Get the free 2024 Dependent Form

Get, Create, Make and Sign 2024 dependent form

Editing 2024 dependent form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 dependent form

How to fill out 2024 dependent form

Who needs 2024 dependent form?

2024 Dependent Form: Your Comprehensive How-to Guide

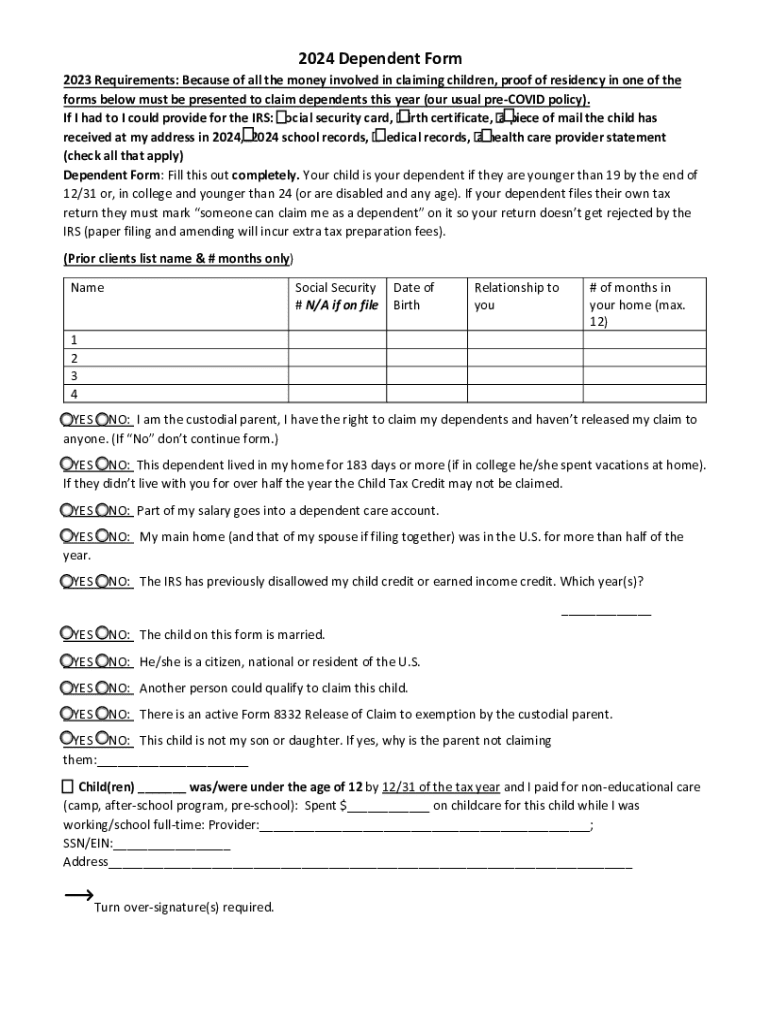

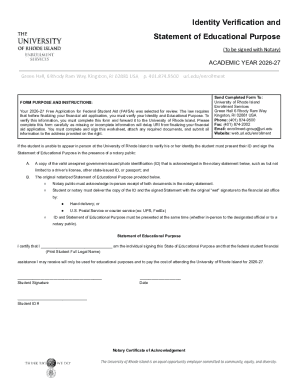

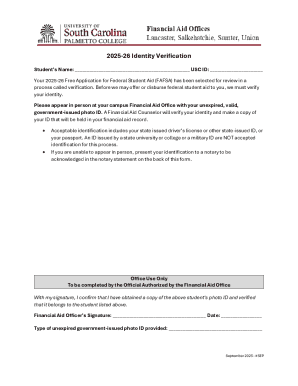

Understanding the 2024 dependent form

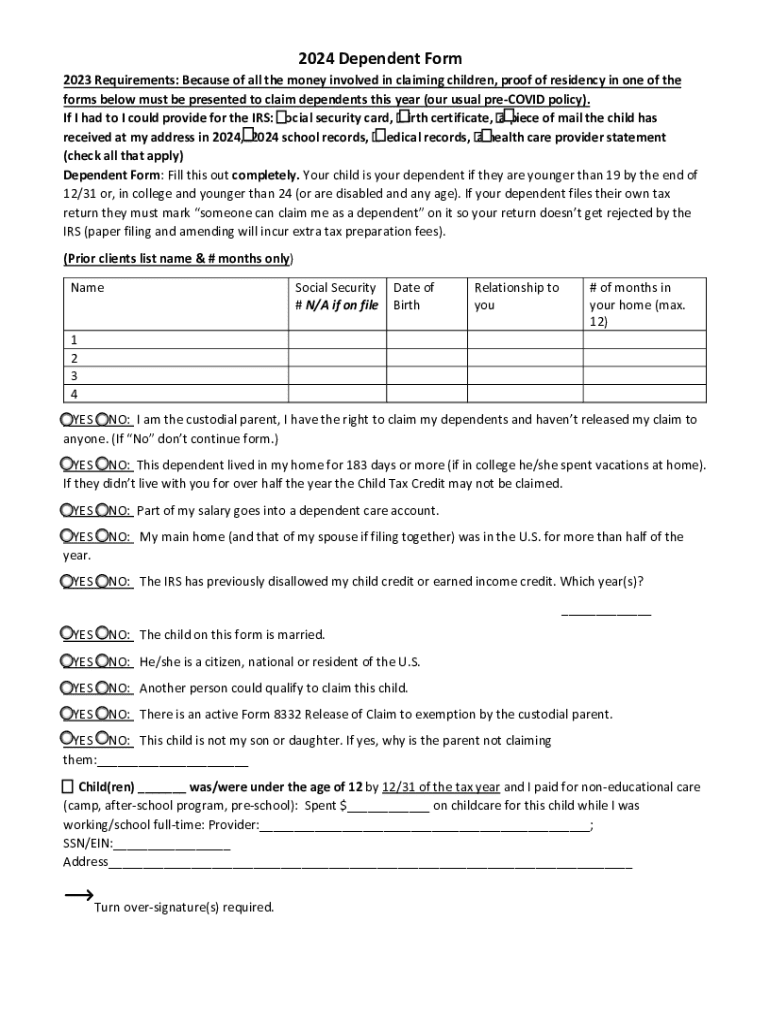

The 2024 Dependent Form is a crucial component for anyone planning to file their taxes accurately this year. This form officially identifies individuals whom taxpayers are claiming as dependents, which is a significant aspect of personal income tax returns. A dependent can be a child or a relative who lives with the taxpayer and for whom they provide more than half of the financial support.

Understanding this form is particularly important in the 2024 tax filing season due to updates in tax laws and changes in eligibility criteria. Familiarizing yourself with the specifics of the 2024 dependent form can help ensure you take advantage of possible tax credits and benefits that come from claiming dependents.

Key changes from previous years include adjustments to income thresholds and eligibility requirements, which affect how many people can be claimed as dependents. This guide will break down all essential aspects related to the 2024 dependent form to simplify the process for you.

Why is the 2024 dependent form needed?

The 2024 dependent form is necessary for a variety of reasons centered around accurate tax reporting. Claiming dependents allows taxpayers to potentially reduce their taxable income and qualify for various tax credits and deductions, including the Child Tax Credit and the Earned Income Tax Credit, which can significantly lower your tax bill.

Eligibility to claim dependents is based on specific criteria, including their age, relationship to the taxpayer, residency status, and financial dependence. If you falsely claim individuals who do not meet these criteria, you risk facing penalties from the IRS, including payment of back taxes or fines.

Ultimately, the 2024 dependent form serves not merely as documentation but as a pathway to potential savings and avoidance of IRS complications.

Gathering necessary information for the 2024 dependent form

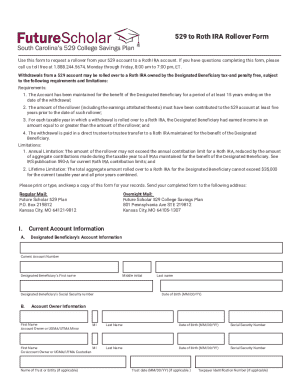

To accurately complete the 2024 dependent form, it is imperative to gather all necessary personal and financial information about your dependents. This process begins with compiling essential personal details, which include the full names and Social Security Numbers of your dependents as these are required for tax filing purposes.

Apart from personal information, you must also document your relationship to each dependent, whether they are children, siblings, or other relatives. This information establishes the eligibility of each dependent claimed. Financial documentation plays another critical role; gathering proof of support can include pay stubs, child support payments, or any form of income that contributes to the dependent’s overall financial needs.

Determining the necessary income documentation

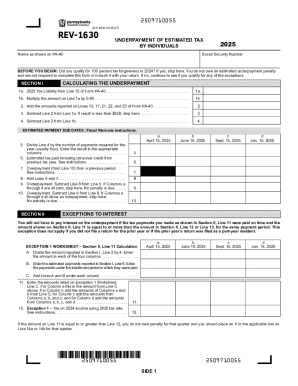

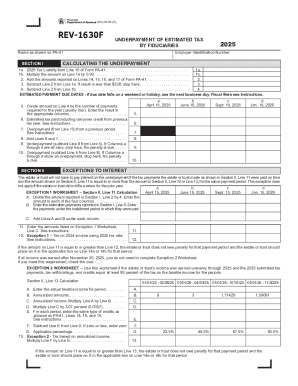

The next step involves determining the right income documentation based on your specific tax situation. Depending on whether you filed a 2023 income tax return or not, you will need different documents to substantiate your claims for dependents on the 2024 dependent form.

For those who did not have an income or filed a 2023 federal tax return, supporting income might come from statements indicating financial support for your dependents. If you had income yet did not file, obtaining replacement documents such as W-2 forms may be necessary. Taxpayers who filed a foreign return must also provide documentation equivalent to a W-2 when supporting their claims.

It’s also wise to have a plan in place for replacing any lost or missing documentation. This step will fast-track your filing process, reducing hassle during tax season.

Step-by-step instructions for completing the 2024 dependent form

Filling out the 2024 dependent form can seem daunting, but breaking it down into manageable sections can facilitate the process. Start with the personal information section, where you enter your details as well as each dependent’s data. Accuracy here is key—ensure that names and Social Security Numbers match the official documents.

Next, move on to the dependent information section. In this part, clarify the relationship of each dependent to you and cite which deductions you are claiming. Then, venture into the income information section, detailing any income that affects dependent status.

As you complete these sections, keep an eye out for common mistakes, such as incorrect Social Security Numbers or mismatched names, which can trigger IRS questions and potentially delay your refund.

eSigning and submitting your 2024 dependent form

Once everything is filled out, your next step is to submit the 2024 dependent form. You have two primary options: digital submission via electronic platforms or traditional paper filing. Both methods have their pros and cons.

Digital submission is faster, and software typically provides eSigning functionality that may streamline the process. Conversely, paper submissions, while sometimes preferred for their tangible nature, may experience delays in processing times due to mail handling. Utilizing platforms such as pdfFiller enables seamless eSigning, ensuring that your submission is both quick and verifies that all necessary information is present.

Navigating changes in tax laws for 2024

Staying informed about recent tax law changes is crucial to maximizing your benefits when filing the 2024 dependent form. The tax landscape can shift annually, often adjusting how dependents are viewed regarding eligibility and benefits. Understanding these changes helps individuals and families make informed decisions.

One notable change this year involves the income thresholds for claiming dependents. Understanding these thresholds ensures you can accurately determine who can be claimed and the tax credits available, thereby maximizing financial benefits. To ensure you stay updated, regularly check the IRS website and consult with tax professional resources.

FAQs about the 2024 dependent form

Taxpayers often have questions regarding what happens if their situation changes after they submit the 2024 dependent form. If you experience a change in your dependent's status, it’s advisable to amend your tax return promptly. The IRS allows these changes, but it’s essential that they are filed correctly to avoid complications.

Additionally, if you believe a dependent no longer qualifies, you can go through the amending process to rectify your claims. Understanding the amendment process is crucial for maintaining accuracy in your tax filings.

Conclusion: Empowering tax filing with pdfFiller

The comprehensive process of completing the 2024 dependent form can be streamlined using pdfFiller. Not only does this platform simplify document management, but it also provides tools for eSigning, collaboration, and accessible file tracking, which is invaluable during tax season.

By utilizing pdfFiller, you're not only ensuring that your tax documentation is accurate and complete, but also embracing a solution that eases the entire filing process, empowering you to handle your tax situation confidently.

Explore the various features of pdfFiller to maximize your document management experience, ensuring a more efficient approach to tax filing and beyond.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 2024 dependent form directly from Gmail?

How can I modify 2024 dependent form without leaving Google Drive?

How do I fill out the 2024 dependent form form on my smartphone?

What is 2024 dependent form?

Who is required to file 2024 dependent form?

How to fill out 2024 dependent form?

What is the purpose of 2024 dependent form?

What information must be reported on 2024 dependent form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.