Get the free Secured Property Tax Roll - State of Nevada

Get, Create, Make and Sign secured property tax roll

How to edit secured property tax roll online

Uncompromising security for your PDF editing and eSignature needs

How to fill out secured property tax roll

How to fill out secured property tax roll

Who needs secured property tax roll?

Secured Property Tax Roll Form: A Comprehensive How-to Guide

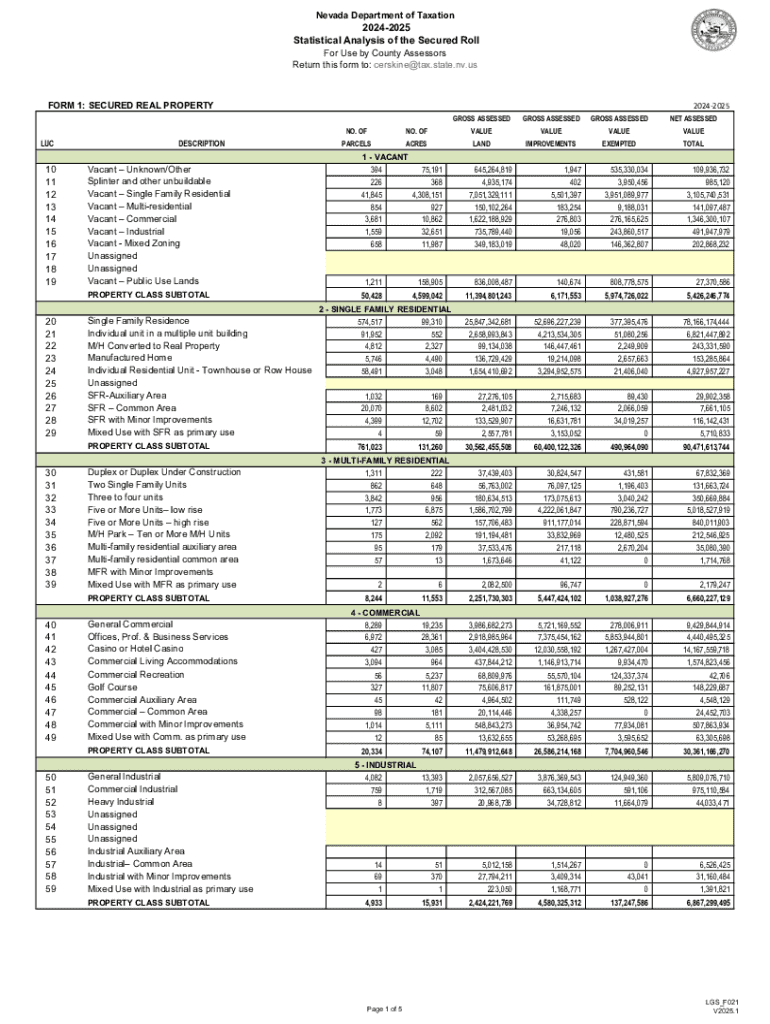

Understanding the secured property tax roll form

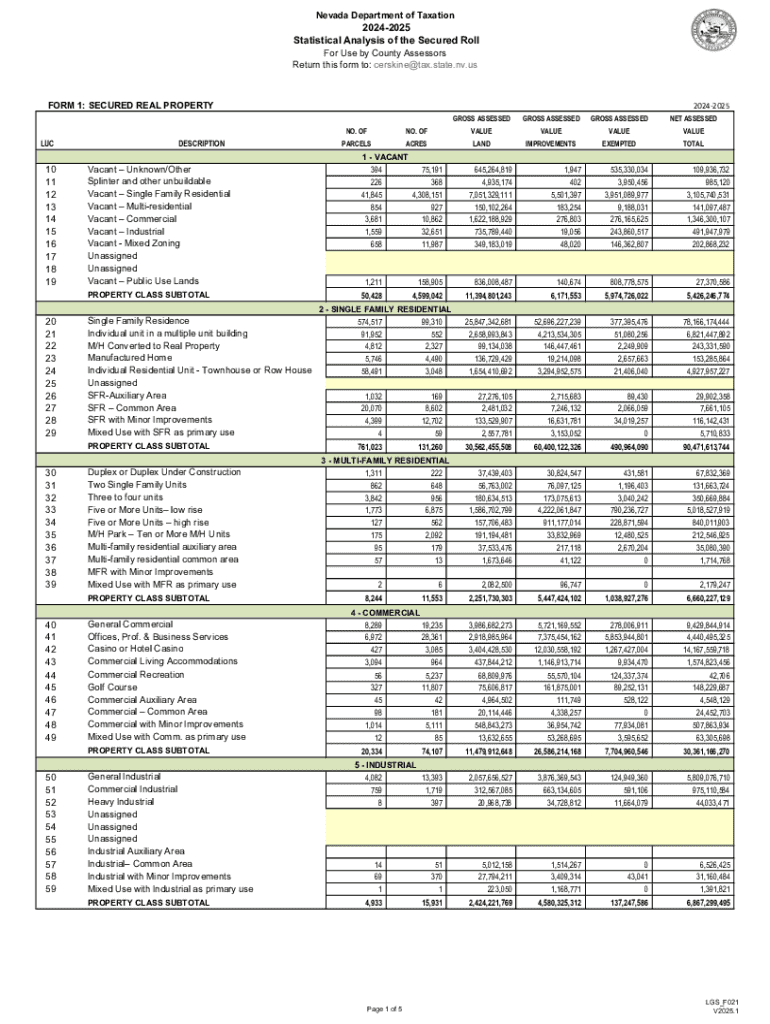

The secured property tax roll form is a critical document used in real estate taxation. It serves as a record for all properties that owe taxes to local governments, ensuring that property owners fulfill their fiscal responsibilities. This form is pivotal because it not only affects individual property taxes but also impacts local funding for schools, infrastructure, and public services.

The secured property tax roll form captures essential details such as property descriptions, ownership information, and assessed values. By accurately filling out this form, property owners help ensure that their tax obligations reflect the true value of their possessions, allowing for fair taxation.

When to use the secured property tax roll form

There are specific scenarios that necessitate the use of the secured property tax roll form. Primarily, it is required when purchasing a property, as new owners must register their ownership and related tax responsibilities. Additionally, it is essential when there are changes in property ownership, such as transfers or inheritances.

Another important use of the secured property tax roll form is for applying for tax exemptions. For instance, individuals seeking exemptions due to senior status or low income must submit this form to indicate their eligibility.

It is crucial to be aware of deadlines related to the submission of this form. Property owners should check local tax authority websites to ensure timely filing and avoid penalties.

Components of the secured property tax roll form

The secured property tax roll form consists of several components that collect essential information. Each section is designed to capture specific details required for proper tax assessment and transparency.

Each component plays a vital role in determining the overall tax liability, ensuring that all data is correctly assessed and reflected in local tax records.

Step-by-step instructions for completing the form

Completing the secured property tax roll form can be simplified by following a methodical approach. Begin by gathering all necessary personal and property information to ensure accuracy and completeness.

Following these steps will facilitate a smoother process, minimizing potential errors that could lead to delays or penalties.

Editing and managing your secured property tax roll form using pdfFiller

pdfFiller provides a user-friendly platform for accessing and creating secured property tax roll forms. Users can easily navigate through the document options to find the specific form they need.

Utilizing interactive tools in pdfFiller allows for effective document editing. Users can add text, images, and signatures, making it easy to personalize the form as needed.

These functionalities ensure seamless management of your tax roll documents without the need for costly software solutions.

Signing and submitting the secured property tax roll form

Once you've completed your secured property tax roll form, signing it electronically is a straightforward process using pdfFiller. The platform offers integrated e-signing capabilities that ensure your document is legally binding without the hassle of printing or scanning.

After signing, you have multiple submission options. Be sure to consult local guidelines regarding how and where to submit your form. Tracking your submission and confirming receipt is equally important to avoid any issues later.

Common pitfalls and how to avoid them

Filling out the secured property tax roll form can seem daunting, but certain pitfalls can be avoided with careful attention. A common mistake is submitting incomplete information, which can lead to processing delays.

Additionally, incorrect property identification can result in significant errors in tax assessments. To mitigate these risks, double-check all entries and ensure that you cross-reference your details with official records.

Tax due dates and avoiding late fees

To prevent costly late fees, understanding key tax deadlines related to the secured property tax roll is essential. These deadlines vary by jurisdiction, and property owners must stay informed about relevant dates to avoid unnecessary penalties.

One proactive strategy is to sign up for email reminders and alerts from local tax authorities to keep track of approaching deadlines, ensuring no critical submission dates are missed.

Special considerations: Senior or low-income tax exemptions

For applicants seeking tax exemptions, understanding the eligibility criteria is vital. Many jurisdictions offer tax relief for seniors or low-income individuals, granting significant savings on property taxes.

To effectively submit exemption requests alongside your secured property tax roll form, ensure you include all necessary documentation and evidence of eligibility. Failure to provide adequate documentation can hinder the review process.

Frequently asked questions

Inquiries about the secured property tax roll form are common, especially regarding updates after submission. If you find yourself in a situation where you need to update your information, it is necessary to contact your local tax authority directly for guidance.

Another frequent question involves the process for appealing property tax decisions. Each jurisdiction has specific guidelines; thus, researching your local regulations can provide clarity on appeals and help you navigate the process effectively.

Staying informed and engaged

It’s important for property owners to stay engaged with updates regarding changes in property tax regulations. Subscribing to newsletters or updates from local tax authorities can provide timely information about new policies or adjusted tax rates.

Following local Treasurer-Tax Collector's blogs or social media pages can further assist in staying informed, offering insights and announcements directly from the source.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit secured property tax roll from Google Drive?

How can I send secured property tax roll to be eSigned by others?

How do I execute secured property tax roll online?

What is secured property tax roll?

Who is required to file secured property tax roll?

How to fill out secured property tax roll?

What is the purpose of secured property tax roll?

What information must be reported on secured property tax roll?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.