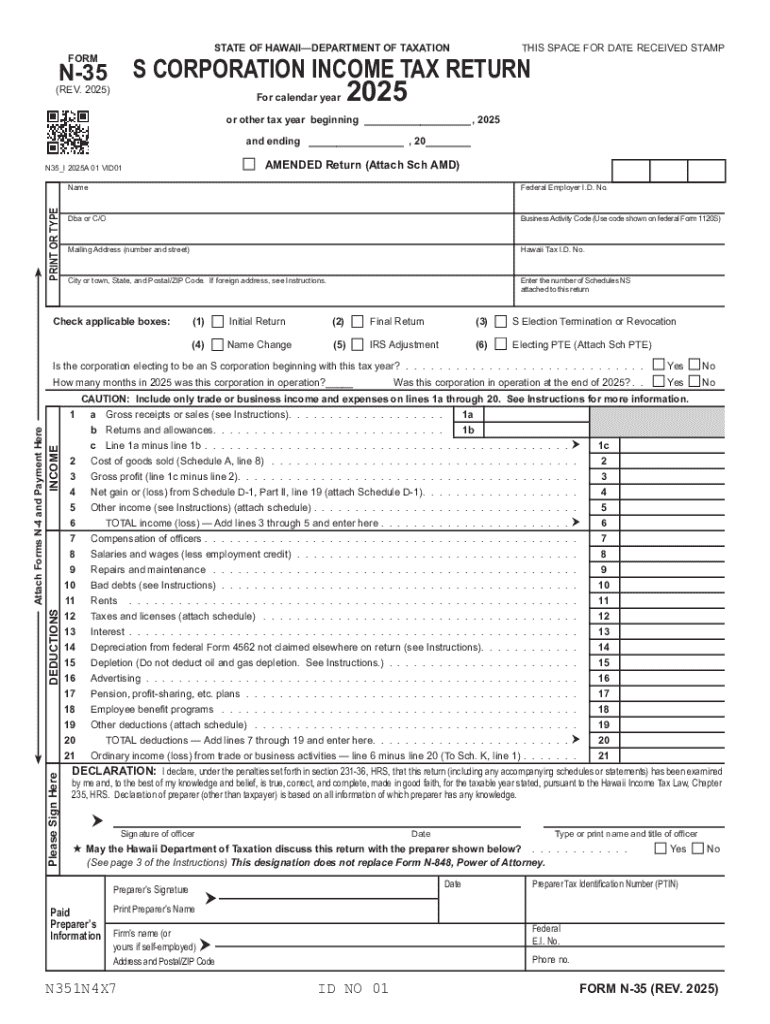

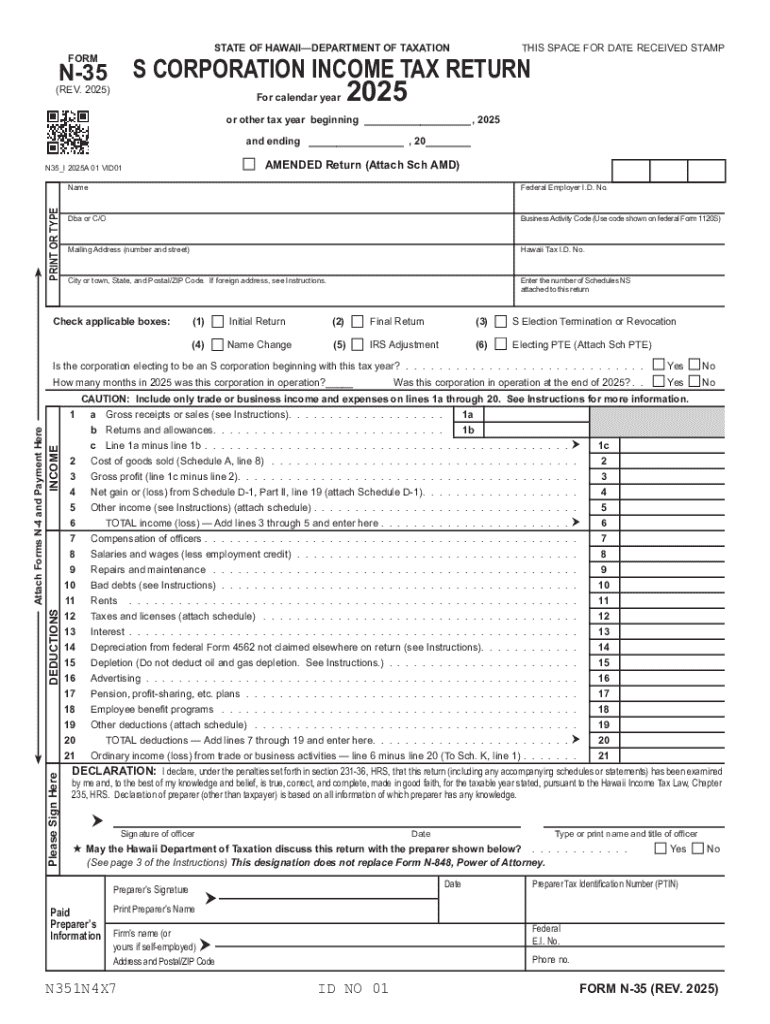

Get the free form n-35, rev. 2025, s corporation income tax return. forms 2025 - fillable

Get, Create, Make and Sign form n-35 rev 2025

How to edit form n-35 rev 2025 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form n-35 rev 2025

How to fill out form n-35 rev 2025

Who needs form n-35 rev 2025?

Form N-35 Rev 2025 Form: A Comprehensive Guide

Understanding Form N-35 Rev 2025

Form N-35 Rev 2025 is a pivotal document used by taxpayers in specific circumstances to report certain financial details. This form, administered by the tax authorities, serves multiple purposes including the calculation of tax liabilities and the declaration of various transactions that impact one’s financial standing. The significance of this form cannot be understated, as it enables efficient tracking and management of tax responsibilities.

Particularly, Form N-35 is necessary when there are specific financial situations which mandate such reporting. This can include income derived from freelance work, rental properties, or any substantial financial transactions that might influence an individual's or entity's tax obligations. Filing accurate and timely reports using this form ensures compliance and helps avoid potential penalties due to incorrect reporting.

Who needs to file Form N-35?

The eligibility to file Form N-35 spans various taxpayer categories. Generally, individuals or entities who earn income from multiple sources or those involved in complex financial transactions are required to file this form. Those operating as self-employed or freelancers particularly need to be aware of their obligations to report such incomes accurately. Furthermore, specific teams, partnerships, and businesses under certain conditions would also need to utilize this form for their tax filings.

In conclusion, anyone encountering unique or complex tax situations, including, but not limited to, marginalized taxpayers earning income through varied channels, significantly benefit from understanding the requirements of Form N-35. This ranges from individuals running small businesses to larger entities managing complex financial portfolios.

Detailed insights into Form N-35

A comprehensive understanding of Form N-35 involves examining its key components. The form includes crucial sections such as personal information, income reporting, deductions, and tax credits. Each of these components plays a vital role in the integrity of the overall submission. For instance, accurately reporting personal details ensures that the form can be tied back to specific tax accounts without confusion.

Income reporting details are equally essential, capturing the range of income sources including wages, freelance payments, and investment returns. Deductions and credits are instrumental in calculating the total tax liability, thus allowing taxpayers to minimize their fiscal responsibility legally.

Common mistakes to avoid

One common pitfall in filing Form N-35 is the omission or miscalculation of income sources. Leaving out certain income or providing incorrect figures can result in penalties and increased scrutiny from tax authorities. Additionally, mistakenly entering incorrect personal information, such as Social Security numbers or addresses, can lead to administrative delays and the rejection of submissions.

To avoid these errors, it is crucial to double-check entries and maintain thorough records for every financial transaction. Keeping detailed logs helps in providing exact figures and information on the form. The consequences of inaccuracies include financial penalties, potential audits, and adverse impacts on one’s tax history.

Step-by-step instructions for filling out Form N-35

Filling out Form N-35 necessitates careful consideration and meticulous attention to detail. To start, gathering all the required information is paramount. This involves compiling documents such as income statements, previous tax returns, and records of any deductions or credits you plan to claim. Organizing this data effectively will streamline the process, significantly reducing the time spent on correctly completing the form.

Now, let's walk through the completion of Form N-35 in detail:

Regarding deadlines and requirements, be mindful that submitting Form N-35 typically has specific due dates aligned with the tax year. Keeping track of these dates will ensure that you file promptly, evading late penalties. Additionally, after filing, it's crucial to check the status of your submission using the appropriate channels provided by your tax authority.

Editing and managing your Form N-35

Utilizing tools such as pdfFiller for editing Form N-35 can greatly enhance the efficiency of managing your documents. With pdfFiller’s intuitive interface, users can easily modify their forms. The cloud-based platform offers a variety of editing features including text addition, deletion, and reformatting options that streamline the entire form-filling process, making collaborative efforts easier.

By utilizing the benefits of a cloud-based platform like pdfFiller, users can access their forms from anywhere, facilitating the ability to make real-time edits. This capability is especially beneficial for teams working collectively on tax forms, allowing for quicker submission and fewer errors.

eSigning Form N-35

One critical advantage of using pdfFiller is its eSignature feature. Adding digital signatures to the Form N-35 is straightforward. Simply navigate to the signing option within the platform, where you can either draw your signature or use a pre-existing scanned version. The legal validity of eSignatures in relation to tax documents is well recognized, ensuring that your filing holds up under scrutiny.

This not only saves time but ensures that you remain compliant with necessary signing requirements mandated by tax authorities, streamlining both the preparation and filing process significantly.

Collaborative features for teams

For teams, sharing and collaborating on Form N-35 becomes a more manageable task with pdfFiller. The platform allows for easy sharing, meaning everyone involved can access the documents without having to worry about email attachments or lost files. This enhances team communication and ensures everyone is on the same page when it comes to financial disclosures.

Features for real-time collaboration enable members to add comments, suggest amendments, and highlight essential areas, all visible to team members. This collective approach fosters a more thorough review of entries, thus reducing the likelihood of errors.

Tracking changes and revisions

Version control is another key aspect of managing Form N-35 effectively in a team setting. pdfFiller allows users to track changes made to the document seamlessly, identifying who made what changes and when. This transparency is essential for maintaining the integrity of the filing process.

In instances where incorrect edits may have been made, reverting to a previous document version is possible, ensuring that the most accurate and compliant submission is filed.

Managing your documents after submission

Maintaining organized records post-submission is critical. Employing best practices for a structured digital document library will not only enhance accessibility but also ease future filing processes. Consider categorizing documents by year, type, or filing status, making them easier to retrieve when necessary.

Additionally, keeping track of future filings ensures that you never miss crucial deadlines for renewals or follow-up submissions. Setting reminders for yourself through a digital calendar, or using tools within pdfFiller can provide a great deal of help in managing your filing commitments seamlessly.

Troubleshooting common issues

Common queries often arise regarding Form N-35, particularly about specific requirements or processing timelines. Addressing these typical concerns upfront is beneficial to anyone engaging with the form for the first time. Many users encounter uncertainty regarding submission methods or particular information requested on the form.

Clarifying complex aspects of the form can eliminate anxiety associated with submissions. It helps in creating more informed filers. To assist with any ongoing concerns or unique situations, reaching out to pdfFiller support can provide guidance. Their team is knowledgeable about handling various file types, ensuring that users receive the necessary assistance tailored to their situation.

Contacting support

When additional help is needed, pdfFiller offers robust support channels. Users can easily connect with customer service representatives through chat, email, or phone. Additionally, a wealth of online resources and tutorials may guide users in navigating challenges encountered while filling out or submitting Form N-35.

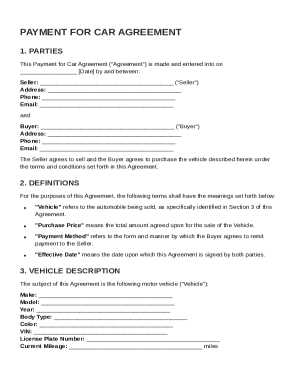

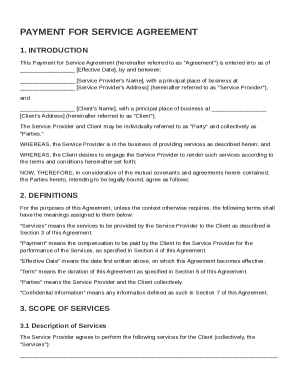

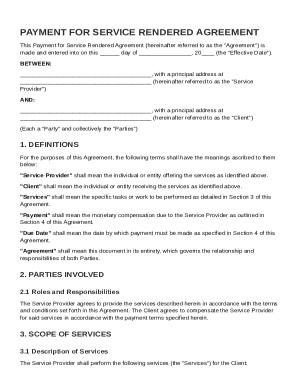

Related forms and templates

When navigating tax forms, understanding related documents is vital. An overview of other relevant tax forms can provide context necessary for filling out Form N-35 effectively. For instance, forms related to income verification or additional deductions can align closely with the details reported on Form N-35.

Comparisons between Form N-35 and other related forms can clarify distinctions in types and requirements. This enables users to select the appropriate forms that align with their tax situations accurately, reducing the likelihood of errors and improving compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form n-35 rev 2025 without leaving Google Drive?

Can I create an electronic signature for signing my form n-35 rev 2025 in Gmail?

How can I fill out form n-35 rev 2025 on an iOS device?

What is form n-35 rev 2025?

Who is required to file form n-35 rev 2025?

How to fill out form n-35 rev 2025?

What is the purpose of form n-35 rev 2025?

What information must be reported on form n-35 rev 2025?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.