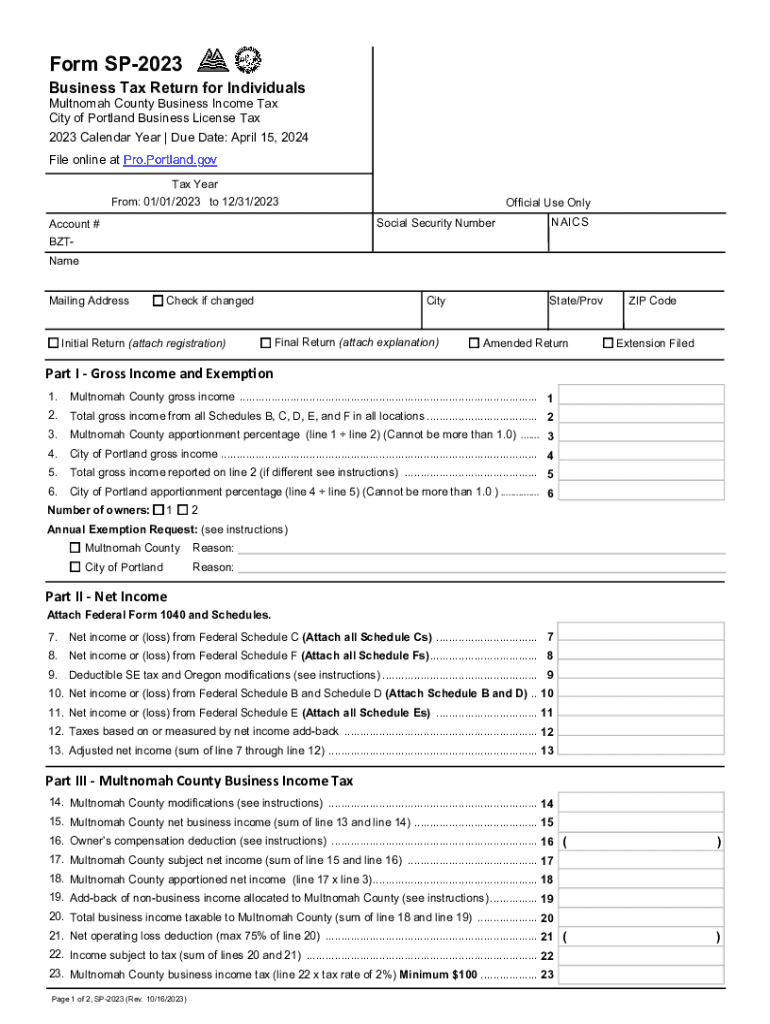

Get the free Form SP-2023 Business Tax Return for Individuals - Portland.gov

Get, Create, Make and Sign form sp-2023 business tax

Editing form sp-2023 business tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form sp-2023 business tax

How to fill out form sp-2023 business tax

Who needs form sp-2023 business tax?

Form SP-2023 Business Tax Form: A Comprehensive Guide

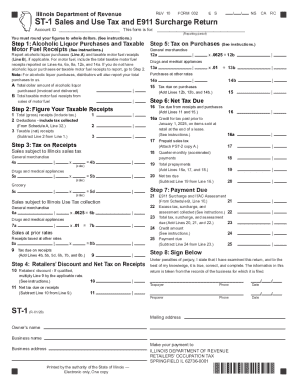

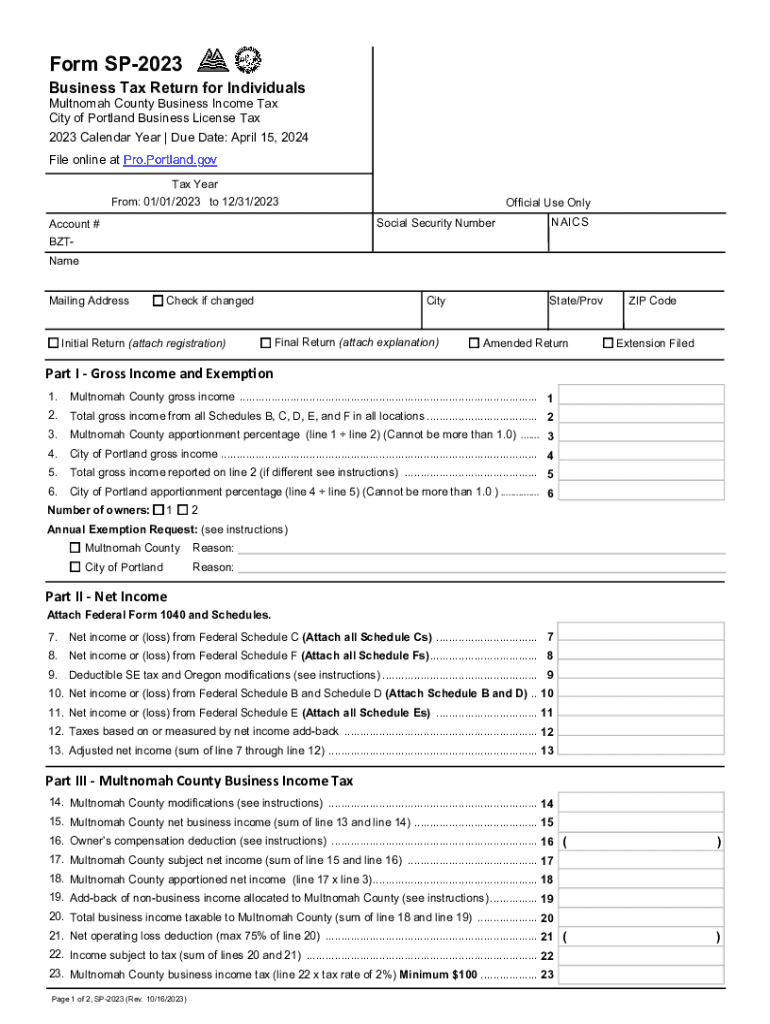

Overview of Form SP-2023

Form SP-2023 serves as a critical document for businesses to report their tax obligations for the year 2023. This form simplifies the process of tax filing, helping business owners ensure compliance with federal and state regulations. Accurate submission is vital as incorrect or incomplete forms can lead to penalties or audits.

Filing Form SP-2023 not only attests to your revenue and deductions but also provides a clear financial picture to the IRS, which is essential for any business looking to secure funding or experience growth. It’s crucial for business owners to familiarize themselves with the key changes implemented for the 2023 tax year.

Understanding the structure of Form SP-2023

Form SP-2023 consists of several key parts that help organize your business's tax information effectively. Each section is designed to capture essential details that contribute to the overall tax obligation. Offering clear instructions ensures that every business owner can complete the form accurately.

Sections breakdown:

Part : Business information

This part requires business identification details, including the legal name, address, and Employer Identification Number (EIN). It's crucial to enter this information carefully, as mistakes can lead to unnecessary complications.

Common mistakes in this section often occur due to typos in the business name or incorrect EIN entries, which can delay processing.

Part : Revenue details

In this section, you will report all forms of revenue your business earned throughout the year, including sales, service income, and other revenues. It’s essential to categorize these amounts accurately.

To streamline this process, maintain organized records throughout the year and consider using accounting software to automate revenue tracking.

Part : Deductions and credits

Familiarizing yourself with eligible deductions can significantly reduce your taxable income. Common deductions include operating expenses, employee wages, and interest on business loans.

Strategizing to maximize tax credits can also provide additional savings, creating a healthier bottom line for your business.

Step-by-step instructions for filling out Form SP-2023

Preparing your documents

Before you begin filling out Form SP-2023, gather all necessary documentation such as revenue statements, expense receipts, and prior year tax returns. This preparation will help you have a smooth filing experience.

Additionally, keeping digital records can not only save time but also make data retrieval simpler when you're preparing for tax season.

Filling out each section of the form

Start by completing Part I with your business information, ensuring accuracy to prevent delays. Then, move on to Part II, reporting your revenue, and be meticulous about categorizing your income correctly.

Finally, populate Part III with valid deductions and credits you wish to claim. For example, if you employed individuals, include the wages as a deduction.

Common errors to avoid

To minimize errors, avoid familiar pitfalls such as mismatching totals, neglecting to sign the form, or overlooking deadlines. Routine double-checking can save your business from potential audits.

Editing and customizing your Form SP-2023

Once you have your form drafted, you may need to edit or adjust some sections to reflect the most accurate information. pdfFiller offers robust editing tools that make this process seamless.

Using pdfFiller’s editing tools

With pdfFiller, you can easily add annotations, highlight important calculations, or insert form fields directly into the document. This feature helps ensure that all changes made are clear and well-communicated.

To edit online, simply upload your drafted Form SP-2023 to the platform, utilize the editing tools, and save your changes. This method streamlines the review process for your team.

Collaboration features

Engaging team members in the review of Form SP-2023 can be beneficial. pdfFiller permits users to invite colleagues to collaborate on documents, enhancing oversight and feedback.

Utilizing the comment features can further facilitate efficient communication, ensuring everyone is on the same page regarding necessary changes.

eSigning Form SP-2023

The importance of electronic signatures can’t be overstated in the realm of business tax filing. Implementing eSigning fosters efficiency and promotes a paper-free environment, simplifying the filing process.

With pdfFiller, the eSigning process is direct and user-friendly. You can create a signature digitally and place it directly onto your Form SP-2023 without needing to print the document.

Step-by-step eSigning process

To eSign your form, login to pdfFiller, upload your document, and drag your signature to the designated area. After placing your signature, you can save and share your signed document with stakeholders easily.

It's important to note that electronic signatures are legally valid and recognized in the eyes of the law, granting you peace of mind in your submission.

Submitting your completed Form SP-2023

Once you’ve completed and eSigned your Form SP-2023, the next step is submission. Understanding your submission options will ensure your form reaches the appropriate authorities without delay.

You can submit your form electronically through the IRS website or via traditional mail. Choose the method that best suits your situation and ensure to keep a copy for your records.

Key deadlines to remember

Filing deadlines are critical for compliance. Generally, Form SP-2023 needs to be submitted by March 15, 2024, for most businesses, although there are exceptions. Staying abreast of deadlines prevents late filing penalties.

Best practices for confirming submission

To confirm your submission, maintain a record of your submission receipt. If you choose electronic filing, the IRS typically sends a confirmation through email, ensuring traceability and peace of mind.

Managing your Form SP-2023 records

Effective record-keeping is crucial for tax purposes. Organizing your Form SP-2023 and related documents can simplify future tax audits and financial analysis.

Utilizing pdfFiller for organizing these documents allows businesses to store their forms securely in a cloud-based environment, where they can be easily retrieved and accessed at any time.

How pdfFiller helps you organize documents

With pdfFiller, businesses can categorize their documents, ensuring quick access to vital information. The search functionality saves time by allowing users to locate specific files with minimal effort.

Cloud-based document management provides flexibility and security, as you can access your documents from anywhere, which is essential for today’s dynamic business environments.

FAQ section – Common inquiries regarding Form SP-2023

With many questions surrounding the completion and submission of Form SP-2023, understanding these can further assist in the process. Here are some frequently asked questions.

What to do if you make a mistake after submission?

In case of a mistake, the first step is to file an amended Form SP-2023. Ensure to follow the IRS guidelines for amendments to clarify past inaccuracies.

How to amend your Form SP-2023?

To amend your form, fill out a new Form SP-2023 with the corrected information, indicating that it is an amended return. Submit this form following the correct channels.

Resources for additional help and support

Utilize resources such as IRS publications, the pdfFiller blog, or even consult with a tax professional for comprehensive support during the tax filing process.

Feedback and support from pdfFiller

Accessing customer support through pdfFiller is easy and responsive. The platform provides various channels for users to get assistance whenever needed.

Moreover, the feedback mechanisms in place allow users to contribute suggestions for improving their experience. Engaging with the community through forums can also offer additional insights and solutions.

User engagement resources are vital for continued learning and support. Leveraging the community ensures that you are well-informed about best practices and tools for using pdfFiller effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form sp-2023 business tax without leaving Google Drive?

How do I fill out the form sp-2023 business tax form on my smartphone?

How do I fill out form sp-2023 business tax on an Android device?

What is form sp-2023 business tax?

Who is required to file form sp-2023 business tax?

How to fill out form sp-2023 business tax?

What is the purpose of form sp-2023 business tax?

What information must be reported on form sp-2023 business tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.