Get the free COLUMBUS TAX ALLOCATION DISTRICT COMMITTEE

Get, Create, Make and Sign columbus tax allocation district

How to edit columbus tax allocation district online

Uncompromising security for your PDF editing and eSignature needs

How to fill out columbus tax allocation district

How to fill out columbus tax allocation district

Who needs columbus tax allocation district?

Understanding the Columbus Tax Allocation District Form

Understanding the Columbus Tax Allocation District (TAD) Form

A Tax Allocation District (TAD) is a designated area within a municipality where incremental tax revenues generated from increased property values are used to finance public infrastructure improvements and community development projects. These enhancements often stimulate economic growth by attracting businesses and residents, thereby increasing overall tax revenue for the local government.

The Columbus TAD Form plays a crucial role in this process. It is utilized by property owners and developers to petition for the establishment or amendment of a tax allocation district. By completing this form, parties can facilitate funding for infrastructure that benefits the community, such as roads, parks, and public transit.

Key components of the Columbus TAD Form

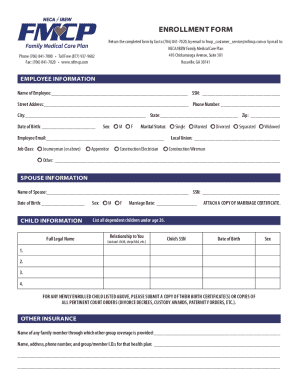

The Columbus TAD Form requires specific information to ensure the proper evaluation of the proposed district. Critical components include property details, the owner's information, and relevant financial data pertaining to the district's anticipated revenue generation.

Supporting documentation is equally important, as it must accompany the TAD form to establish credibility and context. Common documents include property tax assessments, previous development plans, and letters of intent from stakeholders. Failing to provide complete documentation can lead to delays or rejection of the application.

Step-by-step guide to completing the Columbus TAD Form

Completing the Columbus TAD Form can seem daunting, but following a structured approach simplifies the process. Begin by collecting all necessary information from the checklist, which includes property details and owner information. This groundwork ensures that you have everything you need to proceed efficiently.

Once you have compiled the data, fill out each section of the form methodically, ensuring accuracy in all entries. Reviewing the information before submission is crucial; errors can lead to setbacks. Confirm that all entries conform to the requirements laid out by the Columbus planning department.

Finally, the submission process offers various options. You can submit the form online through the city’s portal, send it by mail, or deliver it in person to the appropriate office. Remember to adhere to submission deadlines which are typically outlined on the TAD Form itself.

Interactive tools for Columbus TAD form users

Utilizing interactive tools enhances the experience of completing the Columbus TAD Form. Platforms like pdfFiller offer features that simplify the form-filling process. With user-friendly interfaces, individuals can easily navigate through the form, ensuring that every section is completed accurately.

Additionally, participants can benefit from collaborative tools that allow multiple users to edit or comment on the form before submission. This ensures that all stakeholders have input, ultimately leading to a more comprehensive application.

Electronic signature integration through pdfFiller makes it easy to sign documents securely without the need for printing or scanning. This not only expedites the submission process but also contributes to a greener approach by reducing paper waste.

Common challenges when using the Columbus TAD form

Navigating the Columbus TAD Form is not without its challenges. Many users have questions regarding specific details required on the form, such as how to accurately report projected revenue increases or whom to contact for more clarification.

Common pitfalls often stem from misinterpretation of guidelines or use of outdated forms. Errors can lead to unnecessary delays and frustration. Therefore, it’s essential to ensure that you are using the most current version of the form and that you understand the requirements fully.

Best practices for successfully managing your Columbus TAD form

Following best practices enhances your experience with the Columbus TAD Form and ensures that submissions are handled efficiently. First, effective tracking of submitted forms is crucial. Maintain records of all forms with dates and notes on submission details to easily reference as needed.

Understanding the follow-up procedures is equally vital; knowing how to check the status of your submission can help in avoiding unnecessary worry or delays. After submission, keep an eye out for any communication from local authorities regarding your application, as timely responses may be required.

Leverage tools provided by pdfFiller for ongoing management of your documents. The platform's continuous access and editing capabilities allow you to make necessary adjustments to your forms if requirements change or new information arises.

Additional considerations for stakeholders

For property owners and developers, understanding the implications of the Columbus TAD Form is paramount. The financial impact can be significant, as proper utilization can pave the way for possible funding opportunities for future projects. This understanding extends to how enhanced infrastructure positively influences property values and development potential.

Local governments benefit from TADs through increased revenue generation, allowing for reinvestment into community resources. The establishment of a TAD creates a win-win scenario, as public services improve which, in turn, attracts more businesses and families to the area.

Looking ahead, the future of TAD utilization may witness evolving practices and possible legislative updates that could affect how these districts operate. Staying informed about these changes is critical for all stakeholders involved.

Conclusion

In summary, utilizing the Columbus TAD Form can significantly enhance community engagement and development. By understanding the form’s intricacies and leveraging digital tools like pdfFiller, users can streamline their application process and facilitate desirable outcomes for community infrastructure projects.

As more individuals and teams recognize the value of efficient document management, taking advantage of resources such as pdfFiller not only simplifies the process but also drives community growth.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get columbus tax allocation district?

How do I complete columbus tax allocation district online?

How do I make changes in columbus tax allocation district?

What is columbus tax allocation district?

Who is required to file columbus tax allocation district?

How to fill out columbus tax allocation district?

What is the purpose of columbus tax allocation district?

What information must be reported on columbus tax allocation district?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.