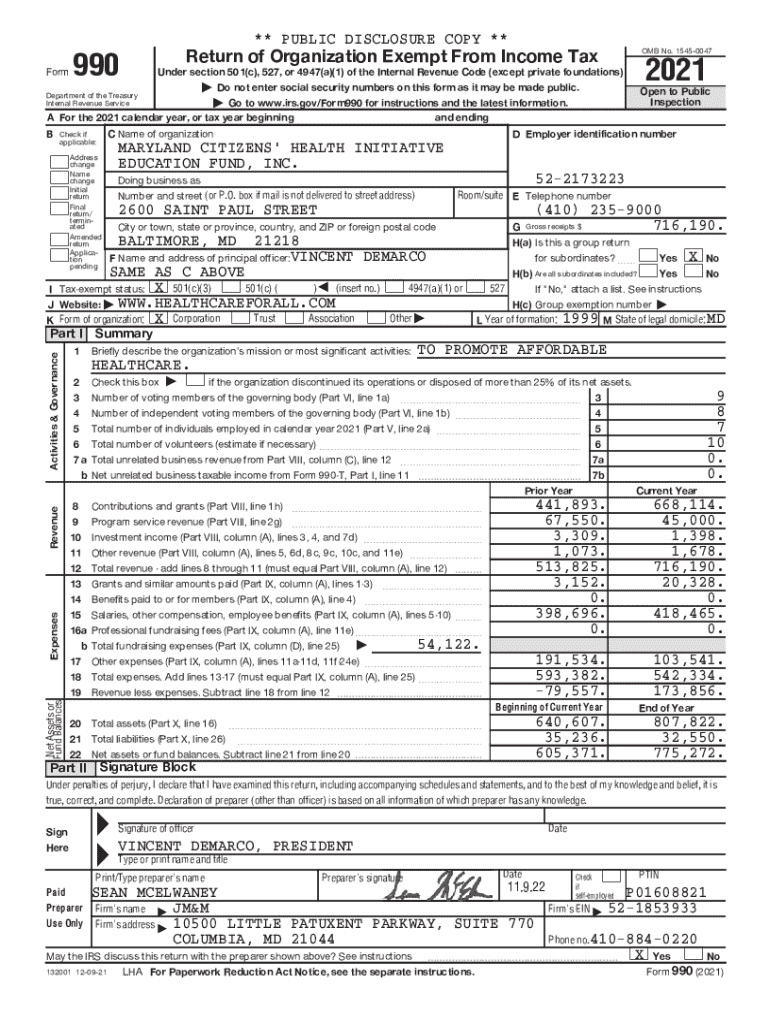

Get the free F.rm 990 Return of Organjzatjon Exempt From Income Tax

Get, Create, Make and Sign frm 990 return of

Editing frm 990 return of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out frm 990 return of

How to fill out frm 990 return of

Who needs frm 990 return of?

Understanding the frm 990 return of form: A Comprehensive Guide

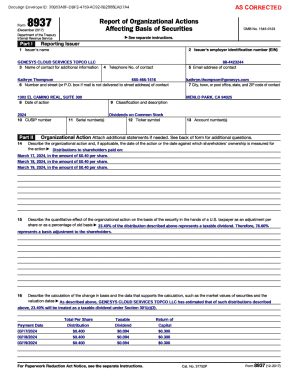

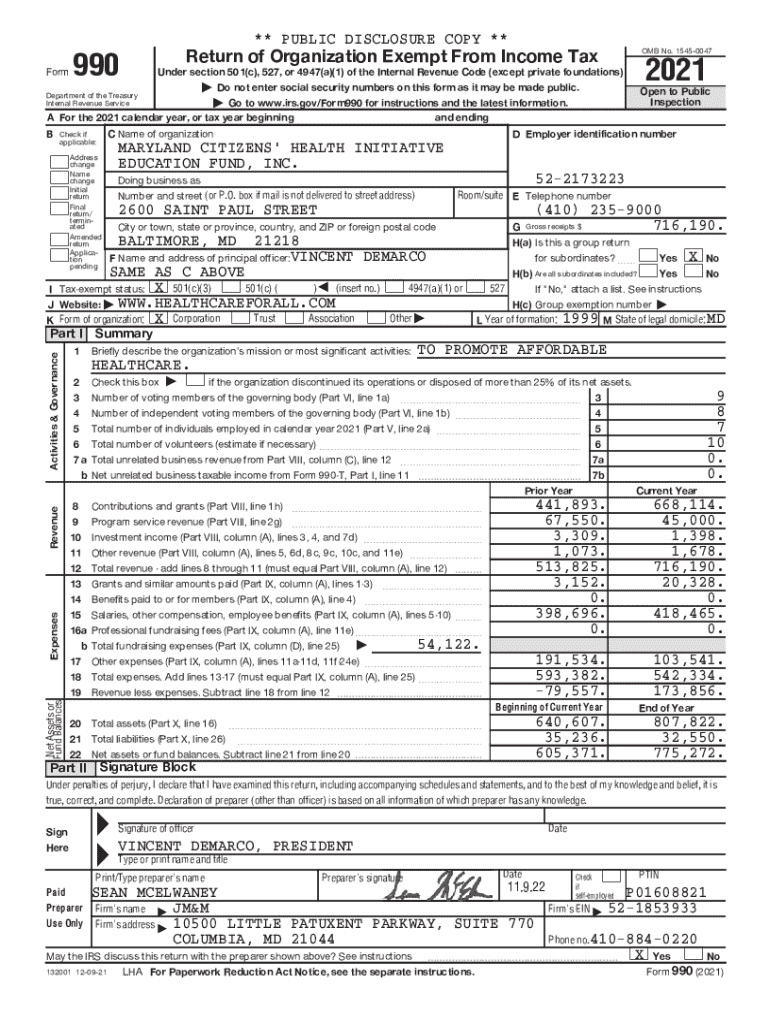

Understanding Form 990: An overview

Form 990 is a crucial document for tax-exempt organizations in the United States. It serves as an informative return filed with the Internal Revenue Service (IRS) that provides transparency about an organization's financial activities to the public. Nonprofits must file this form annually to maintain their tax-exempt status, demonstrating that they are operating within the confines of the law and effectively utilizing funds in alignment with their mission.

The significance of Form 990 extends beyond compliance; it plays a vital role in assuring stakeholders of the nonprofit's fiscal responsibility. By providing thorough financial disclosures and details about programs and governance, organizations can build trust with donors, beneficiaries, and regulatory agencies.

Who needs to file Form 990?

Most tax-exempt organizations, including charities and foundations, are required to file Form 990 annually unless they fall under specific thresholds. These organizations include public charities, private foundations, and other nonprofit entities. Typically, those with gross annual receipts of $200,000 or more or total assets exceeding $500,000 are mandated to file the full Form 990. Smaller organizations may qualify to file the simpler Form 990-N (e-Postcard) if their annual gross receipts remain below $50,000.

Moreover, there are exceptions for certain groups such as churches, state institutions, and other specific entities, which might have different filing requirements. Understanding whether your organization needs to file is fundamental to ensuring compliance and maintaining a good standing with the IRS.

Components of Form 990

Form 990 consists of multiple parts that, together, paint a comprehensive picture of an organization’s financial health and activities. Each section delivers critical insights into different facets of operations, helping stakeholders to gauge transparency and accountability.

The key components include the summary of the organization, an overview of financial information, a detailed account of program service accomplishments, and disclosures regarding governance and management practices. Additionally, there are several required schedules that accompany the form to address more specific topics.

Required schedules and attachments

To provide additional insights, various schedules must be completed, depending on the organization's activities and structure. For instance, Schedule A must be filled out to demonstrate public charity status, while Schedule B lists significant contributors to maintain transparency with donors. Each schedule plays an essential role in clarifying specific operational aspects, especially regarding political activities or fundraising efforts.

Additional schedules, such as Schedule C, focus on political advocacy, and Schedule G addresses professional fundraising services, highlighting the nuanced requirements that different organizations must navigate.

Step-by-step guide to completing the form

Successfully filing Form 990 requires meticulous preparation and organization of documentation. Initial steps include gathering financial statements that provide a snapshot of the organization’s income, expenses, and net assets. Additionally, information about the board of directors, including members' qualifications and roles, is essential, along with a comprehensive list of program activities.

Once information is compiled, each section of the form can be approached with careful attention. For instance, Part I requires a concise summary of the mission and key actions taken during the fiscal year. When filling out Part II, providing accurate and honest financial totals is paramount to avoid discrepancies that could lead to compliance issues.

Common mistakes to avoid

As with any complex form, there are pitfalls that organizations should seek to avoid during the completion of Form 990. One common mistake is submitting incomplete information or discrepancies between different sections of the form. It is crucial that numbers align and that all scheduled attachments are included, as incomplete filings can result in penalties.

Timely filing is another critical aspect. Organizations should be well aware of the deadlines and consider applying for an extension if time constraints are an issue. Misclassifying the type of organization can also lead to filing errors; therefore, always ensure the classification aligns with IRS guidelines.

Tools and resources for Form 990 preparation

Preparing and filing Form 990 can be streamlined using various tools and resources, particularly those offered by pdfFiller. This platform provides interactive tools that facilitate easy editing of Form 990, making document management less daunting. Users can also take advantage of eSigning capabilities, ensuring secure and compliant authorization before submission.

Additionally, pdfFiller supports collaboration among team members, allowing multiple inputs and feedback on the document before it is finalized. Software integrations, particularly with accounting tools, can enhance accuracy and save time, while document storage solutions ensure that important files are organized and retrievable when needed.

Filing Form 990

Once Form 990 is completed, organizations must decide on submission methods. E-filing has become increasingly popular due to its advantages, including faster processing times and immediate confirmation of receipt. The IRS provides designated software providers for e-filing, ensuring that organizations can complete their submission electronically and efficiently.

For those opting for traditional mailing, ensure that documents are sent to the correct address as specified by the IRS and allow adequate time for postal delivery. Tracking the submission afterward is essential; organizations should keep records of submissions and follow up on the status post-filing to confirm acceptance and address any potential issues promptly.

Post-filing responsibilities

After filing Form 990, organizations must adhere to annual compliance requirements to maintain their tax-exempt status. This includes keeping meticulous records of all financial activities, governance documents, and program operations. Ongoing financial management is vital, as it lays the groundwork for future filings and ensures that all changes in operations are properly documented and reported.

Understanding public access to Form 990 is crucial for nonprofits since this transparency is integral to their legitimacy. Organizations must be prepared for scrutiny, knowing that the public can access these forms through platforms like Guidestar or the IRS's own website. This public access not only fosters accountability but can also impact donor confidence.

Frequently asked questions (FAQs)

Common inquiries surrounding Form 990 often involve concerns about deadlines, corrections, and penalties. Organizations that miss the filing deadline should be proactive in addressing potential penalties. Filing an extension can mitigate immediate consequences, but organizations must ensure that they follow up with a complete submission promptly to avoid further issues.

If an error is discovered after submission, organizations can file an amended Form 990. It's vital to act swiftly in correcting any discrepancies to remain in compliance with IRS regulations. Understanding the implications of non-compliance, such as penalties and loss of tax-exempt status, is critical for nonprofit leaders.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in frm 990 return of without leaving Chrome?

Can I create an electronic signature for the frm 990 return of in Chrome?

Can I create an eSignature for the frm 990 return of in Gmail?

What is frm 990 return of?

Who is required to file frm 990 return of?

How to fill out frm 990 return of?

What is the purpose of frm 990 return of?

What information must be reported on frm 990 return of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.