Get the free Midland Commons Tax Allocation District Fund Grant JMC

Get, Create, Make and Sign midland commons tax allocation

How to edit midland commons tax allocation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out midland commons tax allocation

How to fill out midland commons tax allocation

Who needs midland commons tax allocation?

Understanding the Midland Commons Tax Allocation Form: A Comprehensive Guide

Understanding the Midland Commons Tax Allocation Form

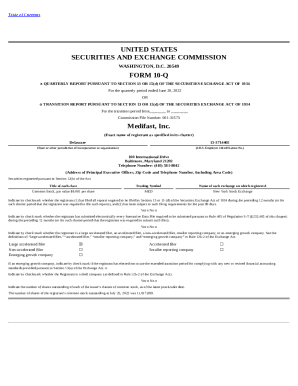

The Midland Commons Tax Allocation Form is a vital document used by municipalities for property tax planning and allocation purposes. It serves as a structured method to collect and allocate tax revenues generated from various properties within the Midland Commons area. This form is crucial in ensuring that tax revenues are appropriated accurately to support local projects, public services, and community development initiatives.

Properly filling out the Midland Commons Tax Allocation Form impacts not only the municipality's financial health but also social services that benefit residents. By ensuring efficient tax allocation, the form helps cities maintain infrastructure, provide essential services, and support local economies, thereby underscoring its importance in the tax allocation process.

Who needs to complete the Midland Commons Tax Allocation Form?

The Midland Commons Tax Allocation Form is essential for various stakeholders involved in property taxation. This includes property owners, municipal finance and planning teams, local government officials, and even real estate developers who are involved in property projects within the region. These individuals need to clearly understand their roles and responsibilities regarding tax allocations.

Eligibility to fill out this form typically requires the individual or team to be actively engaged in tax-related processes or decisions. For example, failure to complete this form as required can lead to non-compliance issues, including potential audits, fines, or complications in property assessments. Therefore, it is essential for the right audience to ensure their compliance by completing the Midland Commons Tax Allocation Form accurately.

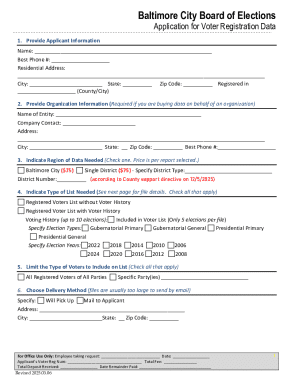

How to access the Midland Commons Tax Allocation Form

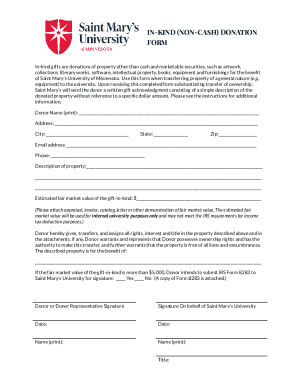

Accessing the Midland Commons Tax Allocation Form is straightforward. The form can typically be obtained online through local municipal websites. Additionally, several platforms, like pdfFiller, simplify the process by offering easy access and comprehensive document management tools. Users can find the tax allocation form by navigating to the relevant local government page or using a search engine.

To streamline the process of obtaining the form, pdfFiller allows users to access a digital version of the Midland Commons Tax Allocation Form. Users can download it as a PDF, making it easier to fill out and print as needed. For those unfamiliar with the downloading process, below are some simple steps:

Step-by-step instructions for filling out the Midland Commons Tax Allocation Form

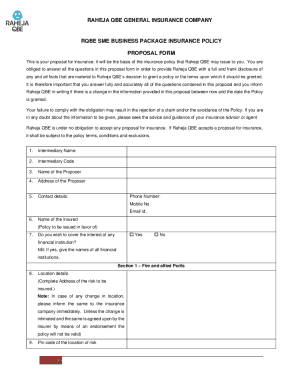

Filling out the Midland Commons Tax Allocation Form can seem daunting at first, but breaking it down into sections makes this process manageable. The form generally contains key areas requiring specific information. Here’s a detailed guide on successfully completing the form:

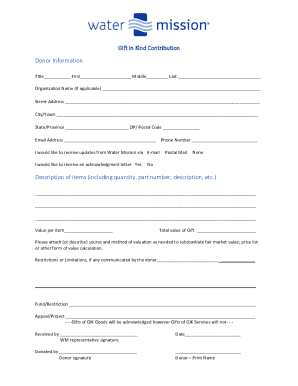

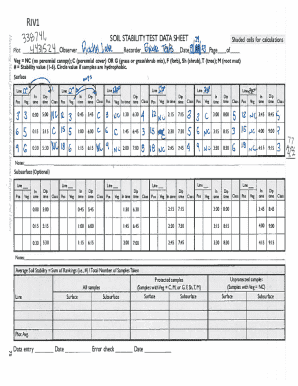

The first section usually calls for identification and contact information. Provide accurate details for both the individual completing the form and any associated organization. Following this, the tax allocation details section requires specifics regarding property values, anticipated revenue, and the allocated tax amounts. Make sure to refer to supporting documentation that may be necessary. Providing accurate figures is paramount to avoid discrepancies that may complicate the submission.

To enhance the accuracy of the submission, it is advisable to double-check all entered information. Minor errors can lead to processing delays or rejections. Keeping a checklist of required documents and reviewing the form before submission will help ensure completeness and accuracy.

Editing and managing the Midland Commons Tax Allocation Form with pdfFiller

pdfFiller offers a user-friendly platform that not only allows you to fill out the Midland Commons Tax Allocation Form but also provides engaging editing tools. Using pdfFiller’s suite, users can easily edit text, add checkmarks, and insert notes directly into the document. This flexibility is particularly useful when collaborating with others who might provide feedback on the form.

To edit the form within pdfFiller, follow these steps:

Once satisfied with the completed form, add a digital signature for authenticity. The eSigning feature in pdfFiller allows users to quickly and securely sign documents online, eliminating the need for printing and scanning. This not only saves time but also streamlines the entire process of document management.

Collaborative features for teams

Collaboration becomes effortless with pdfFiller's tools. Multiple team members can work on the Midland Commons Tax Allocation Form simultaneously, reducing the tedious back-and-forth often associated with document edits. Team leaders can assign roles, ensuring each person knows their responsibilities while contributing to the project.

To effectively share the form with team members within pdfFiller, follow these guidelines:

Additionally, pdfFiller enables users to track changes and comments made by each collaborator, fostering transparent communication. The use of comment features can also clarify the rationale behind specifics within the form, ensuring everyone is on the same page.

Frequently asked questions about the Midland Commons Tax Allocation Form

Common queries about the Midland Commons Tax Allocation Form often arise. Users might wonder how to rectify mistakes or what to do if they encounter difficulties while completing the form. Understanding these FAQs can enhance confidence while navigating tax-related processes.

For other concerns about form usage, users are encouraged to consult the pdfFiller support center that provides detailed resources, including troubleshooting tips. Issues may range from technical difficulties with form uploads to miscommunication regarding tax details.

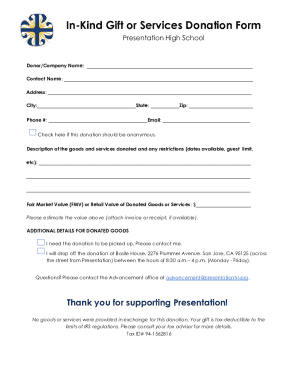

Best practices for submitting the Midland Commons Tax Allocation Form

Preparing your Midland Commons Tax Allocation Form for submission is just as critical as filling it out accurately. Before sending the form to the relevant authority, ensure that you have thoroughly reviewed all fields. Common areas requiring attention include matching submitted numbers with property valuations and ensuring that all supporting documentation is attached.

Understanding various submission channels can also streamline the process. The form may typically be submitted either online, via mail, or in person at designated offices. Familiarize yourself with the specific requirements to ensure compliance with submission deadlines and procedures.

Case studies: Successful use of the Midland Commons Tax Allocation Form

Real-life examples can be quite enlightening when understanding the utility of the Midland Commons Tax Allocation Form. One meaningful case involved a local nonprofit organization that successfully utilized the form to secure tax allocation for funding a community park project. By meticulously filling out the form and supporting it with relevant documentation, they expedited the approval process and pooled community support.

Lessons learned from their experience emphasized the importance of accuracy, timely submission, and understanding of community needs when filling out forms. Their experience demonstrates how proper use of the Midland Commons Tax Allocation Form can lead to significant community benefits.

Conclusion of the Midland Commons Tax Allocation Form process

After submitting the Midland Commons Tax Allocation Form, it's essential to anticipate follow-up actions. This may include communication from municipal authorities regarding the status of your tax allocation request. Understanding how to monitor the status can help in planning subsequent financial aspects effectively.

Adopting a proactive approach by keeping an eye on expected timelines and maintaining communication with officials can assure that the allocation dollars arrive as planned. This, in turn, supports proper fiscal planning for both individuals and local governments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit midland commons tax allocation online?

How do I edit midland commons tax allocation on an iOS device?

How do I fill out midland commons tax allocation on an Android device?

What is midland commons tax allocation?

Who is required to file midland commons tax allocation?

How to fill out midland commons tax allocation?

What is the purpose of midland commons tax allocation?

What information must be reported on midland commons tax allocation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.