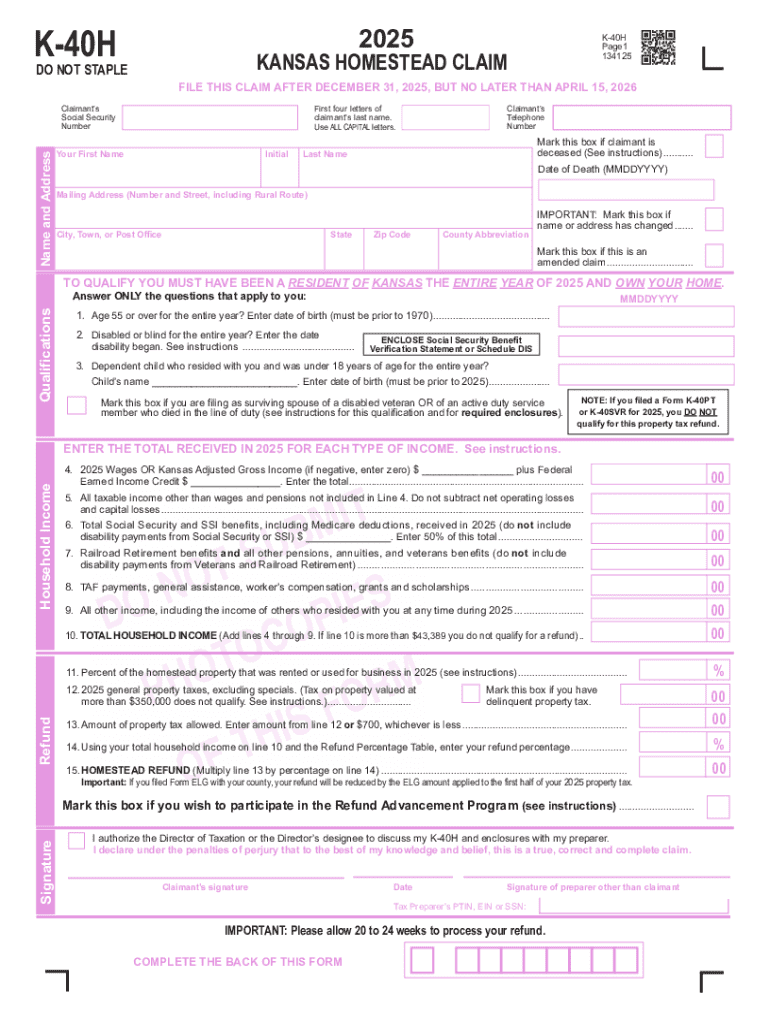

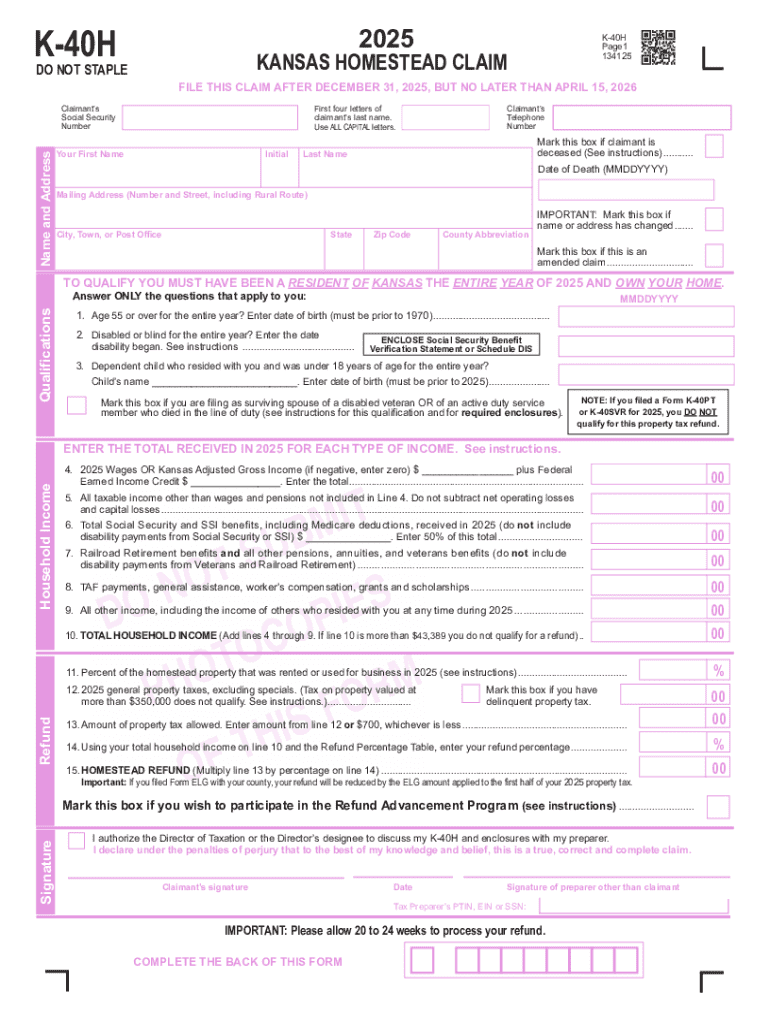

KS Homestead or Property Tax Refund for Homeowners 2025-2026 free printable template

Get, Create, Make and Sign KS Homestead or Property Tax Refund

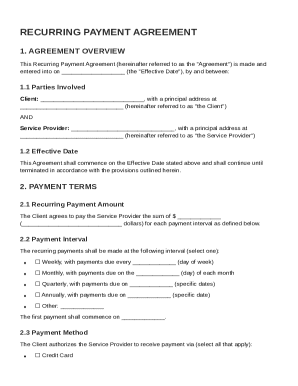

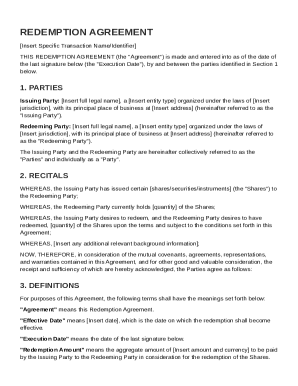

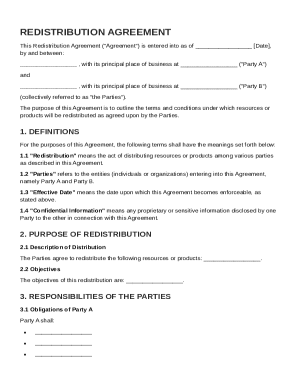

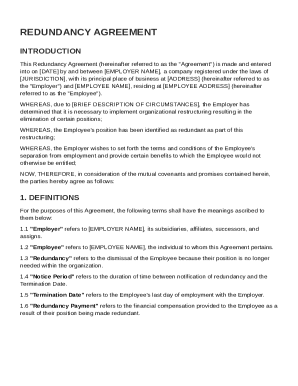

How to edit KS Homestead or Property Tax Refund online

Uncompromising security for your PDF editing and eSignature needs

KS Homestead or Property Tax Refund for Homeowners Form Versions

How to fill out KS Homestead or Property Tax Refund

How to fill out 2025 homestead or property

Who needs 2025 homestead or property?

2025 Homestead or Property Form: Your Comprehensive How-to Guide

Understanding the 2025 homestead or property form

The 2025 Homestead or Property Form is an essential document designed for property owners seeking specific tax benefits or abatements related to their homestead. This form collects information that is crucial for local tax authorities to determine eligibility for homestead exemptions and related financial support. The significance of the 2025 version lies in its updates reflecting modern property laws and regulations, making it vital for homeowners to remain compliant and take full advantage of their rights.

Individuals who own property — whether residential homes, farms, or other types of real estate — need to complete this form. It's particularly important for first-time homeowners, individuals facing significant life changes, or those who have made improvements to their properties. Understanding its requirements is the first step towards effective property management.

Key components of the 2025 homestead or property form

The 2025 Homestead or Property Form encompasses several key sections, each tailored to collect concise and relevant information. Key components include:

Familiarizing yourself with these components ensures a holistic understanding of how each part impacts your overall tax situation.

Filling out the 2025 homestead form: Step-by-step guide

Navigating the form might seem daunting, but breaking it down into manageable steps simplifies the process. Here’s how to proceed:

Interactive tools for streamlining the form completion

Utilizing tools like pdfFiller can significantly enhance your experience with the 2025 Homestead or Property Form. pdfFiller offers robust editing features that make filling out forms easy and efficient.

You can also collaborate with team members or family when completing this form. Sharing the document allows multiple users to review or contribute, ensuring that all critical information is included. Additionally, pdfFiller supports electronic signatures, simplifying the signing process while maintaining legitimacy.

Managing and submitting your completed form

Once your form is filled out, managing its submission with attention to detail is crucial. Begin by securely saving your completed form in the cloud, utilizing pdfFiller’s encrypted storage options to protect your personal information.

Before submission, conduct a thorough final review, checking that all information is complete and correct. To submit your form online, navigate to the appropriate government portal and follow the step-by-step instructions provided. This process typically requires you to upload the form and confirm submission.

Tracking your application status

After submitting your 2025 Homestead or Property Form, it's essential to remain informed about its status. Most jurisdictions provide an online tool where you can check application status easily.

If your status reflects 'No Application,' it may indicate an error in submission or processing. In such cases, reviewing the submission confirmation and contact local authorities is advisable. Common issues might include incorrect information or missing documentation; addressing these promptly can expedite resolution.

Frequently asked questions (FAQs) about the 2025 homestead form

Many users have similar queries regarding the 2025 Homestead or Property Form. Addressing these can alleviate concerns and streamline completion.

Unique scenarios related to the 2025 homestead form

Filing the 2025 Homestead or Property Form isn’t a one-size-fits-all process. Several unique scenarios can arise that require different considerations. For example:

Leveraging pdfFiller for enhanced document management

Using pdfFiller for managing your 2025 Homestead or Property Form not only simplifies the filling process but also enhances overall document management. The advantages of a cloud-based platform ensure you can access your documents from anywhere, making last-minute changes or submissions straightforward.

pdfFiller also guarantees compliance with data protection regulations, providing peace of mind concerning the security of your personal information. Additionally, the platform offers access to legal guidance, assisting users in understanding the nuances of property laws.

Expert tips for successful form management

To ensure a smooth experience with the 2025 Homestead or Property Form, here are some expert tips to keep in mind:

People Also Ask about

How do you qualify for homestead in Kansas?

What is a Kansas homestead refund?

What is Form K 40PT?

What is the homestead exemption in Kansas?

Who qualifies for homestead refund in Kansas?

What is the Kansas Homestead Act?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit KS Homestead or Property Tax Refund straight from my smartphone?

How do I fill out KS Homestead or Property Tax Refund using my mobile device?

Can I edit KS Homestead or Property Tax Refund on an iOS device?

What is 2025 homestead or property?

Who is required to file 2025 homestead or property?

How to fill out 2025 homestead or property?

What is the purpose of 2025 homestead or property?

What information must be reported on 2025 homestead or property?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.