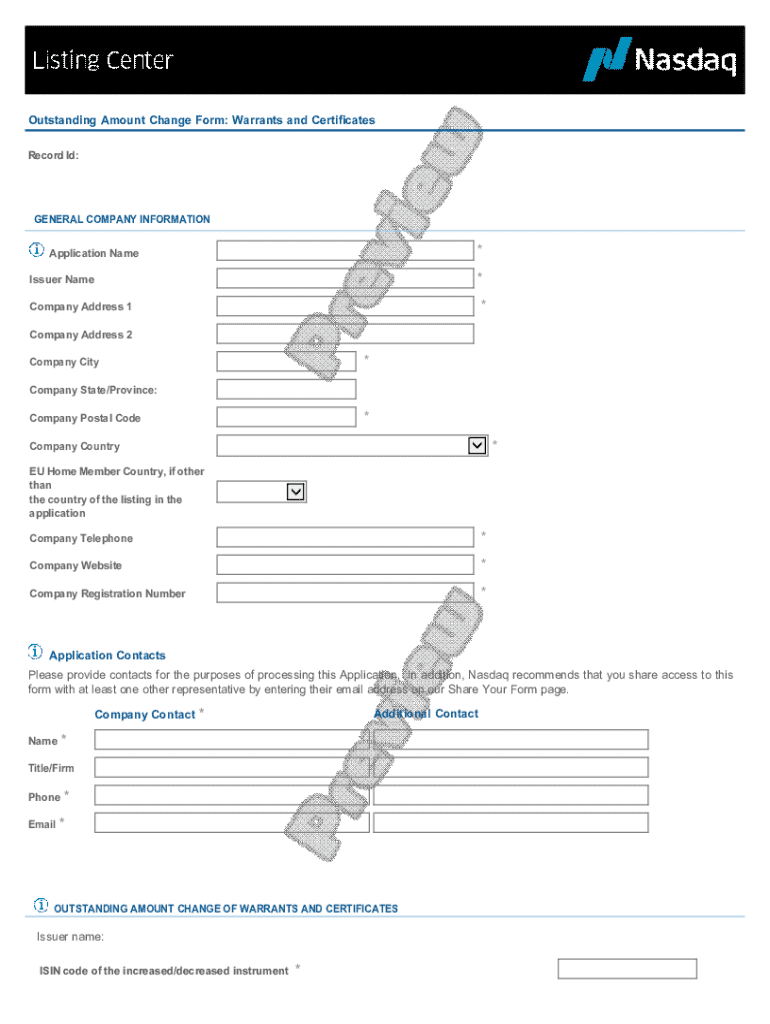

Get the free Outstanding Amount Change Form: Warrants and Certificates

Get, Create, Make and Sign outstanding amount change form

How to edit outstanding amount change form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out outstanding amount change form

How to fill out outstanding amount change form

Who needs outstanding amount change form?

How to Complete the Outstanding Amount Change Form

Understanding the outstanding amount change form

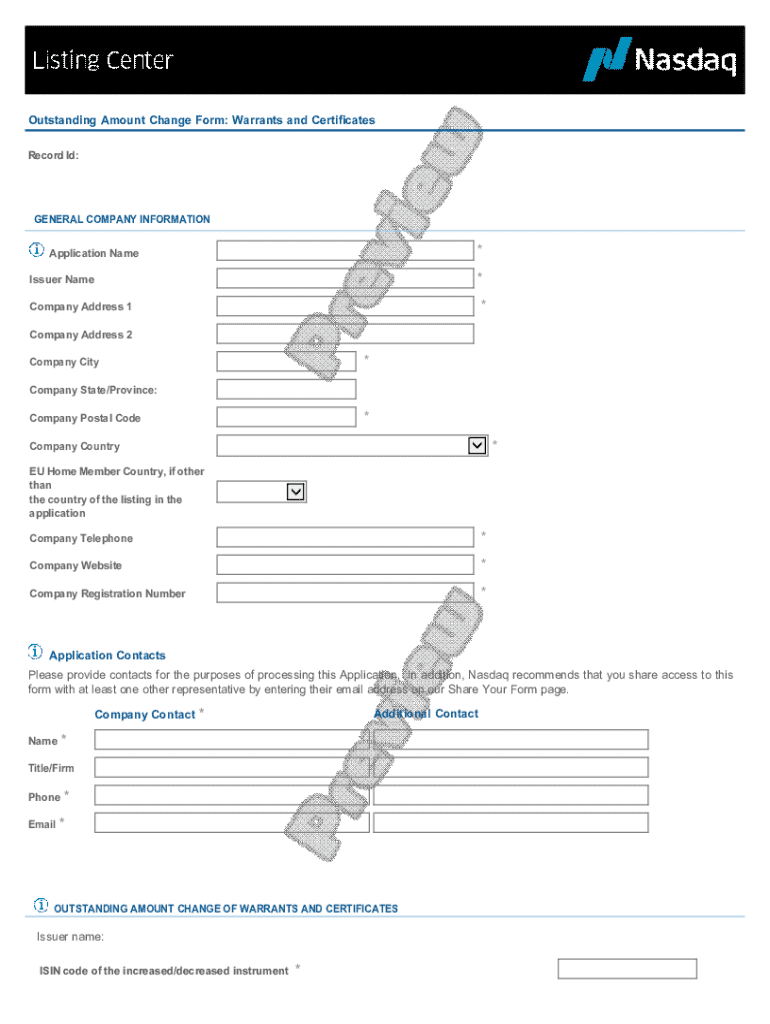

The outstanding amount change form is a crucial document that allows individuals or businesses to request modifications to their reported outstanding debt values. This form serves as a formal request to update the creditors on the current status of financial obligations, ensuring that both parties are on the same page regarding the owed amounts.

Keeping outstanding amounts updated is important as it directly impacts credit scores, negotiations with creditors, and overall financial health. Failure to report accurate information may lead to misunderstandings, increased interest rates, or potential legal issues. Common reasons for submitting this form include changes in payment schedules, renegotiations of debt terms, or the settling of debts that necessitate an updated outstanding amount.

Preparing to fill out the form

Before diving into the completion of the outstanding amount change form, it's essential to gather all necessary documentation. You will need previous statements that outline your current outstanding balances, correspondence with creditors discussing any changes or agreements, and relevant payment records. Collecting these items ensures that you have all the information at hand to accurately report your current financial situation.

Familiarizing yourself with key terms related to outstanding amounts is equally important. Terms like ‘outstanding amount’ refer to the total sum you owe, while ‘satisfactory settlement’ indicates an agreement reached to resolve a debt. Understanding these concepts helps frame your request appropriately and ensures that you can fill out the form without misunderstanding its implications.

Step-by-step instructions for completing the form

Accessing the outstanding amount change form usually begins with identifying where it is available online. On pdfFiller, users can locate the form easily through the search menu, or it can be downloaded directly in PDF or other accessible formats. Convenient access contributes to a smoother, more efficient filling process.

Begin filling in your personal information in the fields provided. Required fields typically include your name, address, and contact information. Accurately entering these details is crucial, as any discrepancies may delay processing your request.

When detailing the outstanding amount, clearly report your current balance and the proposed new amount. It's paramount to ensure that these figures are accurate as creditors rely on them for decision-making concerning your account.

Providing justification for the change is a key part of the process. Transparency here can facilitate smoother negotiations. Valid justifications may include a change in income, a significant life event affecting your finances, or successfully negotiating a lower payment plan with creditors.

You’ll need to list all creditors associated with the outstanding amount, ensuring that you include accurate information about each party involved. This step is vital for maintaining clear communication and ensuring that all affected parties are aware of the changes.

Finally, complete the signature section. With pdfFiller, you can eSign the form conveniently, ensuring that your submission is final and legally binding. If additional signatures are needed, ensure that these are procured before submission to avoid any complications.

Managing your completed form

Once you've filled out the outstanding amount change form, manage your completed document by saving it securely in a cloud-based storage system. This not only prevents loss but also allows for easy access in the future if needed. Sharing the form with creditors and other stakeholders should be done securely to protect sensitive information.

It's crucial to ensure compliance with any legal requirements after submission. This may include following up with creditors to confirm receipt and understanding of your changes. Create a log to track any further correspondence or additional paperwork you may need to submit.

Common errors to avoid when submitting the form

Be mindful of some common errors when submitting your outstanding amount change form. Incomplete or inaccurate information can lead to delays or denial of your request. Double-check that all required fields are filled in correctly, and ensure that the numbers you provide match any accompanying documentation.

Neglecting to sign the form is another frequent oversight. Be sure that you have filled out the signature section, as this is essential for your submission to be processed. Moreover, failing to attach necessary supporting documentation can undermine your request, so always include relevant proof to back up your claims.

Frequently asked questions about the outstanding amount change form

After submitting your change request, you may wonder what happens next. Typically, the form is processed by creditors who will review the justification and may reach out for further clarification. It’s wise to maintain regular communication with creditors during this period to address any further inquiries.

The response timecan vary depending on the creditor's policies, but you should expect to wait at least a few weeks for a response. If you're thinking of making multiple changes to your outstanding amounts, know that this may complicate matters; it's often better to consolidate requests to avoid confusion.

Leveraging pdfFiller for your document needs

Using pdfFiller for document management streamlines the process of handling forms like the outstanding amount change form. The platform’s versatile tools allow you to edit, eSign, and securely store documents all from one cloud-based portfolio, offering unparalleled convenience and organization.

Beyond editing capabilities, pdfFiller enhances the documentation process through features like collaboration tools, which allow multiple users to review and comment on documents. Users have shared success stories about effectively managing their outstanding amounts through pdfFiller’s services, highlighting how the platform helped them stay organized and timely in their responses to creditors.

Additional tips for managing outstanding amounts

Regularly tracking changes and updates to your financial documents is vital. Maintaining an organized log of your outstanding amounts ensures you stay on top of any necessary adjustments and can help prevent future discrepancies with creditors.

Setting reminders for follow-ups after submitting the change form can keep your finances and interactions with creditors on track. Consider utilizing available online resources or subscription-based services that offer debt advice. These may provide insights into current debt trends and suggestions for improvements in financial management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find outstanding amount change form?

How do I edit outstanding amount change form in Chrome?

Can I create an electronic signature for the outstanding amount change form in Chrome?

What is outstanding amount change form?

Who is required to file outstanding amount change form?

How to fill out outstanding amount change form?

What is the purpose of outstanding amount change form?

What information must be reported on outstanding amount change form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.