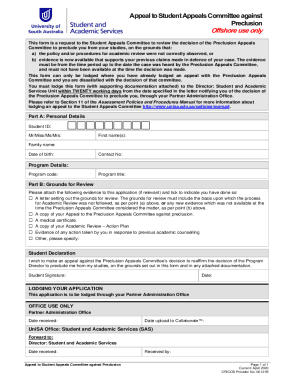

Get the free Request for Taxpayer Identification Number and ... - Jackson, MI

Get, Create, Make and Sign request for taxpayer identification

Editing request for taxpayer identification online

Uncompromising security for your PDF editing and eSignature needs

How to fill out request for taxpayer identification

How to fill out request for taxpayer identification

Who needs request for taxpayer identification?

Request for Taxpayer Identification Form: Your Comprehensive Guide

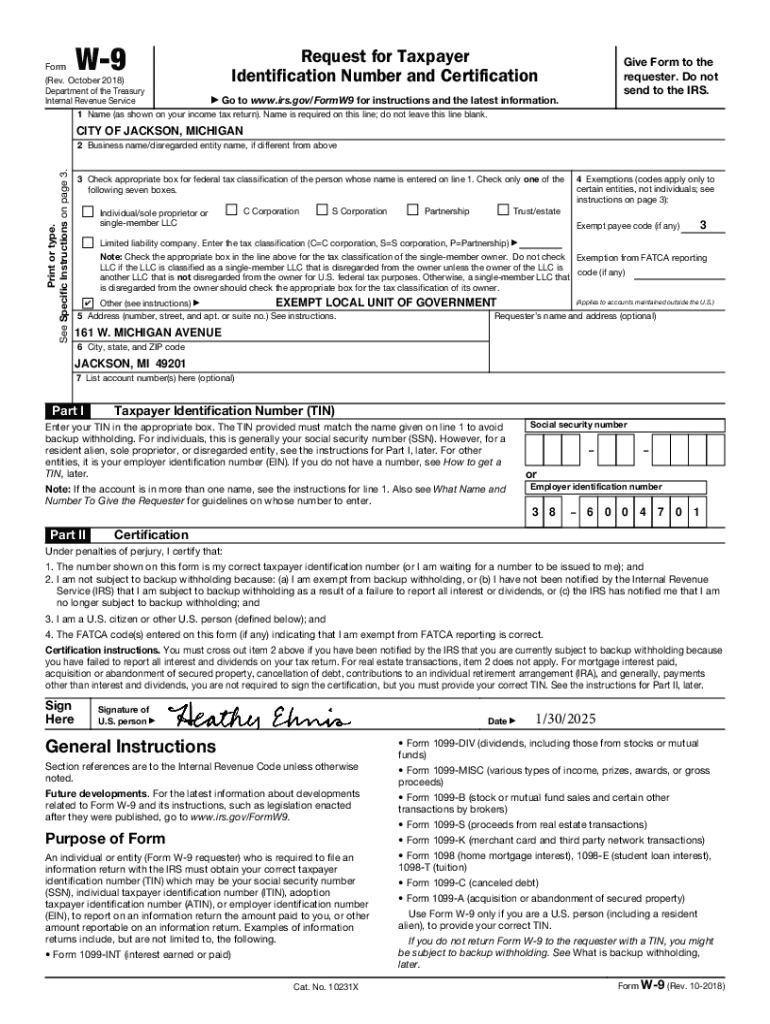

Understanding the taxpayer identification form

A Taxpayer Identification Number (TIN) is a vital part of tax compliance, assigned by the Internal Revenue Service (IRS) and used for identifying taxpayers in the system. It's essential for both individuals and businesses, as it plays a critical role in reporting income, filing taxes, and ensuring proper tax withholding. The taxpayer identification forms are tools to collect the necessary details to issue these identification numbers effectively.

Understanding the different types of taxpayer identification forms is crucial for anyone engaged in financial activities. These documents help ensure that tax obligations are met accurately and timely, protecting taxpayers from potential penalties and audits.

Types of taxpayer identification forms

There are several forms used to request a taxpayer identification number, including Form W-9 and Form W-8. Each serves a unique purpose and context, whether for U.S. residents or foreign entities.

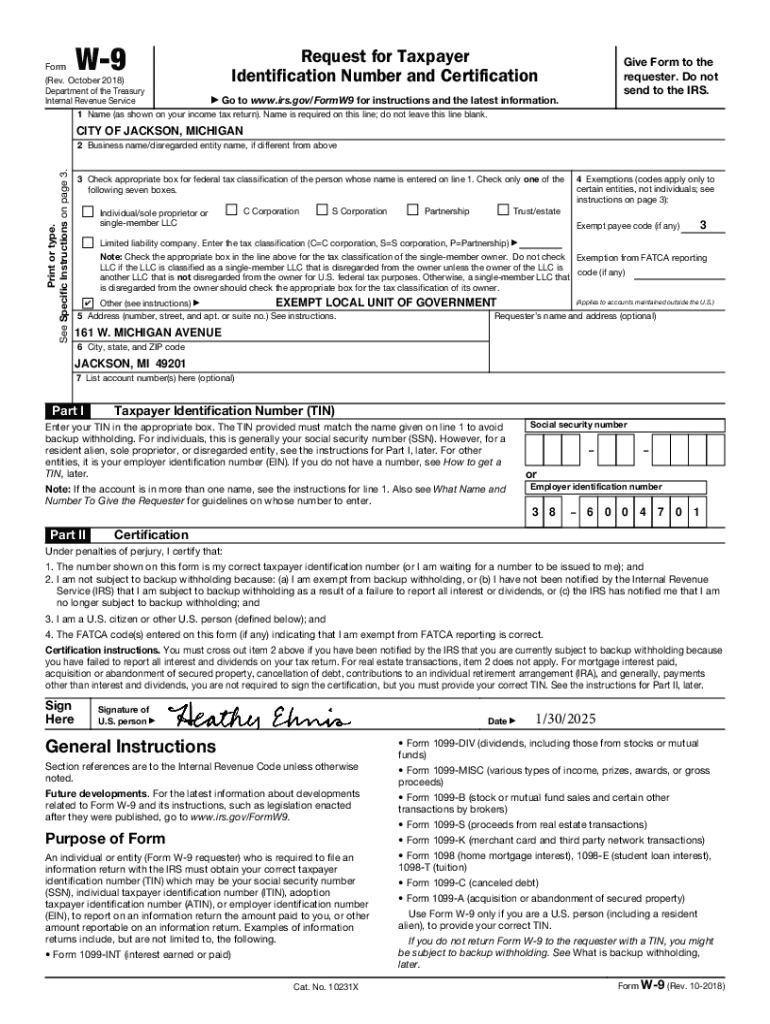

Form W-9

The W-9 form is primarily used by U.S. persons, which includes individuals and businesses, to provide their TIN to another party. It's often required when the taxpayer receives payments as an independent contractor or freelancer. Completing a W-9 assures that the payment processor can report the income accurately to the IRS.

Form W-8

In contrast, Form W-8 is intended for foreign individuals and entities to certify their foreign status for tax purposes. This form is critical for avoiding potential U.S. tax withholding on payments received from U.S. sources. It distinguishes between different types of foreign entities and their necessary tax obligations.

Other country-specific forms

Different countries have their taxpayer identification forms tailored to their systems. For instance, Brazil has the CPF for individuals and CNPJ for businesses, while Canada uses the Social Insurance Number (SIN) and Business Number (BN). Understanding these forms ensures compliance in various jurisdictions, crucial for international business operations.

Key elements of the request for taxpayer identification form

When filling out a taxpayer identification form, accuracy is paramount. The forms typically include several essential sections that need to be completed correctly to avoid confusion or delays in processing.

Key fields include:

Completing all fields ensures that the IRS or relevant tax authority can process your information without any issues.

Step-by-step guide to filling out the taxpayer identification form

Filling out the taxpayer identification form can be formidable, but breaking it down into simple steps can help ease the process. Here’s how to navigate through it effectively.

Step 1: Gathering necessary information

Before you start filling out the form, gather all pertinent information. This includes documents that provide your TIN, legal name, and current address. For individuals, a driver’s license or Social Security card can suffice, while businesses may need official registration documents.

Step 2: Completing the form

When completing each section of the form, ensure that the information matches what is recorded in official documents. For instance, if your business name is listed differently in your registration documents, the name on the form should align exactly.

Step 3: Reviewing your submission

Before submitting the form, review every detail. Misplaced digits in your TIN or typos in your name can lead to delays or issues with compliance. When checking for accuracy, consider the following tips:

Editing and managing your taxpayer identification form

Changes to a submitted taxpayer identification form can be needed due to various reasons, such as errors or changes in your information. The good news is that updating your details is relatively straightforward.

You'll need to fill out a new form reflecting the changes, and this may involve: - Completing a new W-9 or W-8 form, - Notifying the party that requested the previous form that there have been changes, - Ensuring that the new form is dated correctly.

Both signature and eSign options are available to validate your document. Utilizing pdfFiller’s editing features can streamline the process significantly, making it easier to manage your taxpayer identification forms across various needs.

Collaborative efforts: working with teams

When managing taxpayer identification forms, collaboration may be crucial, especially within teams handling finances or compliance. Using tools that allow for sharing and real-time updates can enhance efficiency.

With pdfFiller’s cloud-based platform, teams can:

This capability makes it easy for tax preparers and agents working in accounting to ensure all necessary paperwork is completed correctly and efficiently.

Frequently asked questions (FAQs)

It's common to have questions when navigating taxpayer identification forms. Here are some frequently asked questions that provide clarity on common concerns.

What to do if you make a mistake on the form?

If you discover a mistake after submitting your form, don’t panic. You can complete a new form with the correct details and notify anyone who received the old version. Make sure to track the submission date of both forms.

How to handle rejections or issues with submitted forms?

If your form is rejected, the issuer will typically inform you of the issue. Make the necessary corrections and resubmit. Keeping clear records of communication can expedite this process.

Deadline considerations for filing the taxpayer identification form

Be aware of filing deadlines, especially for businesses, as failing to submit your forms on time can lead to penalties. Understanding specific deadlines for W-9 and W-8 can keep you compliant and minimize stress during tax season.

Security considerations

Submitting taxpayer identification forms involves sharing sensitive information. Therefore, maintaining confidentiality and security is crucial. Always use secure channels to submit these documents, especially when sharing online.

pdfFiller incorporates various security features, such as encryption and access controls, helping you protect your documents. Ensuring that your sensitive information is safe from unauthorized access is a priority, particularly when dealing with tax-related paperwork.

Conclusion: streamlining your tax reporting process

The request for taxpayer identification forms is a pivotal aspect of tax compliance, whether you’re an individual or business. Understanding these forms and using tools like pdfFiller can significantly simplify the documentation process.

With features designed for easy editing, eSigning, and collaboration, pdfFiller empowers users to handle tax-related documents seamlessly from any location. By leveraging these capabilities, you can ensure that your taxpayer identification forms are handled efficiently, keeping your financial and tax reporting processes on track.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send request for taxpayer identification to be eSigned by others?

How do I edit request for taxpayer identification online?

How do I edit request for taxpayer identification in Chrome?

What is request for taxpayer identification?

Who is required to file request for taxpayer identification?

How to fill out request for taxpayer identification?

What is the purpose of request for taxpayer identification?

What information must be reported on request for taxpayer identification?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.