Get the free Columbus Consolidated Government Tax Allocation District

Get, Create, Make and Sign columbus consolidated government tax

Editing columbus consolidated government tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out columbus consolidated government tax

How to fill out columbus consolidated government tax

Who needs columbus consolidated government tax?

Columbus Consolidated Government Tax Form: A Complete Guide

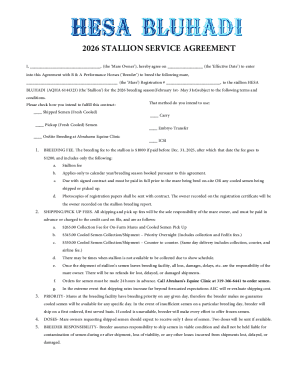

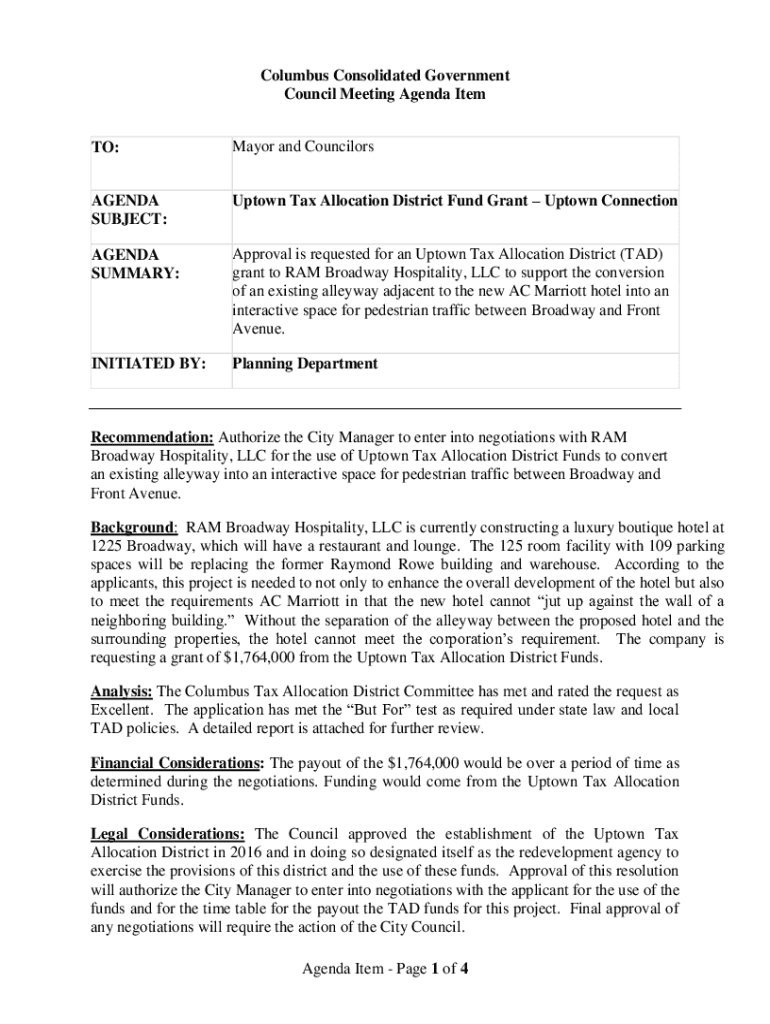

Overview of the Columbus Consolidated Government Tax Form

The Columbus Consolidated Government Tax Form is a vital document utilized by residents and businesses within the Columbus area to report taxable income and determine their tax liabilities. This form is essential not only for individual compliance but also for the effective functioning of civic administration. It facilitates the collection of revenue that funds public services, infrastructure, and essential community programs.

Understanding tax responsibilities in Columbus

Tax obligations for residents and businesses in Columbus encompass a variety of types, including income tax, excise tax, and occupation taxes. Residents must be vigilant regarding deadlines, typically falling on April 15 for individuals and different dates for businesses. It is crucial to keep track of these timelines to avoid penalties or interest charges. Common misconceptions arise around the idea that all forms of income are taxed uniformly; however, specific exceptions apply, particularly for exemptions on certain types of income and deductions.

Who needs to complete the Columbus Consolidated Government Tax Form?

Both individuals and businesses operating within Columbus are required to complete the Columbus Consolidated Government Tax Form. Individuals earning above the minimum income threshold must file annually. Businesses may have different obligations depending on their structure—such as LLCs, corporations, or sole proprietorships. Non-residents working temporarily in Columbus must also complete the form if they meet the income criteria, ensuring they comply with local tax laws.

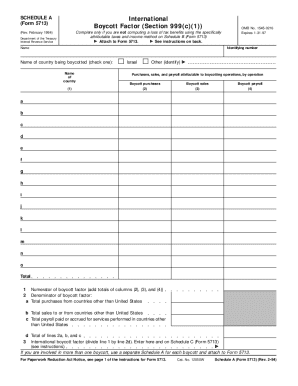

Detailed breakdown of the tax form

The Columbus Consolidated Government Tax Form comprises several key sections: Personal Information, Income Reporting, Deductions and Credits, and Signature Requirements. Properly understanding these segments is vital to ensure accuracy when filing your taxes. Errors in these areas can lead to delayed processing or penalties.

Before beginning the filing process, collect all relevant documents, including W-2 forms, 1099s, and receipts for deductible expenses. Ensuring you have these on hand will support a smoother filing experience.

Step-by-step instructions for filling out the Columbus Consolidated Government Tax Form

Tips for editing and managing your completed tax form

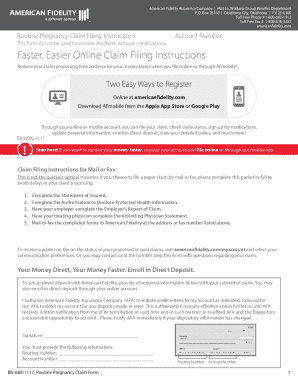

Utilizing pdfFiller’s editing tools can enhance your form management experience. With features that allow you to save, edit, and eSign documents remotely, staying organized is made simpler. By creating folders for each tax year, you can conveniently access forms and keep track of your submission history.

Common mistakes to avoid when filing your tax form

Filing your Columbus Consolidated Government Tax Form correctly the first time is critical. Many people overlook potential deductions like medical expenses or occupational fees that could have a significant impact on their taxable income. Furthermore, inaccuracies in income reporting could lead to audits or penalties, making it paramount to double-check each entry.

Frequently asked questions (FAQs) about the Columbus Consolidated Government Tax Form

Questions frequently arise regarding mistakes on submissions. If you notice an error after filing, it is important to contact the Finance Department promptly. Furthermore, should individuals find themselves unable to pay owed taxes, they should seek advice on payment plans to prevent penalties from accruing. Understanding these aspects helps relieve some of the stress associated with tax season.

Additional forms related to Columbus tax filings

For comprehensive tax compliance, residents may need supplementary forms such as the Excise Tax Form, applicable for specific industries. Understanding additional requirements can ensure that all your bases are covered when it comes to local taxation.

Connecting with tax support and resources in Columbus

Individuals requiring assistance are encouraged to connect with the Tax Commissioner’s Office. The office is well-equipped to provide support and information relevant to file compliance. Additionally, engaging in community workshops can empower individuals to better understand the tax process—both for personal and business filings.

Conclusion of the filing process and next steps

Once you’ve successfully submitted your Columbus Consolidated Government Tax Form, it is crucial to track your tax return status. Keep copies of all documentation, submit electronically for quicker processing, and await any communication from the tax office regarding your return. Understanding what to expect next ensures peace of mind.

Interactive tools and resources on pdfFiller

With pdfFiller, users can take advantage of advanced document management tools. From template creation to collaborative editing, the platform provides a seamless experience for all tax-related documentation tasks. Leverage these features to enhance efficiency in your ongoing tax management needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify columbus consolidated government tax without leaving Google Drive?

Where do I find columbus consolidated government tax?

Can I sign the columbus consolidated government tax electronically in Chrome?

What is columbus consolidated government tax?

Who is required to file columbus consolidated government tax?

How to fill out columbus consolidated government tax?

What is the purpose of columbus consolidated government tax?

What information must be reported on columbus consolidated government tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.