Get the free Louisiana Department of Revenue Post Office Box ...

Get, Create, Make and Sign louisiana department of revenue

Editing louisiana department of revenue online

Uncompromising security for your PDF editing and eSignature needs

How to fill out louisiana department of revenue

How to fill out louisiana department of revenue

Who needs louisiana department of revenue?

A Comprehensive Guide to Louisiana Department of Revenue Forms

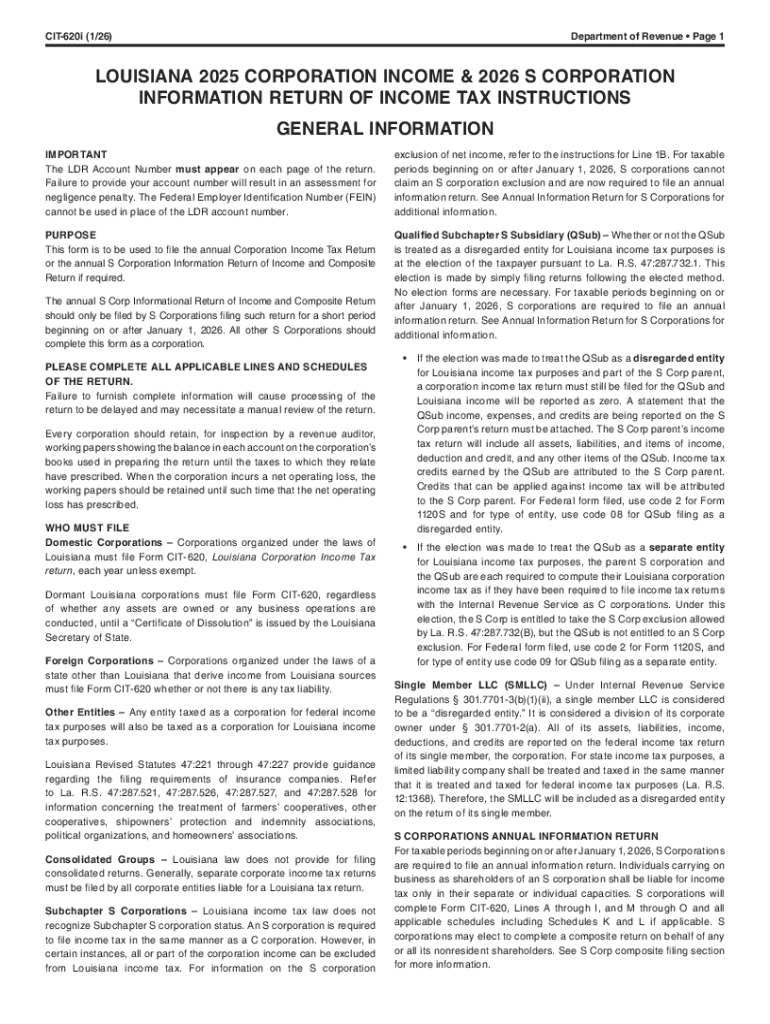

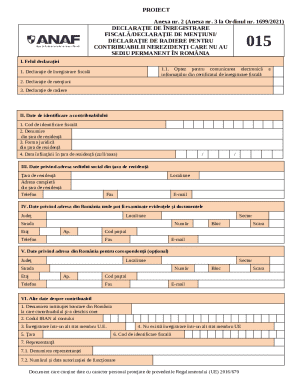

Understanding Louisiana Department of Revenue forms

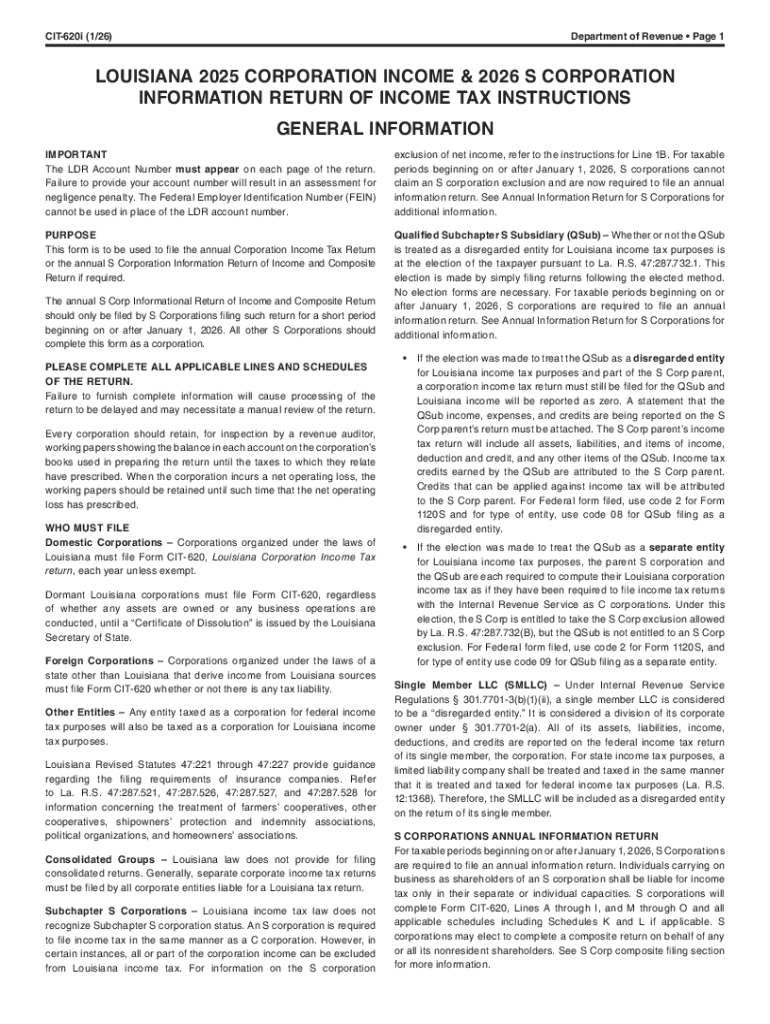

The Louisiana Department of Revenue (LDR) handles the collection and administration of state taxes, and to facilitate this process, various forms are used. These forms are pivotal as they ensure compliance with state tax laws while providing necessary information to both the LDR and taxpayers. Accurate form submission is crucial since errors can lead to delays, penalties, or even audits. Unfortunately, many individuals face common issues such as incomplete information or miscalculations when filling out these forms.

Types of Louisiana tax forms

Louisiana tax forms are categorized based on the type of taxpayer and the nature of taxation. Understanding the different categories can simplify the process of identifying the appropriate form for your specific situation. Each category has unique requirements, deadlines, and purposes.

Understanding the key differences between related forms—like Form IT-540 for residents and Form IT-540B for non-residents—can help taxpayers avoid costly mistakes.

Most requested Louisiana tax forms

Among the numerous forms offered by the Louisiana Department of Revenue, several stand out due to their high demand from taxpayers. These forms serve essential functions in compliance and reporting.

Each of these forms serves distinct purposes and should be filled out with precise information to avoid complications during the processing of returns.

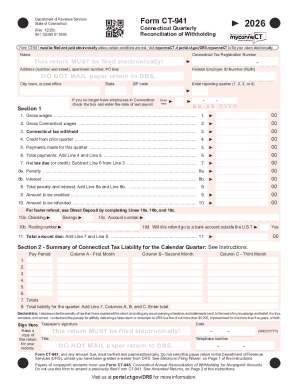

Step-by-step instructions for filling out common forms

Filling out Louisiana tax forms may seem daunting, but with careful attention to detail and guidance, the process can be smooth. For example, let's break down the process for two common forms: Form IT-540 and Form R-1349.

Filling out Form IT-540

This form consists of several sections, including identification information, income details, and tax calculations. Begin by clearly providing your name, address, and Social Security number. Be thorough when reporting all sources of income to ensure accuracy in your tax liability.

Common mistakes include overlooking certain income sources or neglecting to consider deductions that could lower taxable income.

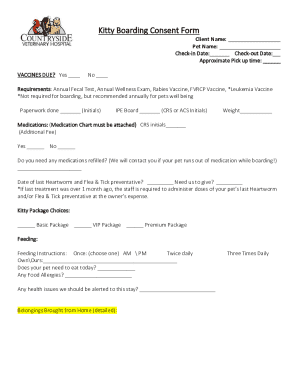

Filling out Form R-1349

This form is specifically for claiming sales tax exemptions. Ensure you meet the eligibility criteria outlined by the Louisiana Department of Revenue. Required documentation may include proof of purchases or sales invoices.

Misunderstanding eligibility is a common pitfall when completing this form.

Editing and managing Louisiana tax forms with pdfFiller

pdfFiller offers a user-friendly platform for managing Louisiana Department of Revenue forms. With easy-to-use tools, taxpayers can upload documents directly and start editing immediately.

Additionally, pdfFiller provides interactive features that benefit individual users and teams alike. Collaboration tools enhance teamwork, while cloud storage ensures that you can access your forms from anywhere, ensuring seamless document management.

Electronic filing and submission options

The introduction of e-filing in Louisiana has simplified the submission process for many taxpayers. E-filing allows for rapid processing and reduces the chance of errors typically associated with paper forms.

E-filing offers several advantages, including faster refunds, immediate confirmation of submission, and a reduced need for physical paperwork.

After submission: what to expect

Once your forms are submitted, it’s crucial to monitor their status to ensure successful processing. The Louisiana Department of Revenue allows taxpayers to track their submission status online, providing peace of mind and transparency.

Notifications from the LDR can come in various forms, including acknowledgments of receipt or requests for additional information. Understanding these communications is essential for resolving any potential issues.

FAQs about Louisiana Department of Revenue forms

Taxpayers often have questions regarding the completion and submission of Louisiana tax forms. Addressing common inquiries can help alleviate stress and confusion.

Resources for further assistance, including helplines and online support, are available through the LDR's official website, ensuring that taxpayers can receive help as needed.

Interactive tools and resources from pdfFiller

pdfFiller provides several interactive tools essential for efficiently filling out Louisiana tax forms. Users can access various templates tailored to specific Louisiana forms, making the process straightforward.

These tools can greatly enhance the filing process, allowing individuals and teams to manage their tax documentation efficiently.

Conclusion and encouragement for using pdfFiller

Navigating the landscape of Louisiana Department of Revenue forms doesn't have to be a complicated endeavor. With platforms like pdfFiller empowering users to manage their tax forms with ease, the entire process—from filling to electronic submission—is streamlined and efficient.

By leveraging pdfFiller's unique features, taxpayers can confidently manage their documentation and ensure compliance with state tax laws, paving the way for a more organized and stress-free tax experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my louisiana department of revenue directly from Gmail?

How do I execute louisiana department of revenue online?

Can I edit louisiana department of revenue on an Android device?

What is Louisiana Department of Revenue?

Who is required to file Louisiana Department of Revenue?

How to fill out Louisiana Department of Revenue?

What is the purpose of Louisiana Department of Revenue?

What information must be reported on Louisiana Department of Revenue?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.