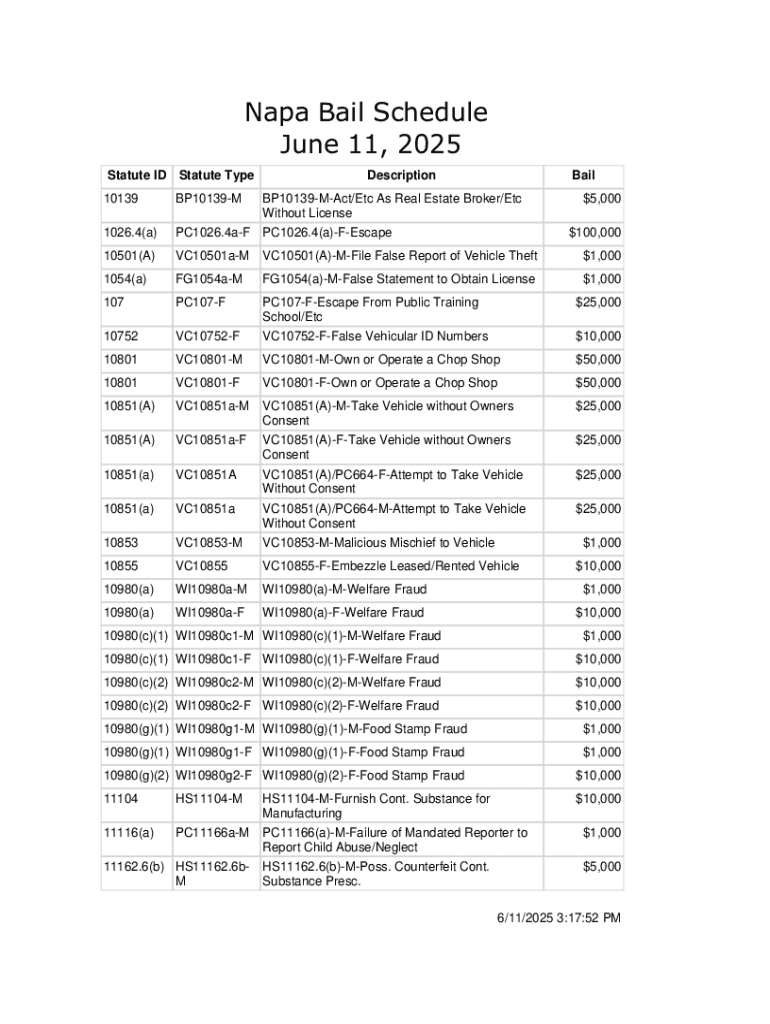

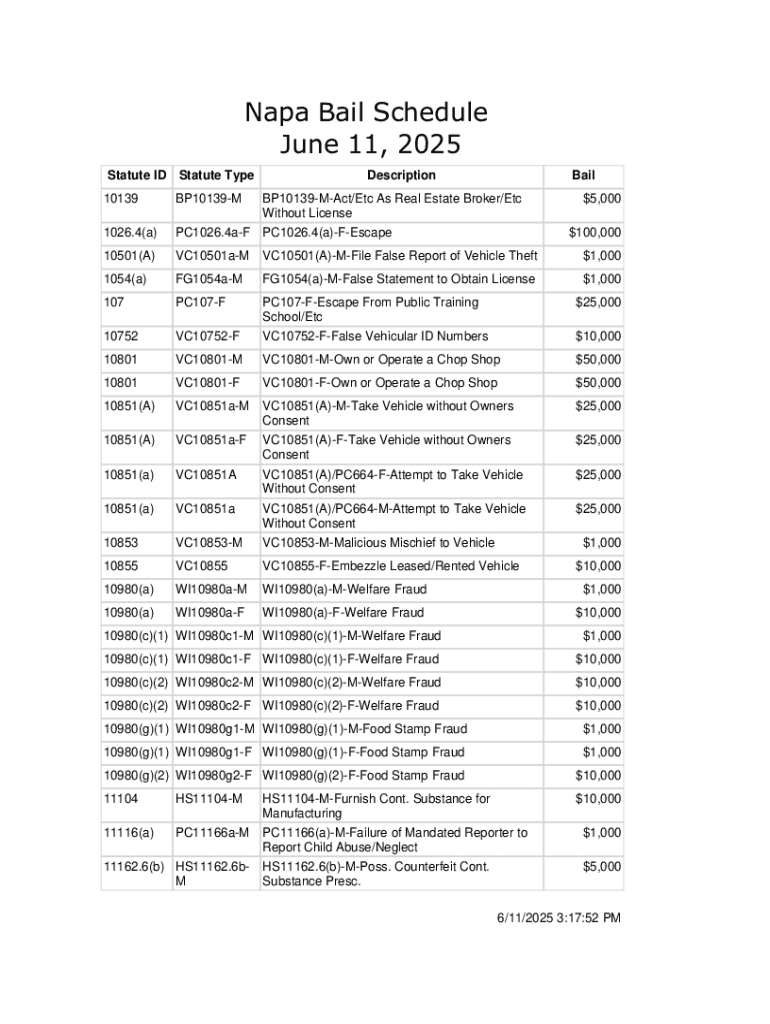

Get the free Statute ID Statute Type

Get, Create, Make and Sign statute id statute type

Editing statute id statute type online

Uncompromising security for your PDF editing and eSignature needs

How to fill out statute id statute type

How to fill out statute id statute type

Who needs statute id statute type?

The Essential Guide to the Statute Statute Type Form

Understanding statute : Key elements of the form

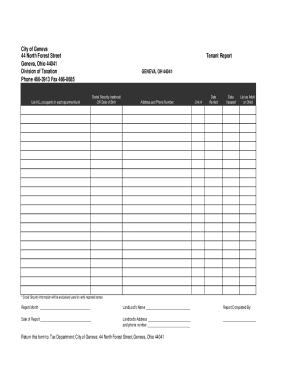

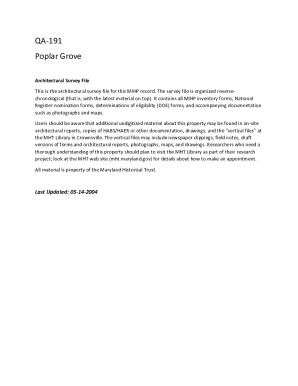

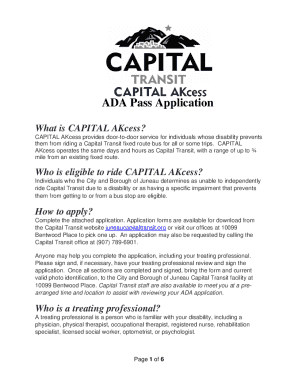

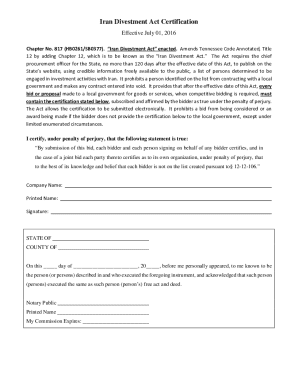

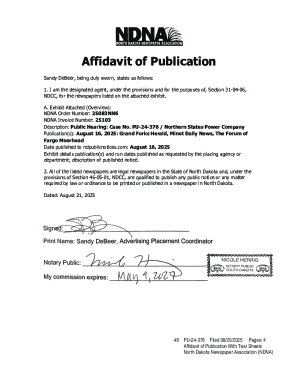

The statute ID statute type form serves a critical function in ensuring legal compliance across various contexts. This form is designed to provide essential information regarding statutes, which are formal written laws enacted by legislative bodies. Understanding the purpose and accurate completion of this form is paramount, as it directly ties to your compliance efforts within legal frameworks.

The accurate completion of the statute ID form is essential because errors or incomplete information may lead to delays in legal processes, fines, or even invalidation of documents. Properly understanding and using the form can happen within diverse scenarios, ranging from legal professionals preparing documentation for court to individuals needing to record statutes for personal or professional use.

Essential components of the statute form

The structure of the statute ID form comprises several essential components that need careful attention. Primary among these are the required details, which encompass personal information, financial data, and various legal disclosures that ensure completeness and compliance.

Personal details often include the name, address, and contact information of the individual or organization submitting the form. Financial information typically involves any related monetary amounts or resources linked to the statutory requirements. Legal disclosures are crucial, as they necessitate clarity in understanding the context and implications of the statutes being referred to.

Step-by-step instructions for completing the statute form

Completing the statute ID form can appear daunting, but following a structured approach simplifies the process significantly. Below is a detailed breakdown of each section to guide users through completion.

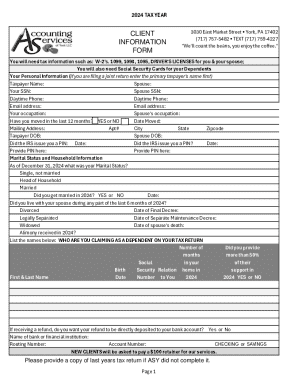

Section 1: Personal information

In this section, accurately input each required field, which generally includes your full name, postal address, and phone number. Ensure all entries match your official documentation to avoid discrepancies that could hinder your application.

Section 2: Financial details

Enter financial information pertinent to your statutes. Common mistakes include entering the wrong amounts or failing to provide supporting documentation. Always double-check your calculations and include all necessary receipts or financial statements.

Section 3: Legal and compliance information

This section demands precise legal terminology and clarity in what's included. It’s important to understand the legal ramifications of your statements, ensuring that all required attachments, like proof of compliance or legal agreements, are included with your submission.

Editing and finalizing your statute form

Once you have filled out the statute ID form, it’s crucial to edit and finalize it to ensure accuracy before submission. Utilizing platforms like pdfFiller facilitates this process with user-friendly features that smooth the editing experience.

Using pdfFiller for seamless editing

To edit PDFs within pdfFiller, simply upload your completed form, and utilize the editing tools to make necessary adjustments. The platform allows for adding or removing sections, ensuring your document reflects all needed information appropriately.

eSigning and collaborating with others

After editing, eSigning the document becomes simple with pdfFiller's integrated features. You can easily create a digital signature and invite colleagues or legal advisors to review the document for collaborative completeness. This not only enhances the accuracy of the final submission but also fosters an efficient workflow.

Frequently asked questions about the statute form

Queries about the statute ID form arise frequently, especially concerning its completion and submission process. Common pitfalls include missing signatures, incorrect financial entries, or inadequate legal disclosures, all of which can impede the progress of your documentation.

Addressing rejections or errors requires a proactive approach. Whenever a submission is rejected, carefully review the notice for specifics regarding the error, and make necessary corrections before resubmitting the form. Keep in mind that updates can often be made post-submission if circumstances change.

Troubleshooting common issues with the form

While filling out the statute ID form, various issues may arise, particularly if you opt for online submissions. Internet connectivity problems or discrepancies in document formatting can hinder the process. Ensuring your internet connection is stable and reviewing formatting requirements before submission can help mitigate these issues.

For technical glitches in pdfFiller, check their support resources or FAQs for troubleshooting tips. Common solutions often involve refreshing the page, logging out and back in, or clearing your browser cache.

Success stories: How statute helped individuals and organizations

Examining success stories serves to highlight the real-world value of the statute ID form. For instance, legal professionals have reported successful navigation through complex compliance requirements when using the form proficiently, thereby minimizing legal risks.

Moreover, organizations implementing pdfFiller for document collaboration have experienced enhanced teamwork efficiency, significantly reducing the time needed for revisions and approvals.

Advanced features of pdfFiller for managing your statute forms

Leverage advanced features in pdfFiller to elevate your management of the statute ID forms. The platform integrates seamlessly with various productivity tools to enhance workflow, making it easier to manage multiple forms and documents.

Additionally, cloud storage solutions offered by pdfFiller ensure your documents remain safe and easily accessible from anywhere. Real-time updates allow all collaborators to make changes simultaneously, ensuring everyone remains informed of adjustments and that the project stays on track.

Compliance guidelines and best practices for statute type forms

Understanding compliance guidelines for the statute ID form is crucial. Variability exists between local and federal regulations that govern such documentation. It’s the user's responsibility to ensure all entries comply with the current legal standards relevant to their specific jurisdiction.

Engaging with legal resources or staying updated through professional organizations helps avoid penalties resulting from inaccuracies. The ramifications of errors on this form can lead to legal disputes or financial repercussions, so maintaining diligence in completing these forms is essential.

Wrap up: Ensuring your statute form is complete and compliant

Completing your statute ID form correctly ensures a smooth process towards legal compliance. Before submission, create a final checklist that evaluates every element of the form, confirming that all required information is present and accurate.

A thorough double-check allows you to avoid common errors and streamline your submission process. Ensuring no detail goes overlooked can save time and mitigate complications, resulting in a formal document that meets all necessary legal standards.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send statute id statute type for eSignature?

Can I edit statute id statute type on an iOS device?

How do I complete statute id statute type on an iOS device?

What is statute id statute type?

Who is required to file statute id statute type?

How to fill out statute id statute type?

What is the purpose of statute id statute type?

What information must be reported on statute id statute type?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.