NY DTF IT-209 2025-2026 free printable template

Get, Create, Make and Sign NY DTF IT-209

Editing NY DTF IT-209 online

Uncompromising security for your PDF editing and eSignature needs

NY DTF IT-209 Form Versions

How to fill out NY DTF IT-209

How to fill out form it-209 claim for

Who needs form it-209 claim for?

Comprehensive Guide to Form IT-209 Claim for Form

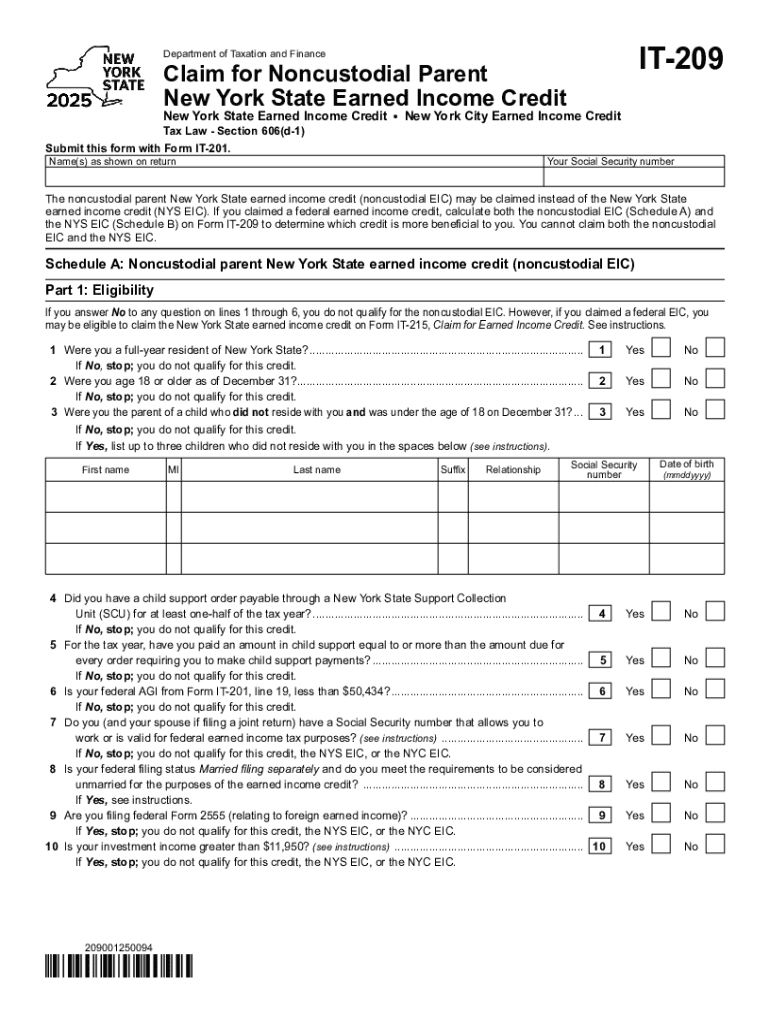

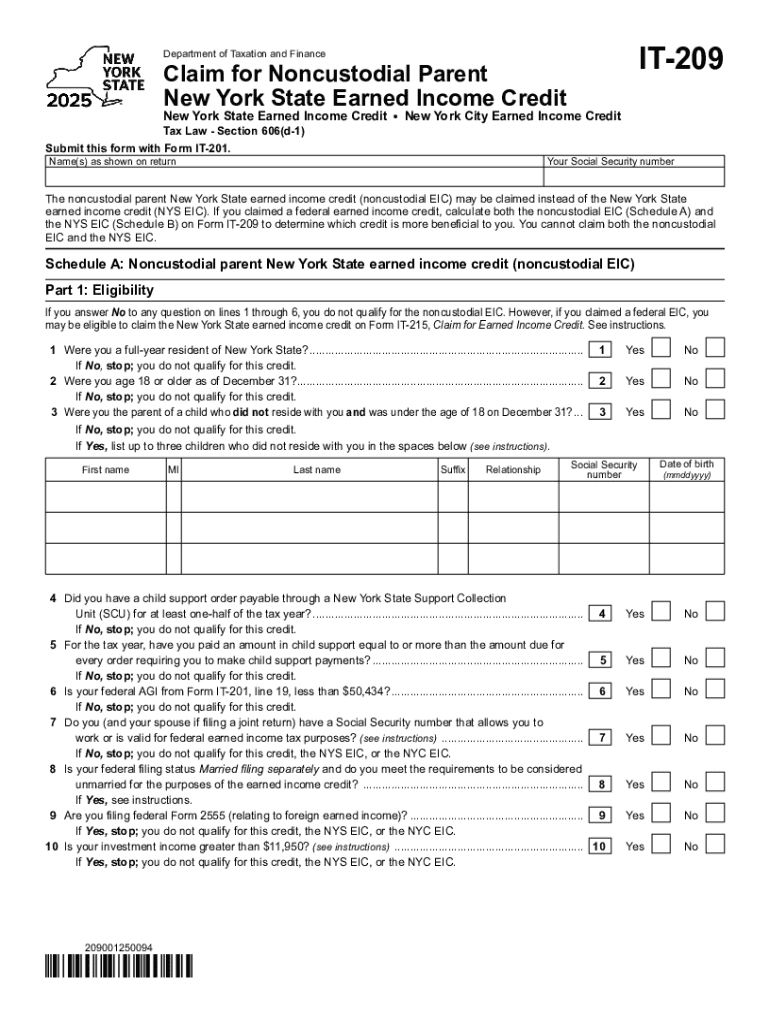

Understanding Form IT-209

Form IT-209 functions as the New York State Income Tax Credit Claim Form, designed specifically for residents to claim their allocated credits effectively. It serves as a critical document for individuals and families seeking to optimize their tax liabilities through eligible credits. Those who need to file this form typically include residents who qualify for certain tax rebates, credits for qualified expenses, or other benefits that can reduce their taxable income.

Importance of initial assessment

Before proceeding with the Form IT-209, it’s critical to assess eligibility for claiming tax credits. Many residents often overlook potential credits, leading to lost financial benefits. This initial evaluation entails reviewing income levels, dependent statuses, and any qualifying expenses incurred throughout the tax year.

Common scenarios requiring Form IT-209 include families with children in school who qualify for educational credits, or individuals who have faced substantial medical expenses not covered by insurance. Identifying these scenarios early can ensure the taxpayer maximizes their claims.

Navigating the Form IT-209

Accessing Form IT-209 is a straightforward process, primarily facilitated through the [website]. Users can find the form available for download in PDF format, which provides a clear structure for accurate filing. Alternatively, for interactive features that simplify the filling process, pdfFiller offers a practical solution by allowing users to edit the PDF directly within their platform.

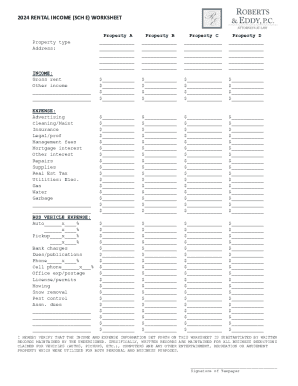

Each section of Form IT-209 is crucial and includes specific areas to fill out personal information, such as name, address, and social security numbers, as well as details pertaining to claimed credits. Understanding each section helps minimize errors and ensures that all information is provided correctly. The main areas covered include:

Filling out Form IT-209

Filling out Form IT-209 can be achieved efficiently through a step-by-step approach. Start by entering your personal details accurately to ensure there are no discrepancies. The first field generally requires your social security number, followed by your full name and address. Always double-check the spelling to avoid processing delays.

In instances where you may encounter fields that do not apply to you, it is advisable to leave them blank rather than entering a zero or irrelevant information, as this can cause confusion during the processing phase. Tips for avoiding common mistakes include:

Utilizing pdfFiller tools

pdfFiller provides additional tools to enhance your experience in filling out Form IT-209. Users can take advantage of features such as editing PDF sections or using the commenting tools to make notes for themselves regarding particulars that matter. These annotations can be beneficial when reviewing the form at a later stage.

Documenting and supporting evidence

An essential step in leveraging Form IT-209 is gathering the required documentation to accompany your claim. Necessary documents may include income statements, tax returns from previous years, or proof of expenditures that qualify for credits. Each type of claim may have different documentation requirements, so it is essential to consult the specific guidelines on the [website].

Once you have gathered these documents, develop a system for organizing them to facilitate ease of access when filling out your form. pdfFiller also simplifies this process by allowing users to upload and manage their documents on its platform, ensuring they are stored securely and can be retrieved whenever needed.

Uploading and managing documents in pdfFiller

The cloud storage capabilities of pdfFiller enable users to upload relevant files directly to their document folders for easy access. This functionality ensures that all documents related to your claim can be organized effectively, reducing stress during the submission process.

Signing and submission process

eSigning your Form IT-209 is a critical step that can facilitate quicker processing. pdfFiller offers a user-friendly guide on eSigning, making it easy to add your electronic signature to the document. A valid signature is necessary to certify the authenticity of your submission and protect against potential claims of fraud.

There are different submission methods available for Form IT-209, such as mailing it to the designated tax office or submitting it electronically via the [website]. Confirming a successful submission involves checking for any follow-up confirmations that may be sent to your email or through the platform’s dashboard.

Tracking your claim status

After submission, understanding what to expect can alleviate anxieties regarding your tax status. Typical processing times for Form IT-209 can vary, but knowing that you can check your claim status online via the [website] is comforting. Keep an eye on any potential updates that may be reflected in your online account.

To follow up on your claim, utilizing online platforms provided by tax authorities can expedite the process. If there are questions about your claim or if a substantial amount of time has passed without updates, reaching out to relevant authorities via customer service is recommended.

Addressing common questions and concerns

Many common questions arise regarding Form IT-209, particularly around eligibility and the filing process. Residents often wonder if their income qualifies them for specific credits or how to amend the form after submission. Having a thorough understanding of the requirements laid out on the [website] will answer many of these queries.

In addition, individuals may encounter issues with their submission, such as rejected claims or overlooked documentation. Knowing how to leverage customer support through pdfFiller can provide resolutions quickly and maintain the integrity of your claims process.

Advantages of using pdfFiller for Form IT-209

Using pdfFiller brings significant advantages to the convoluted process of managing Form IT-209. For one, the platform offers streamlined document management capabilities designed to enhance user experience and ensure efficiency. Cloud-based document handling allows users to access their files from anywhere, making it an invaluable resource for teams and individuals alike.

Collaboration features provided by pdfFiller are also noteworthy, as they allow multiple team members to work together effectively on shared forms. This capability fosters clearer communication regarding the status of various claims or necessary actions.

Security is another paramount concern when submitting sensitive financial information. pdfFiller ensures data protection during your claim process, allowing users to safely store and manage their documents without the added worry of security breaches.

People Also Ask about

Can both parents claim EIC for same child?

What is the Empire Child Tax Credit?

How much is the Child Tax Credit for 2022?

What is NYS it 229 form?

Can you claim yourself as a dependent NY?

What is a IT 215 form?

What is the Empire State Child Tax Credit?

How to file IT-209?

Who can be claimed as a dependent in NYS?

Who is eligible for the Empire State Child Credit?

What is the Empire State Child credit Form?

What is a it 216 form?

What is a IT-209 form?

How do I fill out the additional child tax credit?

What is an IT 213 form?

What is NY it 201 form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute NY DTF IT-209 online?

How do I make changes in NY DTF IT-209?

How do I complete NY DTF IT-209 on an Android device?

What is form it-209 claim for?

Who is required to file form it-209 claim for?

How to fill out form it-209 claim for?

What is the purpose of form it-209 claim for?

What information must be reported on form it-209 claim for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.